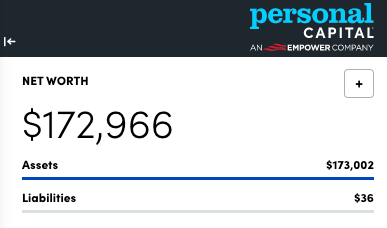

Since last month, I went from 33% of the way toward my $500,000 net worth goal to 35% of the way there. Once I reach $200,000, I’ll be 40% of the way. I find that breaking it up into little steps is a lot more manageable than thinking about the entire goal all at once.

This month finds me sitting at ~$173K, so I’m focused on ways to reach that next milestone. The stock market has been kind, and I’m back to rebuilding my savings after paying off all my credit cards and car note last month. All told, I’m up ~$8,000 this month. And in a few days, I should be getting the first deposit into my new 401k from the job I started a few weeks ago.

Cute dog alert! He was napping right before I took this pic of us

Now that I have no liabilities and only assets to think about, my finances have gotten a bit… routine? So of course I have to rock the boat.

I’m seriously thinking of moving some assets to Bank of America – enough to qualify for the Platinum Honors tier in the Preferred Rewards program – and opening a couple of new cards and a checking account with them. But the thought of switching from Fidelity to Bank of America and from earning points to cashback is giving me heartburn.

Thus are the thoughts that find me on this cool, rainy evening in north Texas.

January 2021 Freedom update

So I think I set up my new 401k correctly and hoping the first contribution hits next week. I have roughly $1,700 going in every month to hit the $19,500 maximum this year. My new company doesn’t offer a 401k match, so it’s all me. I’ve already maxed out my Roth IRA for 2021, so this is purely for the tax and investment benefits – and to get closer to my Freedom goal.

Last year, there were ups and down, but I was up $60,000 once the dust settled. If that holds true again this year, I will be nearly 50% of the way toward my goal when 2022 rolls around. Now that the first $100K is behind me, I’m hoping things will speed up thanks to compound interest and time in the market.

I’m trying not to read too much about the stock market, but there’s talk of another bubble. Staying the course has gotten me this far, so I’m gonna stick to the plan and roll with it.

Rebuilding savings

I’d like to get $30,000 in a savings account as an emergency fund and to be in a cash-heavy position. So for the next few months, I’ll be putting any extra funds into savings. Then I’ll think about investing the rest in a brokerage account – or maybe continue to save in case a good deal comes up on a house.

Although I don’t know where I’d live yet. I recently submitted applications to two Studio Art programs to get my MFA in Painting. So I’ll see what happens and let that direct my course. I’m hoping to be out of Dallas in the next few months. 🎨

Another thing is the computer I’m typing this on is from 2013. It’s still going strong, but has moments where it’s slow or glitches out. I’ve been thinking about getting a new one. But this time, I want all the software and upgrades and extra memory and accessories and all the rest. I’d earmark $3,000 for a new device. If I have it for seven years like I’ve had this one, it’ll be worth it. I was a poor college kid when I got my current basic model computer. It’s been great, but I want to really treat myself next time. 👨🏻💻

I mention this because it would affect how quickly I’m able to meet this savings goal.

Should I leave Fidelity for Bank of America?

Everybody knows I love Fidelity and have been fidelitous to them since forever. But ever since I rolled over my old 401k into my traditional IRA, I find myself with a ~$100,000 account.

Should I?

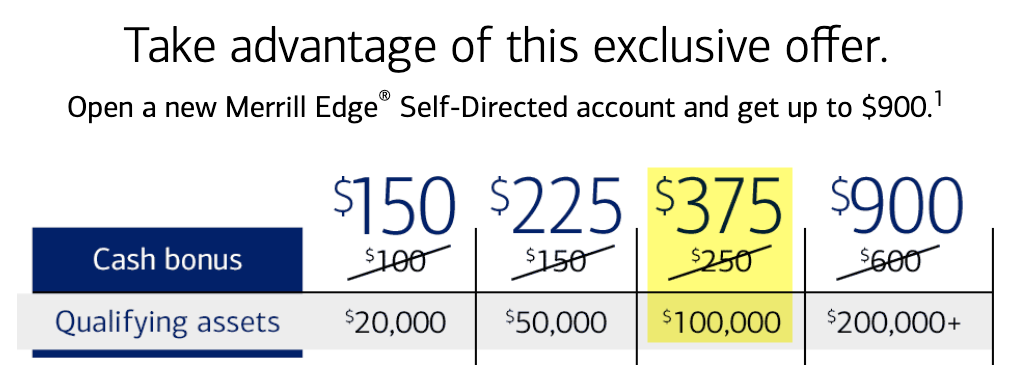

Through April 15, 2021, there’s a bonus offer for opening a new Merrill Edge account. I could roll over that IRA and get a $375 bonus while also qualifying for the Platinum Honors tier in the Preferred Rewards program.

The highest level in one shot

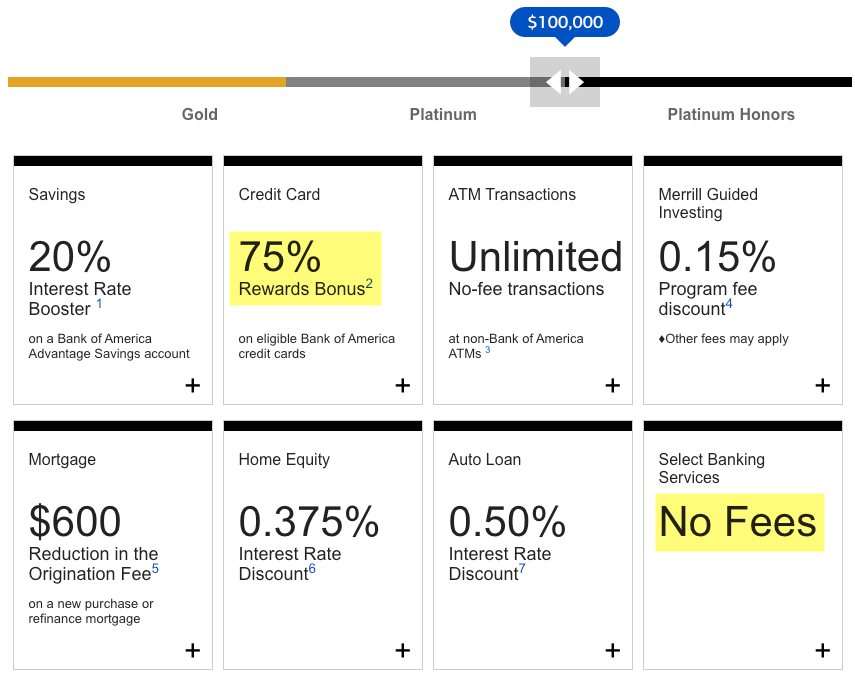

That would get me a free checking account and a 75% bonus on the rewards from Bank of America credit cards. Which would also mean I could earn a couple more credit card bonuses in the process and add new cards to my rotation.

It would be easy enough to move some funds to Merrill Edge and earn a few bonuses. So I’m considering making a jump for it. I’m just not sure if it’s worth it.

I definitely prefer to earn points as opposed to cashback. But it couldn’t hurt to mix things up a little – could it?

If you have Platinum Honors status with Bank of America, is it worth it? I have until April to think it over. But if a checking account bonus pops up before then, I might not be able to resist.

Marking this as “Highly Interesting.” Because I can’t leave well enough alone. 😜

By the numbers

So I’m 35% of the way toward my goal. That’s pretty rad.

| Current | Last Month | Change | 2021 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| 401k | xx | xx | xx | $19,500 | |

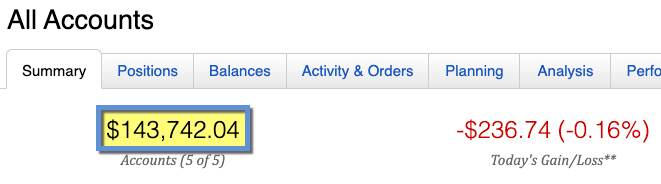

| Overall investments | $143,742 | $137,248 | +$6,494 | As much as possible | |

| Savings | $19,916 | $16,775 | +$3,141 | $30,000 | |

| Net worth in Personal Capital | $172,966 | $165,033 | +$7,933 | $500,000 | Track your net worth with Personal Capital |

I don’t get out much these days

All told, my investments are sitting around $144K.

On the way to $200K invested

And like last month, this month presents another highest-ever net worth.

The trend continues

Everything I get – side income, another stimulus check, extra money after monthly expenses – I plan to aggressively save. If I can get to $200,000 net worth in a few months, that would be so encouraging. Gonna keep plugging away at it. Every day.

January 2021 Freedom update bottom line

And if I could reach 50% of my overall goal by the end of 2021, my momentum would be unstoppable. Now that I’m getting closer, I’m all the more encouraged to save and invest. It’s almost a game now – a really fun one. Especially now that I have no liabilities acting as inertia.

But because I’m me, I’m considering switching to Bank of America to see what their cards and accounts are about. I’ve been with Fidelity forever but if there’s more to gain, I’m all for trying – especially if I can pick up a few bonuses along the way. If you have any experiences, recommendations, or inside scoop please let me know in the comments!

And thank you for reading and following. Starting now, it’s on to the next $100K milestone! Hope to have more to report for the next update. Things are surely on the go. Stay safe out there! ✨

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Get the new MacBook Air from Apple. You could easily halve (or more) your computer budget, and you’ll end up with the best rated notebook ever on TheVerge web site. Don’t bother upgrading the RAM, as the base 8gb is more than sufficient. Do bump the hard drive to 500gb, and any additional space you can add virtually with a 2GB Apple One (iCloud Drive) subscription.

I also think as a percentage you’re too heavily in the stock market. Definitely focus on adding cash, as you mentioned.

Thanks for this tip! I was waiting until Mercury retrograde was over to purchase new electronics, but the more I hear about the M1 chip, I think I wanna wait for the new MacBook Pro model. My current one is from 2013, so really anything is a huge upgrade from what I have.

And yes, definitely focusing on padding out with cash in these next few months. I kinda like being heavily focused on the stock market lol. It gives me a thrill.

Thank you for reading and commenting – I appreciate the advice very much!

BOA is the worst bank ever! Seriously! They are OK to have a credit card with, but not who I’d maintain a financial portfolio with. Research the number of cimplaints against them. Me, I’d go with T Rowe Price or Charles Schwab, or continue with Fidelity since you’ve been happy with them. You want service and knowledge and those aren’t BOA strong points. My money with T Rowe Price has earned 10+ % since I started with them well over 10 years ago. I’d rather earn less and have a trustworthy bank with excellent service than a scammy bank, and that is what BOA is.

Definitely hear you. I’m gonna keep my existing funds and just let them sit there. In that regard, I don’t plan on really using them much more than that. So I think it’ll be OK. I appreciate the heads up though, and it does make me want to keep a closer eye on everything.

Thank you for reading and commenting!

I wouldn’t let $375 be a factor (just over a third of a percent of funds). That and some extra credit card bonus can easily be offset by higher fees and lower fund performance. Analysis of the ongoing effect of a change is much greater than any one-time advantage.

Having the $100K certainly doesn’t mean you’ve somehow outgrown the Fidelity that you love. I think the relationship with your brokerage company should be thought of as more long term than what credit cards you hold/use and points you get (IMHO). Personally I use Schwab, but my thoughts would be the same even if you were looking to switch to them as opposed to BOA.

Congrats on your further progress,

Definitely hear ya. I got to keep my existing funds (FSKAX AND FXAIX) so the fees and fund performance are the same. The $375 and extra credit card rewards are a nice bonus. 🙂

I’m going to keep Fidelity for my Roth IRA and taxable brokerage, as well as the checking account. So I’ll still be with them for my active trading long-term.

Another thought I had was to not keep all my eggs in one basket – and perhaps I can get more out of Bank of America than I originally thought. If it sucks, I can always switch back over. But I made the leap and will see how it goes.

Thanks for watching out for me, Carl!

+1 for not doing the BofA brokerage move. I did it. Got the bonus for the $100k, it basically sat there for a year doing barely nothing. As an IRA broker, they don’t even allow you “limited margin” which Fidelity does, which means you can buy or sell stock with funds that haven’t cleared yet. Even if you put $20k/month on your Premium Rewards card, it basically only comes out to $400. Fidelity will do that much and more with your $100K. Oh – and did I mention Merrill was down on major trading days while Fidelity was still up? I had accounts with both – roughly the same amount, and my Fidelity account is WAY higher now, so much that I recently ditched Merrill and moved the $$ over to Fidelity. Save yourself the headache and don’t do it. It ain’t worth it.

Thanks for this perspective, Kira! I don’t plan on using them for active trading or options/margins. For that, I am staying with Fidelity. And I didn’t know that about the limited margins and them being down during big trade days. Wow. Thanks for that heads up!

BoA is an awful bank. They charge a $3 fee to push (ACH) money out from your BoA account to an external account. Only bad banks like Comerica do that.

I did their $900 for 200k promo. They were supposed to give me expedited Platinum Honors status under the terms of the offer, but didn’t. Calling Merrill gave me the runaround to BoA, and vice versa. Still eventually got qualified under Platinum Honors and got the $900, but geez.

On the plus side, I’ve seen substantially more credit card approvals since then. Approved for Premium Rewards (was rejected before when I had fewer inquiries/accounts), Virgin Atlantic. Opened a biz checking for the bonus, put down $20k, became Gold business, and was finally approved for Alaska Biz (rejected 3x before).

I don’t like BoA. But they gave me money, cc approvals and bonuses, and a 2.62% cashback rate. Everyone else denies me at this point, so I’ll keep money at BoA as long as they keep approving me (contingent to the 2/3/4 rule).

Glad to hear it worked out in the end! I took the bait and will see how long it takes to get the bonus. Also looking forward to more card approvals. I’ve had most cards before and am sort of locked out of most of the desirable cards at this point, so this is sort of a new experiment for me. Encouraged by your positive results – thank you for sharing!

Hey Harlan, long time…

I’m going to offer an alternative view to the others. I have one of my IRA’s at Merrill so I qualify for the Platinum Honors, but I haven’t actually pulled the trigger on a card yet. I did a transfer bonus a year ago. Merrill on the investment side has been fine. I hadn’t experienced any outage issues during the rough patch a few weeks back. I’m on my account several times a day too as I do some options trading in my IRA. As far as gains vs other brokerages, I’m not sure what people are saying, just pick the same(ish) stocks or ETF’s. My RoR was 49% last year so I was pleased.

I don’t bank with BOA, but I’ve heard it’s either ok or not good. If a banking bonus pops up, I’ll definitely jump on it but not use it as my main bank acct. I usually keep a direct deposit of $5 to keep the acct active until I decide to close it. My main checking acct is Chase, and I do use Schwab for my brokerage and for their great no fee ATM card when traveling.

Best case, Fidelity has a transfer bonus for you down the line to come back. Good luck with whatever you decide to do.

Hey Dustin! Good to hear from you!

Sounds like I’m in the same boat. I went ahead and made the transfer. Chase is my main bank and Fidelity is my main brokerage (their cash management account also has no ATM fees worldwide).

I won’t use the Merrill Edge account for any trading. Just buy and hold for three funds (FSKAX, FXAIX, and ITOT). So for that, it’s perfect. And like you said, if it sucks, well… I can also go back to Fidelity.

Hope you’re doing well! Thanks for sharing a page from your playbook!

It would seem that you could move ~$100k to BoA, get the $375 bonus. You could use it for an IRA or Roth IRA that is invested in ETFs. I use Vanguard ETFs at BoA, just for the Platinum Rewards tier.

Yup, that’s exactly what I did! #greatminds

Good to hear from you! 🙂