I’m writing this on my last day in upstate New York, between bouts of packing. I have been here for 76 days.

In that time, I’ve saved a few checks, completed my savings goal, and looked into buying a couple of properties (but haven’t pulled any triggers quite yet).

I’m sad to leave and excited to be back on the road at the same time. Next up is two nights in downstate New York, four days in Delaware, picking up my friend at Dulles and staying a night in Roanoke, then Nashville for a night, Memphis for two weeks, and Oklahoma City for two weeks. Looks like I’m hopping right back to nomad life!

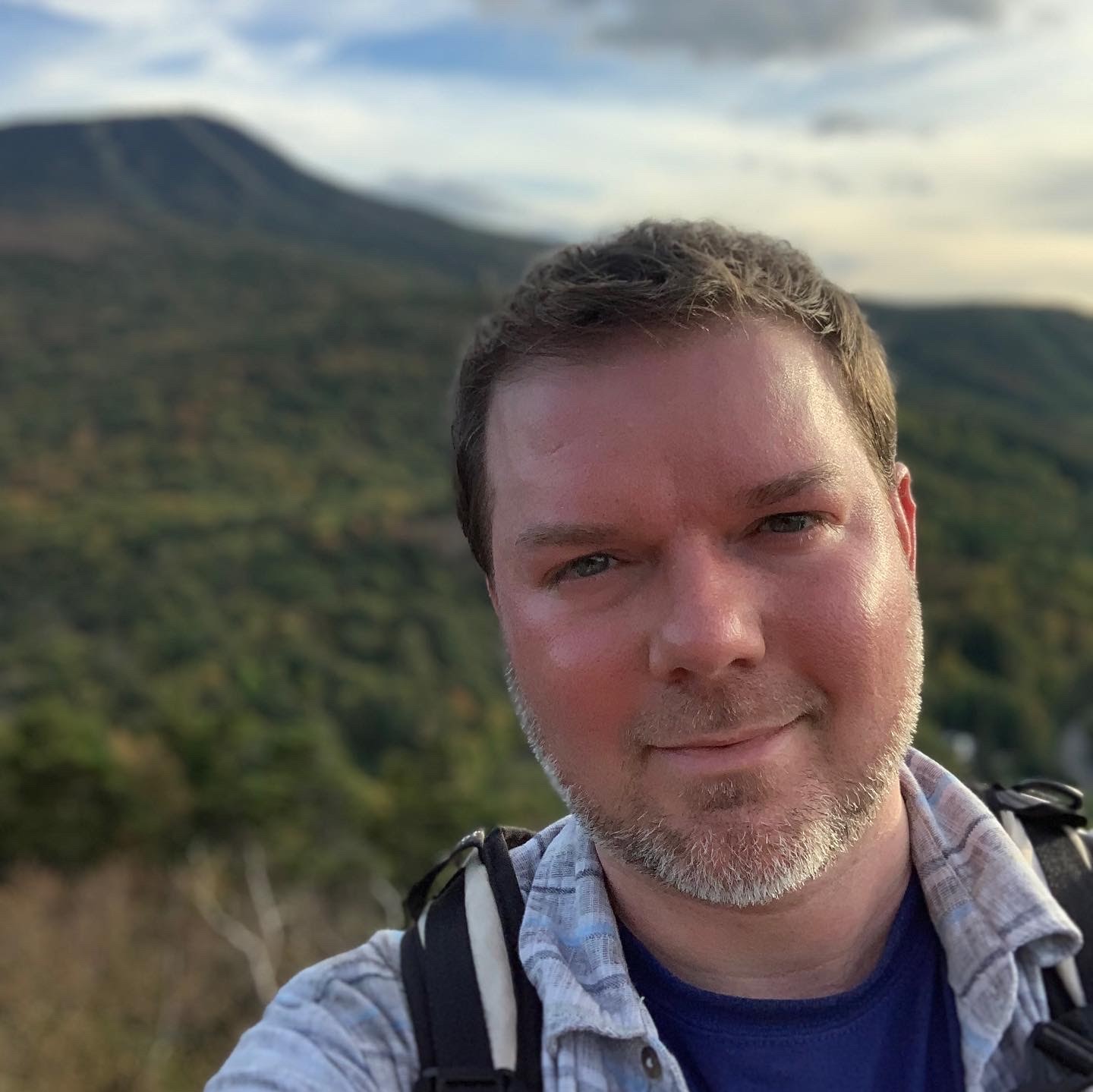

I loved spending time in Vermont

I was also able to spend two glorious days in Vermont last week. I would’ve stayed longer, but it proved to be an expensive destination.

Depending on what happens this month, I’ll either be buying a house somewhere or continuing my nomad journey. (Or both?) Either way, I’m letting the destinations guide me instead of trying to choose places. I’m following prices to places where my dollars go further.

Oh and of course September was a bad month for my Freedom update – down $4,000. Still hoping I can hit $250K in Q4!

October 2021 Freedom update

I looked back to my Freedom update from September 2020, whose title is “Down $4,000 & feeling nervous this month.” 🤣

And had to laugh because I’m similarly down $4,000 from September 2021 and also feeling… Nervous? Anxious? Excited?

I feel things beginning to shift.

I saw Alanis, Garbage, and Cat Power live in September 2021. My first concert since February 2020!

I also didn’t know September is notorious for downward stock prices because of selloffs before the end of the fiscal year. Now I do.

And despite loading up my brokerage account, investing $2,000 in retirement accounts, and saving $3,000 from paychecks, I’m still down from last month. All good though – living and learning.

House house… house?

I’m bent on buying a house to have as an investment property. I figure I should jump in while rates are low and before prices jump any higher. It would be a primary residence first, then an investment property later. The thing is, I don’t know where to buy.

I’m considering Memphis or Oklahoma City. Memphis to be close to my family and because it’s a place I know well. Or Oklahoma City because my son is there and I could be more of a father to him. I don’t know much about the area, but it would be nice to be closer for bonding time now that the option is there.

I feel – at this moment – that OKC will win out.

But I still want to look in Memphis to get a basis of comparison.

Or, third scenario. Neither works out and I continue living on the road. In that case, I would drop my dog at my mom’s and spend winter in Mexico. These next few weeks are pivotal.

Not beating inflation, but it’s fine

Because I’m uncertain about my next move, I’ve been stashing all my extra income in a checking and/or savings accounts, which I never do. Y’all know I keep my checking account balance low on purpose.

But the thought of an impending down payment, renovation project, or set of closing costs has me keeping money out of my brokerage account and in savings for now. It pains me to not give every job a dollar – and I hated missing on September’s “dip” – but I might need that money soon.

More mountains

I wonder if that means I’m poised to buy something and how long I’ll wait to invest it. This has truly been the signal of my intentions. As much as I get lost in thought, and despite all my processing here, I find myself making plans almost unconsciously. In that way, following the money is guiding the decisions I’ll make for the future.

By the numbers

It pained me to turn my pluses into minuses this month, but that’s how it goes. I’ve broken out my investments by account and kept that setup from last month. Here are the numbers.

| Current | Last month | Change | 2021 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| Overall investments | $184,870 | $191,277 | -$6,407 | As much as possible | |

| 401k (contributions only) | $14,167 | $12,500 | +$1,667 | $19,500 | |

| Traditional IRA | $110,917 | $116,399 | -$5,482 | xx (can't contribute) | |

| Roth IRA | $45,344 | $47,627 | -$2,283 | $6,000 | COMPLETE! |

| Taxable brokerage | $9,200 | $8,766 | +$434 | $15,000 | |

| Savings | $30,180 | $30,178 | +$2 | $30,000 | COMPLETE! |

| Net worth in Personal Capital | $226,460 | $230,333 | -$3,873 | $500,000 (overall goal) | Track your net worth with Personal Capital |

I’d love to be at $250K by the end of the year, so I guess we’ll see where we land. I’ll keep dumping $2K per month into my retirements accounts and save as much as I can otherwise. The rest is up to chance and the stock market.

I’m still proud of my progress

Everything has felt so uncertain this month. I removed the stock apps and trackers from my phone because I was getting too attached to watching the markets every day. In some ways, I think it’s best if I don’t know.

I want to keep in touch with my goals, but the longer this journey goes on, the more I realize I’m at the mercy of the market and its dips.

October 2021 Freedom update bottom line

This month I:

- Invested $2,000 in retirement accounts

- Saved $3,000 in checking

- Sent extra funds to my taxable brokerage account

- Still ended up $4,000 down from last month

- Explored houses in Memphis and OKC

The chance to spend more time with my son in Oklahoma City would be amazing. His mom and I have been talking and they’d like for me to be around more.

(For those who don’t know, I have a bio son after donating sperm to a lesbian couple – and I’m a gay man.)

To think this would be a part of my journey was something I hadn’t considered before, but I’m open to it, and seeing if I can make it happen. Me, an Oklahoman? What is life, anyway?

Being able to work remotely has made this so much easier. And like everyone else, I’m desperately ready to travel again. It’s been hard having a travel blog these past couple of years. But I am hopeful, and looking forward to Japan in April 2022.

Thanks to everyone who follows these updates. As always, I’ll post on Instagram these next few weeks as I head back down south. Please follow me there to keep in touch!

Stay safe and scrappy out there – hope everyone has a good weekend! ✨

-H.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

FWIW, I wouldn’t buy a house in your circumstances. You’re not committed to a particular place, and at your age, I think you’d be better plowing your money into the stock market. I’m retired, and do have a house I’ve lived in for 26 years, but I view it as an expense of how I want to live, not as an investment. Heavens, if I had invested the money we spent to buy a house, 26 years ago, I would be enormously ahead financially, but we had children, it was a lifestyle decision, no regrets.

My son in his twenties read I WILL TEACH YOU TO BE RICH, a corny title, but good book, I imagine you’ve read it. Really cautions against home ownership in many situations. Good luck whatever you decide is right for you.

Thank you, Kate! I know Ramit and his teachings well. I did go ahead and put a house under contract. After weighing the pros and cons, it seemed like a good financial choice and a hedge against inflation. I will continue to invest heavily in index funds, too. I’m trying my best to put all the advice together in a way that feels good and makes sense. It feels like family and stability is winning. Like you said – it’s a lifestyle decision. I don’t feel like I will have regrets either.

Thanks tremendously for sharing these thoughts. Really good stuff.

You are onto something about being close to family, especially the little ones. I’m a guncle to many tots and I don’t want too much time to pass between visits…they seem to grow a foot each time! If you know if your heart you’re nomadic, don’t tie yourself down physically for now. You plan for seeing family frequently, esp. with a home base somewhere nearby (even if it’s a guest room you rent or extended hotel points you burn).

Excellent viewpoints! For me, a house would also be a jumping off point toward real estate investment and something I can potentially keep and pass on later. I hear you about not getting tied down. I have a place under contract rn and oddly enough, I still feel very free. It’s just a house. And I can still do the things I love. There’s something about having a home base that really appeals to me.

Thanks so much for adding your thoughts here!

Oklahoma has one of those “move here and stay for a year and we’ll give you $10k” type programs. Could be really worth it if you were planning on moving there anyways. And they will even give the $10k as a lump sum if you buy a house.

tulsaremote.com

I saw that one! I’m targeting OKC and don’t think they have anything like that. But yes, I definitely thought of it. Tulsa’s too far from where I wanna be. $10K lump sum sounds good rn though. ::sweating emoji::

If buy something go small and less maintenance as possible. Having a house is time consuming and an expense.

Absolutely. I think I found a place. Going to close on it in two weeks. It’s kinda perfect. I can’t wait to share more. Thank you, Boonie!