If you’ve opened small business credit cards, chances are you have a business credit score – one you might not even know about.

Business cards are totally different animals from personal cards, in their protections and how they’re treated by law. In general, consumer (personal) credit cards give you more protection against unwanted activity, and with extended warranties.

But a small business card can be an excellent way to separate your business expenses and earn bonus points in categories lots of personal cards simply don’t have, like office supplies, cell and cable bills, advertising, and shipping – to name a few.

If you want to open small business cards, it’s good to know where you stand

Here’s more about your business credit score – and how to check it for free.

What’s a business credit score anyway?

I’ve opened lots of small business credit cards these past few years, both in my name as a sole proprietor and with a business entity name. If you’ve opened a small business card, there’s data out there totally separate from your personal credit score.

Although banks ask for your SSN and for you to personally guarantee your business credit line, many small business credit cards do NOT appear on your personal credit report. But it’s not like they disappear.

Instead, there’s a system of metrics to create a whole other score for your small business.

Business credit scores look for completely different patterns than personal scores

There are 2 main systems: Experian, and Dun & Bradstreet.

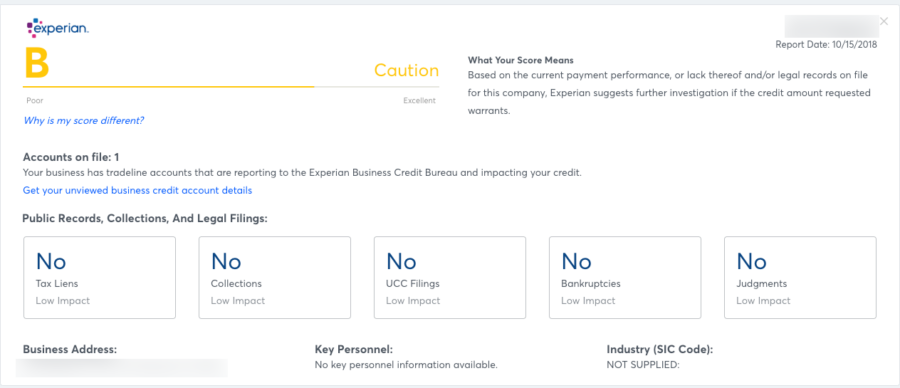

With Experian, you’re given a grade A through F. And with Dun & Bradstreet, you’re given a score between 80-100, between 50-79, or 49 and below.

With both, higher is better (closer to A or closer to 100).

You’re ranked with if your business has had:

- Tax liens

- Collections

- UCC filings

- Bankruptcies

- Judgements

Of course, these items can appear on your personal credit report, too. But this score only takes into consideration actions taken against your business.

Use Nav to see your small business credit score

In the past, it’s been expensive or tricky to see your business credit score. But with Nav, I was able to plug in my business information and get an instant credit report. They can pull from both of the main systems.

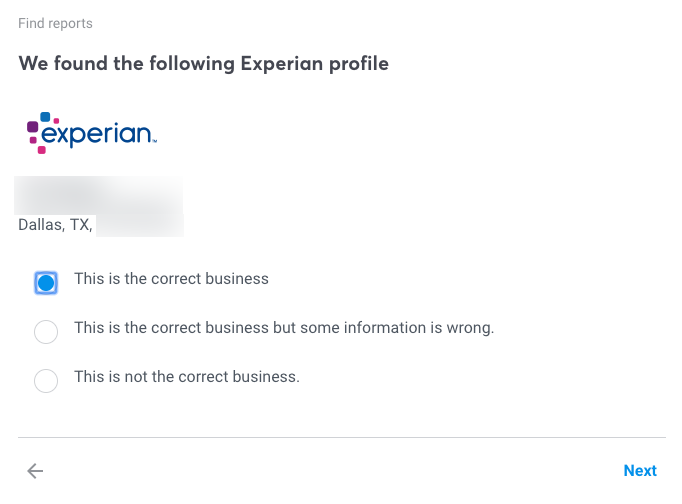

After you sign up for free, Nav will ask you to confirm your personal information. Then, you’ll have the chance to find your business in Experian and Dun & Bradstreet’s systems.

I easily found my business with Experian

After I entered the information, I found my business with Experian. And was given a “B” grade – probably because I only have one type of credit (small business credit cards).

If you’re in the same boat, you’ll likely have a similar result.

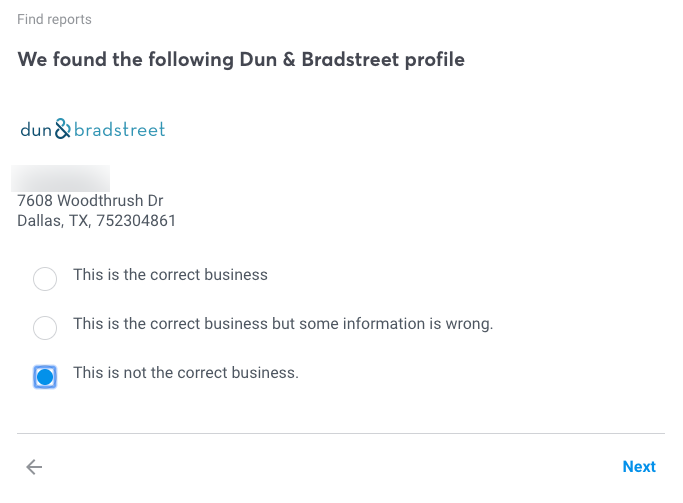

No dice with my Dun & Bradstreet profile

But with Dun & Bradstreet, I couldn’t find my business anywhere. I saw lots of others with similar names, and they showed me dozens of addresses – but none of them were mine.

They were all in Dallas, though (where my business is). I have no idea why it was easy to find myself with Experian, but not with Dun & Bradstreet.

I don’t have extensive business credit history by any means, but I’m glad I was able to confirm the information out there, even if it’s limited.

Why it’s a good idea to check your small business credit score

Simply because lots of small business have similar names. And if you’ve had different addresses and used SSNs and EINs, it’s hard to link them together as one entity.

For example, if your business name is “Joe’s Coffee Shop,” you might be mistaken for “Cup of Joe Coffee” or “Joe’s Coffee Stand” or some other similar sounding name.

Mistakes happen. If two small business have limited history, but similar names, they can become intertwined. And though one of them might be squeaky clean, a judgement or lien on the other can bring them both down.

My small business cards are for Airbnb hosting

And when you go to apply for another small business card, you could be inexplicably denied. Just like personal credit scores, you might have to file a dispute.

But it only takes a few minutes to check your business credit score and it’s free.

Plus, if you ever get to the level where you form an LLC, incorporate, seek business loans, or apply for a business lease – you are definitely going to want to know where you stand.

My businesses are small hobby-based enterprises, but ya never know. And on another level, I kinda just want to know what information is out there and correct it if it’s wrong.

Bottom line

Most of us in the points & miles world picked up a small business credit card at some point. There’s information out there about your small business – and it’s free to check.

What’s also kind of scary is at a certain point, I was asked to match addresses from a long list of other business to go in and view their profile. So the propensity for human error here is kinda frightening.

There’s no good way to serve up a business credit score. After a while, they try to match names and addresses as best as they can. One wrong match can tank your score, even if you did nothing wrong. And that could prevent you from getting more small business cards in the future.

Nav will ask if you want to upgrade or subscribe to monitoring. You don’t have to, and you don’t need a credit card to see your score – so it’s truly free to check. If you have an A or B with Experian, you’re fine.

I’d never heard of Nav before and didn’t know this was even possible until a few weeks ago. It’s certainly interesting. And I’m glad my score was decent despite only having a few business cards.

Here’s the link if you wanna check your own business score.

Let me know if you had a similar experience claiming your business!

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I Have several small business cards that I opened as a sole proprietor using my SSN. If I close some of them will it affect my personal credit score at all? I don’t need them all but was keeping them bc I know account age helps your score with personal cards.

If they don’t appear on your personal credit report, they have absolutely no bearing on your score at all. So you can cancel them if you want!

Thank you, Harlan!

Nav credit scores have been screwy in my case (like non existent), and I have been in business for more than 30 years with a perfect record with multiple business accounts and loans (besides credit cards.) Like they had NO record of me until I opened an account as you detail above 4 years ago. My Nav scores have been very low since then (Even with personal FICO scores above 800 all along.)

The good news, the only business credit card applications for which I have been denied have been Chase due to LOL/24.

Having said that, it cannot hurt to see what they might have to say…. Maybe I angered the Nav gods 🙂

Very strange! I have no idea how they go about matching all the information to businesses. It seems sloppy at best and downright frightening at worst. I have a vague business name so it’s easy to confuse it with 100s of others. I wouldn’t want to become entangled with someone else’s business dealings. But this is a whole new world for me.

Thanks for the insight! I’m glad I’m not the only one with mixed results. Maybe some tending to this is in order.

Thanks again, Doc! 🙂

I’m going to have to check out Nav. Thanks for sharing!

It’s certainly an interesting new world. I met their rep at FinCon and she was totally sweet! Hope you’re able to find Nav useful. Thanks for reading and commenting! <3