Hey all! Meet Spencer!

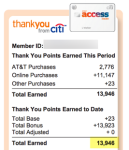

He loves the Plastiq and Citi AT&T Access More combo as much as I do. I thought it would be fun to add his ideas about the recent RadPad promotion debacle that lead to the new Plastiq offer – to shake it up a little here at ol’ Out and Out. 🙂

A big thanks to Spencer for lending his thoughts!

Anyone who’s read Out and Out knows Harlan LOVES earning miles and points when he pays rent. When there’s a fun promo, you better believe he’s ready for it.

The Rent Promo Of The Year (Or Not)

Two weeks ago, RadPad rocked the points world with a promo that allowed fee-free credit card rent payments via Android Pay.

Gone too soon

This earth-shattering offer was set to run through the end of 2016. That’s four months of fee-free, points-earning rent fun!

Fast forward to last night.

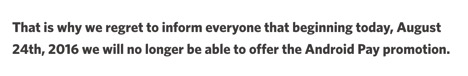

RadPad posts an update on their blog. They have pulled the promo.

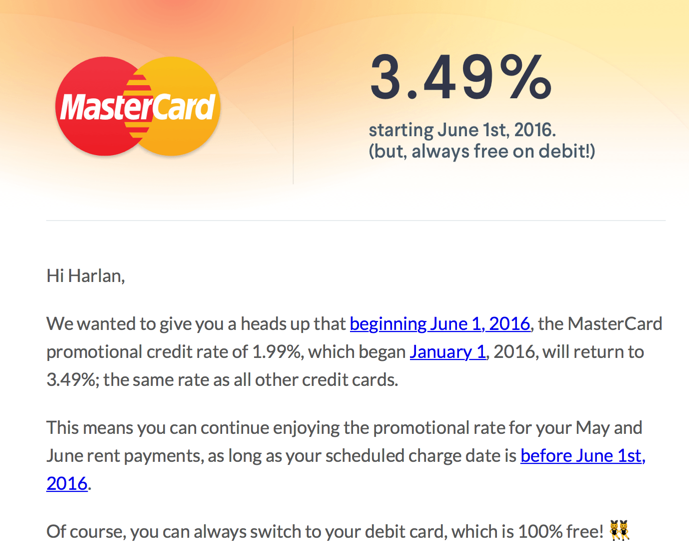

RadPad’s crushing announcement

Only people who registered prior to August 24th, 2016, would be eligible and they will only be eligible for one rent payment that has to be paid by August 31st, 2016.

According to RadPad, Android Pay use increased from less than 5% of rent payments to 70% in the span of two weeks. That’s insane!

Well, so much for that points windfall.

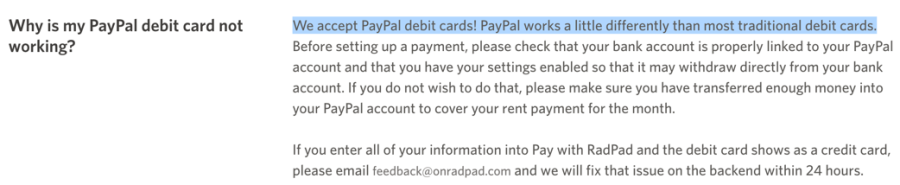

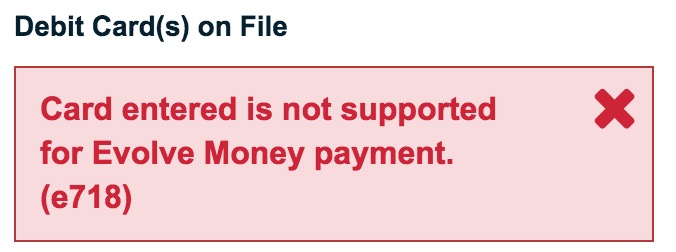

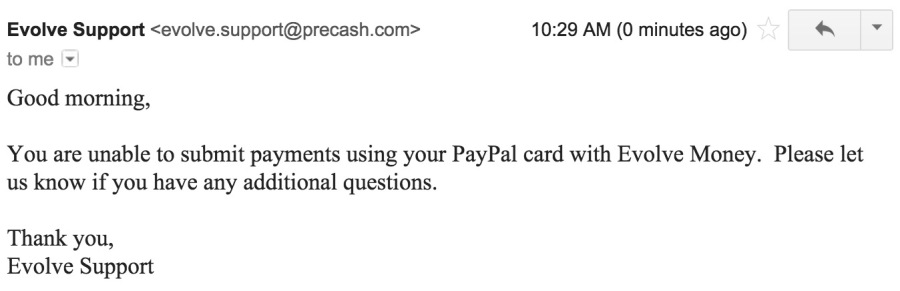

If you were set on fee-free RadPad, where does that leave you?