I love when an annual fee posts on a Citi card. Because that means it’s time to pick up the phone and ask for Citi retention offers. While Amex is sometimes generous, I’ve found Citi is the best at giving incentives to keep their cards – especially those with annual fees.

I currently have 6 Citi cards (3 AA cards, Prestige, AT&T Access More, and Rewards+). And called because the fee on my Citi Prestige just posted.

While I’m excited about keeping that card this year, I figured I’d ask if they could scoot bonus points my way, especially since I depleted them to go to Puerto Vallarta again.

There was nothing available for that card, but then I asked the helpful agent to check the others.

I call about once every 6 months – every single time, I’ve gotten at least 1, and usually more, worthwhile deals. This time was no exception.

If you have Citi credit cards, it’s always worth calling for a retention offer

Here’s my latest!

Citi retention offers: Spend $1,000, get 8,500 AA miles – done!

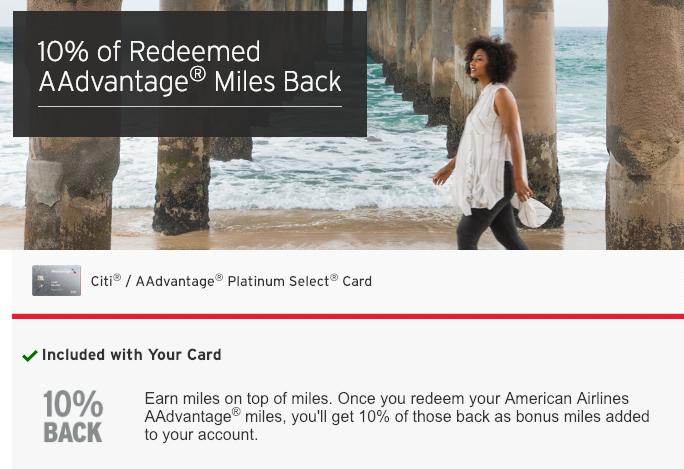

So yeah, nothing for keeping the Prestige. But the phone agent threw out an offer that was too good to pass on my Citi AAdvantage Platinum Select card:

- Spend $1,000 within 3 months, get 7,500 bonus American miles

That’s in addition to the 1 mile per $1 spent the card already comes with – for a total of 8,500 miles!

So 8.5X AA miles on $1,000 – pretty great deal!

The call took ~15 minutes, and was a surprise because the annual fee on that card isn’t coming up for a few months.

At 2 cents each, I value that many miles for $170 worth of AA award flights (8,500 X .02). Citi retention offers are unique to each card account, so your offer might be bigger, smaller, or nonexistent. But It’s always worth it to call and check.

If you have multiple Citi cards like me, I recommend calling once every 6 months or so.

I also got a balance transfer offer on my AT&T Access More card – 0% interest through February 2020 for a 3% fee, which, meh.

Assessing my 4 AA cards

This was also an opportunity to consider part of my card collection, because I actually have 4 AA cards to my name right now (!):

- Citi AAdvantage Platinum Select – $99 annual fee

- Citi AAdvantage Amex, which I kept for Amex Offers and is no longer available – $85 annual fee

- The CitiBusiness AAdvantage Platinum Select I got a few months ago for the 70,000 mile offer (now expired) – $99 annual fee (will cancel next year)

- Barclays Aviator no AF version – $0 annual fee and will keep forever to help boost credit score

I’m planning to keep one of them for the 10% mileage rebate on up to 100,000 miles redeemed per calendar year (which more than covers the cost of the annual fee).

Worth the cost of admission

I could keep the old Amex card, because the annual fee is a bit lower at $85, and comes with all the same benefits.

But another consideration is MasterCards are more useful with Plastiq payments – especially for mortgages, car payments, and student loans. Because Amex put the kibosh on certain payment types (including mortgage payments – you can only use a MasterCard or Discover card for those).

Check out this ARTIFACT

In no way do I need 4 AA cards. I’ll keep one with an annual fee for the 10% mileage rebate. And have a few months to pick one.

That’ll be an opportunity to address the 28 total cards I currently have. I’d like to get down to 20. That’ll be part of spring cleaning. 💪💳

Bottom line

Citi phone agents can be a bit daft about retention offers. You specifically have to say the word “cancel” (something like, “I’m thinking of canceling my card and want to speak to someone”).

You might get passed around a couple of times to reach the right person. But in general, they’re quick – especially during weekdays.

I call with the pretense of asking about a single card. And at the end, ask if they’d mind checking the others, too. Most of them are game – and that’s usually where the good stuff is.

I recommend grabbing something to write with, or open a text document to type them up. Because sometimes there are multiple offers, and you’ll have to crunch numbers fast.

Go with the spending offer you’re most comfortable with. And if it comes to statement credits or points/miles, it’s helpful to have a value for your points in mind beforehand (can’t go wrong with 2 cents each).

I was expecting something on my Prestige card, but hey, I’ll take $170 worth of miles for a quick call. Motto/moral/theme: never hurts to pick up the phone and ask.

Have you gotten any good Citi retention offers lately?

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

How do you have an Aviafor Silver for $0?! I would’ve happily kept mine for the $195 AF and free companion ticket if they hadn’t closed my account without notice. I had to get an attorney to get proper compensation from that inept bank, and that settlement also means I can’t ever have another account with them for life. I keep hoping they’ll exit the US market.

Sorry, it’s not Silver. It’s just a silver color. It’s whatever the $0 version is lol. And yeah, don’t worry, their terrible card lineup will do them in sooner or later.

That’s pretty crazy though – an attorney! Intense!

“So 8.5X AA miles on up to $1,000 – pretty great deal!”

If you have to spend the whole $1000 to get the bonus, than it is not really “8.5X AA miles on up to $1000”

It’s 8.5X AA miles on exactly $1000

Hey Bob! You’re right – I’ll update. Thank you! 🙂

Good for you, Harlan!

I actually had a different experience with my Citi AAdvantage Platinum Select card, Called to see if they would waive the annual fee. The gracious CSR said that would not be possible, but offered me 3000 “courtesy” AA miles. No additional spending or anything else. Never forwarded me to a retention specialist.

I am skittish about saying “cancel,” because that is how I instantly lost my Citi AA AMEX a while back.

Barclays is definitely unpredictable and random. They have these paroxysms of generosity…Then… Nothing at all an any card

Yeah Barclays has always been strange. I’ve also had luck with US Bank, oddly enough!

3,000 AA miles = $60, so yeah I’d take that too!

Instead of cancel, you could say something gentler, like “Thinking of closing… want to talk to someone.” I had the same thing happen with Amex. They were like, OK it’s closed! But I think now they have to read to you a disclosure or something? That was a few years ago by now.

Thanks for sharing your experience! 🙂

Thanks for reminding! Do you think it is better to wait for the annual fee to post like with the other credit cards? Btw, when is the next Dallas meet up!

I’ve had luck both after the fee posts and like 6 months into the cardmember year… there doesn’t seem to be a pattern. I’d try anyway just to see what comes up.

And I was thinking 2/17 or 2/18? Do either of those work?

I will try to give them a call in the next week for an offer when the fee is due then! Probably the middle of the week may work better for others. Some may have the Monday off for holiday and may be out of town.

Ahhhh right! I go to PVR on 2/20 so maybe 2/19. Or when I get back. Somewhere around that time. I’ll figure it out this week.

Let me know how the call goes and if you get any good offers!

I don’t think 8000 miles for $1000 is a good deal. You can get 10s of thousands of Delta SkyMiles for spending money you would spend anyway on their cards.