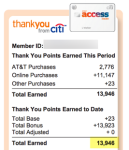

I’m getting more into Citi’s ThankYou program recently (because Citi ThankYou points are so easy to earn).

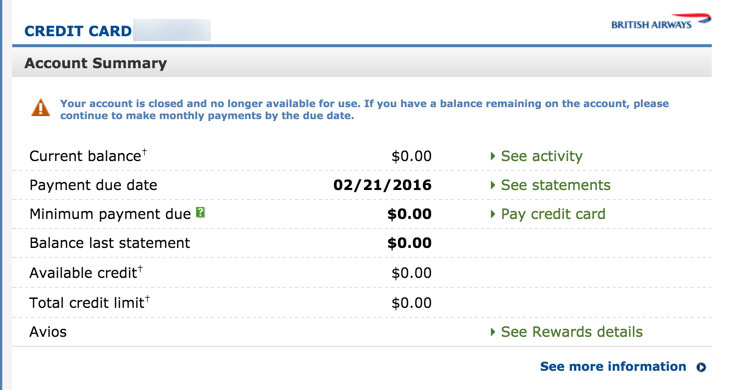

And while I can’t totally abandon Ultimate Rewards (for access to United Airlines, British Airways, and Hyatt), I’ve been thinking of award flights where collecting Citi ThankYou points instead of Ultimate Rewards might actually make more sense.