Update: One or more card offers below are NO LONGER AVAILABLE. Please check here for the latest deals!

Well color me surprised. I wasn’t expecting to see any type of limited-time offer on the Amex Starwood cards again. But now we have one, although it’s only on the business version of the card.

And, it’s dumb. Geez, Amex, it’s like you’re on the Titanic, and about halfway across the Atlantic right now…

The short

The most restrictive offer ever on an otherwise so-so card. Either Amex is desperate or thinks we’re stupid… or both. Not worth it for most.

The long

- Link: Honest Reviews

Wowww, let me peel this out a little.

With this offer, you’ll earn 2 free nights at:

Participating Category 1-5 hotels & resorts worldwide after you use your new Card to make $5,000 in purchases within the first 3 months.

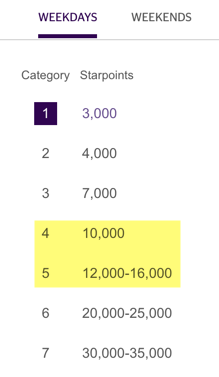

Here’s SPG’s weekday award chart (you get a 1,000-point discount on weekends at Category 1 and 2 hotels):

Starwood’s award chart

Obviously, you want to target the Category 4 and 5 hotels to make the most of the offer.

So at best, this deal is worth:

- 20,000 Starwood points for 2 nights at a Category 4 hotel

- 24,000 Starwood points for 2 nights at a Category 5 hotel @ 12K per night

- 32,000 Starwood points for 2 nights at a Category 5 hotel @ 16K per night

Considering the usual sign-up bonus on this card is 25,000 Starwood points after completing the minimum spending requirements, you actually come out worse with the first two options.

There are a few instances where this deal might be worth it, like 2 nights at the new Westin Nashville, but you’ll have to be selective

The only way you can do well is IF you find a Category 5 hotel at the 16K per night rate. Even then, this doesn’t beat the previous limited time offer of 35,000 Starwood points.

Restrictions!

The beauty of Starwood points lies in their variety of uses, like:

With this offer, you actually lose the ability to do these things with your points.

I’m really failing to see how this offer is better…

To boot, if you used the free nights at a Category 1 hotel during the weekend, for example, this offer would be worth only 4,000 Starwood points (!!!).

Really, Amex? I actually prefer the basic 25K offer which is also still available.

Can it be a good deal?

In limited settings. For example, Philadelphia, Portland, Seattle, and Nashville are all cities with surprisingly high hotel rates.

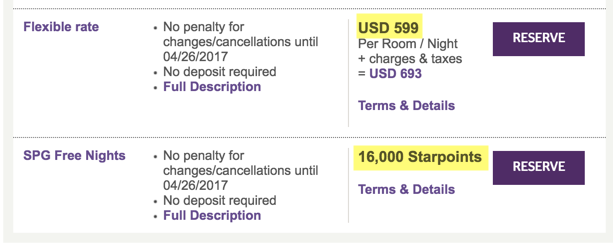

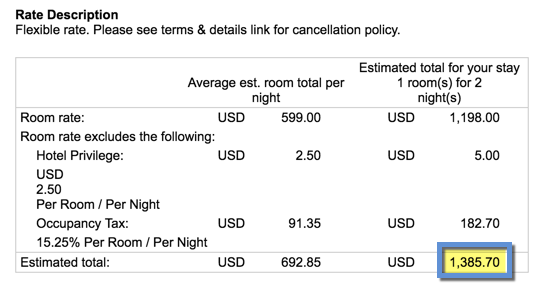

The base rate at the new Westin Nashville is well over $600 per night (and it will be a Category 5 hotel)!

Here’s one instance where this offer is stellar

With this 2 free nights offer, you’d save well over $1,300:

Worth it

Many cities in Canada, like Vancouver and Toronto, can also be expensive. Or London. Or Paris. Hawaii sometimes (there’s a Category 5 hotel in both Honolulu and Kauai).

If you can find a Category 5 hotel that’s typically expensive, and that’s how you intend to use this offer, you’ll save yourself 32,000 Starwood points in the process.

And, as shown above, it can be a good deal – easily over $1,000.

It’s just… in comparison to the normal offer, or previous limited time offers, I wouldn’t trip over myself to pick it up, unless you have a specific use in mind.

Grade: D

Sorry, Amex. Your desperation is showing.

Why the low grade? For one, you can’t earn this sign-up bonus if you’ve ever had this card… in your entire lifetime.

Had this card 10 years ago and canceled it to explore other hotel chains? Well, Amex is saying you can’t have the bonus. No bonus for you! Which is damn stupid.

And, Amex likely knows they are sounding the death knell with their SPG card portfolio and are trying an offer to attract new customers. On the surface, it looks good: 2 free nights. But when you analyze it, you realize quickly it’s nothing special.

You know what would’ve been, though? THREE free nights. Now that would’ve earned a “B” for “Bitchin'”!

OR – the ability to use the 2 free nights at ANY category of hotel, including the super high-end ones.

But as it stands, Amex, ya blew it!

Keep or DTMFA: Keep.

Why am I rating this with a “D” but saying to keep it?

Because either:

- Amex will keep the portfolio and try to make the card better

- Chase will get the portfolio and try to make the card better

This comes marked with a big “hopefully” of course. But personally, I want to stick around to see what happens with the card.

I’m also curious to see how Marriott will treat Starwood now that the deal is done. Will they keep it semi-separate a la Ritz-Carlton? Or go ahead and make it Marriott?

Either way, one thing is for certain: SPG will be dead come 2018, and your Starwood points will be worth much less. Marriott is going to neuter SPG because they have literally no incentive to keep the program intact.

What, you think the largest hotel chain in the world is going to care about cannibalizing a once-great loyalty program after they join operations?

A final thought is this card gets you access to the lounges at Sheraton hotels, and that’s worth having if you stay there often.

But mostly, I’d keep this card in hope of some Chase – Amex competition, depending on how they divvy up the existing customer base.

That, to me, makes the card worth keeping (but curiosity killed the cat, right?).

So what’s your take? Do you agree with my Honest Review? Is the 2 free nights offer compelling enough to sign up for, or do you prefer the normal 25,000 point offer?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I’m on the fence with this one also. For someone who wants a Marriott card but can’t pass the hurdle of having too many Chase cards, or too many other cards in the last two years, getting an Amex SPG might be a way of getting the foot in the door with a card that is almost definitely going away.

Anything is possible, but the days of an AmEx SPG card are probably numbered. There might be some good incentives from Amex to convert the SPG to something else rather than let the account go to Chase.

Definitely. I think we will be seeing something one way or the other in the next few months. Most likely very early 2017. *fingers crossed*

If you get the card now, with the annual fee still waived the 1st year, that should be plenty of time to see where it’s headed.