Contents

1. Starting Notes

2. Points Vs. Miles (And Their Value)

3. Envisioning a Goal

4. Checking Your Credit

5. Choosing an Airline

6. How to Pick a Card (Or Two)

7. Real Life Examples

8. Score!

9. How to Keep It Going

10. Keeping Track of It All

11. Wonderful Side Effects

12. Final Words

13. Resources

Now that you’ve chosen an airline or have one in mind, it’s time to pick one or two credit cards to get you started.

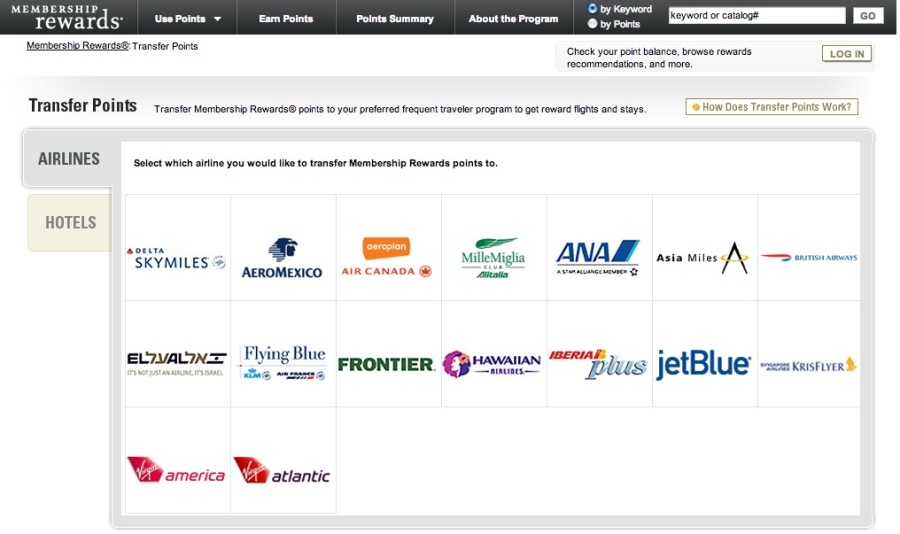

If you picked Delta:

The American Express Gold Premier Rewards card is the first valuable choice. This card makes it so easy to rack up the miles that you’ll arrive at your goal destination in no time. Right now, the signup bonus is 25,000 miles. It’s worth noting that in addition to Delta, you can also transfer into Air France and KLM’s Flying Blue program, British Airways, Hawaiian Airlines, Aeroplan, JetBlue, Virgin American, and Frontier through the Membership Rewards program. All major airline alliances are represented within this program. The annual fee is a little steep at $175 a year, but it’s waived for the first year and the bonus points more than cover the cost.

The American Express Gold Premier Rewards card is the first valuable choice. This card makes it so easy to rack up the miles that you’ll arrive at your goal destination in no time. Right now, the signup bonus is 25,000 miles. It’s worth noting that in addition to Delta, you can also transfer into Air France and KLM’s Flying Blue program, British Airways, Hawaiian Airlines, Aeroplan, JetBlue, Virgin American, and Frontier through the Membership Rewards program. All major airline alliances are represented within this program. The annual fee is a little steep at $175 a year, but it’s waived for the first year and the bonus points more than cover the cost.

The second choice is to get the American Express Delta Gold Skymiles card. The signup bonus is 30,000 miles and gives you a ton of great benefits on Delta flights like a free checked bag, annual $99 companion certificate, priority boarding, and in-flight discounts. The annual fee is $95, waived the first year. If you take two trips a year and check bags for free on both (including award flights), this card more than pays for itself. The extra 5,000 miles this card gets you in comparison to the first is great, but I do think the other card makes it easier to earn miles overall. Still, either choice is a great first step. If you want to go to Europe, you’d be nearly halfway just by opening one of these cards.

The second choice is to get the American Express Delta Gold Skymiles card. The signup bonus is 30,000 miles and gives you a ton of great benefits on Delta flights like a free checked bag, annual $99 companion certificate, priority boarding, and in-flight discounts. The annual fee is $95, waived the first year. If you take two trips a year and check bags for free on both (including award flights), this card more than pays for itself. The extra 5,000 miles this card gets you in comparison to the first is great, but I do think the other card makes it easier to earn miles overall. Still, either choice is a great first step. If you want to go to Europe, you’d be nearly halfway just by opening one of these cards.

If you picked American:

This one is the only one with no credit card programs as transfer partners. However, the American Express Starwood Preferred Guest card lets you move points into your AAdvantage account and even gives a 5,000 mile bonus with every 20,000 point transfer, which is nice. This card has a standard signup bonus of 25,000 miles, but with the transfer bonus it’s really more like 30,000. A lot of people in the points/miles community love this card. I can’t solidly recommend it for two reasons: 1) It’s a hotel card which can earn you a lot of points if you stay often at Starwood properties. I usually stay with friends or family during my travels, or at places sourced from Airbnb (if you haven’t heard of it, check it out). Hotels only sometimes. But if you prefer to stay at hotels, definitely get this card. Its earning potential becomes powerful the more you use it to pay for stays at any Starwood property. 2) The signup bonus is nice, but after that, I find it’s hard to maintain the momentum. This card uses a program called Starpoints. When you have them, they’ve valuable, but when compared with airline miles programs, hard to accrue. Also, cobranded airline cards get you nice perks when you fly. This one won’t help you at all when you’re up in the air. The annual fee is a reasonable $65. As with everything else here, see if it makes sense for you.

This one is the only one with no credit card programs as transfer partners. However, the American Express Starwood Preferred Guest card lets you move points into your AAdvantage account and even gives a 5,000 mile bonus with every 20,000 point transfer, which is nice. This card has a standard signup bonus of 25,000 miles, but with the transfer bonus it’s really more like 30,000. A lot of people in the points/miles community love this card. I can’t solidly recommend it for two reasons: 1) It’s a hotel card which can earn you a lot of points if you stay often at Starwood properties. I usually stay with friends or family during my travels, or at places sourced from Airbnb (if you haven’t heard of it, check it out). Hotels only sometimes. But if you prefer to stay at hotels, definitely get this card. Its earning potential becomes powerful the more you use it to pay for stays at any Starwood property. 2) The signup bonus is nice, but after that, I find it’s hard to maintain the momentum. This card uses a program called Starpoints. When you have them, they’ve valuable, but when compared with airline miles programs, hard to accrue. Also, cobranded airline cards get you nice perks when you fly. This one won’t help you at all when you’re up in the air. The annual fee is a reasonable $65. As with everything else here, see if it makes sense for you.

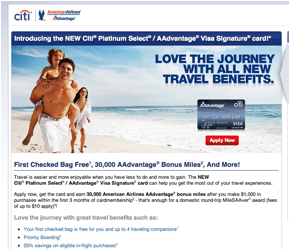

American’s banking partner is Citibank, which issues a great card for earning AAdvantage miles. If the previous card isn’t for you, get the Citibank Platinum Select/AAdvantage Visa Signature card. The signup bonus as of press time is 40,000 miles (over halfway to many destinations!), though it’s usually 30,000 miles. Still a decent bonus, and a nice boost for your mileage account. The annual fee is $95, waived the first year.

American’s banking partner is Citibank, which issues a great card for earning AAdvantage miles. If the previous card isn’t for you, get the Citibank Platinum Select/AAdvantage Visa Signature card. The signup bonus as of press time is 40,000 miles (over halfway to many destinations!), though it’s usually 30,000 miles. Still a decent bonus, and a nice boost for your mileage account. The annual fee is $95, waived the first year.

If you picked United:

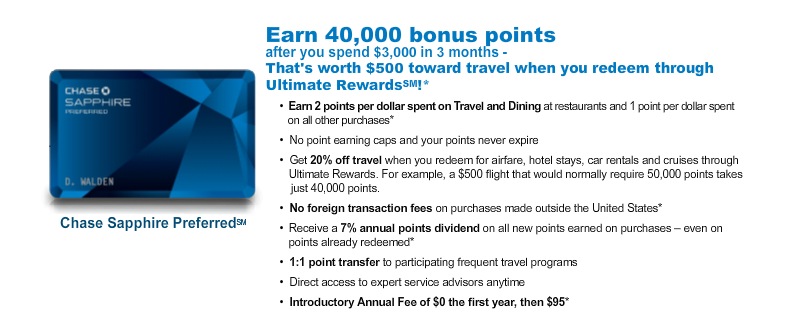

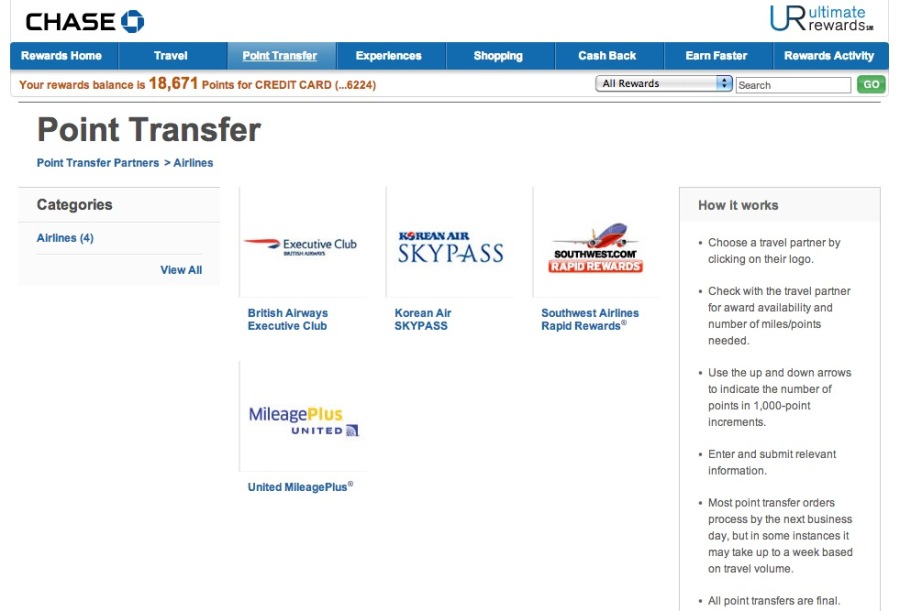

Definitely get the Chase Sapphire Preferred card. Hands down. You can transfer points into MileagePlus at a 1:1 ratio. As of press time, the signup bonus is 40,000 points, equivalent to 40,000 United miles. It’s also easy to transfer to Southwest, Korean Air, British Airways, and a slew of other programs. This is significant because it unlocks the power of all three alliances by utilizing the Ultimate Rewards program. It’s a good one, especially if you picked United. The annual fee is $95, waived the first year.

Definitely get the Chase Sapphire Preferred card. Hands down. You can transfer points into MileagePlus at a 1:1 ratio. As of press time, the signup bonus is 40,000 points, equivalent to 40,000 United miles. It’s also easy to transfer to Southwest, Korean Air, British Airways, and a slew of other programs. This is significant because it unlocks the power of all three alliances by utilizing the Ultimate Rewards program. It’s a good one, especially if you picked United. The annual fee is $95, waived the first year.

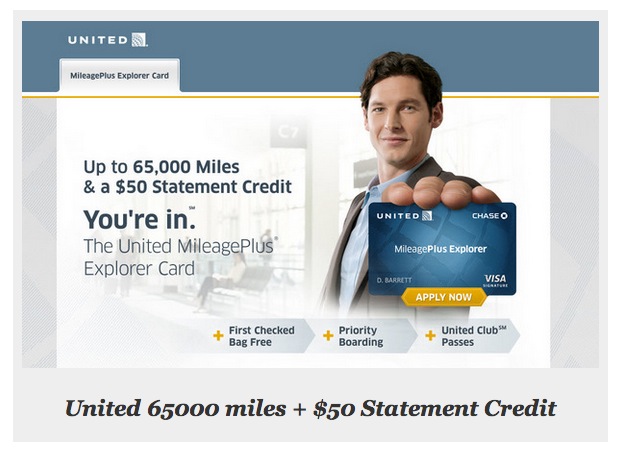

Chase also issues the United Explorer card. The signup bonus is 30,000 miles, but they often run promotions for much higher, sometimes up to 65,000 miles. It features free checked bags, priority boarding, lounge passes, and prevents your miles from expiring as long as you have the card. The annual fee is $95, waived the first year. If the choice is between this or the Sapphire Preferred, I’d go with the latter. If you can swing both, you can get up to 105,000 miles to use on United and its partners, which can get you to nearly any destination in Europe, Asia, South Africa, or South America. Alternately, you could take four round-trip flights within the United States – all compliments of United.

Chase also issues the United Explorer card. The signup bonus is 30,000 miles, but they often run promotions for much higher, sometimes up to 65,000 miles. It features free checked bags, priority boarding, lounge passes, and prevents your miles from expiring as long as you have the card. The annual fee is $95, waived the first year. If the choice is between this or the Sapphire Preferred, I’d go with the latter. If you can swing both, you can get up to 105,000 miles to use on United and its partners, which can get you to nearly any destination in Europe, Asia, South Africa, or South America. Alternately, you could take four round-trip flights within the United States – all compliments of United.

If you only need to fly within the U.S.:

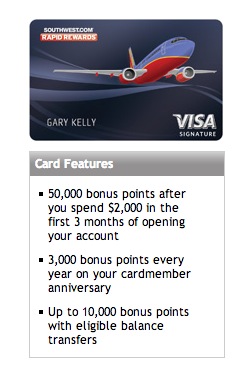

If you’re in the Northwest, pick Alaska. If you’re in the Southwest or in a Southwest hub location, go with them. In the heartland, choose Frontier. And if you’re a New York who just wants to get down south for a break, definitely get familiar with JetBlue. Sometimes a regional airline is all you need. All of them have their own credit cards with various banking partners. Southwest has Chase, Frontier has Barclays Bank, JetBlue partners with both American Express and Chase, and Alaska is with Bank of America. All of these, except for Southwest, tend to be a bit more guarded with their signup bonuses when compared with the legacy carriers, but all of them start you off with one or two free domestic round-trop flights.

A note about US Airways:

US Airways is a bit of an anomaly as an airline. They recently merged with American Airlines, effectively forming the largest airline in the United States. They are in a formative period. Barclays Bank issues a US Airways credit card with a nice 40,000 mile signup bonus. That’s two free domestic round-trip flights or a good running start toward a free international ticket. The annual fee is $89, waived the first year. My advice is to keep an eye on any developments and to redeem awards quickly. Anything already booked, they’ll have to honor. If you have goals that are attainable within the Star Alliance, go with United if you can. Otherwise, start looking into Oneworld. As with everything, do what makes sense for you.

US Airways is a bit of an anomaly as an airline. They recently merged with American Airlines, effectively forming the largest airline in the United States. They are in a formative period. Barclays Bank issues a US Airways credit card with a nice 40,000 mile signup bonus. That’s two free domestic round-trip flights or a good running start toward a free international ticket. The annual fee is $89, waived the first year. My advice is to keep an eye on any developments and to redeem awards quickly. Anything already booked, they’ll have to honor. If you have goals that are attainable within the Star Alliance, go with United if you can. Otherwise, start looking into Oneworld. As with everything, do what makes sense for you.

About Chase Ultimate Rewards and American Express Membership Rewards:

These are two great credit card programs that will open up your redemption options on multiple airlines tremendously, though it’s helpful to have one airline that’s a go-to. Ultimate Rewards or Membership Rewards will help you build or top off accounts to get to your travel goals even faster. If you pick a card that uses either program, it can be very beneficial. If it’s not feasible to have a card with either of these programs, don’t sweat it. You can still get to a great number of places without them.

Regarding all credit cards:

Be sure to meet the minimum spend requirements and pay your cards off in full every month. This will keep your credit healthy and your miles and points free. Don’t worry too much about the annual fees. I’ve found that, considering all the amazing travel benefits, it pays for itself many times over.

![]() Go sign up! All links to cards can be found on the About page or on the home page, the Resources section at the end of this guide, or by searching on the airline websites.

Go sign up! All links to cards can be found on the About page or on the home page, the Resources section at the end of this guide, or by searching on the airline websites.

Next up: Real Life Examples

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply