Also see:

- Cut the Crap: The Fidelity Investment Rewards Credit Card is THE BEST cash back card!

- Is the Fidelity Amex the best cashback card in the universe?

I’ve written lots about the AMEX Fidelity card. It’s such a great addition to any wallet. (Too bad they’ve lost the WorldPoints mall, though.)

Now that the Barclaycard Arrival Plus is a Barclaycard Arrival Minus, I recommend the Fidelity AMEX as a card to take its place.

BUT, before you sign up, remember you can get an easy $600 with the Discover It card – and the double cash back promotion has been extended until September 30th! (I’m signing up this weekend, on August 1st. And it’s available via my links!)

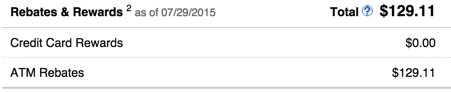

For non-bonused spend – think oil changes, dentist, post office – the AMEX Fidelity card is great. That’s because when you hit 5,000 points, you can redeem for a $50 statement credit to your Roth IRA (which is tax-fee forever!), college savings account… or cash management account.

Why cash management?

Link: Fidelity Cash Management Account

Really, the Fidelity Cash Management Account is a bank account like any other, with a few key differences.

First, there are no branches. But there are also no fees.

And everything is free.

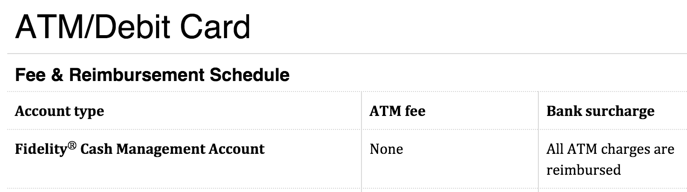

There are no minimums to think about, no X number of transactions required. And you get unlimited ATM withdrawals at ANY ATM in the US.

Note: In practice, however, I’ve gotten ATM fees reimbursed globally. It’s not a stated benefit, but in action, it’s effectively world-wide.

You get free checks (if you still use those), and a free debit card.

I also like that checks deposited via the mobile app clear within a day (or two at the most) and direct deposits show up the next day. Usually mid-morning, and oddly enough at around 10:15 am Eastern Time.

The bill pay functions are as robust as any other bank. You can pay utilities, credit cards, student loans, individuals… all within a few clicks.

I’ve used Fidelity’s bill pay hundreds of times and have never had an issue with on-time payments or a payment not being received. So, after many successful payments, I trust it.

Potential uses

I actually have an account at Chase that I opened in college in 2005. I got a good deal, it’s free, and I’m grandfathered into it for as long as I want it. I value my relationship with Chase because they have the BEST credit cards on the market right now. I’d also like to get a mortgage soon and will see what they offer.

But I’ve been using the Fidelity Cash Management account as an unofficial business account for my Airbnb side hustle. It’s essentially an operating account, in that I only use the account for Airbnb cash flow – and if there’s any left over, I pay bills, or transfer it out. Then reset this cycle each month.

I’ve grown to love having a cash flow separate from my Chase account. It’s easier to manage because it’s independent of my “daily life” cash flow.

Other uses:

- Collect reward money from the AMEX Fidelity card

- Budgeting a la the envelope method

- Transfer money into it when you travel to get cash for free at ATMs

- Separate direct deposits from more than one job

- Any other reason why you’d want money kept on the side

- As a main bank account – make the leap to online-only

This account would be great for the envelope method.

If you’re on a budget and you allow yourself to spend $X on something each month, when the money runs out, that’s it. You could automate deposits into the account and stick to a budget once and for all.

And if you’re traveling beyond the realm of your bank, make any ATM “yours.” Any and all fees related to withdrawing money are reimbursed the same day the withdrawal clears. When you pull out $60, that’s it, regardless of how much the ATM charges.

The other upside is that it’s completely free to have the account. And, obviously, if you invest with Fidelity, this account makes it super easy to make trades, add to your IRA, etc.

Things to be aware of

My biggest concern was, “What if I need to get a certified check?”

Here’s what happens. You go into any bank, ask for a cashier’s check. They’ll usually charge $10 to $12 for the service. Fidelity charges nothing extra on their end.

I’ve only had to do this once or twice under unusual circumstances. Bill pay and ATM access has been flawless.

Even though I have a “regular” banking account, I only ask for a check once in a blue moon. Once I let this idea go, and realized I had the option if I ever needed it, the rest was easy.

There are limits on the account for your first 30 days. You won’t find this written anywhere on the Fidelity website, but there are. You can’t access bill pay and there are extreme daily limits with the debit card.

I recommend opening the account, putting the debit card away, and pulling it out a month later once the initial limits are removed. I guess this is so you don’t open an account, launder a whole lot of money right away, and then close the account. It sucks until after the initial period, then it’s great.

The daily transaction limit is $10,000, and you can withdraw $500 a day at ATMs (which is typical).

When you pay a bill to an individual, the money isn’t taken out until the other person cashes the check. Some banks take the funds out right away, some don’t. This one does NOT.

They say use any ATM “in the US.” I’ve withdrawn money in Ireland, Italy, England, Canada, etc. and never paid a fee. As long as you use a bank ATM (as opposed to a currency exchange service) and pull out local currency, I think you’ll be fine.

I’ve never not had an ATM immediately credited the same day. I’ve only had to call once or twice. They’re quick to answer and help. But I haven’t had any issues with the account.

Versus Schwab

The inevitable question is, “How does it compare to the Schwab Bank High Yield Investor Checking Account?”

They’re essentially the same.

- Schwab uses a hard pull when you open their account

- Fidelity uses a soft pull

- Schwab requires you to open an investment account, although you do NOT have to use it – ever – if you don’t want to

- Fidelity doesn’t require any other accounts

- Schwab used to have a 2% cash back card that linked to the account

- Fidelity has a great 2% cash back card that can link to your account if you want it to

- Both have no fees

- Both reimburse all ATM fees (yes, worldwide)

- Both have free bill pay

- Both are great if you invest with the respective firms

Bottom line

If I didn’t have such a good deal with Chase, I wouldn’t think twice about dumping them for Fidelity’s Cash Management Account as a bank replacement.

Be sure to read the customer reviews! They’re really insightful.

My favorite use of this account is to utilize the envelope method for budgeting. But I’m using it as an unofficial business account for my side hustle, to keep the cash flow separate. I’m enjoying it a lot, using it this way.

In conjunction with the AMEX Fidelity card, it’s a great account to have, if only to collect the cash rewards. It’s free, easy to manage, and a soft pull on your credit report.

Leave it open for 30 days before you start using it, because they have strict daily limits for new accounts.

Anyone else like/use the Fidelity Cash Management Account? Anything I missed, or any questions about how it works?

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I don’t think you mentioned it but another great thing about this account is that it doesn’t charge any foreign currency conversion fees on ATM withdraws abroad

Very cool, eh?

I really love this account! Thank you for adding to the convo! 🙂

Are you sure? I currently have Schwab and was contemplating a switch to the Fidelity CMA, so I called and spoke with them about this. They said over the phone (and it’s disclosed on the website) that there is a 1% conversion fee. There are no fees for using an ATM or foreign ATM, but they seemed to indicate there is a foreign conversion fee.

Yes, I’m sure. I know it’s against the official policy (and what a Fidelity agent will tell you), but in practice I’ve never paid a foreign conversion fee on ATM withdrawals.

I’ve never used the cash to make a purchase internationally, but I’d think that would warrant the 1% fee.

It is important to be aware that: “Please note, there is a foreign transaction fee of one percent that is not waived, which will be included in the amount charged to your account”.

I use this card when traveling internationally. If you add funds to the account from any source be aware that it can take three to four days for them to be available for withdrawal. Overall, I am happy with the card.

Correct. The foreign transaction fee is for purchases, not cash withdrawals (in my experience).

And yup, it does take 3-4 from an outside institution, but that’s any bank.

Same boat – very happy overall! 🙂

Here is the text from the web page you linked to:

1. All Fidelity ATM withdrawal fees will be waived for your Fidelity® Cash Management Account. In addition, your account will automatically be reimbursed for all ATM fees charged by other institutions while using a Fidelity® Visa® Gold Check Card linked to your account at any ATM displaying the Visa®, Plus®, or Star® logos. The reimbursement will be credited to the account the same day the ATM fee is debited from the account. Please note, there is a foreign transaction fee of one percent that is not waived, which will be included in the amount charged to your account. The Fidelity® Visa® Gold Check Card is issued by PNC Bank, N.A. and the check card program is administered by BNY Mellon Investment Servicing Trust Company. Those entities are not affiliated with each other or with Fidelity Investments. Visa is a registered trademark of Visa International Service Association, and is used by PNC Bank pursuant to license from Visa U.S.A. Inc.

I’m aware of the official policy. In my experience though, I’ve never been charged that foreign transaction fee. It just shows up as a cash advance at the current exchange rate – no extra fees added.

Good stuff. I have accounts at both Schwab and Fidelity. Schwab is my walking around money/checking, while Fidelity is mostly investments. I like that Fidelity reimburses ATM fees immediately (or at least I think I’m remembering that correctly) vs statement close at Schwab.

Ah, I didn’t know about the reimbursement at statement close with Schwab. Thanks for sharing!

I’m doing my investments with Fidelity (Roth IRA) and use the cash rewards from the AMEX Fidelity card to help top it off. It all adds up (then compounds)!

Free is free, though, and they’re very comparable accounts/services. I know some people get hung up on the hard pull with Schwab. Still, it’s pretty apples to apples.

One problem with Fidelity Cash management is that Fidelity does not issue the card, so if you ever have a problem you will not be dealing with Fidelity, where the service is good, but with some card issuer where the service will not be as good.

This hasn’t been my experience. Any time I’ve had an issue, I’ve called Fidelity directly and they’ve taken care of everything.

The number on the back of the debit card is Fidelity. What’s been your experience?

I believe the 3-4 days wait time to have the money available in your Fidelity CMA when there’s a transfer from an external linked bank account is a bit longer than usual. I have experience with this at other banks where the transfer is complete the next business day if the transfer is done in the morning and in other cases 2 business days. Most common is 2-3 business days from accounts I’ve seen.

But also note that Schwab has its own actual FDIC insured Banking arm whereas Fidelity does not. Fidelity’s CMA is backed by FDIC insurance because the money is swept into an FDIC-insured bank account.

Per Fidelity – “The Fidelity® Cash Management Account’s uninvested cash balance is swept to one or more program banks where it earns a variable rate of interest and is eligible for FDIC insurance. At a minimum, there are five banks available to accept these deposits, making customers eligible for nearly $1,250,000 of FDIC insurance.”

“Customers may obtain the benefits of FDIC insurance eligibility* in a Fidelity® Cash Management Account through the FDIC-Insured Deposit Sweep Program and the Program Banks listed below. Once you open and fund your Fidelity® Cash Management Account, the available Cash Balance will be held on your behalf at one or more of the Program Banks assigned to your account. Once at a bank, your Cash Balance will be eligible for FDIC insurance coverage up to the applicable limits.

Fidelity will assign a Program Bank List to your account. The banks on the list will be eligible to receive your Cash Balances. If you open your account online today then your account will be assigned the Program Bank List shown below. After your account is established, you will receive a New Account Profile confirming your account details, including the Program Bank List assigned to your account. If you open your account online, you will receive information about the Program Bank List that will be assigned to your account before you complete the account opening process. After your account is open, you may contact us to change to another Program Bank List if one is available.”

“Program Bank List

CITIBANK NA

ASSOCIATED BANK NA

THE PRIVATEBANK AND TRUST CO – unavailable

THE BANK OF NEW YORK MELLON

US BANK

GOLDMAN SACHS BANK USA

PEOPLES UNITED BANK

BANK OF OKLAHOMA

CITIZENS BANK NA

PACIFIC WESTERN BANK

HSBC BANK USA

FIRSTMERIT BANK NA

FIFTH THIRD BANK

SUN TRUST BANK

UNION BANK NA – unavailable

WELLS FARGO NA”

“Fidelity will manage the movement of money between Fidelity and the Program Banks assigned to your account; this will occur automatically whenever you make deposits, execute transactions or withdraw money from your Fidelity® Cash Management Account.”

What has been your experience with ACH withdrawals to pay credit cards and such? I tried using this account once to my ACH rent payments, but I could not get the it to work, so I wen’t back to USAA. I’m in the process of consolidating accounts again, so I’m curious if ACH payments like credit cards, Home Owners Association dues, etc will work with the cash management account.

Hi Komrad!

My experience with it has been as with any other banks. I use the account constantly to receive payments and to pay down cards from every bank. Usually, the withdrawal comes out 24 hours later – just as with most other banks.

No complaints there.

I’ve also used it for rent, and other ACH payments and all have gone through without a hitch!

I’d recommend for you to give it a try for sure!

As a financial planner, I totally understand where you’re coming from.

I read your site fairly often and I enjoy your posts.

I shared this on twitter and my followers enjoyed it too.

Kepp up the good work!

Harlan,

I found out something spectacular about the CMA account. Please email so we can discuss.