This month’s update is a little late – for the best reason possible.

On September 10, baby Beck was born early in the morning under the Full Harvest Moon. 🌕 So far, he’s already back at his full birth weight and has lost his umbilical plug. He’s a sweet, happy boy – already looking around with deep blue eyes and smiling as he stretches his fingers and toes. We are already completely in love with him.

Welcome earthside, baby Beck

I can’t wait to set up an investment account and USAA membership for him. But for now, we’ve all been resting and adjusting to this sweet new energy.

It’s been hard to keep up with the outside world, but every time I check on the stock market, it seems the lows get lower.

I’m continuing with my investment plans, but my overall net worth is obviously down this month. More and more, it’s looking like this is going to be a lost year for the market – and for my progress.

All good though.

History tells us that incredible bull runs usually follow lows like this. And anyway, I have my hands full for a while with a newborn.

September 2022 Freedom update

History also tells us that September is a harbinger for how the rest of the year will go. If September is down – watch out. October isn’t exactly a picnic either. Some of the worst crashes have happened in October (Great Depression, Black Monday…).

The only X factor is that the market tends to perform well during midterm election years like this one. But something tells me that won’t matter this year.

Daddy H

As it stands, I’m personally preparing for the market to keep dropping. But instead of pulling back, I actually increased my contributions. And just added some cash to my HSA and to Warren’s UTMA account.

I’ve also seen real estate prices drop with price cuts aplenty, even here in Oklahoma. For that reason, I want to focus on having enough cash to snag a cute little bungalow house in Oklahoma City over the next few months. The best time to buy is when there’s blood in the streets… and these streets are getting bloody.

Beck is here!

We had an incredibly smooth birth at home last weekend. Active labor was only two hours or so. The midwife and her team did the delivery and followup care and left, and suddenly there we were – already at home with our new baby boy.

He nursed immediately and slept peacefully throughout the night. We kept waking up to look at him and see if he needed anything. Such a serene soul already. And I’m happy to add another Virgo to the mix. 😆

BABY

Warren is adjusting well – slowly but surely. As Beck “un-squishes,” he’s looking more like Warren every day. They are definitely brothers.

We were well prepared for his arrival and had everything we needed, including an arsenal of diapers. Because of that, we haven’t spent much since his birth. Just groceries and the usual expenses.

My parental leave started and I’ll be off work until January. Mama and baby are doing great. We’re all just finding our feet again after the big event. *big deep breaths*

Continuing to invest

On the financial front, I:

- Started paying down my 0% credit card that I used to upgrade our HVAC system

- Added $200 to my HSA account

- Added $200 to Warren’s UTMA and $100 to my own taxable brokerage account

- Kept investing $2,000 a month through my 401k

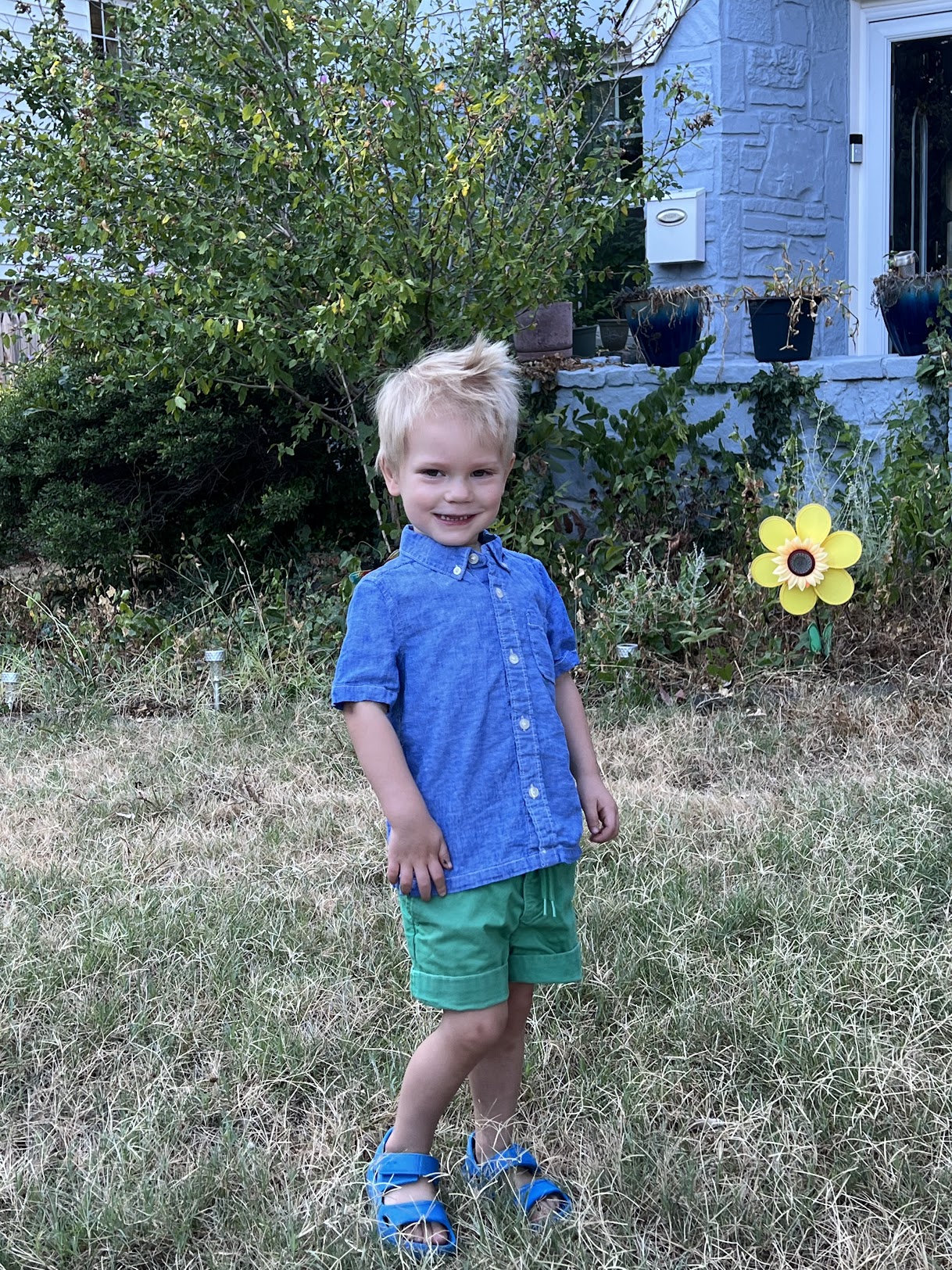

First day of preschool

Warren turned 3 and started preschool – and now has a little brother. Lots of transitions for him, but he’s handling them in stride. Such a great kid.

Seeing the lower real estate prices really makes me want to snag an investment property. I’d like to have many valuable assets to pass along to my sons one day. And now is a once-in-a-generation opportunity for wealth creation.

Because of that, I’m also actively looking for another job that pays more. It’s clear my current job isn’t going to give me a raise, so I’m going to take the parental leave and look for something else. Having kids to look after really motivates one to move it along.

Plus, I’ve decided it’s time to give myself a raise and promotion. 🥰

I think these next few months will bring even more news and progress. I already can’t wait to share!

By the numbers

In the ongoing tale of up and down and up and…

I turned more pluses into minuses this month.

You’ll notice I added $2,000 to my 401k, but it’s only up by $651.

That’s because the market is falling faster than I can invest. It doesn’t bother me per se, because I know that’s how it goes, it’s just that I’ve been at this same level for a while and I’m yearning for progress.

47%!

My consolation is that when the bull market returns, I’ll roar back too, having bought in at lower valuations with a better cost basis.

For now, I’ll prioritize saving cash and snapping up another house around here. My own home has held its value pretty well. Here’s the full picture:

| Current | Last Month | Change | 2022 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| Overall investments | $194,811 | $200,312 | -$5,501 | As much as possible | |

| 401k (contributions only) | $14,500 | $12,500 | +$2,000 | $20,500 | |

| 401k (overall balance) | $32,807 | $32,156 | +$651 | As much as possible | |

| Traditional IRA | $100,273 | $104,425 | -$4,152 | xx (can't contribute) | |

| Roth IRA | $45,533 | $47,488 | -$1,955 | $6,000 (in contributions) | COMPLETE! |

| Taxable brokerage + UTMA | $9,426 | $9,830 | -$404 | $25,000 (total invested) | |

| Savings | $8,298 | $8,293 | +$5 | $30,000 | |

| Primary home equity + appreciation | $42,156 | $40,957 | +$1,199 | $20,000 | COMPLETE! |

| LIABILITY | |||||

| Credit card/HVAC upgrade | $17,962 | $18,143 | -$181 | $12,000 | |

| Net worth in Personal Capital | $235,049 | $238,918 | -$3,869 | $500,000 (overall goal) | Track your net worth with Personal Capital |

Trying not to add pressure on myself, knowing that slow and steady wins the race. For now, things are good and opportunities are either here or right around the bend.

NOW is the time to invest heavily in the market. I’m personally on track to max out my 401k, Roth IRA, and HSA this year – the first year with that triple whammy.

So even though I’m “down” this month, I know I’m actually right where I need to be.

September 2022 Freedom update bottom line

In the last 30ish days, I:

- Welcomed a newborn son!

- Added $2,000 to my 401k

- Kept investing in index funds every pay period

- Got a bit more equity + appreciation on my house

- Chipped away at my credit card, HSA limit, and taxable brokerage account

For what it’s worth, I pulled these numbers on September 4 and will update again in early October. Trying to maintain a sense of integrity about this data, even if it’s late this month.

My growing family and the support of so many has touched me deeply in this past month and despite my net worth number, I am certainly a very rich man in so many ways.

I’m almost ready to alert my realtor to my plan to buy another house – just need a bit more cash and I’m trying to get that rolling in through the rest of the year. I can’t wait to travel with my boys. We’re all doing well and taking it slow with our new arrival.

If you’re in the market for a new travel credit card, consider using my links to apply. I’ll get a commission and will use it for the ongoing diaper fund and to care for these boys. 🙏🏻

Thank you to everyone who reads these updates. It means the world to me. 🌌

Stay safe and scrappy out there! ✨

-H.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Congratulations Harlan and family!!

So, so sweet! I’m very happy for you all.

Congrats! So cool that you get 3+ months parental leave. I couldn’t imagine having to go back to work so soon after the baby pops out. Yes, strap in for a wild ride. Fedex just posted their worst miss in 20 years which many are calling a harbinger of things to come. Just stick to it though. You’re doing great.

Probably not on your radar anymore but Japan is dropping their border restrictions and regular tourism will resume soon. Japan is beautiful in November (or any time, really).

Still no job for me. Little bummed about that, but it is what it is, and I can’t really complain. Hope the fam stays well.