In the middle of Eurotrip 2014, I had a moment where I was like, OMG, I’m staying exclusively at Club Carlson properties (except for one night at the Grand Hyatt Berlin).

So the news that US Bank, issuer of the Club Carlson Visa, may be imposing cash advance fees for Serve reloads was disconcerting. And now that Amazon Payments is over, too… I don’t know what I’ll do to manufacture spend now. This is a hot topic in the points and miles community, and there is some speculation about the new REDcard and possible changes to Serve. In any case, I am looking forward to the next step because I do think the Club Carlson Visa is a very good card to focus on for day-to-day, non-bonused, or manufactured spend.

I couldn’t have done Eurotrip 2014 without that card.

How I did it

In the months leading up to Eurotrip 2014, I used the Club Carlson Visa and my primary card, in addition to running $2,000 per month through Amazon Payments and Serve. AP and Serve alone earned me 10,000 Gold Points per month. With the other spend, I was netting over 20,000 Gold Points per month.

I always do this when I have a travel goal: focus spend on a certain card. Right now, I am in flux as I have no future trips planned. But I do like having a good array of points, so I’m tapping into bonus categories offered by the Chase Sapphire Preferred and the Amex EveryDay Preferred. All non-bonused spend is still going on my Club Carlson Visa.

I also had to have a friend do this with me. We both got a free night with each award redemption, and decided to visit each location in two- or four-day chunks for that reason.

Where I stayed and cost per stay in points

- 4 nights in Munich at Park Inn Munich-East FOR OKTOBERFEST: 38,000 x 2

- 2 nights in Vienna Park Inn Uno City: 38,000

- 2 nights in Bratislava Park Inn Danube: 13,500

- 4 nights in Budapest Radisson Blu: 9,000 x 2

Total points for 2 people: 145,500

Total free nights: 12!

Time commitment

My friend and I split everything 50/50. It was easy to do because Club Carlson lets you transfer points between accounts (ANY accounts) as long as you have status. We are both Gold thanks to the card and transferred points between our accounts as needed.

For this 12-night itinerary, we each needed 72,750 Gold Points. By using Amazon Payments and Serve, and focusing spend on the card for ~20,000 Gold Points per month, it took us each about 4 months of mostly automated spend to earn enough points (and still have some left over). Not bad for a free European vacation that hopped around 3 different countries for nearly 2 weeks.

The earning of the points was almost completely passive. Other than the Amazon Payments and Serve, all I did was keep the Club Carlson Visa in the top of my wallet. Every purchase, I pulled it out. Easy. Zero thought required.

People think that earning and burning points is hard. My time commitment each month to earn these points was max 5 minutes. I had a goal, I focused my spend, and let the points add up.

The payoff

Oh man, this is the part I LOVE.

4 nights in Munich would’ve been 239 Euros per night, 956 Euros total or $1207.

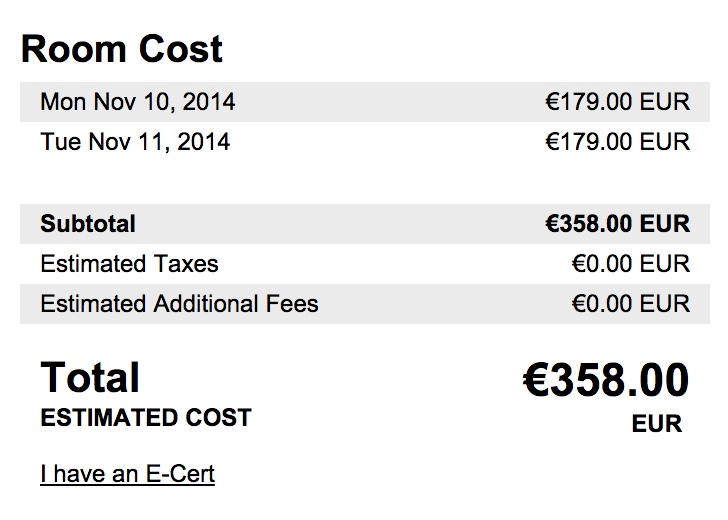

2 nights in Vienna: 358 Euros or $452 (after free upgrade)

2 nights in Bratislava: 207 Euros or $262 (after free upgrade)

4 nights in Budapest: 313 Euros or $401 (not including upgrade to apartment suite)

Total cash value of 12 nights in Europe:

$2,322

And having breakfast included in the room rate every day was amazing! We also received upgrades out of 3 out of 4 stays – not in Munich during Oktoberfest, for obvious reasons, but the room was perfectly serviceable.

In fact, I got damn near 2 cents of value for each Club Carlson point, which is pretty much freaking unheard of.

Repeatable?

This is just one example of how to use the card/program, and this scenario could be repeated with a combination of countries and continents.

In general, Club Carlson’s US properties are not so great. But they have TWO properties in Reykjavik, Iceland, and have a large presence in Scandinavia, Europe in general, Africa, and parts of Asia. If the locations of their properties match with your travel goals, it could be worth aligning spending habits with the Club Carlson program.

And if not, I find Hyatt to be a good secondary program, especially when transferring from Ultimate Rewards.

Bottom line

This trip made me really see the value in the Club Carlson program. It’s very worth it to have some Gold Points around, and the program is synergized when used in tandem with a friend, partner, or spouse.

Some of their properties are basic and a bit out of a city’s downtown area, but if all you want is a clean room and a base camp for travel explorations, this program comes highly recommended.

Anyone else have any good Club Carlson stories? Any totally standout properties (I currently don’t view them as having “aspirational” hotels)?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

[…] Hyatt, Club Carlson is my go-to. And it looks like I will continue Club Carlson-ing around Europe, this time at the Radisson Blu Royal in Dublin, right […]