Happy Holidays! 🎄 I feel a little bad for saying this but… 2020 was actually a really good year for me. No, I didn’t travel nearly as much as I wanted and being at home all year with an occasional trip to the grocery store wasn’t what I had in mind. But I did a lot of good, important work. Most of it inward.

I know this year has been hard for so many people, and I almost don’t want to celebrate my wins publicly. But that’s what these posts are about, and I’ve always posted when things have been down. So with that…

I’m hoping 2021 will be the year I thought 2020 would be: lots of travel, live music, and exploration. During the last year of reflection, I’ve been wanting to leave Dallas, reconfigure my future, and take control of my finances.

I’m a new plant dad and love having so much green around

And I’ve been doing well on that last part! I have so much to tell you. So much has happened right at the end of the year.

December 2020 Freedom update

To begin, I’m starting a new job in January 2021 at a digital advertising agency. I’m sad to leave my current company and this is a lateral career move. My salary is about the same but I’m hoping the opportunities will be worth it.

And now, the financial details.

NO CREDIT CARD DEBT!

Yesssss!!! I felt shame about starting this series with credit card debt. Life happened a lot in 2019. I had to replace my HVAC system that July in Texas, got dumped by my boyfriend at the time and took a trip to Iceland and Greenland because I was depressed and in my feelings, and moved back to Dallas from Austin. I charged all of it.

A lot of 2020 was about dealing with that and cleaning up past messes. I’m not happy about it, but… it’s all gone now. And this year was actually conducive to staying put and sticking with a plan. The only credit card balances I owe are for normal charges that I’ll pay off each month. 💯

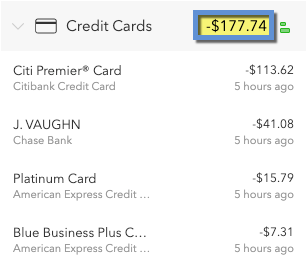

Now I’m just charging the usual expenses

This has been such a slog for me. I can’t believe I paid off $25,000 in credit card debt in a little over a year. With this gone, I can save my extra income.

I will say this, though: I’m glad I had credit cards to help pad things out when I needed them. I used a 0% APR promotion to hold the balances, so I didn’t pay any interest. Mostly, it was the psychological portion that caused the most strain.

Car = PAID OFF

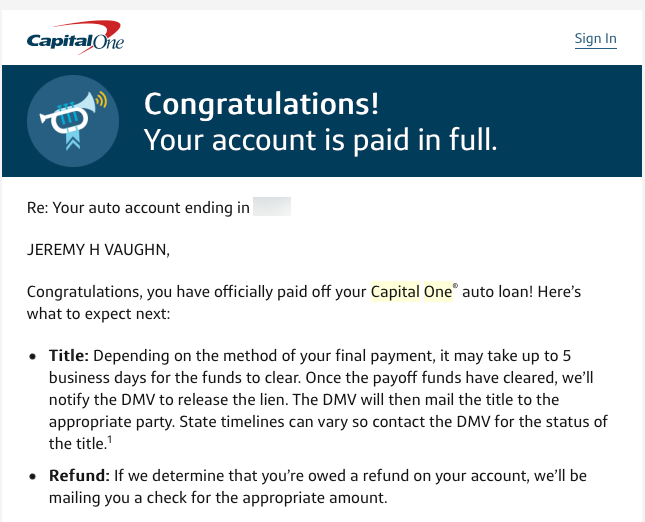

I dipped into my savings to pay off the last of my car loan.

Yes, I figured because it was my last liability, and the interest rate was higher than my savings account, that I should bite the bullet and get rid of it. I owed ~$3,400 and paid it off via Plastiq to count toward the minimum spend on my new Citi Premier card. 💁🏻♂️

(Aside: I downgraded my Citi Prestige to a ThankYou Preferred and opened up a new Citi Premier card… and that’s a whole other post!)

So with this payment, I killed off my last liability and met most of a minimum spending amount. Boom.

It felt amazing to get this email

The downside is that my savings amount is lower now. But I’ll spend the next few months bulking it back up and thinking about all that interest I won’t ever have to pay. 😈

Maxed out my 2021 Roth IRA

Not really, because it’s not 2021 yet, but… I transferred $6,000 to my Fidelity account and plan to max it out in a few days on January 1, 2021. I’ve done this a time or two and it always feels amazing to get it done at the beginning of the year. I’ll go with VTI or FSKAX and call it a day.

I’m a fan of dollar cost averaging (DCA) as much as the next guy, but you can’t beat time in the market.

I also took this from my savings account because I figured the returns I’ll earn will be higher over the course of the year. And it also allows me to focus on my other financial goals for 2021. Getting this done early gives me a running start toward the rest of them.

Which brings me to…

2021 financial goals

I’ll start the year with a fresh 401k and some of my savings depleted. My financial goals for next year are to:

- Max out my new 401k – $19,500

- Build savings back up to $30,000 – I’m currently at ~$17,000, so $13,000 more

- Put any extra income into a taxable brokerage account – $$$

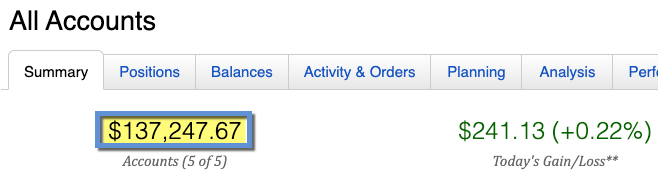

I’m up $7K since this time last month

This signifies a shift from paying down liabilities to building assets – something I mentioned a year ago. And now I’m here, in the position of focusing only on building assets.

I plan to put my 401k contributions on autopilot, then direct everything toward savings until there’s enough in there, and lastly channel everything into a taxable brokerage account.

This is also the first year I have access to an HSA account, so I’ve already chosen to contribute to that.

All in all, I’ll be saving around 50% of my income – potentially more.

Also worth noting – my new company does NOT offer a 401k match. I thought all companies had some sort of match these days? I only mention because all the contributions will be mine. Here’s hoping they start matching at some point next year!

By the numbers

My new table is simpler and more pared-down. Dare I say… boring?!

| Current | Last Month | Change | 2021 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| 401k | xx | xx | xx | $19,500 | |

| Overall investments | $137,248 | $126,669 | +$10,579 | As much as possible | |

| Savings | $16,775 | $27,099 | -$10,324 | $30,000 | |

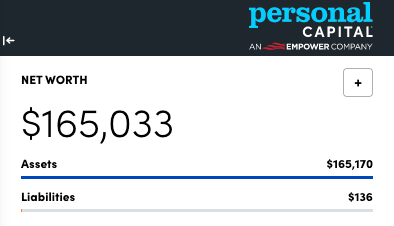

| Net worth in Personal Capital | $165,033 | $158,599 | +$6,434 | $500,000 | Track your net worth with Personal Capital |

I have no more liabilities to track, only assets, and if things continue like they have been, I’d hope it all trends upward.

Another new high

I’m tickled that I’m 33% of the way toward my $500,000 dollar goal – a full third of the way. Can I finish it in the next few years? With compound interest on my side, I’m sure going to try my damnedest.

Keep going plz

In a few days, I’ll have another $6,000 in my Roth IRA earning returns. And also a new 401k receiving deposits twice a month. And on my own, I’ll save and invest separate from that. This is a great place to finally be on my road to financial independence.

My biggest priority at first will be to fully stock my emergency fund. I love knowing my car loan is gone and maxing out the Roth IRA so early, but also don’t want to get back into the situation I was in before. Now that I’ve made it this far, I’m excited to keep moving forward.

December 2020 Freedom update bottom line

What I’d really love to do is reach a $250,000 net worth by the end of 2021. Think I can do it in a year? That’s ~$85,000 more than right now. But considering my net worth rose $60,000 in 2020, I think I can do it now that I’m debt-free and have no interest working against me.

Plus I’ll have more money in the market and more time in the market overall. If I reach the halfway point, I’m confident I’ll reach my full $500,000 goal. Here’s hoping the stock market continues its growth. I’m hearing talk of a bursting bubble situation, but I don’t know what to believe any more other than slow and steady wins the race.

In the meantime, I’ll be getting started at my new job – eep! It’s always a little nervous to be the new person in the group. I’m hoping next month will be full of growth.

Until then, I hope everyone stays safe and healthy! Thank you for reading – I hope the journey is fun to follow! ⚓️

Happy New Year! 🎉

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Killing it. Great job!

Thank you, Hank! Appreciate it!

What a turn-around you have made! Congrats, and thanks for your open and honest posts.

Thank you so much for reading, and for commenting. I really appreciate having you here!

It’s too bad you don’t also have some real estate. The net worth boosts from property would serve as a tailwind.

I sold my condo in June of this year. It dampened me on the property experience. I might buy again in the future, but next time I want to make sure to have a sizable down payment, so I’ll focus on building that up for a while. Definitely something to think about for the future. I appreciate you reading and commenting – thank you!

Congratulations Harlan. You conquered many milestones on your path to financial freedom. Stay focused and you’ll hit the 250k and 500k milestones in no time

Yes! I’ll keep plugging away and investing in simple broad-market index funds. Now that I don’t have any headwind, I’m hoping to speed up the progress. And I can’t wait to travel again next year!

Thank you, Rick! Hope you are doing well. Happy New Year!

Congratulations on your further progress! You have the added advantage that in this rather short period of time you’ve experienced the good and the bad in various ways. You’ve survived the trial and tribulations, and come out better on the other end. Have a New Year’s toast to what you have achieved and to an even brighter future,

Thank you, Carl! My biggest lesson learned was to ignore the news and downturns and keep contributing anyway. Cheers to you as well and Happy New Year! 🙂

Actually, this post really inspired me. Great job and keep up the good, bad, and in-between news!

Thank you, Trisha! I certainly will!

Congratulations Harlan! I can imagine the relief you must feel to have settled your debts. I’m really glad to know things are going better for you.

Enjoy your holidays.

Nice work this year, congrats! It feels great to be debt free!

Potentially some good news for us for a change but still waiting on things to run their course. This would be HUGE for us and would be a new chapter in our lives. Hell, maybe even a new book with the way things have been going 😀 Stay tuned.

Congratulations on the new job! Paying your car off is also a huge milestone, I did April 2020 and it’s been a huge burden off my shoulders. No more $541/mo payment. Impressed you already contributed the max to your Roth IRA for 2021, I’m still trying to do the same for 2020 but did max out my 401k for the first time in my entire life. I too am surprised about the lack of any matching for the 401k. At least you still have the tax benefits. Hoping I get a refund check in a few months because the amount I paid in taxes last year relative to my take home salary was a bit ridiculous.

Thank you, Elliot! And congrats on all your progress – paying off the car, maxing out your 401k, and maxing your Roth IRA. That’s awesome!

I’m also wondering what’s gonna happen with the tax situation this year. I also still haven’t gotten my second stimulus yet. Still a lot of things to shake out.

Would love to get updates as you make progress. And thank you for commenting! Keep it up. Slow and steady wins.