Also see:

- FoundersCard Membership: Is it worth it?

- Details about FoundersCard benefits (Cathy Pacific, Avis, hotel discounts)

Update: You can lock in a FoundersCard membership for $295 a year through May 13th, 2016 when you sign-up with my link. This is $100 less than the usual rate!

So you guys know I’m been working toward FIRE (financial independence, retire early) lately. And part of that means ruthlessly cutting out extraneous spend.

So far, I’ve gotten rid of my gym membership, canceled credit cards that no longer serve me, and have cut back on my eating out (more trips to Costco!).

FoundersCard is $395 a year, which is a little “ouch.” I’m nearly due to the pay the annual membership dues again to keep the card for another year and I looked at it with an eye to cut it.

But, I’m going to keep it for another year.

Here’s why.

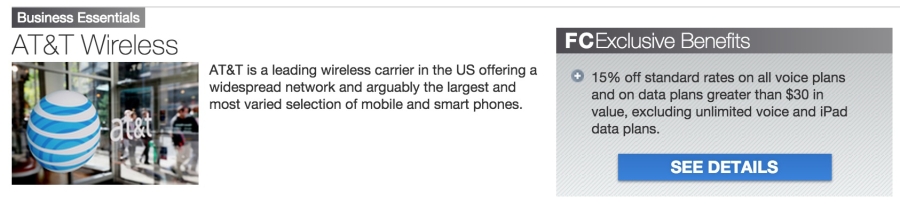

The AT&T Benefit

This benefit alone makes up exactly 1/3 of the annual fee for me.

I save ~$11 per month automatically.

$11 per month is $132 per year, which already brings the annual fee down to $263.

By far the most practical benefit. Set it and forget it. It gets applied automatically each month. Great if you have AT&T as a cell provider.

Free TripIt Pro for a year

If you have the Barclaycard Arrival Plus, you already get this for free.

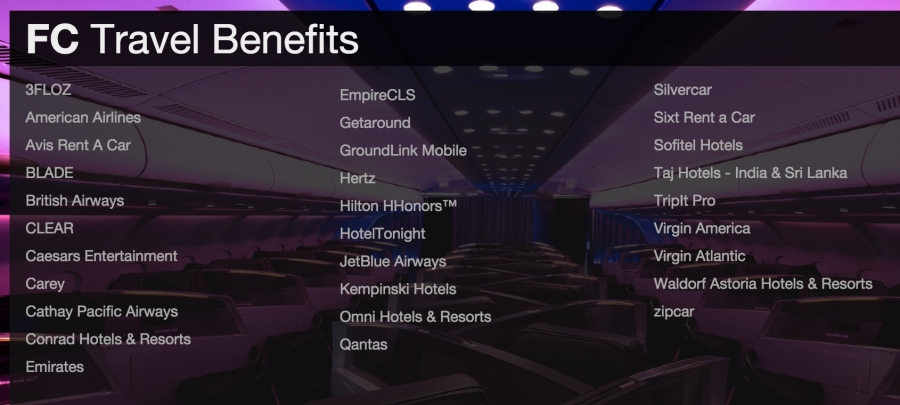

FoundersCard has a lot of the same ancillary benefits as a lot of premium credit cards. Like 10% British Airways flights, free Hilton HHonors Gold status, and free Avis First membership – benefits of the Chase British Airways Visa, Citi Hilton HHonors Reserve, and American Express Platinum Card, respectively.

I’m thinking about dumping the Barclaycard Arrival Plus, but I really do like TripIt Pro. So I can keep it for free.

This’ll save me $49 the first year and give me a 20% discount afterward.

Re: the Barclay card… I dunno, I’m really assessing it. Wondering if it’s worth it. More thoughts in a future post.

Anyway, following the math from above, this brings my annual fee down to $214.

Free Hilton Gold Status

I don’t stay in Hilton hotels often, but I might more now that I’ve dumped Club Carlson and recently picked up the Chase IHG MasterCard.

The last time I stayed at Hilton was at the Hilton London Tower Bridge when I went to see the Tori Amos musical “The Light Princess.” (I really should review that… the hotel, not the musical. The musical was fabulous.)

I was upgraded to a junior suite and given free breakfast and internet. And lounge access! Yup.

Needless to say, I drank my ass off at the club lounge, and started each day with a hearty breakfast (why does free food taste so much better?).

I want to value this at $200 a year if you stay at Hilton hotels often. But I’ll go with $150.

That brings my annual fee down to $64. (I don’t have any Hilton credit cards. I only have status through FoundersCard.)

Other perks

K, so $64 isn’t that much when you consider the events (though I’ve never attended – the timing has always been terrible) and other perks that will definitely add up to more than that.

Like:

10% off British Airways flights

Free Cathay Pacific Silver status

That can get you lounge access to Cathay Pacific business class lounges but only until the end of 2015 (HT: reader David!).

Free Virgin Atlantic Silver status and 20% off flights

Free Virgin Atlantic Silver status and 20% off flights

Doesn’t that get you extra miles when you fly on Delta?

Free AA Platinum Challenge

This’ll save you $240. I did the challenge in 2013 on my flights to Easter Island in LAN business class. Be sure to read the Wiki before you sign up!

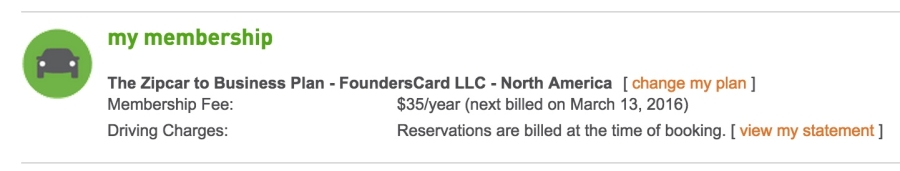

Waived Zipcar application fee and 50% off yearly membership

I love love love this. I use it all the time, so maybe I should’ve added it above. But whatever. You get free application fee (usually $25) and yearly membership for $35 a year instead of $70 a year.

And they’ll start you off with $15 in driving credit and give you 20% off weekday rentals. It all adds up!

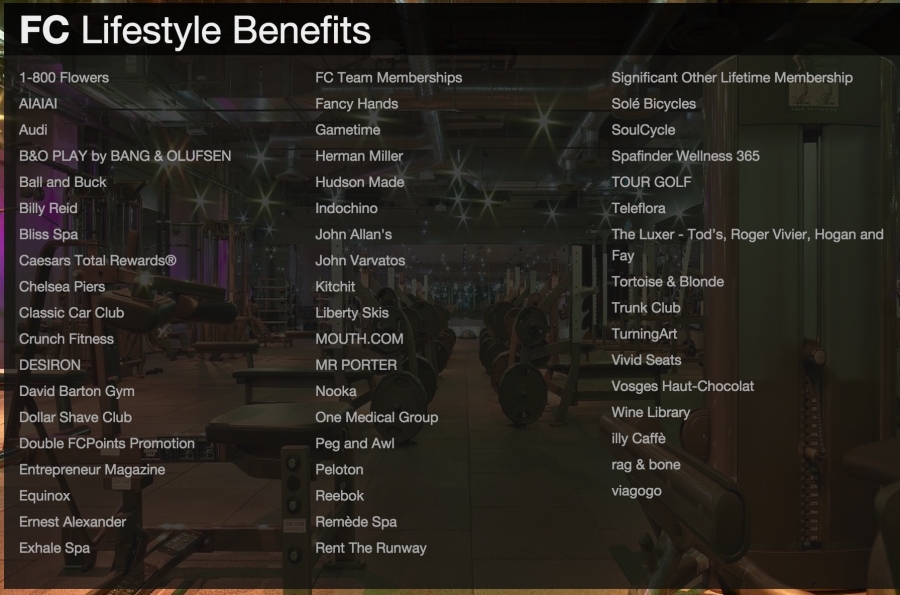

You’ll also get:

- $18 worth of free razors from Dollar Shave Club

- A free subscription to Entrepreneur magazine (I read it on the train)

- Preferred pricing on Apple products

- UPS discounts

- Free Hertz #1 Club Gold membership and 15% off rentals

- Lots of other stuff

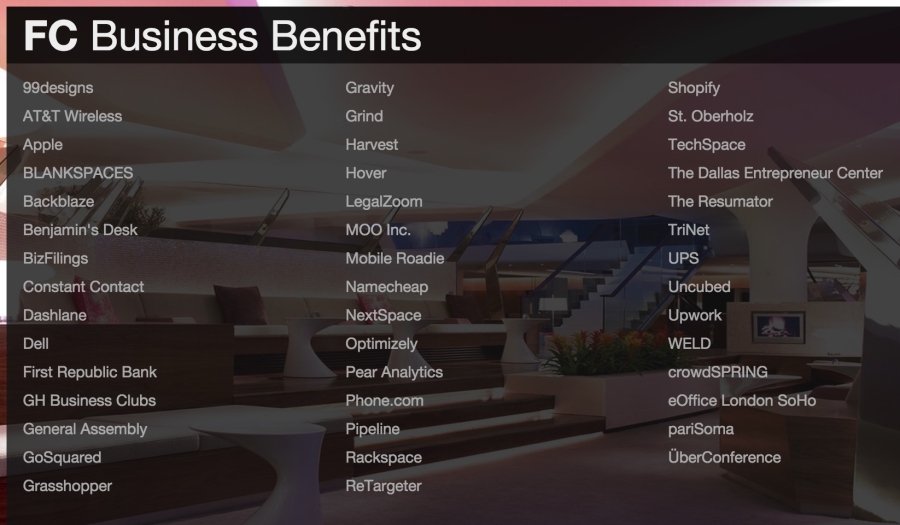

ALL the rest

Here’s everything. If you want to know more about a specific perk, ask me in the comments below. Because when you use my link to sign up for $395 a year, you can’t see the website. You can only see a sign-up page.

Bottom line

FoundersCard is geared toward travelers and entrepreneurs.

I was looking for a reason to dump them because I’m aggressively cutting expenses right now to pay down my student loans. But in the end, I decided to keep it because I get more value from the discounts and travel perks than what the membership costs.

If you wanna sign up, you’ll be locked in at $395 per year for life, which is good to know that it’ll never go up.

They have lots of interesting startups that are part of their offerings. And I’ve managed to find ways to maximize the membership beyond the annual fee. Perks are always being added.

In particular, I like that the AA benefit changes quarterly (in the past they’ve offered 5% off fares).

Oh and I forgot to mention: you get free Caesars Total Rewards Diamond status. Good if you are into Caesars hotels or take advantage of their partnership with SPG. (This shouldn’t be in the bottom line but I’m leaving it here anyway.)

Feel free to ask questions!

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I find it interesting AT&T Wireless is listed under “business” yet this FoundersCard discount cannot be used with business accounts. Only personal accounts. Especially since FoundersCard is for business executives.

How does Cathay pacific silver status give you oneworld lounge access? It only gives you ruby status, not emerald or sapphire, no? I’m a bit confused.

You’re totally right. I confused the oneworld lounges with the Cathay Pacific Business Class lounges. My mistake. Fixed now!

I thought that Cathay Silver was just OneWorld Ruby…meaning no OneWorld lounge access. Or did I miss something stupid?

Hi Cliff! No sir, it was my error. Fixed now!

It’s clear that your degree is not in accounting or mathematics. If you’re serious about cutting your expenses, start with your cell plan. You could save at least $30/month by switching to T-Mobile or an MVNO.

LOL, nope, my degree is in painting.

Re: T-Mobile. I’d love to switch but am on a family plan and they do NOT cover large parts of upstate New York, where it would be needed. So coverage is a factor here, too.

But you know, I’ll look into it anyway. Maybe I could get a better deal as an individual on T-Mobile. I’d wanna check out their international coverage, too. You might be on to something. Thank you!

Cathay Pacific Silver status does not give you access to oneworld lounges! Silver on Cathay is only Ruby Status.

Yes sir, fixed. Thank you!

Cathay Pacific will end its lounge access to Marco Polo Club Silver members by year end.

Good to know! I’ll add that! Thank you!

What discount do you get on Equinox or Apple?

The Apple discount is UP TO 15% off, depending on what you want to buy (computers, monitors, software, etc.)

The Equinox discount varies between Sport Clubs and Corporate All Access Clubs in certain locations. For example, for a San Francisco resident, FC benefits only apply to Northern California membership rates and All Access membership rates. It does NOT apply to membership rates if you’re dedicating to only 1 location though you may get their non-FC promo rates. I hope that’s clear.

And initiation fees are usually waived, depending on which gym you want to join.

I thing the Apple discount is only 8%

Peter

It depends on what you buy. Your discount might be more for a desktop computer, and less for a laptop, for example.

But yes, 8% sounds like the average discount, which is still pretty good!

we only got a 2% discount from Apple on a new MBP.

Hi Max-san,

Thank you so much for your email.

We love to propose you 2% discount but it’s from Jan 5th. Sorry for the inconvenience but we closed business for 2016 yesterday and will resume from Jan 5 th.

You can’t use discount but please use our Online Store if you are in hurry to purchase.

Best and happy holidays,

Asako

what discount do you get for exhale spa?

Here’s what they say:

– 20% off all spa therapies (excluding acupuncture).

– Complimentary week of Transformation for new Exhale guests; includes 1 week of unlimited classes, $25 towards a spa therapy, and 10% off boutique purchases. Members may bring a Guest for the Complimentary week of Transformation.

Harlan,

This is a very informative post. I’m not a huge fan of products or services that force you to sign up before you can see what you are getting. They seem to be running the $395 / year lock-in through January 31, 2016 again, I’m wondering if anything substantial has changed in their benefits (I’m sure they change all the time). I’ve been a big SPG card user in the past but now with the Marriott merger I’m doubting whether it will be worth continuing. Hilton Gold and free AA challenge seem worthwhile, though you can get Hilton Gold for free with Amex and $20k spend. Are both of those still around for 2016 benefit year? Also, what is the JetBlue benefit?

Hey Matthew!

Erm, they change the AA benefit quarterly. This quarter it’s for a lounge membership via Business Extra. Other quarters, they’ve had a 5% discount on fares, or a status challenge. But they’re good about switching it up.

Hilton Gold is still around.

And in fact, they’ve added more benefits than they’ve taken away. Everything here is still available, and I confirmed they will have Caesar’s Diamond status in 2016.

The $395/year lock-in has been going on for a while, but they keep extending it. So I guess it could end at any time.

The JetBlue benny is 5% off fares and 6x points per $1 spent on flights – they give you access to a special FC portal.

Re: Hilton – $20K spend is a lot, and other credit cards give it to you with payment of the annual fee. But this is a nice status to have if you don’t want to bother with tracking the spend or opening up another card.

I’ve really enjoyed having the card, and will renew again this year. Hope that helps!

What about Total Rewards , do you still get Diamond Status immediately?

YES. That benefit is still very much on-the-go. I confirmed with FoundersCard that it WILL remain for 2016.

Hi,

Wondering what the Silvercar discount is?

Thanks!

Hey Rob! It’s:

20% off all car reservations

Not bad at all! That could add up if you rent from them often!

What is the discount on CLEAR?

FoundersCard Members receive 6 months free of CLEAR membership.

Discounted $140 annual fee thereafter (regularly $179).

The first comment ws never responded to regarding AT&T Business accounts. Can you please verify if you can use this cards discounts with an AT&T Business account or only personal accounts?

Sorry, it’s only for personal accounts per the T&Cs:

“New and existing customers are eligible for discount as long as currently under a personal or post-paid family plan (business/corporate plans are not eligible for preferred pricing).”

What is the Audi discount? Thank you!

Here are the details:

-At participating United States dealers, you will be able to purchase or lease select MY15/16/17 Audi models at Dealer Invoice price plus $300 (excluding RS 5, RS 5 Cabrio, RS 7, TT RS, A8 W12, Q5 hybrid, and R* models. Other exclusions may apply.).

-Examples of Dealer Invoice pricing may be found online via websites like Edmunds.com or others, but we make no guarantee of accuracy on those prices listed.

-FoundersCard Members can purchase one (1) Audi vehicle per year with this program.

-For eligibility in this program, FoundersCard Membership must be current and in good standing for a minimum of six (6) months prior to purchase or lease.

This is almost a year and half old article, would you want to give an update on how you like it? And are benefits working out for you?

Yes! I still use many of the same benefits listed here – not much has changed. They change the AA benefit every quarter, and they’ve added a few “this n that” discounts, but the core perks are all still intact. I’m happily renewing my membership for as long as it stays like this.

Maybe I’ll dig a bit deeper and post a new review soon. Thanks for the idea! But yes, still very satisfied overall.