No doubt that the landscape of “the game” has greatly changed recently. Alas, there is no more Bluebird, Vanilla reloads are long gone, and even our trusty Serve is taking a knocking from cash advance fees. Oh, and Amazon Payments finally closed down its cash cow. Yet it trundles on. Here are a few things I’m looking forward to and can’t wait to write about in the upcoming months:

REDbird

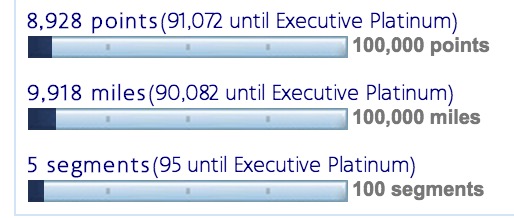

This new card from Target and Amex is not available in New York yet, or California, or Texas. You know, the most populated US states? I imagine they are testing it all out right now. How can you find out where REDbird is? These two tools:

- A Google map I found: Where is REDbird? (HT: Frequent Miler)

- The official source: The Amex website

Next month, I am going down to the land of REDbird (Memphis, TN) for Christmas. All the Memphis-area targets carry REDbird and I’m dyinggg to get one and bring it back to New York. Can’t wait to post about my adventures in reloading. I will kill off my Serve account in early December after one final round of loading and paying.

This one has some potential, and it would certainly change the MS game in a huge way if they continue to allow credit card reloads.

Evolve Money

Mark this one “developing.” Evolve Money has rolled out the ability to let consumers pay bills for free with a credit card – for now, only Discover.

IF – and it’s a big if – they allow free payments with Visa, MasterCard, and/or Amex… oh, well that could be a great thing for paying off my student loans (which Evolve has listed as a merchant). AND for getting a ton of points while doing it.

Very curious to see where this one goes.

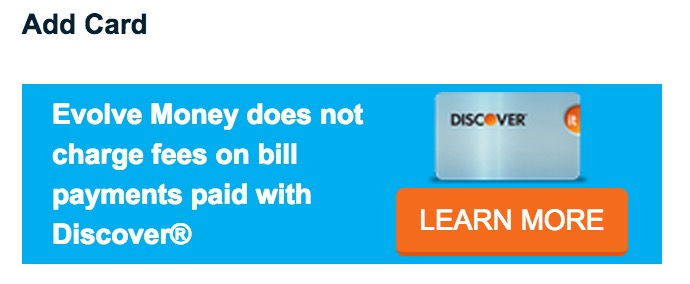

Airline status

More and more, I’m caring less and less about having status on an airline. I was Platinum on American for this entire year, and only managed to fly ~10K miles.

Or, I should say, 10K paid miles. I was in Paris, Italy, Munich, Vienna, and Budapest this year… but most of it was on award bookings.

Or, I should say, 10K paid miles. I was in Paris, Italy, Munich, Vienna, and Budapest this year… but most of it was on award bookings.

I do think that need for status is case-by-case and personal. If you’re flying domestically a lot for business, status is great. If most of your (leisure) travel is in premium cabins, is status really that important? I will most likely fly the same amount and in the same style in 2015 as I did this year. So for me… I’m not too worried about it. I do think American is the best status around if you need it or want it.

Hotel status

Oh, now we can talk. I still think hotel status is important. Because even on award bookings, your status with a hotel does matter. In fact, as I Club Carlson-ed through Europe, I hit upgrades 4/4 times. And some of them were really nice! Club floor, junior suite, corner room… I’m impressed and grateful with Club Carlson for recognizing my status continually… and for upgrading me.

In addition to being Gold with Club Carlson (thanks to the US Bank Club Carlson Visa), I’m Platinum with Hyatt (thanks to the Chase Hyatt Visa), and Gold with IHG (thanks to a status match with roundabout thanks to the previous two cards).

Even if you fly on award bookings, with premium cabins, priority check-in, and lounge access already secured, you’ll want some sort of status when you get to your hotel (unless you are Airbnbing it).

Bottom line

Once the holiday dust settles, we might find ourselves presented with two new ways to manufacture spend. And that could be really lucrative and mean thousands of points and miles for free. I’m excited but not getting my hopes up. We’ll see what happens once I return from the Land of REDbird and when/if Target changes their credit card reload policy.

As I’m faced with the prospect of losing my airline status next February, I find that I really don’t care. There is no more mileage running and most of my travel this year was on award bookings anyway.

Hotel status is as easy to get and maintain as holding on to a particular credit card, and the upgrades have kept rolling in. I do nothing to maintain the status other than pay the annual fee on a credit card. Sign me up. I think it’s worth it.

We are finally getting into some new territory after many glancing blows from the manufactured spend circuit (no more VR, no more Amazon Payments, no more Bluebird, changes to Serve, etc). Color me curious to see how this plays out!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

[…] Also see: State of the Game: What I’m Looking Forward To (MS, Points/Miles, & Status) […]