Also see:

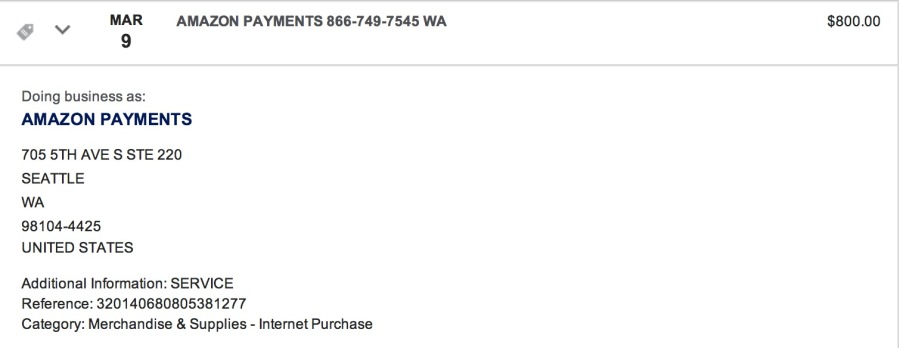

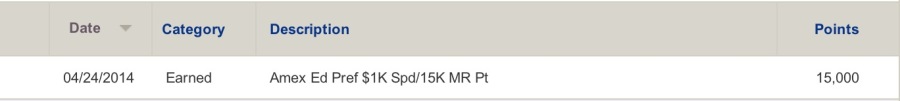

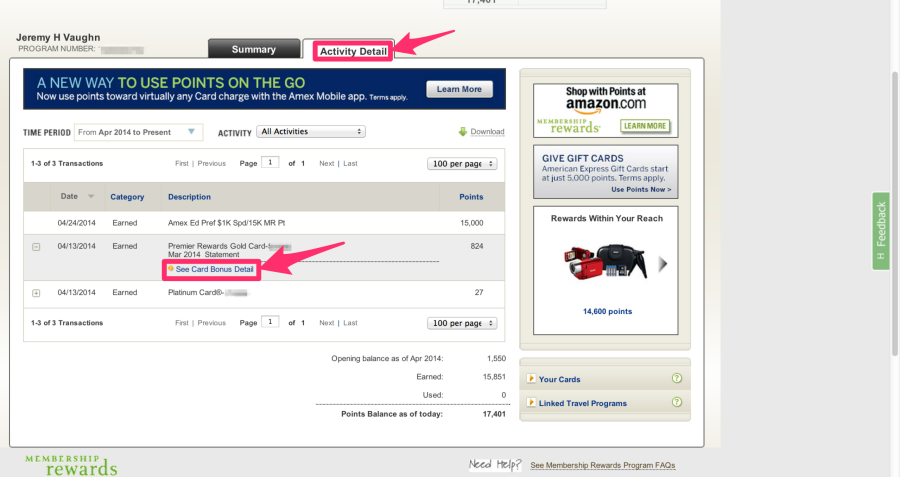

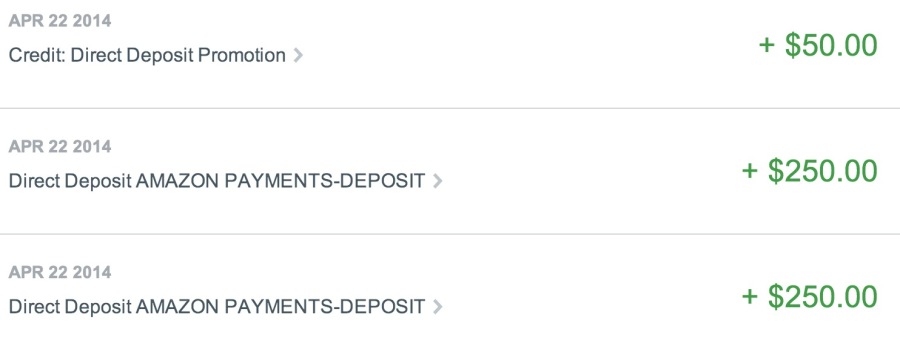

- Explosions! The earth is moving! (I got an Amex signup bonus.)

- “Secret” Benefit of Amex Premier Rewards Gold Card is Gone

- Now you can see Amex bonus transactions online

I just reviewed my latest post and I’ve written about Amex a LOT recently. This is neither a good thing nor a bad thing. Chase’s products are functioning smoothly and as they should; I still love the Arrival card; still jammin’ on my Club Carlson Visa. The only anomaly recently has been with Amex.