Also see:

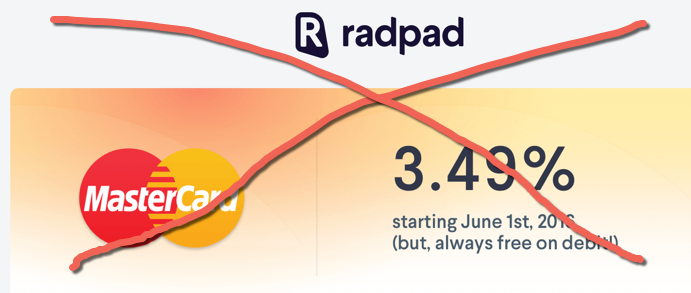

I’ve long enjoyed using RadPad despite its 2% fee because I’ve been earning 3X Citi ThankYou points per $1 spent on rent with my Citi AT&T Access More card, which far outweighs it, especially when paired with Citi Prestige.

But on June 1st, 2016, RadPad is increasing its rent bill payment fee to 3.49%, which makes the service much less appealing.

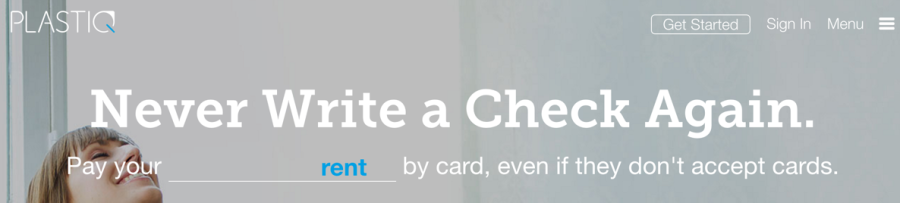

But, Plastiq easily takes its place – and charges a 2% fee on MasterCard payments. Even better, you can earn 3X Citi ThankYou points with the Citi AT&T Access More card. And, it works on mortgage payments, too.

Plastiq is the new sheriff in town

- Link: Plastiq

- Link: Citi AT&T Access More card

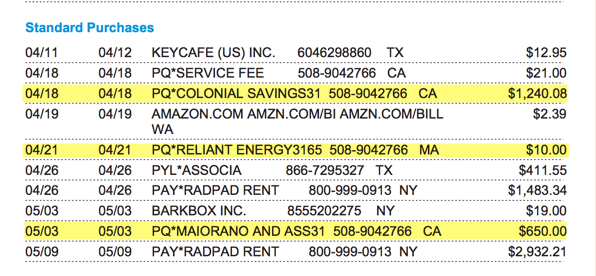

I did test payments during my last billing cycle and just got the statement.

I paid rent and a mortgage payment to see how they’d code and if I’d earn 3X Citi ThankYou points. And I paid a utility bill to see how that would go.

I also wanted to see how fast they’d make the payments.

I paid:

- Mortgage payment on 4/18 (ACH)

- Utility bill on 4/21 (ACH)

- Rent on 5/3 (check)

Here’s how fast they posted:

- Mortgage payment received 4/22 (4 business days)

- Utility bill received 4/28 (5 business days)

- Rent check sent 5/5, received 5/9 (5 business days)

These times are totally acceptable. And, they were pretty fast with sending out the rent check – it took the same amount of time as an ACH payment.

The utility payment only earned 1X Citi ThankYou point per $1, which is in-line with Citi’s official policy:

You won’t earn 3X Points for purchases of and payments for medical services, insurance, taxes and government services, education, charities, and utilities.

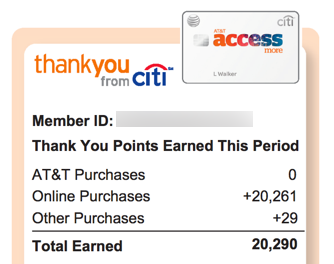

But, I got 3X on the rent and mortgage payment, which is awesome.

I’d heard a few complaints about slow payments with Plastiq, and was nervous about relying on them. So I left plenty of margin for error – but was pleased with the payment speeds.

Is it worth the 2% fee?

Plastiq charges a 2% bill payment fee for a MasterCard payment. And a 2.5% payment for Visa and Amex.

Times you might consider paying the fee:

- When you know you’ll get more than 2 cents of value per point/mile

- To quickly meet a minimum spending requirement

- To hit a threshold bonus for status/elite qualifying miles/bonus miles

- To float a charge for a couple extra weeks

- When the points’ value outweigh the service fee

In the case of the Citi AT&T Access More/Citi Prestige combo, you get 3X Citi Thank You points on rent and mortgage payments with the former card. And can use them at a rate of 1.6 cents each toward American Airlines flights for having the latter card.

It’s a powerful combo that puts you nearly 3% ahead even after paying Plastiq’s 2% fee (3 * 1.6 = 4.8% – 2% fee = 2.8%).

For a $1,000 payment, for example, you’d earn 3,060 Citi ThankYou points and pay a $20 fee. But those points are worth ~$49 toward American Airlines flights, putting you ~$29 ahead even after the fee.

After 12 $1,000 payments, you’d be ahead by ~$348.

You could do even better by transferring the points to an airline partner, like Etihad or Singapore (which has better award flight rates in some cases) – especially for Business Class or First Class award tickets.

If you use a 2% cashback card, the fee is obviously canceled out – and you can use Plastiq’s service to float your payment instead of pulling it out of your bank account right away.

Bottom line

Plastiq is the only service I know of that lets you earn points or miles for paying mortgage payments with a credit card. And it’s a handy service for paying rent, too.

Even better, those payments earn 3X Citi ThankYou points with the Citi AT&T Access More card, which I highly recommend for this – or if you shop online or at Costco a lot.

It also works nicely with the Mileage Plus X app to earn 5X points in total at Amazon.

I’m pleased with how quickly Plastiq processed my mortgage payment and will continue to use them for as long as the rate stays around 2%. Housing is the biggest monthly expense for most peeps – it’s nice to earn extra points or miles for it.

Let me know if you’ve had an experience with Plastiq!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Thank you for the great post! I have the Prestige card and I am now considering the Citi AT&T card after reading your post! I was wondering if the Thank You points for the Citi AT&T would go to the same Thank You points account as my Prestige card or if I would end up with two Thank You points accounts. If that is the case, would I be able to transfer points between the two Thank You accounts? Thanks so much!

Thanks for reading!

You’ll get another ThankYou account but it’s very easy to link them. After you set it up once, all your ThankYou points will go to the same account – and you can use them like normal for AA flights or transfer them to partners.

It’s so worth it to have the AT&T Access More card, especially if you already have Citi Prestige. Excellent combo and so easy to rack up the points.

Great! Thanks so much Harlan!

Why do you talk about Citi Prestige combo with this card? Is it just because to get extra value with AA travel only? Did I get that right?

Yup, exactly. You could also pair it with Citi ThankYou Premier if you like to transfer your points to partners.

You can use Citi Prestige to book flights on AA codeshare partners, too. And because the points are worth 1.6 cents each toward AA flights, that’s a great benchmark to make sure you’re getting the best value for your points. Of course anything more is even better.

Also, on its own, the Citi ThankYou points earned from the Citi AT&T Access More card are only worth 1 cent each. It’s the pairing that adds a lot of value to the card.

Thanks for asking for clarification! 🙂

Applied and was instantly approved for the AT&T Access More card tonight.

Nice limit; will pair nicely with Plastiq. I also do a bit of online shopping and with this card might axe a few other cards that are specific to other online retailers.

Heck yeah, awesome! I’d say Prestige and this card are my #1 and #2 favorite cards – would love to hear what you think after using it for a couple of months. Congrats!

Oh, the Prestige. Shucks, I only have Premier. I may need to move investing to Citi in the Citigold, then the Prestige. Sounds like Citi will own me then. 🙂 Am I falling into their trap?

Yeah, sounds like it lol. But that’s OK if their offerings work for you. That’s actually the ideal situation: build a relationship with a bank and use their products. I’m finding, more and more, Citi is getting more of my business and regular spending than Chase. For lots of reasons – value of TY points, ease of earning in popular bonus categories, relaxed rules for multiple cards, and excellent card benefits.

As I always say, when banks compete, YOU win. 🙂

Does paying with citi att access more card 3x on rents ? Tried looking everywhere couldn’t find that.

Yup, sure does.

I checked with customer care and they have mentioned i only earn 3x on att purchases and purchases made on retail and travel websites but not on rents/mortgages. Wondering if plastiq falls into this category of websites for rent payment and thats how all of this works?

Exactly! It shows up as an online purchase so you get 3x.

Thanks Harlan for the post!

My rent payment was received in 8 days (including the weekend). I would definitely recommend sending the payment with plenty of time before deadlines to avoid late payments. otherwise so far so good 🙂

Thank you very much 🙂