RIP: Chase Ink Plus was one of the best cards for 5X categories. Yes, you earned 5X Chase Ultimate Rewards points at office supply stores, and on phone, cable, and internet service. And 2X on hotels and gas.

Um, what business is he in? Cuz I’d be all up in it

Chase Ink Plus is gone and in its place… the Chase Ink Preferred. Compare it here. But they nerfed the 5X categories! (And kept them on the Chase Ink Cash, thank gods – compare it here.)

If you’ve opened more than 5 new cards in the last 24 months from ANY bank, go ahead and stop here. And read some of my other posts. Cuz its unlikely you’ll be approved for this one.

If you’re on the prowl for a card to use for your small business, the Chase Ink Preferred is still extremely worthwhile.

The short

Not as good as Ink Plus. Redundant if you have other Chase cards. Most of us can’t get it, anyway. But worth it if you spend even small amounts in the bonus categories.

The long

- Link: Chase Ink Business Preferred – compare it here

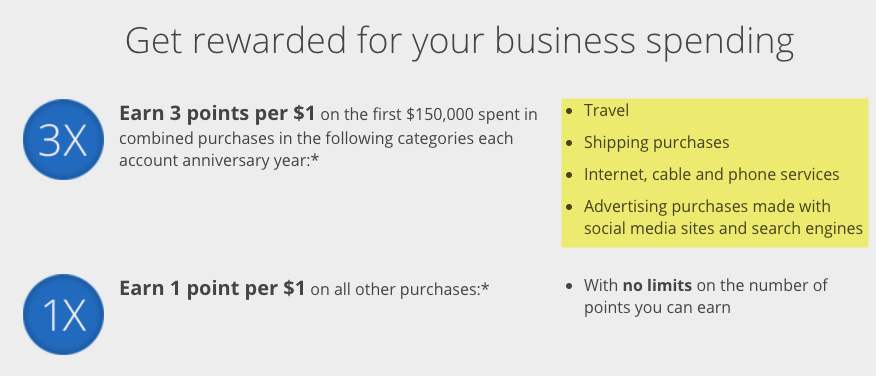

With the Chase Ink Preferred, you’ll earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months after account opening. And you’ll get 3 points per $1 in these categories:

- Travel

- Shipping purchases

- Internet, cable, and phone services

- Advertising purchases made with social media sites and search engines

On the first $150,000 spent in combined purchases each account anniversary year. Mmmkay?

The Ink Preferred is a nice way to access these 3X bonus categories

This is an excellent card to have if you spend a lot on travel. And “travel” here is extremely broad. Think airfare, hotels, tolls, parking garages, subway passes…

Internet, phone, AND cable is another huge category for most people AND offices. So, another win there.

And if you ship a lot of items (perhaps for eBay or Amazon sales), or advertise your business, you’ll get 3X points for your efforts there, too.

If you spent the maximum of $150,000 in the bonus categories, you’d earn a staggering 450,000 Chase Ultimate Rewards points ($150,000 X 3). Which is enough to do… A LOT. Even if you don’t spend that much, 3X is still a strong earning rate.

However, if you have other Chase cards, like the Sapphire Reserve, you already get 3X on travel. And if you have the Ink Plus (no longer offered), you can still earn 5X on internet and phone. Which is pretty awesome. But if you don’t have either, the Ink Preferred is a nice way to access a lot of strong bonus categories.

Cell phone coverage

Another benefit of the Ink Preferred is your cell phone is covered for theft and damage, up to $600 per claim (max of 3 in a 12-month period). There’s a $100 deductible, so more like $500 per claim.

Wait what?

You have to pay your bill with the card to access the coverage. Which is great because hey, 3X bonus category.

I haven’t seen this feature on a lot of cards, so it’s nice to have. Especially if you’re accident prone. Or just clumsy. 😉

How bout that annual fee though?

There are no foreign transaction fees. However, there IS a $95 annual fee if you apply online.

If you apply in-branch, though, it’s waived. So try to do that if you want to apply. But if you’re not near a Chase branch, online is the way to go.

To put the $95 annual fee into perspective, you’d only have to spend $2,533 per year in the 3X categories to recoup it.

Because the points are worth at least 1.25 cents toward travel when you book through Chase. So $2,533 X 3 X 1.25 = 9,500 Chase Ultimate Rewards points. That’s ~$211 a month in the bonus categories. This shouldn’t be hard for most people.

She’s like damn that IS a good deal

With that in mind, this card is worthwhile if you want a small business card. Or if you’re looking for a new card with a strong sign-up bonus and a lot of bonus categories.

The sign-up bonus alone is worth $1,250 (100,000 x 1.25) toward travel. So really, it’s a no-brainer. I’d apply for this card before you can say “submit application,” if only I could.

Grade: B

Why not A? The 5/24 rule and no 5X categories. And no waived annual fee the first year.

I wouldn’t let that separate me from an easy $1,000 sign-up bonus though. This B for “Bitchin'” is perhaps the most solid B+ I’ve ever awarded. Without the 5/24 rule in place, no doubt this card would be an A. I love having access to new bonus categories (and so should you).

Keep or DTMFA: Keep.

- Link: Chase Ink Business Preferred – compare it here

Considering you only need to spend a little over $200 a month in the bonus categories to make the annual fee worth it, that should be pretty easy. Between travel, cable, internet, and phone, most people (and especially businesses) would do well to hang on to this card.

At a bare minimum, the 100,000 point sign-up bonus is worth it. And you’ll come out very far ahead in any result, even if you do have to pay the annual fee for a year or two.

So I say this one’s a keeper. Again, especially if you like the 3X bonus categories. There are enough of them to appeal to most peeps.

What’s your take on this card? Anything you wish were added, or that you really like? All observations welcome here.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Wow, now I _almost_ want to stop opening new cards. With the benefits of Citi Prestige or Amex Platinum, the Ink Preferred could complement nicely, focusing on the rewards from the purchases since the Citi and Amex offer the airline fee reimbursement, Global Entry, and other benefits. So, business owners could skip over the Chase Sapphire Reserve ($450) and instead go for the Ink Preferred.

I could definitely see firms benefiting from the rewards… Earn 3 points per $1 on the first $150,000 spent in combined purchases on travel, shipping purchases, Internet, cable and phone services, and on advertising purchases made with social media sites and search engines each account anniversary year.

If the 5/24 rule wasn’t in place, I’d be applying. Since I know that the 5/24 is in effect, I know I’ll be auto-denied. In today’s marketplace, i don’t know if this card will even exist in two years, and since two years is a long time, I probably won’t stop applying for other cards just for the potential that this card might exist.