I’ve written how everyone with a Citi card should call at least once a year and check for a Citi retention offer – particularly if the card has an annual fee.

My Citi Prestige annual fee recently posted. I called, and no joy. This week, the fee on my beloved AT&T Access More card posted, so I called again.

This time, I got my favorite retention offer so far: an extra 2X Citi ThankYou points on all spending, with a max of 35,000 points.

That breaks down to 3X points per $1 spent on up to $17,500 spent in non-bonus categories. And 5X points per $1 spent for online purchases (which are a bonus category with this card). Wow.

Gosh I love this card

I immediately queued up mortgage, HOA, and car payments with Plastiq (because it’s a MasterCard, which you can use for those payments) and moved the card into my wallet – a place it hasn’t been for a looong time.

3X Citi ThankYou points for everyday spending is an awesome return. I value that at 6% assuming each point is worth 2 cents each.

Morever, earning an extra 35,000 ThankYou points is worth $700 to me by that same metric. AND this card earns an extra 10,000 Citi ThankYou points when you spend at least $10,000 in a cardmember year. Because this offer will also trigger that bonus, I value it for an additional $200.

So yes, this quick call recouped the card’s $95 annual fee nearly 10 times over. And is a great reminder why you should always always call Citi about retention offers.

Note: The Citi AT&T Access More card is no longer available. Nope, not even for product changes.

Citi retention offer details

I noticed a few new things with this call, which was very similar to Middle Age Miles’ call on their Citi Premier card.

For one, I’d heard you could accidentally close a card through the automated system if you say “close card” so I said “representative” and got an agent pretty fast.

I explained the fee had just posted on my card and I wasn’t using it as much (which is true now that I’m using the Citi Double Cash for mortgage payments through Plastiq). The agent asked, “Do you want to close it?”

So I said, “Well, I’m thinking about it… do you have any bonus offers available if I keep it?”

She replied, “I can only transfer you to check if you say YES, you want to cancel.”

That kinda gave me pause. My thought is too many cards were canceled through the automated system so now they need verbal confirmation before they do it. I didn’t want to say it. But I did. “Yes, close the card.” 🥵

When I tell you I was sweatin’, dear reader. Omg. What if they actually canceled my AT&T ACCESS MORE CARD that you can’t get any more? I was shooketh. But, that did the trick and I got transferred. Whew.

The next agent

Then I got an account specialist on the line. Went through the same spiel again. “Are there any bonus offers?”

She asked if I wanted a lower APR? Nope, don’t carry balances.

How about a balance transfer offer? I listened out of curiosity. 4.99% APR and a 3% fee. Nope, that sucks.

“Do you have any offers to earn bonus points?” That’s when she unleashed the best retention offer I’ve ever gotten from Citi. But could it possibly get better?

“Hmmm… any others?” I had to ask. But no, it was just the one and it was more than enough. “I’ll do it.”

She explained the offer would be applied the next business day and I’d have six months to complete all the spending. Perrrfect.

I should’ve asked about any offers on other cards, but I was at work so had to rush back. And besides, $17,500 in spending will keep me busy for a bit.

Yussss

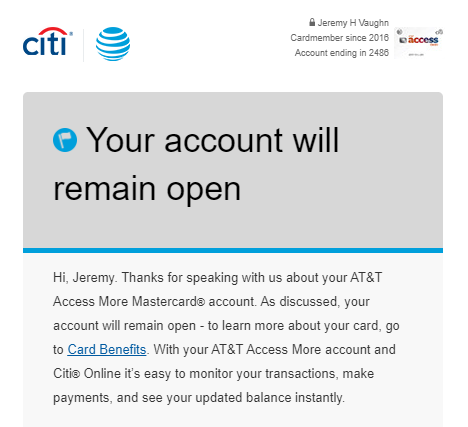

Today, I got an email from Citi confirming my card is still open (thank gods!). I really love the AT&T Access More card and find it’s way worth the $95 annual fee. As long as it stays in its current form, I see no reason to ever close it.

Bottom line

Citi retention offers are a huge feather in Citi’s cap. Even though I wanted to keep my card, I didn’t intend to use it for that much spending – and now I am.

If I really wanted to cancel, this offer would’ve swayed me. But even still, Citi got me to put it back in my wallet – a place it hasn’t occupied for years – and actually use it for everyday spending for a while. Smart, smart move.

So this is a reminder to check your Citi retention offers, even on cards you plan to keep, and especially on cards with annual fees. Just call the number on the back of your card and ask for a representative.

Apparently, you now have to explicitly say you are going to close the card to get an account specialist. And if my offer is any indication, Citi has stepped up their game with some aggressively good retention deals.

Between all the category bonuses, promotions, points rebates, and spending offers like the one I got, Citi ThankYou points are my favorite points to earn and burn right now. It’s a shame that Citi cut travel insurance benefits on all their cards, which might drive some peeps into the arms of Chase or Amex.

I wanna keep my precious score for a long, long time

Now I have Citi Prestige, Rewards+, Double Cash, and AT&T Access More all earning Citi ThankYou points. And just to beef it up, I’m seriously pondering another Citi Premier in the near future. It’s just that… now that I have an 850 credit score, I’ve become protective over it and don’t want to lower it over the hard pull. Decisions, decisions. (But I’ll prolly do it very soon.)

Please share – have you gotten any Citi retention offers lately?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

That’s awsome news. I know how fond you are of TYP.

Heck YES! I think Citi is knocking it out of the park with the earning capability. They’re still behind UR and MR, but definitely holding their own. They’re by far the easiest points for me to earn organically.

Hey Harlan – Congrats on the awesome ATTAM retention offer!!! That 2x extra TYP offer is the best! I’ve been hitting mine hard in the 6 weeks since I got it – already spent more than half of the $17.5k cap for the bonus points. Also, many thanks for the links!!! Talk soon and take care ~Craig

Squeeee, was so excited when I got it! Your posts definitely inspired me to call, especially when I saw the annual fee post. 🙂 Talk soon, C!

Got a 20k offer on my Prestige for 4K per month spend x 3 months. I put about 50k, mostly Plastiq for my mortgage on it. (Took advantage of a limited time 1.5% offer last year.) Will be switching my mortgage to a double cash soon.

Good plan, Steve – exactly what I would do. #greatminds 😉 Good on you for getting that offer – and thanks for sharing the datapoint!

Yesterday I ask for the 35k 2x TYP offer on my Double Cash card