August 2024. This date has been in my mind for a long time as the original goal date to accumulate a $500,000 net worth. Now it’s here—and my net worth is still hovering around the $300,000 mark.

This date was set because of my 40th birthday, coming up in a couple of weeks. Back then, I didn’t know I would move, buy and sell two houses, be a digital nomad for a stretch, or have three kiddos. And who could’ve predicted a pandemic in the middle of everything?

Not bad for 40

Despite many ups and downs (this month AND in the last few years), I’m in good spirits.

I have a lot to report and process this month, so let’s get crack-a-lackin’.

August 2024 Freedom update

First of all, I start my new job tomorrow! After being laid off last month, I was only unemployed for about three weeks, with many leads along the way.

Wow. I am so grateful for how the community immediately came to support me. I needed it, and will forever be amazed at how many good people are on my side.

Layoffs are rough, no doubt, and three weeks is nothing compared to what others have endured (including myself last year).

Splash pad and pool time

I regrouped quickly, rested a bit, hung out by the pool and had a few margaritas about it. I lost the employer part of my 401k, health insurance, and a couple of paychecks—that all stung, and obviously I wasn’t able to make much financial progress in the last month.

But—I have freelance income rolling in and will soon have back all those things I lost: a 401k, health insurance, and steady checks. Big sigh of relief there. I’m glad for me, but even more for the kids.

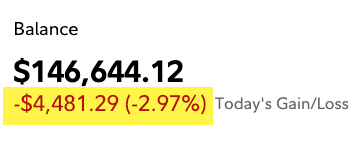

On the other side of the coin, the stock market is currently going down down down. When I woke up it was down 4%, and is down 3% right now. For my portfolio, these are huge drops.

Big ouch

A 3% drop (or gain) equates to $1,000s lost (or made). I was up $13K last month and am down $14K this month. You can see how even small changes add up to hundreds. And that’s just my Fidelity accounts.

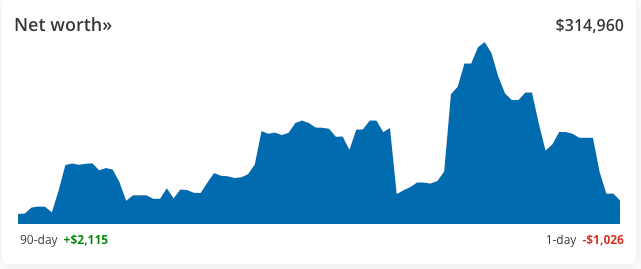

Just two weeks ago, I was touching $340K

I’m looking forward to consistent work. I’m going to sit in this room and make as much money as I can over the next year.

My five-year-old boy starts school this week, so we both have new “jobs.” While he’s at school, my partner will look after the other kids, and I’ll be up here writing my little heart out.

I took my previous goal seriously. And now that I have a little wiggle room, I intend to take full advantage of it to close the gap in this final stretch.

This month’s progress

With little income and many expenses, I didn’t make much financial progress this month. Well, I did in the sense that I quickly found a new job and got a few freelance projects completed (those payments should appear soon).

I also started Points Hub, which I hope you’ll join to geek out about points and miles with me. Click the link in that previous sentence to read about it—there are some cool partnerships in there.

To recap, I:

- Got a new job!

- Made enough to make my car payment, credit card minimum payments, and buy groceries—and that’s about it

- Didn’t invest a cent 🙁

- Kept three kids alive

- That is plenty

By the numbers

You’ll notice my net worth number in the table below is $4,000 higher than in the net worth screenshot above. That’s because my $4,000 HSA rollover is still processing and should land in my Fidelity account any day now. (I’m hoping soon so I can buy the current “dip.”) So I added that to the total.

| Current | Last Month | Change | 2024 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| Overall investments | $300,435 | $311,576 | -$11,141 | As much as possible | |

| Roth IRA total | $78,906 | $76,076 | +$2,830 | ||

| Roth IRA 2024 | $2,700 | $2,700 | xx | $7,000 (in new contributions) | |

| Taxable brokerage + UTMAs | $3,739 | $3,936 | -$197 | $25,000 (total invested) | |

| Savings | $2,162 | $2,073 | +$89 | $30,000 | |

| Raw land | $40,400 | $40,400 | xx | No goal, just including for completeness 🙂 | |

| LIABILITIES | |||||

| Car loan | $24,332 | $24,715 | -$383 | ? | |

| Credit card #1 (0% APR) | $8,577 | $8,663 | -$86 | $0 | |

| Credit card #2 (0% APR) | $11,696 | $11,815 | -$119 | As much as possible | |

| Net worth in Empower Personal Dashboard | $318,903 | $333,007 | -$14,104 | $500,000 (overall goal) | Track your net worth with Personal Capital |

Summertime gladness

Over the next few months and year, I’ll work as much as I can to pay off those dang credit cards, max out my 401k, and build my savings. At this point, I am off to the races. I feel good and ready to go.

Short- and long-term goals include:

- Pay off credit cards

- Build my savings account again in 2024

- Work up to 15% in 401k contributions at the new job

- Put more money into Beck’s UTMA (tabled for now)

- Contribute to new baby’s UTMA (ditto)

- Max out my Roth IRA for 2024

Find new sources of incomeAll good here!

I’m set up for success. At this point, I just have to sit down and do the work. I enjoy working, so for me, that’s a good place to be.

August 2024 Freedom update bottom line

- Link: Join Points Hub

I’m mentally steeling myself to go into full-time work mode again. This time, the house will be a little calmer because my oldest is heading to kindergarten.

I’ll use the extra headspace to take on extra work to generate revenue, both to catch up and get ahead.

I am fully cognizant that it’s now August 2024. I’m ready to get beyond this level. One good push could take me the rest of the way, so I’m preparing to wrap up this portion of my journey.

I also must say how incredible this community had been over the last month. Y’all know how to make a guy feel special. I hope I can return that in some way, whether it’s words of encouragement, being an ear, or just holding positive space. I’m ready to give back and feel both rested and energized for the next chapter.

As always, thank you for reading and following my journey. Hope everyone is doing well!

Stay safe and scrappy out there! ✨

-H.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Take advantage of this BIG dip and buy, buy, buy! I lost 40% of my deferred comp account value when it hit the fan in 2008. I didn’t sell anything but stopped investing until the DOW dropped to 7500 (I think the bottom was 6900). Then ,using catch up provisions, I invested $1500 a month (deferred comp limits are higher than IRA) for five years and rode the market all the back and more. I retired in 2013 at 62 with a seven digit account. The market always comes back! But you don’t always get to buy at a big discount……

That is exactly my plan! You get it!

I come to Boarding Area to read about airline-related stories, not your financial statement. Do you really thing viewers to Boarding Area care?

And yet you saw the headline, clicked it, read my financial statement, and scrolled all the way down to leave a comment. So yes, I think viewers to BoardingArea care about things that are travel adjacent. Next time you can save your shitty comments. Why go out of your way to be an asshole?

I came to boarding area to see travel related content, and this is certainly relevant to me and my interests. I enjoyed reading it and am glad you are doing it. Bravo from me, and keep going man!

Congrats on the new job! You actually landed something pretty fast so that’s a big positive.

Thank you, Boonie! I am grateful for the quick turn! So many changes!