I’ve always said, “earn and burn.” Meaning earn your points and miles, then burn them in short order. I keep my points balances low – having 100,000 points is a good enough minimum cushion for me.

Because with that amount, I can get to most places in business class one-way (and to a few in business class round-trip). It’s also enough for me to begin planning a trip. And if I need more, I can start earning what I’ll need. Usually, the easiest way is to open a new credit card.

I’m accumulating points but have no idea how to use them

These days I can earn, but there’s no way to burn. I have a few cards I want, but keep waiting to apply for them. It feels pointless to have a storehouse of points and miles when most places are closed to Americans and there’s uncertainty about when we can travel again.

But my wanderlust is kicking up big time and I know when I’m able, I’ll be off like a rocket. 🚀

I’m torn between earning lots of points while I’m still in lockdown and waiting to see what happens. Who knows what devaluations and program changes are coming down the pipeline, especially with basically every airline and hotel chain massively struggling right now? It’s keeping me in a holding pattern. Not only with this topic, but with pretty much everything.

My current credit card strategy

That’s not to say I haven’t been earning points. Many card issuers added lucrative bonus categories on popular credit cards to incentivize spending and, I’m guessing, to prevent a big wave of closures.

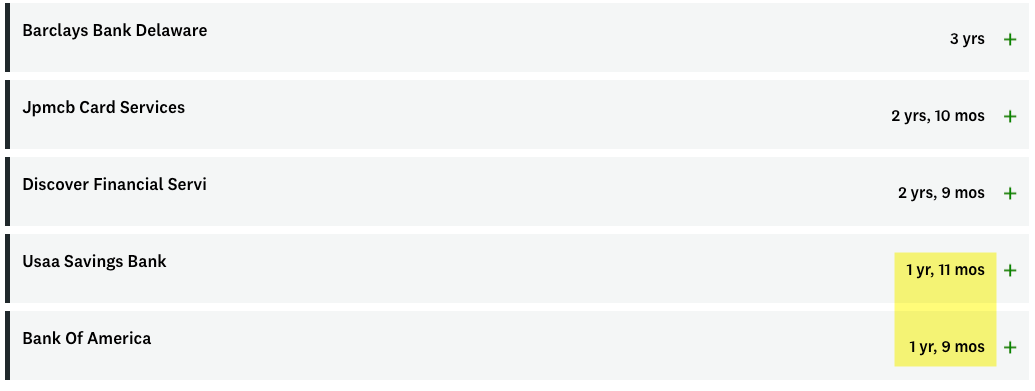

I currently have 23 credit cards – many of which, like my Amex Hilton Aspire, made big changes at the start of the pandemic. For example, I earned 12X Hilton points at grocery stores and used the $250 resort credit for takeout and delivery.

I happily took $250 worth of food from my Amex Hilton Aspire

And other cards did similar. Here are my current points balances as of today:

- Amex Membership Rewards points – 150,000

- Citi ThankYou points – 111,000

- Chase Ultimate Rewards points – 39,000

- American miles – 133,000

- Alaska miles – 132,000

- United miles – 65,000

- Hilton points – 173,000

All told, I have ~800,000 miles/points to use, which is enough for at least a few trips. And yet. Uncertainty.

By the way, I track my points balances with AwardWallet – click through to make your account if you don’t have one. And I have four free upgrade coupons for first time users. Here’s the code to the first four who want it: free-qftaye

My current credit card strategy is to maximize everything I can from the cards I already have – and then potentially add a few more later this year.

Within this realm, I’m focusing heavily on transferable points (Amex Membership Rewards points, Citi ThankYou points, and Chase Ultimate Rewards points) and looking at new cards that earn them.

Mostly because – worst case scenario – I can always redeem transferable points for cash. I wouldn’t feel good about opening an airline credit card right now, like an American Airlines or United card, unless I had a specific plan to use them instantaneously.

And personally, I’m not ready to fly to a new place while the pandemic is going on, even domestically. What’s the point of visiting a place as a leisure traveler if most tourist destinations are closed? Not to mention the unnecessary risk to get to those closed places.

The three cards I want soon

I’m focused on the earn more than the burn. Within that realm, I want to earn “safe” or transferable points.

I also have a confession. You guys aren’t going to believe it.

It just kinda happened

In three months, I’ll be 0/24! 😲

I have the entire credit card spectrum open to me now – including Chase cards. Which fuels my conundrum: why earn tons of points if I can’t go anywhere?

That said, I’m looking at these cards:

1. Chase Sapphire Preferred

I’m eligible to earn the sign-up bonus again, so why not? The annual fee is only $95 and I can always use more Chase points. Well… you know. In the future sometime. Maybe.

It’s been over 4 years since I’ve earned a Sapphire bonus, so I can apply and earn it again. The only hitch is I currently have eight Chase cards, so I don’t think they’ll give me another one. I’m ready to close one or shift a credit line around to make it happen, though.

I miss Hyatt hotels 🙁

We all know Chase points are only good for Hyatt stays. It’s been that way for a while. #facts

This is exactly what I did with my stay at Hyatt Ziva in Cabo San Lucas – redeemed Chase points for it.

I’m confident I’ll want to use Chase points at ~*~some~*~ point in the future, so getting this card seems like a safe bet while I can to:

- Strike while iron is hot

- Make hay while sun shines

- Get it while getting is good

- Your other choice of action-bound-by-time cliche

2. Citi Premier

Citi can’t help but constantly tinker with their ThankYou cards. But this time, I love it.

Very good, yes

Seriously, I’m impressed with the new bonus categories on the Citi Premier card. Starting August 23, 2020, you’ll earn:

- 3X Citi ThankYou points on air travel and for

- Hotels

- Restaurants

- Supermarkets

- Gas stations

Those are incredible, pandemic-ready categories. Dining, groceries, and gas? Plus the addition of air travel and hotels when we can utilize those categories again? ✔️

I personally think these are the best bonus categories of any credit card out there right now – especially for the modest $95 annual fee. I have no idea why people aren’t talking about this card more.

Of course, the Chase Sapphire Preferred earns 2X Chase Ultimate Rewards points on travel and dining and has the same $95 annual fee. And the Amex Gold earns 4X Amex Membership Rewards points at restaurants uncapped, 4X points US supermarkets on up to $25,000 per year in purchases, and 3X points for flights booked directly with airlines or through amextravel.com, but that card has a $250 annual fee.

I currently have Citi Prestige, which earns 5X Citi ThankYou points on dining and air travel. But I’m also paying a $495 annual fee. So I have to figure out if it’s worth paying a premium to earn more points – and if the additional 3X bonus categories (gas and supermarkets) are worth switching over.

Whatever happens, I definitely think it’s a better card than the Chase Sapphire Preferred or Amex Gold. People will say the transfer partners aren’t as strong, but there’s so much overlap these days that it really comes down to a few individual airline programs and personal preference. More on this next month!

3. US Bank Altitude Reserve

I’m wont to get the US Bank Altitude Reserve card again because of its $400 annual fee. But, there’s a $325 annual credit which covers most of that, plus the welcome offer is worth $750… toward travel.

Ah, travel. So then the question becomes, is it worth opening this card to hedge a bet that we can travel within the next year?

I do think this card is stellar, especially for the first year. Plus, it earns 3X points on mobile payments (Apply Pay, Google Pay, Samsung pay). And it’s a Visa, which means you can earn 3X points on Costco purchases.

Bae <3

I find myself homebound and visiting Costco more, so it might be worthwhile to snag this card and load up on points toward future travel. I’ll definitely wait until later this year to see if things improve… but it’s on my radar. 👀 And it really is a fantastic card if US Bank (a very conservative bank) will have you.

Much to ponder.

Credit card strategy bottom line

The general theme here is one of uncertainty. There’s plenty to earn and nothing to burn. So it’s tough to form a plan.

I’m going to earn on the cards I currently have and maybe open a few more down the line.

The three cards I’m looking at are:

- Chase Sapphire Preferred – great bonus and I’m eligible. I should get it if I want it before I’m over 5/24 again

- Citi Premier – the new bonus categories are fantastic! They kick in August 23, 2020. If current spending trends continue, it looks to be a killer card to have for pandemic necessities and beyond

- US Bank Altitude Reserve – I’m shopping at Costco a lot more and it’s the best card for Costco spending. But that $400 annual fee is a deterrent until travel starts opening up again

So now I wanna hear it.

What’s your credit card strategy right now? Are you opening new cards and earning points? What’s your focus and plan for them? Tell me everything!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I’m just about done using the $250 resort credit for takeout with Aspire, and about half way through the ShopSmall. . They also issue gave me a $250 statement credit when I called them about not being able to use the resort credit that expired in late March due to COVID-19.

Oh wow, jackpot! I’m just hoping I can use the resort credit again when my card renews! Either way, this card is a total keeper. I’m going to make it my mission to maximize the crap out of it in 2021, if only to make up for lose time lol. 🙂

I’m LOL/24 until 2022 and still rebuilding credit from disasters of the LAST recession that it’s taken a decade to get past. It’s been hard getting banks that I don’t have past relationships with to take me, so it’s been AMEX/Capital One/Synchrony/Discover/Petal/Fidelity Visa, as a mix of cashback and points cards. I have baseline 2% cards and some no international fee ones (the PayPal MasterCard is both).

So Chase isn’t an option. Other banks MIGHT be an option in 2021, but I have to figure out a strategy instead of just shotgunning.

At present I am spending in month 2 of 6 months chipping away AMEX Hilton Aspire and AMEX Gold sign up bonuses, over halfway there. I already nailed Amex Green and Cathay Pacific card bonuses earlier this year, and a Venture in 2019 (the Venture bonus had to be used as cash for emergency expenses though, but kept my savings plan on track).

Right now I have my eyes on a RTW AsiaMiles Oneworld redemption in business class. Whether it is just Asia/India/Europe or includes Australia depends on how man AMEX points I can add to my 50k Asia Miles balance (if there’s a good transfer bonus I’ll likely commit). The plan would be use my 5 (!) stopovers and 2 open jaws judiciously (I find 2-4 hour flights in EasyJet or AirAsia exit rows to be just fine).

That trip scenario sounds absolutely dreamy right now. Shotgunning has been my strategy of choice for the past few years because of being over 5/24 or already having/closing cards or what have you. But I paused for a while and suddenly find myself with choices again. Only we can’t travel anywhere. Once things pick up a little more, I’ll get my strategy more together too. Until then, I’m taking advantage of Covid bonus categories and not really spending much anyway.

If you haven’t already gotten into Citi, there’s a ton you can do with TY points – and they transfer to Asia miles, too. 🙂 Thanks for sharing the draft of your plan – I’d be curious to know how this works out down the road!

For now, considering underwriting during Covid-19, I’m probably on the sideline for a while, to try to seize some opportunities once I am clear of 5/24 in a few months. I might try for a business card though… With seven Amex credit cards, I have too many from them, so trying to find business cards that won’t appear on personal credit reports.

Bank of America or Citi business cards for sure. And Barclays for AA miles. There are still a few gems out there. Did you ever pick any up?

I can’t wait to read more of your posts!

Thank you, Pam! 🙂

I think if you have the funds available, the Bank of America setup is hard to beat during the pandemic.

Hmmmmz. I just feel like I can beat the rate with the points multiplier on other cards. And save points for future travel. But this has been on my mind lately. I need to be guided toward the light lol.

Yes you can do better especially if redeeming at Level 1 Hyatts or Biz class travel, but the versality of cash is king. I thing this more evident than ever now.