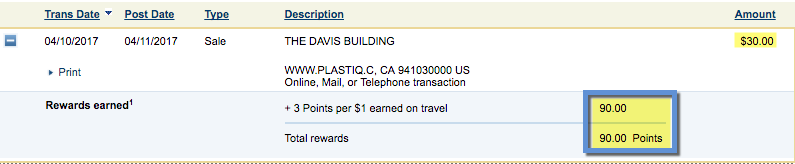

It looks like some payments with Plastiq are triggering 3X points per $1 with the Chase Sapphire Reserve card. Apparently, rent or mortgage payments are coding as “lodging/travel” and appear as “travel” – which is a 3X category.

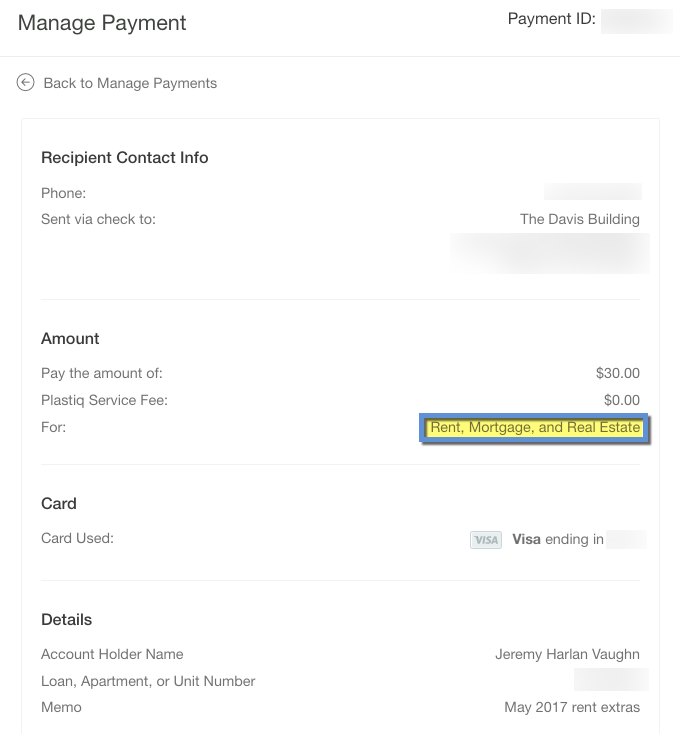

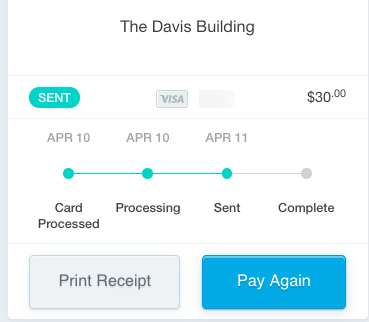

I made a $30 payment toward one of my Airbnbs and didn’t change the category in Plastiq – I left it marked as a rent payment.

And when I checked today, it had cleared and earned 90 Chase Ultimate Rewards points (3X).

If you have rent or mortgage payments, it would be worth it to use your Chase Sapphire Reserve card, even considering Plastiq’s 2.5% fee.

By the numbers

- Link: Sign-up for Plastiq

| Chase Sapphire Reserve® | 60,000 Chase Ultimate Rewards points |

|---|---|

| • 3X Chase Ultimate Rewards points per $1 spent on travel & dining • 1X Chase Ultimate Rewards points per $1 spent on all other purchases |

| • $550 annual fee | • $4,000 on purchases in the first 3 months from account opening |

| • Why this is my favorite card for travel and dining | • Compare it here |

If you have a payment of $1,000, you’d end up paying $1,025 ($1,000 X Plastiq’s 2.5% fee). And you’d earn 3,075 Chase Ultimate Rewards points.

Despite the $25 fee, those points are worth at least ~$46 toward travel booked through Chase (3,075 X 1.5 cents per point). So you come out ahead by $20+ per $1,000 sent.

Even if you have the Chase Sapphire Preferred, you’d pay the same $1,025. And earn 2,050 Chase Ultimate Rewards points (2X for travel). If you value these points at 1 cent each, that’s a ~$5 loss. But if you value then at 2 cents each (which I do), you can come out ahead by ~$16 (2,050 X .02 = $41. And $41 – the $25 fee is $16).

Either way, that’s an extremely decent return for those payments.

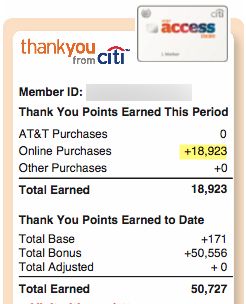

Sayonara, AT&T Access More

Y’all. I have been jammin’ on my Citi AT&T Access More card for rent and mortgage payments through Plastiq for the longest (it’s no longer available to new applicants).

My statement closed today, actually. And I got my usual ~19,000 Citi ThankYou points this month:

BUT. I’d rather have an extra 19,000 Chase Ultimate Rewards points by far.

So after I spend $10,000 on my SPG biz Amex this month to get 2X Starwood points (Doctor of Credit has the deets on the promotion I signed-up for), I will switch my Plastiq payments to my Chase Sapphire Reserve instead.

I’ll do this for as long as the gettin’ is good. However, I’ll still put $10,000 in payments on my Citi AT&T Access More card to score 10,000 bonus points each calendar year – which amounts to 4X on that first $10,000 spent (which I’ve already more than met).

I’ve been using that card because of the broad 3X categories and still use it heavily. But rent and mortgage payments are the lion’s share of my spend on that card. And now that’ll go on my Chase Sapphire Reserve for as long as this lasts.

What else triggers 3X?

This is the biggest question. I’m not sure how “rent” translates to “travel” for Chase but I won’t question it. Rather, my only curiosity is “What else works?”

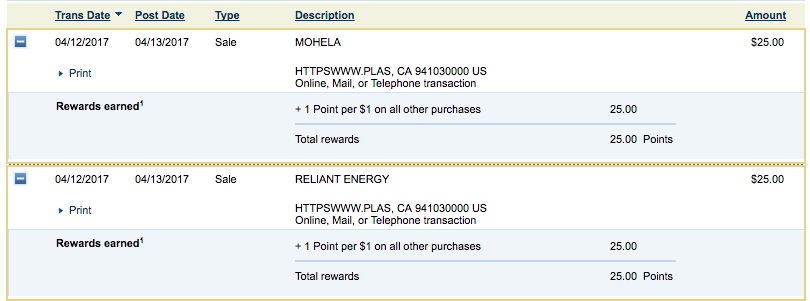

I will make a couple of payments to my utility company and student loan company to see how those code. Unless anyone has any data points already. If not, I will share mine in a couple of days when they post.

Update 4/13/17: I made two $25 payments to my student loan and utility company and only got 1X. So this is very much a “test it and see” situation.

If all payments through Plastiq trigger 3X that would be a huge deal. I just hope this gravy train lasts for a while. I certainly plan to earn as many extra Chase Ultimate Rewards points as I can while this is available. And honestly, rent and mortgage is my biggest category anyway so I’m beyond pleased with this.

Is Plastiq reliable?

In its infancy, Plastiq had its growing pains. Customer service was dismal, some payments were late (or worse, never showed up), and it left a bad taste with lots of peeps – for good reason.

However, they’ve improved hugely since then. I’ve personally made dozens and dozens of payments through their service and have never had a missed or late payment. *knocks on wood*

That said, they give you an estimate of how long payments will take. If it’s electronic, they’ll say 3 to 5 business days.

For a paper check through the mail, it’s 5 to 7 business days. Add a few extra to that.

I like to send my payments 10 or even 12 business days in advance. They’ve always gotten to my recipient when they said to expect them. But if a payment is delayed or gets lost, I want to give myself a few days to send the payment another way so I’m not scrambling.

So, I’ve had a very positive experience – no delays or mishaps. Be smart about it and you’ll be fine.

Bottom line

For whatever reason, rent and mortgage payments via Plastiq are coding as travel with the Chase Sapphire Reserve.

I’m not sure (yet) what else works for this 3X. But I’ll know more in a couple of days.

Before you schedule several payments, I’d send a small amount or just one – then check if you earned 3X. If you do, go wild while you can. This may last a while, or it may not.

I’ll update here with more data points regarding those other payments. If you already have any, please share below.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

It will be interesting to see if its being coded as TRAVEL due to the Vendor or the Plastiq Category as Rent/Mortgage/Real Estate.

Citi ATT card has been great in that it codes as the Plastiq Category.

Harlan, great blog! Did you add the recipient as a business or a person? Do you have any data points that show payment yielding 3x on CSR was sent to business or person? Thanks.

Thanks, Alan! 🙂

All my recipients so far have been businesses. But you have the opportunity to add what “type” the payment is – so you could select rent, theoretically, and send the payment to an individual.

The payment above was sent to a business, coded as rent with Plastiq, and earned 3X.

Thanks.

You’re welcome. If you think of, let me know how your experience goes – I’d be curious to hear!

Harlan, just want to follow up that my Plastiq payment to my landlord using CSR did code as travel and posted with 3x bonus. The recipient was set as a business. Thanks again.

Yes! Enjoy it as long as you can. Thank you for following up, I appreciate hearing about your experience.

Maybe I missed it but in doing my own test with Plastiq and paying $10 with my Chases Reserve card on my my mortgage, not only did it code for 3x points but it also triggered the travel credit.

Dayyyyam…

With our rent right now, that’s 5,121 points per payment on Chase Sapphire Preferred. At your valuation of $0.02 per point, that’s $102.42 in free travel credits per month, less Plastiq’s ~$42 fee, netting a $60/mo free travel profit.

That, times 4 more months of rent (assuming this deal holds up) is $241 in free air travel credits. That’s *easily* enough for flights around Europe.

Do you know for a fact that the CSP counts as travel with Plastiq? I plan to apply for the CSP in the next month and paying for my mortgage will definitely help with hitting the $4000 and earn 2x URs.

Nope, I am commenting based on this article and comments on several others. I will be trying this for our June payment coming up. I’ll post a reply here either way.

I can chime in to say I just made 4 payments with my US Bank Altitude Reserve card and they ALL posted at hotels/lodging AKA travel. I suspect they would code the same with CSP and CSR because they both use Visa merchant codes. No guarantees, so best to try a small amount first to test. But yeah… many payments are posting as travel.

I’ve made a rent payment previously with the CSR and it coded as travel. I’ve tried looking elsewhere for a datapoint with someone using CSP and have not found any.

I hope Palomino shares his transaction when he attempts to pay through Plastiq with CSP and hopefully it is charged as travel. I’d rather go on evidence rather than association for similar credit card products.

Fair nuff. I do think CSP and CSR should code identically, though. But yes, more data points are always good! 🙂

Hey Harlan,

I see you’re in Dallas too. Wanna catch up for a coffee or beer sometime?

Heck yeah! Where in Dallas are you? I’m in Oak Lawn.

Awesome! I used to live there a few years ago at the IMT Seville off of Reagan St.

We’re in one of the buildings in Dowtown now and I work in Deep Ellum. 7 minute commute FTW.

Seems like we’re only a few minutes apart – let’s make this happen!

I’ll email ya! 🙂

My brother is in town this weekend, but I’m pretty free after that. And I love Deep Ellum (Downtown, too)! I sense a beer in our near future. #psychic

Another DP for Chase Manhattan – paid mortgage and, sure enough, 3x on my CSR UR tally!

Thanks everyone!

Sweeeet! *high five*

I think they changed this. Paid my mortgage in May, and got 3x points for Travel. Paid again on June 5, and only got 1x point. I opened a case with Plastiq customer service, and they are checking into it.

I think so, too. I have yet to confirm for myself but I’ve heard lots of data points. Let me know what happens with your case!

So you have heard a lot of people say that it doesn’t work anymore?

I think they changed this. Paid my mortgage in May, and got 3x points for Travel. Paid again on June 5, and only got 1x point. I opened a case with Plastiq customer service, and they are checking into it.

Well, this was a fun short run. Just wanted to say thanks as this post was the original reason I began using CSR for Plastiq, and it was nice to get the bonus for a few months. I’ve been patiently (anxiously?) awaiting my most recent rent payment to post, as all DPs suggested it would code as 1x. Roger that. Ah, well.

This fully cements my plan to revert CSR to CF, as my AF just posted. I PCd last fall also per your suggestion, but this is the first AF since. I don’t feel I need CSR anymore as I’m about to get a free (until next year) CSP courtesy of the automatic Fairmont PC happening in August. If you take out Plastiq, I’m really not spending that much to make a difference between 2x and 3x. All airfare goes on other cards (either AX Platinum if I’m confident the flights will go smoothly or Citi Prestige if I’m flying an unreliable carrier like AA), and Hyatt/Hilton/SPG/Marriott/IHG stays go on those respective cards. So what’s left is dining (which more often than not codes as 1x if the merchant uses Square) and the ultra-rare time I may stay in an independent hotel. I’ll move Silvercar to the RCR since it’s Infinite, and Hertz already goes to the SPG biz card for 5% off. That’s way more info that you needed to know, but thanks for the inspiration. 🙂

Your plan makes sense, especially with the dining spend considered with the AF in the equation. I wish I’d gotten that Fairmont card when I had the chance! That would’ve been my path to FU. Le sigh.

For my travel spending, I use the exact same cards as you. Very interesting, I love hearing about this stuff – the more details, the better lol.

Thanks for circling back and for reading all this time. I truly appreciate you!

Just a quick follow up to praise Chase (IKR?!). I’d intended to do the PC on the last day of June but realized I’d been super busy and forgotten. There was no reason to switch earlier since the registration period for last quarter’s categories had closed. Anyhow, I did it tonight after driving to Hattiesburg and back so I could save 20% for life on T-Mobile. My exciting Saturday! 😀

Calling Chase is so darn effortless and amazingly efficient. As soon as I got off the phone, the site showed this card as CF instead of CSR and even offered me the opportunity to register for this quarter’s categories. Well, surely that wouldn’t *actually* work already, right?! But yes, yes it did! Boom. I wish every other institution would invest significantly in trying to copy Chase’s IT.

Forgive my stupidity. What does AF stand for? Why did you get rid of Chase Sapphire Reserve? What did you replace it with and why.

And finally, how did you get 20% off T-Mobile?

AF = annual fee

Replaced CSR with CF (see my earlier comment for explanation)

See this for info on the 20% TMO deal: https://www.reddit.com/r/tmobile/comments/6inlmy/update_q2_20_hookup_existing_customers_can/

The only problem with those ThankYou Points from the ATT More card, you cannot transfer those to airlines to get mega point usage. I am struggling with what good are these even at 3x earnings.

Hey Byron!

So if you have the Citi Prestige or ThankYou Premier, you can link the accounts and then transfer the points to transfer partners. I have Citi Prestige, so that’s how I use the points. Hope that helps!

I cancelled all those we had and merged points and sent them to Etihad in hopes of those 36K Brussels flights, and then downgraded one of those cards to the ATT More. I am sure I will be getting one of those cards back when the clicker on time for that card to come around. I use an excel sheet to tell me when to cancel and when to ask for the card again. I will just keep getting those ATT More points.

Thanks

That sounds like an *excellent* plan. Kudos for the spreadsheet!

I would accumulate now and transfer later, too. 🙂

Chase Sapphire Reserve. 03/27/2018 Made a rent payment through plastiq and it came through as 1x, unfortunately.