I was reading an article called “How to invest even if you’re treading water financially” via Get Rich Slowly and a certain part jumped out at me (bolding and links mine):

“Don’t despise small beginnings.

The first steps in any endeavor are humble. Gustave Eiffel, famous today for his tower in Paris and the Statue of Liberty, started as an unpaid assistant in a foundry. Setting aside $10 a month might feel meaningless: “What difference can that ever make?” That’s wrong. It makes a difference in many ways:

- It breaks the ice. You’ll never again wrestle with the question: Should I start?

- It forms a base: It is easier to add a dollar to an existing savings account than it is to start with just one dollar.

- It creates a habit.

- And best of all, it sets in motion the power of compound interest.”

Start somewhere

Even the title of the article made an impact with me. Because I do slash DID feel like I’m treading water. But I refuse to wallow in it. Instead, I’m going to create small, actionable steps that I know will work.

When I started using Evernote, I was overwhelmed with it.

Even though I signed up in August 2013, I didn’t actually create a note until September 2013. And I didn’t really start using it until mid-2014, 9 months later. And now I use it all day every day for a steady stream of uses.

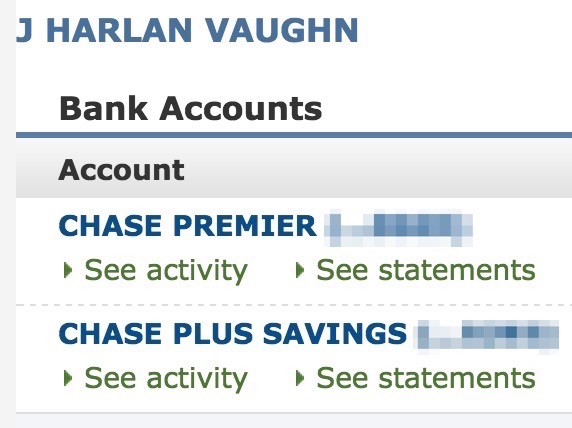

Seeing my savings account in online banking would make me feel kinda shitty.

When I opened my Chase checking account in college, they threw in a savings account, too.

And I let it sit there for 4 years with nothing in it.

I didn’t have a use for it. Because I wasn’t saving.

And over time, seeing the $0 balance started to make me feel bad.

Then I resolved to start saving 10% of everything I make. I mean EVERYTHING.

Adding the first $20 felt anti-climatic.

But remember like attracts like.

Now I have over 13,000 notes in my Evernote account.

And I’ve saved nearly $3,000 since March 17, 2015. That’s already 5% of my $60,000 goal. In just ~8 weeks!

Don’t wait for a “day”

When I wanted to start saving 10% of everything in mid March, I thought, “Nah, I’ll wait until the 1st. Easier to track.”

And then I followed that with, “You know what. NO. I’m starting today. Today is a good day to start.”

People (including me) often say they’ll wait for:

- New Year’s Day

- Their birthday

- The 1st or 15th of the month

- Some holiday

- Next check

- Next time

No.

Forget all of that. What’s today? June 15th? June 15th is a great day to start. So is every other day.

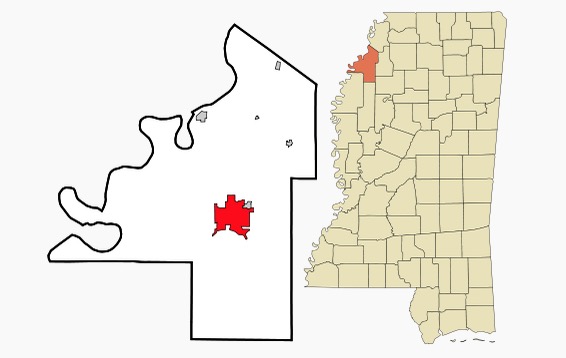

Growin’ up

My socioeconomic background isn’t exactly the most thrilling. I’m from a small town in rural Mississippi. My parents were/are not exactly affluent.

I have $80K in debt that I’m going to erase.

I’m not bummed about it any more. I’m cutting expenses, earning more with my side hustles, and throwing every cent I can toward it.

I’m also saving, paying down my student loan, AND maxing out my Roth IRA.

Because like attracts like:

- The money I have in my savings account is attracting more money into it

- What I’m putting into my Roth IRA is attracting more opportunities to contribute

- Every time I erase a debt, all of my debts are zero

So I’m going to keep plugging away.

This is despite where I “should” be in life, based on my upbringing.

Anyone can start saving. Start with 1% ($1 for every $100!) and go up from there.

The travel angle

This applies to mileage accounts too! And it’s in line with setting a goal.

There are so many ways to earn miles here and there. And like everything else, humble beginnings are OK. I praise them!

Because soon enough, you’ll wind up with thousands of Evernote notes, or money in a bank account… or miles in a mileage account.

Really, setting a goal and making up your mind to stick to it sends a powerful message into the universe. And you instantly start attracting your goal to you.

Bottom line

We all gotta start somewhere, right?

And that’s OK.

It feels silly to put $1 into a savings account. Or only have 1 note in a notebook. Or 1 mile in a mileage account.

But once you get your machine working, you’ll soon have more than enough – to the point of abundance. Abundance is the goal. And then you can start sharing with those you love. 🙂

Do you have a goal you’re starting right now? Or a big goal you’ve completed?

Would love some inspiration as I grab a shovel and start digging out!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Go Harlan! Very inspiring. You are already a great success!

Thank you!!! 🙂

Go Harlan Go! 🙂

I believe John Bogle mentioned the story of a Vanguard client who only had a minimum wage job but kept regularly putting whatever he could into his account and over the years ended up with a million!

I’ve only recently gotten full-throttle into the FIRE philosophy. The last 4 years I’ve maxed out both my 401k and my IRA. I opened a Vanguard account and have an automated transfer to it every week.

I really recommend getting a dashboard of your finances through a site like personalcapital.com or mint.com. There is no better feeling than seeing that graph of your net worth inching up month after month!

By the way, I wanted to let you know I enjoy your blog and picked up several good tips on the miles hacking game – I just started learning about it this year.

That’s awesome! And thank you for reading!

I haven’t maxed anything out… yet. But planning on doing it for the first time this year. It’s just time, you know? As my confidence grows in this area, I hope to be able to add helpful tips to anyone else who’s interested in doing this. It’s definitely a change of mindset, but will be well worth it.

Congrats on your progress so far. Let’s keep it going. 🙂

Thanks again!

Just found your blog last week, love your writing style and that you include other things besides just miles. I’m in the same boat as you! Student debt to pay down, living in nyc, and just this year started throwing whatever I can towards getting those debts to zero. Opened a Roth IRA, and saved a 3 month emergency fund. You can do it man!

Thank you for the good vibes! So cool to hear!

I just feel like I finally made up my mind. It feels good. Here we go!

And thanks for reading!

I like your comparison of saving money and saving miles. Since I started in the miles game 3 yrs ago I have been saving UR points for a trip to Asia. I now have enough for two tickets and maybe one of the ways in business. It has been hard at times as people brag about the million plus miles they MSed to get but that is not my thing. So I have plugged along saving a few thousand a month along with a few card signups. I am planning that trip for hopefully October/November next year. So saving miles a little at a time does work. I may not be drinking Dom in 1st class but I will be able to afford a great 16 day vacation to 2 or 3 countries without going into debt.

Best of luck with your personal finances. I am blessed to be debt free (except my mortgage) and able to save for a good retirement and enjoy my life without debt. I will be buying a new car for cash soon. The freedom of being debt free has allowed me to make some life choices that have been for the better but would not have been possible if I would have had debt.;

So inspiring! I will be with you in the debt-free category very soon. Sounds like a great way to live. I’ve had student loans hanging over me since I was 17 – nearly half my life – so I’m ready to finally axe them. And never get into debt again (except for a mortgage, like you).

Thank you for reading and sharing your story!