My friend Angie passed this tip along today, and I must say I was very tempted.

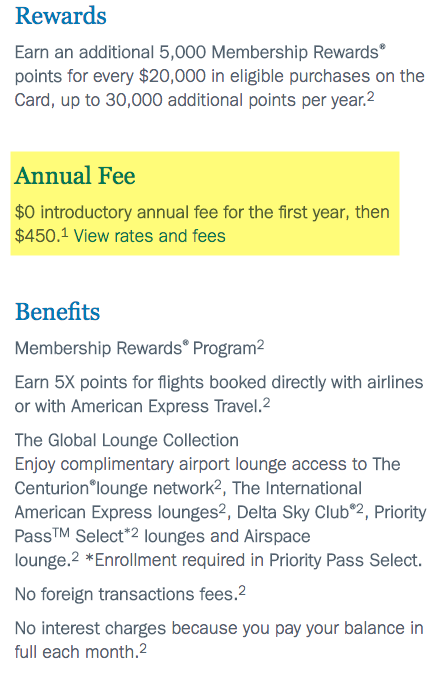

You can pick up the Ameriprise Amex Platinum Card with no annual fee the first year.

Good deal alert!

For those of you who can’t earn the sign-up bonus on an Amex card, the good news here is there isn’t one – so you’re not missing out on anything.

Plus, now is a good time to apply because the $200 annual travel credit will reset in January 2017.

So you essentially get the card free for a year, plus $400 in statement credits ($200 in 2016 and $200 in 2017).

Why the Ameriprise Amex Platinum Card?

The typical benefits of other Amex cards are all here, too. Including access to the Centurion lounges, Priority Pass Select, and Delta SkyClubs.

And you’ll get 5X Amex Membership Rewards points for airfare.

Click this tab to find the card

Angie confirmed she is NOT an Ameriprise client and was instantly approved online today. In fact, she doesn’t have any accounts there.

This is a nice workaround to the once per lifetime rule. You might consider trying for this card if you want to keep lounge access but don’t want to pay another annual fee.

Also, you get $400 to have the card the first year.

There’s also evidence that you can reapply for this card shortly after closing it – just to put that out there.

…in theory

Finally, I can personally confirm it’s possible to have two Amex Platinum Cards at the same time – in case you don’t want to cancel your existing card before opening this one.

Any drawbacks?

Just the minor ding to your credit score, but that’s temporary.

No one needs two Platinum Cards. But if you’re in limbo, or nearing the annual fee on your existing one, you can get an easy double dip for the $200 travel credit.

To my current knowledge, you can still set United as your preferred airline and purchase gift cards through the MileagePlus X app to trigger the credit.

Mostly, this is an easy way to get free lounge access and an extra $400 worth of stuff in exchange for a hard pull. Just keep an eye on the renewal date, because the $450 annual fee will kick in the 2nd year.

Bottom line

I’m all about easy wins. And this is one if I ever saw it.

Consider the Ameriprise Amex Platinum Card to replace your current Platinum Card when you near renewal. Or if you just want to get the $200 annual travel credit twice in the first year- and free lounge access.

If you’re on the fence like me, you have about a month (I’d apply by mid-December at the latest) to decide.

And, as of today anyway, you don’t need any sort of relationship with Ameriprise to be approved.

Just thought I’d pass along. Feel free to share any data points about recent approvals, your experience with the card, or anything related to the annual travel credit.

I’m also happy to help with questions! <3

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Doesn’t show up for me. All I see is an offer for a gold card

Hmmm. Strange.

Thanks for the great tip!

You’re welcome! Thank you for reading!

Got my wife to sign up last month. Just in time as my annual fee came up on my card. No charge for additional cards so she added me on and now I don’t lose my Amex lounge success. Both her card and mine also qualify for TSA precheck credits. We both have ours already do now we will use those for our kids.

Sounds like an excellent plan!

And thumbs up for the Global Entry/PreCheck – such a lifesaver!

I’m curious to know if anyone else had success in applying for this card without a pre-existing relationship with Ameriprise? It’s great that theres no chance of signup bonus clawback. I’m just trying to avoid any unnecessary drama with AMEX. Many thanks!

Yes, you can be approved without a relationship with Ameriprise.