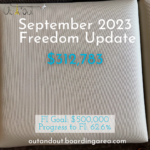

Somehow I’m back at 61% of my $500,000 savings goal and up nearly $19,000 this month. Not gonna lie, last month was devastating being down so much.

So while I love restoring growth, I know better than to get attached or assign mental possession to it. It could just as easily slide down again (and it has). In my case, it will.

Because we have a lot of expenses coming up in the next few months. The only thing that could provide levity is for the stock market to keep going in this upward trend, which… is it?

With my upgraded Hilton Aspire card

There’s been a lot of positive economic news lately (in the world at large), and my 401k has nearly recovered all the losses from earlier in the year. This month, my other investment accounts rose back to their October 2023 levels. If the market continues to improve, it could seriously make up for (and exceed?) my upcoming expenses.

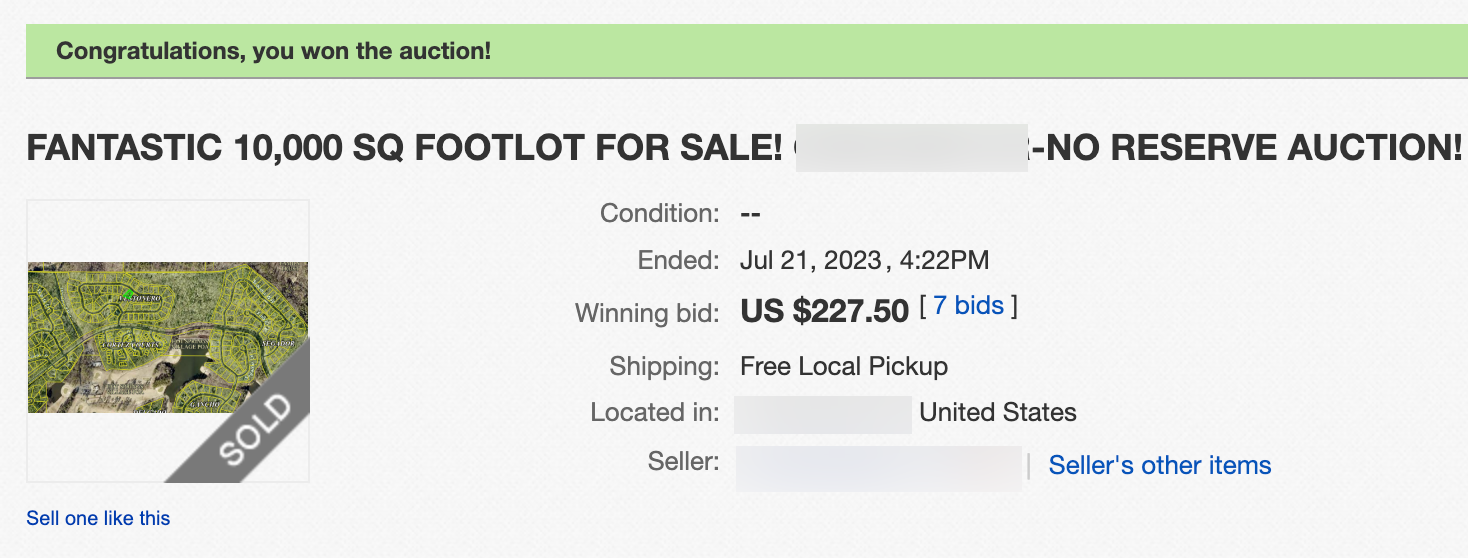

And if the housing market improves, I could add to my home equity. Again, trying to stay level, but there it is: that hope that things will start to turn around.

Either way, I’m staying on track, adding cash to accounts when I can, cutting expenses wherever possible, and steadily paying down debt—all at the same time. As I have someone managed to do for years.