It’s been over 4 years since I first professed my love for the Fidelity Cash Management account – one of the best no fee checking accounts. And about the same amount of time since I wrote about the Aspiration Summit account.

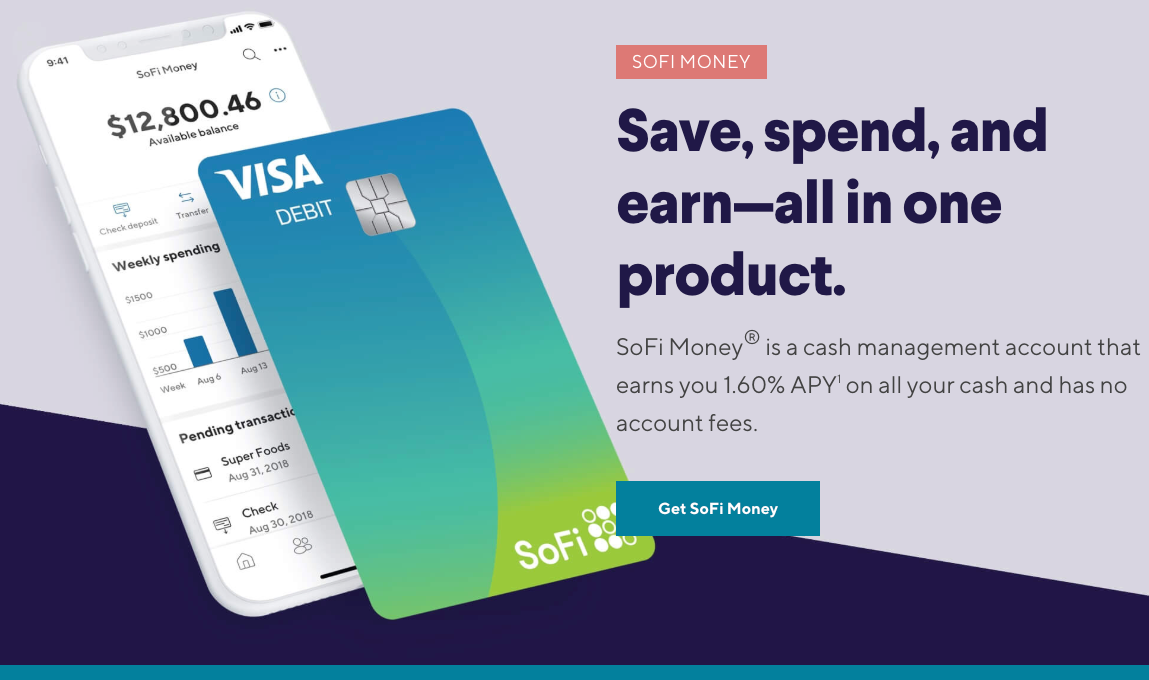

But that was before SoFi Money came on the scene. That account has no fees – but also free unlimited ATM withdrawals worldwide AND 1.6% APY on any balance you carry. It’s now the one I recommend most if you’re looking to dump your brick-and-mortar bank (and you probably should).

There’s a new sheriff in town, and it’s SoFI Money

All are fantastic checking account options because there are no fees, no minimum balances, and no direct deposit requirements. Essentially they’re free to open and keep forever, even if you never use them. Even better, these accounts reimburse ATM fees from ANY ATM in the world. And there are no hard credit pulls to open.

There are a couple of key differences. But, bottom line, you should have at least one of these accounts!

Best no fee checking accounts

1. SoFi Money

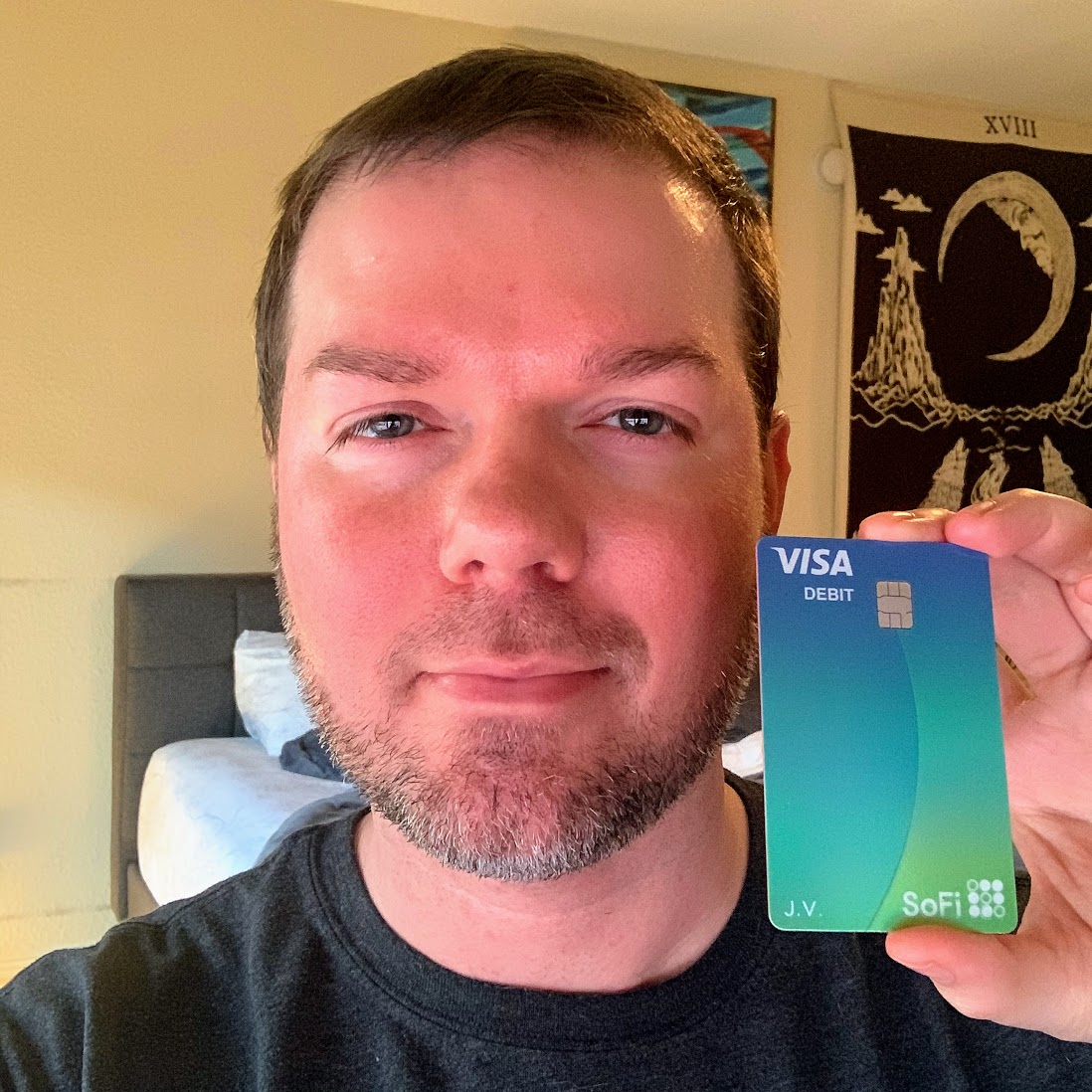

This one is new to the list – it launched in 2019. And if you only get one of these accounts, open this one because you get:

- Unlimited, instant ATM reimbursements worldwide allowing you to use any ATM that accepts Visa – an amazing perk for travelers

- 1.6% APY on your balance – comparable to many high-interest savings accounts

- No fees, no minimums

- Sub-accounts to save for your goals, and joint accounts for your S.O.

- Blazing fast sign-up – I had an account open in 2 to 3 minutes

- $75 bonus when you open an account and make two direct deposits of $500 each – and it posts within a day or two

It’s basically a traveler’s dream checking account. And the $75 bonus when you open it is one of the easiest money I ever made!

King of free checking accounts and perfect for traveling

I really can’t say enough good things about this checking account. It’s simple to use, travels well, and is even good enough to be your main checking account. Plus it’s the only one that earns interest on your balance.

Here’s my full SoFi Money review.

2. Fidelity Cash Management Account

This was my go-to for a long time. You can use it anywhere without ATM fees. When you withdraw from a fee-bearing ATM, the fee is reimbursed the same day the charge clears your account.

It’s also an amazing tool for overseas travel. I transfer some cash into this account a few days before a trip. In the past, I’ve paid nasty interchange charges each time I’ve needed to access my cash. With this card, there is a 1% fee built-in by Visa but there are no additional fees. I don’t mind the 1% because it’s $1 per $100 – which is a small price, in my opinion, for all the convenience I get from this account. I love it.

I also used this account for my Airbnb business as a de facto business checking account. I let the balance build every month. Then paid the rents and bills. And transferred the rest to pay down my student loans. Rinse and repeat each month.

It’s an easy way to keep all that separate from my (other) main Chase checking account – which I wouldn’t recommend these days. I got it forever ago and don’t pay fees to have it. If I did though, I’d have zero issue dumping it for this account. Now, I like how it keeps things apart per the envelope method.

What to know before you get a Schwab checking account

The inevitable question is, “How does it compare to the Schwab Bank High Yield Investor Checking Account?”

They’re essentially the same. BUT:

- Schwab uses a hard pull when you open their account

- Fidelity uses a soft pull

- Schwab requires you to open an investment account, although you do NOT have to use it – ever – if you don’t want to

- Fidelity doesn’t require any other accounts

AND:

- Both have no fees

- Both reimburse all ATM fees (yes, worldwide)

- Both have free bill pay

- Both are great if you invest with the respective firms

I didn’t want the hard pull or an account I’d never use. Between them, the Fidelity account was better for me. And I’ve just stuck with it.

Here’s my full Fidelity Cash Management account review.

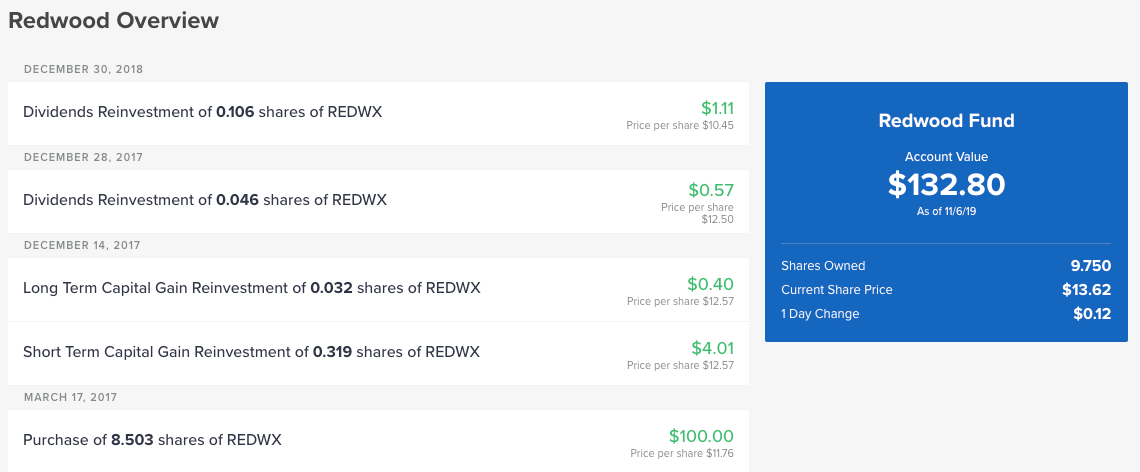

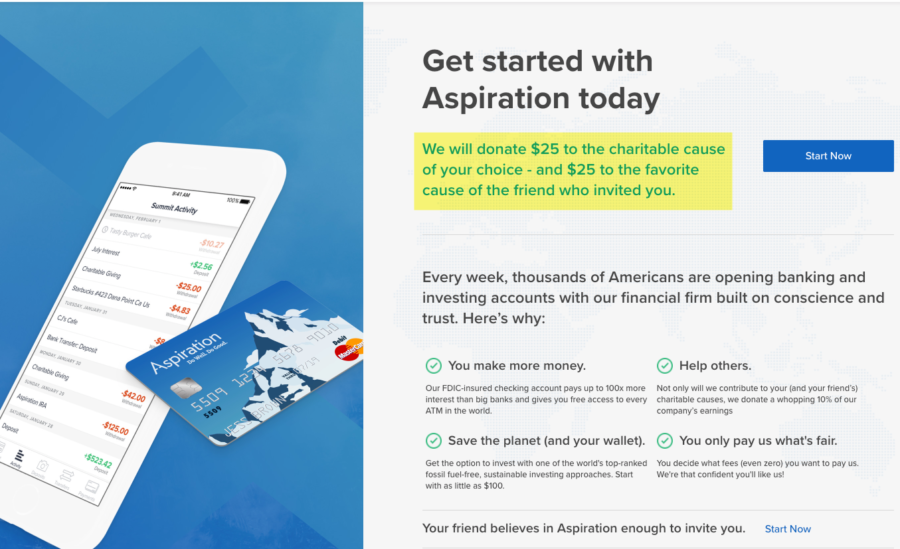

3. Aspiration Summit

So this account has several of the same features as the Fidelity account. And, it has a savings component.

I also bought $100 of stock in Aspiration’s Redwood Fund just to see how it would perform

When you direct deposit at least $1,000 in the account each month or have $10,000+ saved, you’ll earn 1% interest on the balance, which compounds monthly. So if you’re interested in saving too, this is a great account for an emergency fund. But be aware, you can get much better rates elsewhere and without the requirements. It’s really only good for the free ATM withdrawals.

You’ll also get $25 to donate to charity when you sign-up.

There are no fees, no minimums, and no requirements to keep the account free. But there’s one important difference in how ATM fees are reimbursed: it happens when your monthly statement closes instead of when the charge clears, like you get with SoFi or Fidelity. And you’re limited to 5 withdrawals per month. If you withdraw sporadically, this shouldn’t be an issue, though.

If you’re interested in a no-fee checking account with global ATM access, this one is another contender. Especially because they’re committed to helping and protecting the environment with their profits.

Here’s my full Aspiration checking account review.

Which one is best for you?

Definitely SoFi Money because you earn a little interest on your balance and ATM reimbursements are instant. By far, this one will serve the needs of most peeps just fine. Plus, the app and user experience is top-notch.

Although I personally like Fidelity for being able to link my IRA accounts. And an edge to Aspiration Summit for its versatility as a savings account and commitment to the planet. Net-net, all are excellent options.

I’d go with the Fidelity account if you:

- Already have other Fidelity accounts

- Want your ATM rebates back within a day or two

- Have a Fidelity Visa

And recommend the Aspiration Summit account if you:

- Don’t mind waiting for the ATM fee reimbursement

- Like the charitable giving option

- Like what the company stands for

All these accounts a stellar choice for completely free banking. I’ve used them all extensively and never had an issue. So I recommend them wholeheartedly.

And if you are paying fees to have a checking account, to keep a minimum balance, or to access your money… stop that immediately! There’s no need to pay anything.

Bottom line

- Link: Open a SoFi Money account and get $75

- Link: Open a Fidelity Cash Management account

- Link: Open an Aspiration Summit account and get $25

I know we get caught up on credit cards in this hobby of ours. But we all need checking accounts to make our payments. There’s simply no need to pay fees to have your money in an account or to access it – no matter where you are in the world.

I’ve withdrawn cash from my Fidelity account in Ireland, Japan, Germany, Chile… and occasionally withdrawn money when I couldn’t use a credit card.

I can personally vouch for it. Although with SoFi Money on the scene, there’s a new show in town – and it’s now the best no fee checking account option.

It mainly comes down to how quickly you want your ATM fees reimbursed. And if you want a hybrid savings option.

Even if you already have a checking account you like, consider the envelope method – all are great free options for this.

Even if you only use them for international ATM withdrawals, that’s reason enough.

So now I’m curious – what’s your favorite checking account? Are there any better than these?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

You forgot to mention that Schwab’s No Foreign Transaction Fee also applies to ATM’s. In that aspect, it has an advantage over Fidelity (1%).

That’s very true! I usually use credit cards with no FTFs to buy things overseas. But I still pull out a little cash to have on hand. In my opinion the $1 charge per $100 is nominal to:

– Skip a hard pull

– Have my Fidelity accounts linked (I also have the Fidelity Visa)

– Avoid opening a Schwab account I won’t use (though I know I don’t have to use it)

– Get ATM fees reimbursed immediately instead of once per month

But the hard pull is a big deal for me, especially since I like to open new credit card accounts often. But I do understand why people like the Schwab account – especially if they already have an account there. But for me, a buck here and there is worth it for the Fidelity account.

I grabbed Schwab forever ago, before I knew about Fidelity. We’ve used it around the world with great success. They reimburse ATM fees once per month, but it’s a hard pull unfortunately.

I have a Fidelity cash account from when I opened my taxable brokerage account. They were doing a “free 300 trades” offer a few months ago that I ditched Tradeking/Ally for.

I didn’t think anyone else knew about Aspirations. I got an invite from one of the CSR reps after asking a zillion questions. I’ll likely open an account for each of us before we leave the country for good, but I’ll use your link instead of the CSR’s link.

Awesome! Thank you, Ken!

The Aspiration Summit account is particularly good if you need to carry a balance because of the 1% APY on balances over $2,500. I use my Fidelity account daily and my Aspiration account sometimes. They’re both top-notch. The Schwab account is good too – but I’d def go with the Fidelity account to avoid the hard pull like you said.

I’ve used both around the world too, and had zero issues. All the accounts mentioned are excellent if you’re overseas and need to occasionally take out some cash. When will you leave the country permanently? I’m not sure if I ever could – but I would love to live in Europe for at least a few years.

Probably this summer once our lease ends. BTW I’m not getting reply notifications.

OK, I’ll check into that!

And wowww that’s crazy!!! Where will y’all go? A couple of places or travel all over for a while? So awesome.

I’ve been using my Fidelity ATM card for few years now and I love it! Fees are refunded automatically. One time it didn’t because the fees were embedded and it was a round number, but I called Fidelity customer service and the nice lady took care of it immediately.

That’s awesome to hear! The one or two times I’ve called, I’ve also had good customer service. I love the account too – thank you for sharing your experience!

Great post – thanks for the info.

I knew about schwab but not the other two.

I also consider the soft pull an important differentiator.

Schwab gives you $100 to open the account, so that was totally worth the hard pull for me. Plus it opened the door to the Amex and its associated opening bonus (while offering the option to convert Membership Rewards to cash at a very favorable rate).

Does Fidelity welcome in-branch MO deposits? That’s another huge advantage of Schwab to me. They have locations everywhere, even in places like my home state where most major banks don’t exist.

Thanks for taking the time to present the other options. It’s good to have choices. 🙂

Schwab 100%, no FTF on cash withdraw has saved me tons. Plus, I got $100 bonus when I opened the accounts. I’ll take Scwhab anyday (especially if you are overseas long term).

Hello, any idea if Aspiration also charges the 1%? I look at the stie and didn’t see it mentioned. I would like a Schwab acct but the hard pull is keeping me away for now.

Hey DW! 🙂

Yup, Aspiration also has the 1% fee: https://support.aspiration.com/hc/en-us/articles/208713397-Foreign-Transaction-Fees

It comes to $1 per $100 so unless you’re pulling out huge sums of money, you likely won’t notice it. I usually pull out ~$200 to have on hand in a new place, so $2 for the convenience is more than worth it for me. Plus there are no forex fees with the right credit cards anyway. So I really don’t think about this too much. Hope this helps!:)

@Harlan,

A couple things to clarify with the Fidelity CMA. The 1% FTF you speak of is for DEBIT card purchases, not use of the ATM. There is no 1% fee on cash taken out of the ATM. With so many credit cards without a FTF, this is a non-issue for me. Second, the Fidelity CMA allows you to buy-in to many of their money market (MMA) funds. This is the most annoying thing about the CMA. If you aren’t depositing money all the time, it may not be a big deal. Fidelity will automatically sell from the MMA to cover expenses (debit card transactions, bill pays, ACH, cash withdrawal at ATM). Fidelity has a few funds paying higher than 1.6% APY, offers SIPC + extra cash insurance + has great customer service.

Totally. I always include the bit about the 1% fee because it doesn’t say anywhere that ATM transactions are specifically excluded because Visa bakes it into the final cost you see. But I am with you – I’ve never seen a fee or anything extra for all the times I’ve done this. People get so caught up on it though.

And def feel ya on the Fidelity CMA + MM funds. I just don’t have the patience and wherewithal to go through the extra steps. Plus, I keep my checking account balances pretty low to begin with. But some peeps might find that feature to be HUGELY valuable and that’s another reason I love Fidelity and their CMA. I also have it linked to my Fidelity Visa and IRAs, so it’s super convenient to have and use for fully-integrated investing.

Always enjoy hearing your insights – thanks for adding these observations and tips. I appreciate it!

Yes, the SoFi account was very easy to open. I tried a single withdrawal and the fee was refunded in a separate transaction right away, with no issue. Tried Schwab, but ended up with only the investment account, no debit card.

I was thinking about Aspiration, but the delays in fee reimbursements, and the chance that some months I might make more than four withdrawals made it not worth another inquiry on Chex.

Hey CardShark! Feel you re: Aspiration. I like them because I see them trying. I’ve met a few of the folks on the team and like their mission and what they’re going for. So I suppose I have a bit of an emotional connection to the brand, which is great from a customer marketing perspective – they really are doing their best, and I believe they will keep improving, so I’m happy to recommend them.

But I hear ya. Now that SoFi is in the mix, that account won’t be worth it for most. Unless, of course, you prefer their social mission/values and aren’t a heavy ATM user. Def not worth a Chex inquiry if you can’t/won’t use it. I keep it around because it’s a free backup, mostly. #TeamSoFi all the way though – the APY and INSTANT reimbursements make it next level IMO.

Thank you for reading and commenting!