Hi again from Upstate New York! I’ll be here a couple more weeks, then drive to Vermont and Delaware – then home to Memphis. From there, I’ll regroup and maybe do one more big loop around the Southwest this winter.

And then?

Well, you know I don’t plan that far out – but I’ve been looking at houses in Memphis and will hopefully snag one soon.

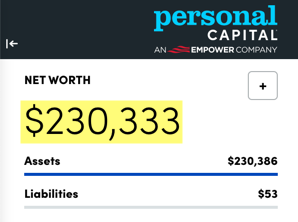

This Freedom update finds me with my highest-ever net worth, up over $13,000 since last month, and nearly halfway to my $500,000 goal.

The Catskills have been good to me

When I leave here, it will have been two months in Upstate New York. By staying at a friend’s house, I’ve been able to save all my extra cash, complete my savings goal, and put the excess into my taxable brokerage account. My only expenses have been groceries and eating out, with the occasional splurge.

Professionally, it’s been great too. I started writing for NextAdvisor on Time.com and have built up a cadre of articles on Business Insider. I’ve also been killing it at my regular 9 to 5, and posted on social media every day in August 2021 as part of my trashy mystery witch school (which I’ve been doing for one year now).

You can follow me on Instagram for thoughts about divine masculinity, sexual awakening, daddy issues, travel and travel memories, investing, and random slice-of-life stuff. 🍉

Now for the money! 🤑

September 2021 Freedom update

This month has been an absolute steamroller. My net worth is $230,333, which puts me just $20,000 away from the halfway point of my $500,000 goal. That means that for the rest of 2021, it only has to increase $5,000 each month to hit 50%. And that is pretty certain.

The only “hiccup” would be if I buy a house. I’d put some cash down, which would go into equity. But considering it would be a primary-then-investment property, I think I’d include it in my net worth.

This is starting to take on a life of its own

And, I’m close to hitting $200,000 in my investment accounts – another milestone! But clearly most of my net worth is in index funds, which is great, but adding real estate to the mix would add some diversity.

However the pendulum swings, I’m working toward my third $100K. And I’ll be over the total halfway point to kick off 2022. That’s super rad. 😎

Now I invest the rest

I reached the $30,000 savings goal – so I set another one. In the next four months, I want to get $6,000 more into my taxable brokerage account – for a total of $15,000 by year end.

After I pay bills from my checking account, I move the rest to invest in FSKAX. And I keep my checking balance low – like $100 or less. There is no reason to keep much in checking now that I have a cash emergency fund.

Work.

I consider the checking account to be the “clearing house.” Everything gets dumped into there, then I send it to various places and put it to work.

In this way, I sent $3,500 to my investments last month.

Once I get back on the road, I won’t have as much extra to invest. But I’ll still send every last sent when I can. So yeah, I think $6,000 is a realistic goal.

What happens if I buy a house?

I just spent so much time building up my savings – what if I tap it for a down payment? You know what? GOOD.

Then I can focus on rebuilding my savings to have money for another future investment. With rates still low and prices coming down a little, I feel like the next few months are the prime time to pounce.

All I’m saying is – don’t be surprised if I pop on here next month and say I closed on something. 🎉🏡

Being upstate has been absolutely bucolic

Then I can spend time and cash getting a place all cute before renting it out and buying another one. Now that I’m a roll with index funds, I’d like to get another income source going. It’ll be slow and worthwhile.

I would like to keep $30,000 in cash at all times though. Any time my savings dips below that, I’ll pause everything else and switch to replenish mode.

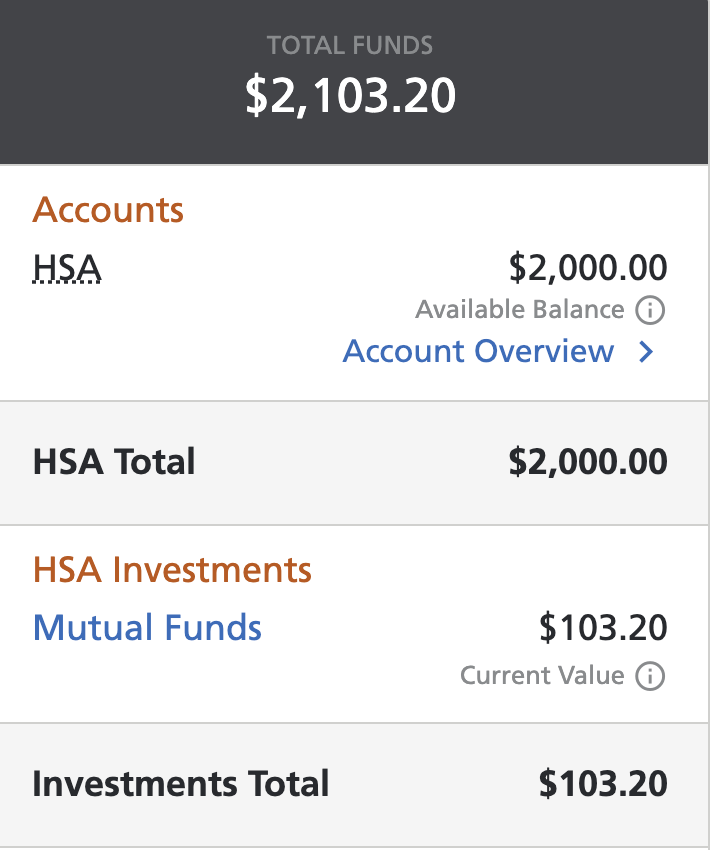

I invested with my HSA, too

The HSA available through my employer requires $2,000 in cash before you can start investing. Anything over that amount, you can invest.

When I saw Vanguard’s Total Market Index Fund was available, I decided to move enough cash over to meet the threshold and start investing.

My new triple tax advantaged account

I’ll throw in $200 per month into this account through payroll deductions because I can contribute before-tax funds, the investments grow tax-free, and I’ll pay no taxes at withdrawal (for healthcare expenses). I don’t spend a lot on healthcare, but Future Me might. So now I have this working on my behalf, too.

Future Me is gonna be so set! 👊

By the numbers

I decided to expand this section to show exactly where my investments are. I have a mix of 401k, traditional and Roth IRAs, and now – my taxable brokerage account.

| Current | Last month | Change | 2021 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| Overall investments | $191,277 | $179,445 | +$11,832 | As much as possible | |

| 401k (contributions only) | $12,500 | $10,833 | +$1,667 | $19,500 | |

| Traditional IRA | $116,399 | xx | xx | xx (can't contribute) | |

| Roth IRA | $47,627 | xx | xx | $6,000 | COMPLETE! |

| Taxable brokerage | $8,766 | xx | xx | $15,000 | |

| Savings | $30,178 | $29,160 | +$1,018 | $30,000 | COMPLETE! |

| Net worth in Personal Capital | $230,333 | $216,898 | +$13,435 | $500,000 | Track your net worth with Personal Capital |

Fire emoji

My traditional IRA is all rollovers from 401ks of previous employers. Sort of a 401k graveyard. Except it’s still living.

Anyway, I put all my IRA money into the Roth IRA and you bet your tuchus I’m maxing it out again on January 1, 2022.

Beyond that, I’m tracking my current 401k until I hit the $19,500 max for the year and added a new goal to focus on for the rest of the year: $15,000 in the taxable brokerage account.

I considered making it $20,000, but between hitting the road again and maybe buying a house, I thought it best to keep it conservative. But between us, $20,000 is still my stretch goal. 😉

September 2021 Freedom update bottom line

So there we go. Money moves this month were:

- Starting investments with an HSA

- Reaching my $30,000 savings goal

- Sending all extra cash straight to index funds

- A big $13,000 net worth increase over last month

- Close to $200,000 invested (!)

- Almost at 50% of my overall $500,00 goal

For the rest of the month, I’ll collect a couple more paychecks, head to Vermont for a while, then start heading down South. I’d still love to spend a few months in Mexico at some point, but if a good house pops up, I might try to snap it up. We’ll see what shakes out.

All that to say, it was a good month – and the halfway mark is just around the corner. Now that I’m almost to $200,000 invested, this is starting to really locomote. 🚂

Thank you to everyone who reads these updates. Your comments and encouragement are everything. Thank you. ✨

Stay safe and scrappy out there! – H.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

You’re crushing it, up $13k in a month is impressive AF! One day I’ll get there! 😀 Love reading your updates. So many scenic locations! Interesting that you are considering buying a house again after your Dallas experience. Crazy how much cheaper homes are in Memphis vs DFW or Long Island.

FSKAX has been pretty steady for me, took a look at my portfolio and it’s up 47% from my cost basis which is partially a rollover in 2018 and the rest from aggressive investing. I pulled back on my HSA but when I get a raise I may return to more contributing more. Just a couple hundred more and I can invest! 😀

Keep fighting the good fight and you’ll be at 50% in no time!

Ah man, you’re crushing it, too! We are pretty similar in our methods/progress. Aside from the house, I’ll stick to good ol’ FSKAX – I believe I have a similar double digit gain from cost basis as well. Thanks for checking in here as well as sharing your progress. It’s inspiring to see other people working on their financial goals.