I got a targeted email offer today on my Barclaycard AAdvantage® Aviator™ Red World Elite Mastercard®. It’s not earth-shattering or anything but thought I’d share because it does require registration.

The email subject is “Finish the year strong and earn bonus rewards.”

It’s worth registering for if you’re targeted.

Deets

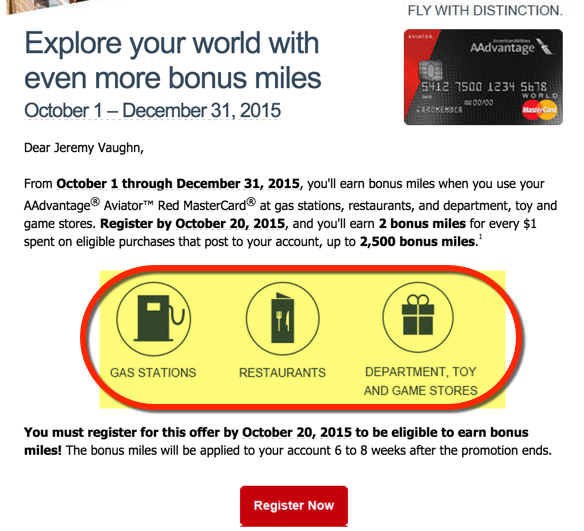

The offer is for 2 bonus AA miles, in addition to the normal 1 AA mile earned, per $1 spent at:

- Gas stations

- Restaurants

- Department stores

- Toy stores

- Game stores

So they’re definitely going after the holiday shopping set, as it runs from October 1st through December 31st.

I got a cap of 2,500 bonus AA miles (so $1,250 in spend) – but Barclays has been known to give varied offers, so be sure to check your email to see if you got anything from them.

The registration link goes to a page where all you have to do is check a box, and hit “Submit.” That’s it.

If you’re planning on shopping a lot in these categories and maxing out other quarterly bonus categories on other cards like Discover it® – Cashback Match™ card or Chase Freedom (which both have Amazon.com as a bonus category in Q4), the Barclays offer could be worth maxing out afterward.

Me, I like the restaurants category, as I tend to eat out way too much living in NYC. I love AA miles, and I’d rather earn 3X AA miles than 2X Chase Ultimate Rewards points on dining, at least up to the $1,250 limit.

Keep in mind gas stations is a category here, too. Lots of gas stations sell gift cards, so for those of you with a Kate machine and a friendly gas station nearby, this could be an easy way to earn an extra few thousand AA miles.

Bottom line

Nothing amazing, but worth a look in your email and quick click of a button to earn some bonus miles.

I’ll toss a bone to Barclays and put this card back in my wallet come October, and use it for some dining spend.

I only have one 10,000-mile anniversary bonus coming my way soon from this card, then I’m gonna see if I can’t downgrade to a no annual version, or product change it, or otherwise dump it.

I already have the (no longer issued) Citi® / AAdvantage® Platinum Select® Amex I like to use for the 10% rebate on award redemptions, Small Business Saturday, Amex Offers, et al. And the 10% rebate perk doesn’t stack if you have more than one card, so…

Feel free to ruminate about credit cards or how to maximize this, or post if you got a better offer than I did in the comments!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

same offer.. 1 out of 4 aviator cards I managed. Last time around, it was my wife, now it’s me. I love AA miles.

Nice! Yes, there doesn’t seem to be a pattern to it.

Thanks for commenting!

I hope they send me the offer. If not, should I call them? Big furniture purchases coming up….

I think the big news is the bonus on department stores considering the time frame includes the Xmas shopping season! We see various offers for bonuses on gas and restaurants often but I’ve rarely seen one include department stores. I assume Target and possibly even Walmart might work under that category but who knows. Restaurants will continue to go on Chase Sapphire but Xmas shopping will go to this card.

Usually big box stores like Target or Walmart are excluded from the department stores category, but you never know!

And I agree, this is a solid promotion for the upcoming holiday season!

I got get 15,000 bonus for spending $500 per month in Oct, Nov, Dec so 16,500 points total. Very excited.

Dang, jel!

It came in the mail and no registration required.

Cool! Interesting to hear about all the ways they’re targeting customers.

I usually end up transferring my Ultimate Rewards to United, but since I seem to have better luck finding award seats on AA flights, the 2x dining on the Aviator will win vs. the 2x dining on my Sapphire Preferred.

Has anyone seen the bonus points post yet? I definitely clicked the box to activate the promo, but I haven’t seen the bonus points on my statement or current activity yet.

I think I remember reading that the bonus points would be applied 4-6 weeks AFTER the promotion period. So you’ll get them in January or February sometime.