Update: This offer is no longer available. Check here to see the latest card offers!

Capital One shook things up this week when they announced mondo 200,000-mile sign-up offers on their Spark Miles and Spark Cash cards. And on the Spark Miles card, those rewards will become transferable to 12 airlines starting December 2018, which is stellar. It’s always good to have more options – especially with flexible rewards programs.

In fact, peeps looking for a single-card solution to most points dilemmas finally found their match. You can redeem the points for 1 cent each, and with the Spark miles card, transfer them at a 2:1.5 ratio to useful airlines like Air Canada, Etihad, and Qantas.

They’re excellent deals if you want a rewarding small business card without hassle. You’ll end up with $3,000 or 225,000 airline miles after the minimum spending is complete.

The required spending and opportunity cost are high with this one

But they’re NOT for everyone. I’ll explain why.

$3,000 or 225,000 Airline Miles After a Boatload of Spending

- Key Link: Capital One Spark Cash for Business – learn more here

- Key Link: Capital One Spark Miles for Business – learn more here

Who wouldn’t want a chance to earn $3,000 in cold hard cash from a single sign-up bonus? Especially one that can also translate to 225,000 airline miles?

On the Capital One Spark Cash for Business, you’ll earn a $500 cash bonus when you spend $5,000 in the first 3 months of opening your account. Then an additional $1,500 when you spend $50,000 in the first 6 months.

With either Spark card, you’ll have $3,000 to spend – and in the case of the Spark Miles card, 225,000 miles to play with

And with the Capital One Spark Miles for Business, you’ll earn a bonus of 50,000 miles when you spend $5,000 in the first 3 months of opening your account. Then an additional 150,000 miles when you spend $50,000 within the first 6 months.

Those are gigantic bonuses, but then again – so is the spending. It breaks down to ~$8,333 per month for 6 months.

These cards are aimed at small business owners. If you have a bout of spending coming up for things like equipment, computers, or other upgrades, you can more easily meet the minimum spending.

The differences between the cards

Both cards require the same big spending to hit the maximum reward thresholds. The Spark Cash card is a pure cashback card, whereas the Spark Miles card earns rewards to offset travel purchase, or to send to 12 different airline programs.

The earning rate on both is the same – 2X.

1. Capital One Spark Cash for Business

| Capital One Spark Cash for Business | $500 Cash |

|---|---|

| |

| • $95 annual fee, waived the 1st year | • $500 cash bonus when you spend $4,500 in the first 3 months of opening your account |

| • Earn an unlimited 2% cashback on every purchase • No limits on how much you can earn | • Learn more here |

This card is all about cashback. The rewards you earn are redeemable in any amount for any purchase. You can’t beat the simplicity with the rewards program – and the site and app are intuitive and user-friendly.

Granted, other 2% cashback cards have no annual fee, but there are often “gotchas” when it comes time to use your rewards.

I see the annual fee you pay starting the second year as a convenience fee more than anything. And the sign-up bonus you can earn would cover the annual fee for 32 years (remember, the first year it’s $0)!

You’ll earn $1,000 from 2% cashback on the $50,000 you’ll spend to earn the $2,000 sign-up bonus. So you’ll end up with $3,000 to do whatever the heck you want with.

2. Capital One Spark Miles for Business

| Capital One Spark Miles for Business | 50,000 miles ($500 toward travel) |

|---|---|

| • Limited time offer |

| • $95 annual fee, waived the 1st year | • 50,000 miles - equal to $500 in travel - once you spend $4,500 on purchases within the first 3 months from account opening |

| • Earn an unlimited 2X miles on every purchase • No limits on how much you can earn | • Learn more here |

The rewards you earn from are worth 1 cent each toward nearly any travel purchase. Whereas the Spark Cash card earns straight cashback, this one is better if you want to redeem for travel like flights, Airbnb/hotel stays, Uber rides, cruises, or pretty much anything else related to travel.

Wanna visit Austin to see 6th Street? Use Spark miles toward your flight, hotel stay, Uber to downtown, or even the parking. It’s all about travel

And starting December 2018, you can transfer the miles at a 2:1.5 ratio to:

- Aeromexico

- Aeroplan (Air Canada)

- Alitalia

- Avianca

- Cathay Pacific

- Etihad

- EVA

- Finnair

- Flying Blue (Air France & KLM)

- Hainan Airlines

- Qantas

- Qatar Airways

So you’ll earn 2 Spark miles or 1.5 airline miles per $1 spent.

If you meet the full $50,000 in minimum spending, you’ll earn an extra 100,000 Spark miles, and wind up with 300,000 Spark miles. They’re worth $3,000 toward travel purchases.

I used Etihad miles to book a Business Class award seat on Brussels Airlines from New York-JFK to Brussels!

Or if you transferred them to an airline, you’d have 225,000 miles (300,000 X .75). That’s enough to fly in First or Business Class to nearly anywhere in the world – or several award flights in coach, which can be worth much more than $3,000.

Capital One rules & policies

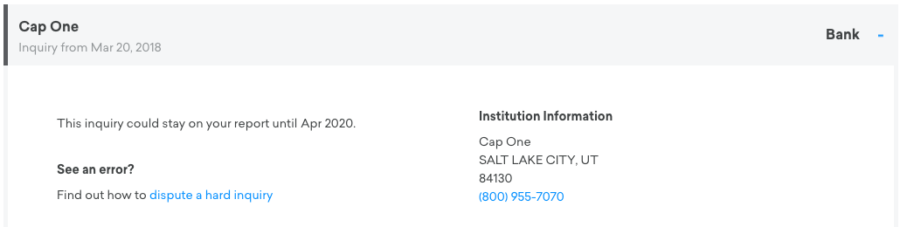

Capital One is a conservative bank, and won’t approve more than 1 application per 6 months. That’s if you can get an approval.

I’ve applied for a couple of Capital One cards the past few years and gotten auto-denied both times. The last time was actually for the Spark Cash card when the bonus was “only” $1,000, so I’m hesitant to apply again.

No love from Capital One here

The other reason is because Capital One pulls from all 3 credit bureaus (Equifax, Experian, and TransUnion). So without a firm sense I *might* be approved, I don’t want 3 new credit inquires on my report.

They seem to deny peeps with lots of cards opened recently. That said, they also tend to be lenient with small business applications.

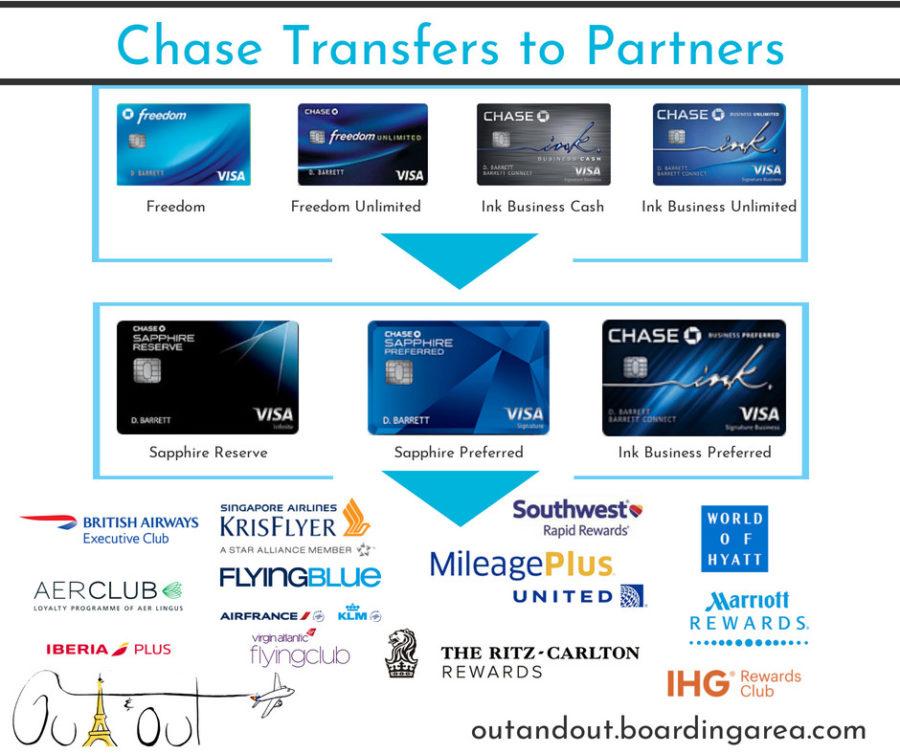

All the best airlines have other transfer partners

The big earthquaking news is CAPITAL ONE HAS TRANSFER PARTNERS ZOMG. But you can access these partners (which the exception of Finnair and Hainan) through other programs:

- Aeromexico – Amex

- Aeroplan (Air Canada) – Amex

- Alitalia – Amex

- Avianca – Amex and Citi

- Cathay Pacific – Citi

- Etihad – Amex and Citi

- EVA – Citi

- Flying Blue (Air France & KLM)- Amex, Chase, and Citi

- Qantas – Citi

- Qatar Airways – Citi

And I wouldn’t call Finnair or Hainan notable losses. There are plenty of Amex and Citi cards that let you earn points to transfer to these same airlines – AND to other, more useful programs.

I’m hopeful Capital One will snag a truly great transfer partner in the future, though.

You can do better with category bonuses

The Spark cards earn a flat 2X on every purchase (1.5 miles for the Spark Miles card). This simplicity is both beautiful and limiting.

I personally spend the bulk of my money on travel and dining, so I’d rather earn bonus points for those purchases. For the odd purchase where I only earn 1X, I’m either meeting minimum spending or making up for it with category bonuses.

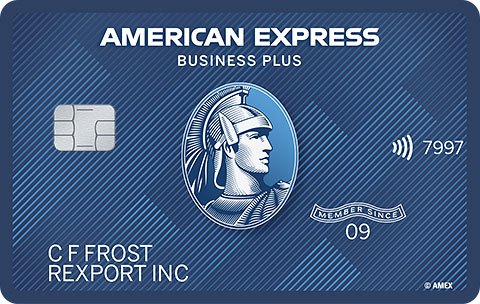

| Blue Business Plus Credit Card | 10,000 Amex Membership Rewards points |

|---|---|

| • 2X Amex Membership Rewards points on all purchases on up to $50,000 in spending per calendar year • No bonus categories to think about or activate and NO annual fee • Can transfer the points you earn to Amex travel partners |

| • $0 annual fee (See Rates & Fees | • $3,000 in eligible purchases on the Card within your first 3 months of Card Membership |

| • This is by far the best card for 2X points on all spending | • Learn more here |

The Amex Blue Business Plus card (learn more here) earns 2X Amex Membership Rewards points on up to $50,000 in purchases per calendar year. That’s a hard limit for some small businesses, but there’s no annual fee as opposed to the Spark cards’ $95 annual fee (after the first year).

| Chase Freedom Unlimited® | • Earn an additional 1.5% cashback on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cashback |

|---|---|

| |

| • $0 annual fee | After, earn unlimited 1.5% cashback on all purchases |

| • Great for everyday spending | • Compare it here |

And the Chase Freedom Unlimited earns a flat 1.5X Chase Ultimate Rewards points on all purchases.

You need to pair Chase cards to earn more points, but it’s so worth it

You have to pair it with a premium Chase card (with an annual fee) to transfer to travel partners. But Chase has much better transfer options, like United, Southwest, and Hyatt. And the cards with an annual fee all have category bonuses.

Opportunity cost

Spending $50,000 on one card means you’re not spending $50,000 on another card – or meeting minimum spending on other cards. Sure, you might gain $3,000, but you could meet the minimum spending on several cards for that much spending.

And if you spend a lot in certain categories, you could be missing out on a huge amount of bonus points.

$50,000 is a LOT of spending – and you could maximize it in other ways

There is always an opportunity cost in this hobby – this deal just seems like a very big one. If your business is handily spending $8,000+ per month, you could earn 6 to 10 card bonuses instead of one, with a potential value of way more than $3,000.

It’s more to manage, but in terms of sheer spending, $50,000 can get you a lot more than this.

So who should consider the Capital One Spark cards?

If you:

- Have no trouble spending $50,000 in 6 months

- Want supreme simplicity from a rewards program

- Want to commit to one card and one bonus for half a year

- Like Capital One’s cards and ecosystem

- Want to access the new travel partners

- Don’t want to overcomplicate your wallet, travel goals, or award strategy

This card has niche appeal – but not as narrow as it seems at first look. Tons of small businesses spend enough to earn this bonus quickly.

And Capital One has its fans. The website is easy to use and the rewards program couldn’t be simpler. Many peeps find value in that – and see the transfer partners on the Miles (NOT the Cash!) card as a fun extra instead of a limitation.

Bottom line

- Key Link: Capital One Spark Cash for Business – learn more here

- Key Link: Capital One Spark Miles for Business – learn more here

The more I look at the offers on the Capital One Spark cards, the rawer the deal gets. The numbers are eye-popping:

- $3,000 to spend after meeting the minimum spending (on anything with the Spark Cash, toward travel with the Spark Miles)

- 225,000 airline miles to transfer with the Spark miles card

- $50,000 in tiered spending over 6 months to earn the full bonuses

These are excellent offers from a single signup bonus. You can, of course, do better with multiple card offers and category bonuses. But that adds complexity.

If you’re a small business owner and want to keep it simple (and can complete all the spending), these offers are bar none. Go for ’em.

Remember, you can access most of the transfer partners with Amex or Citi. And we don’t yet know how fast the transfers will take – that will be important to know.

Finally, other cards or card pairs can get you similar earning rates. But again, if you want simplicity, it’s hard to top these offers. They’re for a niche crowd, and for that crowd, get them while you can. These deals are for a limited time with no end date yet announced.

What do you think of the revamped Capital One Spark cards?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Can one just put taxes on this card in April and meet the bonus? seems like $900 convenience fee and you done.

Yup, def. That would work – boom!

I’ve got a question that has been studiously ignored by every blogger I’ve asked, because it’s inconvenient to answer, but here goes again: can you get a second card if you already hold one for your business?

I am not sure I understand. Until recently, people could get more than one of a particular type of card, both personal and business. They have stopped being as accommodating lately. It varies by issuer.

Yes, you can. The only limit is one card every 6 months with Capital One, as far as I’m aware.

How sensitive are they to Msing?

Not very, as far as I know. The trick with CapOne is getting approved in the first place. Once you’re in, you’re in.