January 2022 felt like the longest month in a while. As I write this, the stock market will close on a downswing, which means all the numbers I just changed from pluses to minuses are going further into negative territory later today. Such is the stock market roller coaster ride, especially lately.

On top of a volatile month, I had some cash outlays that I’ll get caught up this month. All around, it felt like the hits kept comin’.

I’m still standing

But, life’s good and things are in the works, as they always are. I keep dancing around this midpoint in my FI journey – right around the $250K mark. When I cross it, there will be much celebration. I’ve been thisclose for a few months now.

This month, I’m down $8K. But we know how quickly things can change. Slow and steady. Except it’s really slow and feels shaky?

Unlike other months, I’m detached from the numbers and continuing to invest as I always have. I have 2.5 years left to reach my $500K goal.

February 2022 Freedom update

I don’t mean to sound dour. Au contraire – it’s been a great month full of growth and change.

Grrr-ness

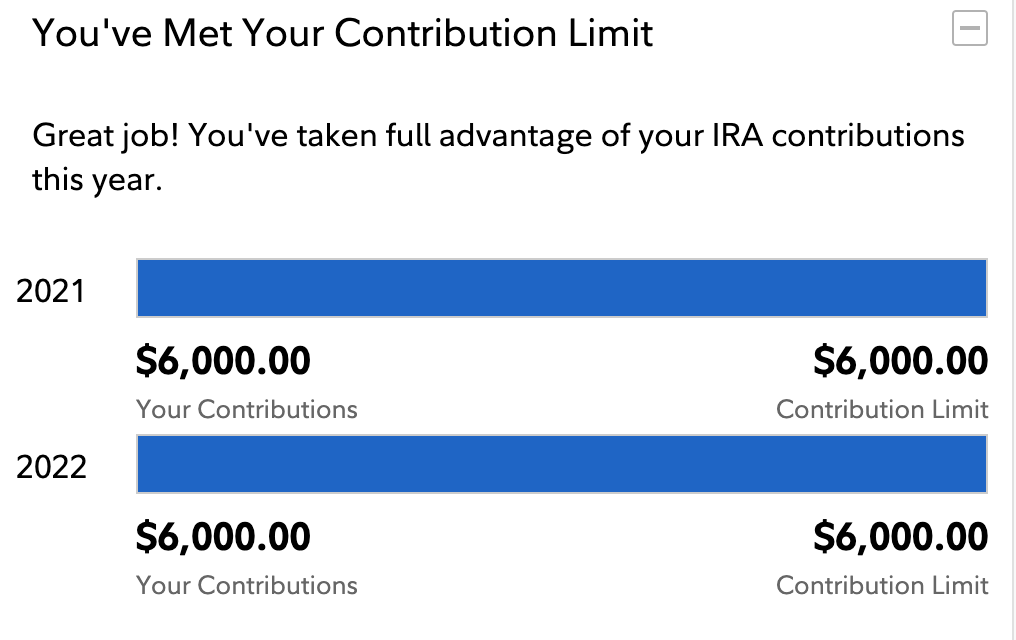

It’s just that – I maxed out my Roth IRA on January 1, like an eager investor. The market was strong and things looked promising. Days later, it all tumbled and that $6,000 isn’t worth $6,000 any more. Which is fine – it’ll go back up. It’s just part of the ride.

My overall goals haven’t changed. In 2022, I still want to:

- Save $30,000 in savings accounts

- Get to $25,000 invested in my taxable brokerage account

- Max out my 401k again

- Shoot for a $350K net worth by year end

My son and dog playing in our yard

I’m also in the full swing of #dadlife and all that entails. I get to actively co-parent my son every day and he’s doing so great. I swear he grows taller almost every day. It’s going too fast! 😫

This month, I’ll get caught up with my credit card bills from attorney fees. It was expensive – but worth every penny. That was part of my long, roller coaster-y January. Good thing my lawyer accepts credit cards. #minspend 🤑

Keeping on

The good thing about the dip is that I’m dollar cost averaging with my 401k contributions and bought low a couple of times. That resulted in discount stocks, so I’m pleased with how that turned out.

I also continued to add money to my HSA and bought the dip with investment funds inside that account.

But I was mostly in spend mode last month. 💸

Cute dog alert! 🚨

The good news is that I’m quickly meeting the spend on my brand new Capital One Venture X card (which I am LOVING, btw!). And now I’m working to pay it all down before interest hits. That means lots of extra freelance work and late nights working while my son is taking naps or sleeping. I try to spend as much time as I can with him during the day.

I feel my identity and relationship to money changing because of him. More and more, I just want to make sure I’m secure enough to take care of his needs. It’s been such a shift, and I’m still catching up to that, too. These past few months have been nearly nonstop action.

By the numbers

I added $1,667 to my 401k last month, but my overall balance is only up $801 – just to illustrate the effects of this current dip.

My house is already appreciating. The payments are manageable and it hasn’t needed any big maintenance yet (thank gods). I love my little house so much.

Once I get caught up this upcoming month, I’ll start funneling cash into my savings account to rebuild my emergency fund. That’ll give me some security in case anything happens. But as it stands, I have some more attorney fees to pay before I can really focus on that.

| Current | Last month | Change | 2022 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| Overall investments | $208,496 | $217,160 | -$8,664 | As much as possible | |

| 401k (contributions only) | $1,667 | $0 | +$1,667 | $20,500 | |

| 401k (overall balance) | $23,786 | $22,958 | +801 | As much as possible | |

| Traditional IRA | $116,374 | $122,427 | -$6,053 | xx (can't contribute) | |

| Roth IRA | $52,890 | $55,829 | -$2,849 | $6,000 (in contributions) | COMPLETE! |

| Taxable brokerage | $9,770 | $10,250 | -$480 | $25,000 (total invested) | |

| Savings | $6,116 | $6,113 | +$3 | $30,000 | |

| Primary home equity + appreciation | $18,183 | $15,591 | +$2,592 | $20,000 | |

| Net worth in Personal Capital | $238,904 | $247,214 | -$8,310 | $500,000 (overall goal) | Track your net worth with Personal Capital |

I know I keep alluding to lawyers, and suffice it to say I can’t speak about any of that yet. But I will as soon as I’m able. It’s just gonna be a little while longer, but we’re almost there.

Beautiful sunset here in OKC

So that’s my financial snapshot going into February 2022. I’m heavily invested in stocks, but continuing to add more all the time.

I always think about buying more crypto or stashing something away in a REIT through Fundrise or Elevate Money, but feeling like that’ll be a distant goal from where I’m at now.

Still, it’s good to diversify and once I get to a good spot, I’d love to explore some alternative investments.

February 2022 Freedom update bottom line

In the last 30 days:

- I’m thoroughly in the swing of #dadlife

- My stocks are down like everyone else’s

- My home equity continues to build

- I got a running start on my Capital One Venture X card minimum spending with retainer fees

- I stuck to my overall investing plan and added more funds to my 401k and HSA accounts

I’m working my hiney off to pay everything down right now and keep everything flowing. The stock market is doing its thing and I’m staying fully invested because I’m doing my thing, too. If this year is a rough patch – so be it. Investing in stocks is still the best long-term investment out there, even if this year ends up with negative returns. I’m in the mindset of wow – I’m getting everything on sale. Here’s hoping February picks up.

In a couple of weeks, I’m heading to Boston and Washington, DC – my first time flying since March 2020! I’ll have to do another post on that. I’m suuuuper excited to be back in the sky! ✈️

Thank you to everyone who reads these updates. It means the world to me. 🌌

Stay safe and scrappy out there! ✨

-H.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Children can definitely be life changing. I’m so happy that you have the opportunity to be with your son in a daily basis. It does go fast!

And enjoy your flight!

Thank you so much, Audrey! It’s been such a ride lately. Hope to share more soon. So good to hear from you. Hope all is well with you, too! <3

Great post, Harlan! How are you tracking/assessing appreciation/home value?

Thank you, Billy! I’m using Zillow’s Zestimate. I know it can be notoriously unreliable, but it’s actually pretty accurate for my area. Also, my car is worth much more than the value I use for it and it’s totally paid off, so I figure any discrepancies will come out in the wash.

I subtract the mortgage balance from the Zestimate to come up with the number value. So far, it seems to be good for tracking and isn’t very far off the mark.

Thanks again for reading and commenting!