Man, the news of CVS changing their policy to cash-only for Vanilla Reloads shook my little points manufacturing world upside down. I loved it so much because I essentially turned CVS into my bank; loading Vanilla Reload cards was my deposit transaction. Quite literally, because that’s how I’ve been paying rent up until this month.

So now what?

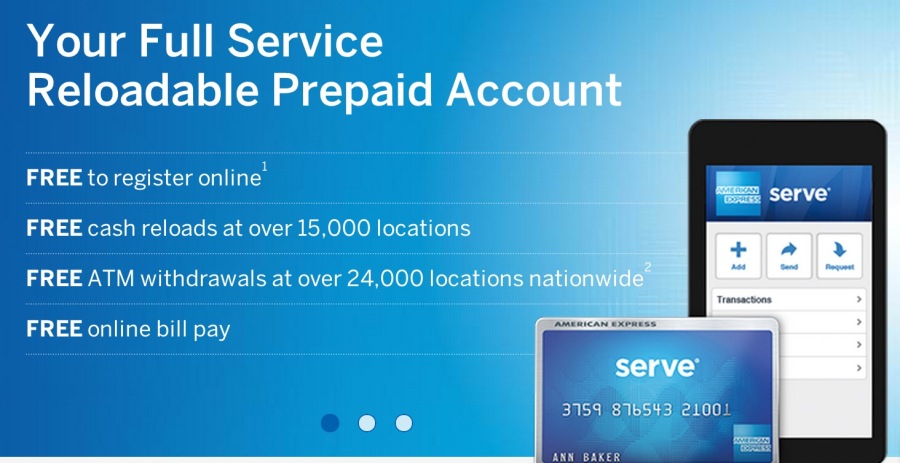

Serve

I’ve been considering making the switch to Serve, only because you can load up to $1,000 to the card via credit card through the website. No in-person running around needed, unlike Bluebird. The drawback is that you’d have to do this 5 times, as the limit is $200 per day. Not so bad. 10 seconds a day for 5 days to get a couple thousand points (worth at least $40, right?).

Of course, to get Serve, I’d have to close my Bluebird card. But now that the bill pay function has been cut off, I have no need for the card any more. Aaaand, I guess I just decided to get a Serve card! The joys of writing out thoughts.

Gift cards

One of the cool things about the Arrival card is that it gives access to Barclays RewardsBoost portal. Right now at the portal, you can purchase Amex gift cards for 4 points a dollar. Further, you’d get 2 points a dollar for charging it to the Arrival card for a total of 6 points a dollar. Not bad, not bad at all. So, $60 toward travel per $1,000 gift card.

The drawback? No bill pay function. And once you get the gift card, you might miss out on category bonuses from other cards, so it’s best to use the gift cards for non-bonused spending. One way I like to cash them out is through Amazon Payments. It’s free to send up to $1,000 per month with a credit card. Even if you get one $1,000 gift card via the portal and cash it out at Amazon Payments, you’re still earning a small chunk of change.

The other drawback is the $8.95 shipping fee. Damn, I hate that. It’d be more palatable at $4 (or free!), but considering I get $60 back, I can live with paying a bit of a fee to get the card shipped. After all, we were all paying around that much to load up $1,000 worth of Vanilla Reloads anyway.

William Paid

My biggest expense, like most New Yorkers, is rent. I’ve used William Paid exactly twice to pay my rent. There is a 3% charge to send a rent check, so if your rent is $1,000, you’d have to pay a $30 fee to pay it. It’s a nearly break-even proposition. If you earn 2,000 points to pay rent (worth $20) but have to pay $30 to do so, it amounts to a $10 charge… but you’re then paying for the points. NEVER PAY FOR POINTS.

My biggest expense, like most New Yorkers, is rent. I’ve used William Paid exactly twice to pay my rent. There is a 3% charge to send a rent check, so if your rent is $1,000, you’d have to pay a $30 fee to pay it. It’s a nearly break-even proposition. If you earn 2,000 points to pay rent (worth $20) but have to pay $30 to do so, it amounts to a $10 charge… but you’re then paying for the points. NEVER PAY FOR POINTS.

Bottom line: only do this if you’re trying to meet minimum spend. Only in that case could this service ever be useful. Or desperation. We’ve all been there. The two times I’ve used this service have been a combination of both: desire to meet a minimum spend requirement quickly. In all other cases, avoid.

Reselling stuff

I haven’t mentioned this yet, but my beloved Kohl’s trick is dead. No longer is the Ultimate Rewards portal paying out 10 points per dollar for Kohl’s purchases. And so soon after I caved and got a Kohl’s card. I’m fairly confident it will return in time for the holidays, and at that time, it might be worthwhile to buy items that are easy to resell at a small profit and generate a TON of points in the process. I’ve never done this, but some people are super into it. Could be great for hitting a high threshold spend bonus, like $30K on the British Airways card to get a BOGO certificate.

Kohl’s is just one example. If you see a high payout for any merchant on the portal, you can recreate this with any store and any resell website.

Amazon Payments

Mentioned above, but deserves its own spot. I’ve been sending $1,000 a month through Amazon Payments to generate some extra points since I first got into the points game. I’ve always viewed it as complementary to the Bluebird card, not a replacement. However, now that Bluebird is no longer an option, I’d recommend running some money through this service to generate some points, cash out gift cards, or meet minimum spends. It’s a great service. And, in my experience, money is direct deposit within a day or two. Never had any issue with it. But don’t go crazy: there have been reports of people getting shut down for opening multiple accounts. Just open one and use it responsibly.

Bottom line

And that’s about it. Anything else I’ve seen written about, for me, crosses into shady/unethical and I won’t take part in it. I’m now hoping to use Serve to at least pay my rent, and Amazon Payments as a way to generate some extra points on the side. Nothing (yet) truly replaces Bluebird, but until the next service comes out of the woodwork, this is how I’ll be manufacturing spend regularly.

Bluebird was a godsend to us points chasers, allowing us to get a quick hit of points on the regs.

What will you do now that Bluebird is gone? Are there any other methods that I missed? I’d be very interested to here how the game lives on.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

You can also fund bank accounts with your CC (and earn sign up bonuses for opening the accounts), use t-mobile + reloadits and use target amex facilities.

My only concern with that would be: are those charges coded as a cash advance since it’s being used to fund a bank account? If so, the fee could be a deal breaker.

I would like to explore Evolve, and of course see what all Serve can do when directly compared with Bluebird.