Also see:

- Airbnb Hosting by the Numbers: 2017 Update

- So You Wanna Be an Airbnb Host? Part 1: Finding the Right Place

I’ve written extensively about my adventures hosting on Airbnb. I’ve always leased apartments, then listed them on Airbnb. That formula worked in New York and continues to work in Dallas.

The Airbnb service is intended to rent space in your primary residence. I’d never done that because I didn’t want strangers in my actual home. But last month, I took a weekend and converted my spare bedroom and bathroom into a private guest room and listed it on Airbnb.

And so far… wow! The response is incredible. Guests are loving it. And something that surprised me… so am I!

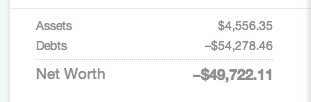

A nice benefit is I’m earning more than if I had a roommate. And I’m even thinking it could get to the point where it could cover my entire mortgage payment – I could live in my own place for basically nothing!