Also see:

Wanted to shed some light on this topic because I’ve gotten a lot of questions about it since my original post on the Fidelity Cash Management Account from July 2015.

Despite what the Fidelity website says, despite what any phone agent will tell you, Fidelity does NOT charge a 1% conversion fee on international cash advances.

Why don’t they make it official?

Couple of things came together at the right moment.

I spoke with a Fidelity agent who seemed to really know his stuff. I asked specifically about the 1% conversion fee when withdrawing from foreign ATMs. He knew exactly what I was talking about.

“It’s an unofficial benefit,” he explained.

“But why don’t they make it official?”

“I think soon, they will.”

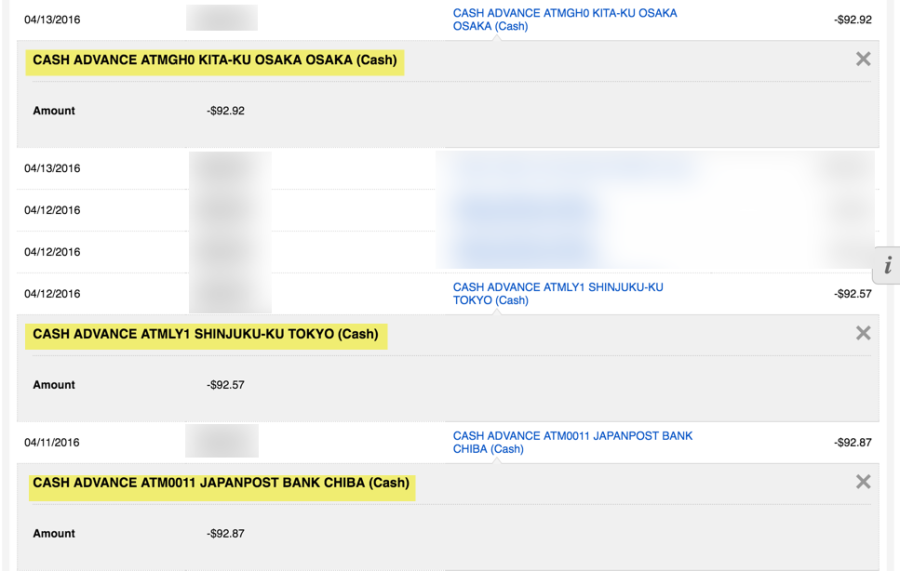

Then, I got back from Japan, where I used ATMs for cash withdrawals a few times (Japan is surprisingly cashy!).

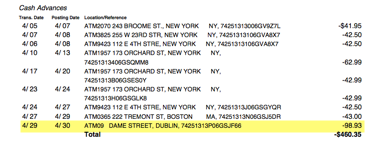

Three times, I withdrew 10,000 yen (~$93) from ATMs. What showed up on Fidelity’s side, as posted transactions, are direct currency conversions. There were no fees added.

This was also true in Ireland.

I’ve also withdrawn cash in Canada, England, and Italy over the past year or so. I’ve never once had a fee assessed.

In practice, the Fidelity Cash Management Account has completely free cash withdrawals from any ATM world-wide.

Why the hangup?

I’m curious as to why it’s set up this way. Obviously, the experience is different than advertised – in the customer’s favor.

But, if you ever are assessed a 1% fee, you’ll have no recourse because of the official policy – which is in writing.

On the other hand, a 1% fee on a $100 withdrawal is $1. It’s not enough to inspire any real passion one way or the other – yet people get really fired up about this sticking point.

I’m always just happy it’s so easy to access funds when I need them wherever I happen to be – and a 1% fee seems more than fair.

Although again, in practice, I’ve never paid a dime for the privilege my own money. Which is one of the many reasons I love my Fidelity Cash Management account.

However, I’ve never used the card for purchases abroad. And I never will.

I’d rather earn points with a credit card if Visas are accepted. And I’d fully expect to pay a 1% fee on a purchase with the Fidelity Cash Management account anyway.

Bottom line

Wanted to share my many experiences with withdrawing funds globally via the Fidelity Cash Management account. It’s a must for any world traveler.

It’s free to open and keep. No fees, minimum balances, or ATM fees to think about. In fact, you can use any ATM in the world without a fee.

In writing, Fidelity says you’ll pay a 1% fee for international cash advances. But in practice, no. A Fidelity rep confirmed this “unofficial benefit” and I used it thrice this past week in Japan.

Even if a 1% fee was assessed, that’s only $1 per $100 withdrawn.

I’m also curious to hear experiences or opinions one way or the other, because this seems to be a hot topic and a deal-breaker for lots of peeps.

Finally, if you don’t have a Fidelity Cash Management account and aren’t married to any particular bank, sign-up immediately! Best bank account out there for daily use.

For short-term savings with a great interest rate, check out the Aspiration Summit account. Between these two, there’s no reason to ever pay a fee for basic banking.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Just recently was advised of this, and good thing as I’m about to spend the next month in three different countries. Even using it here in the US I just love the ATM rebate .. Being able to take out money anywhere is great.

Thanks Fidelity !

Awesome! I love the ATM rebate too. Agree with you, it’s an all-around great bank account!

1% conversion fee is from Visa and supposedly it’s included in the exchange rate. This fee should not be confused with additional fees that are occasionally charged by the bank that issued your credit or ATM card. These fees are listed separately.

That’s excellent info, John. I didn’t see any extra fees for the transaction. But if it was built-in, I guess I wouldn’t.

Thanks again for clarifying!

Capital One 360 does not charge any fees either.

Nice, thanks for adding!