Savings and gambling! What could go wrong? 😹

Yotta, an online-only savings account, lets you play the lottery in such a way that you always win. Or at least, never lose.

Instead of earning interest like other high-yield savings accounts (where interest rates are currently 4% or more), Yotta pays you in daily lottery tickets with drawings up to $1 million.

Fascinated? Horrified? Maybe a little curious? That was my initial reaction.

Also, why not?

When I saw their partner banks are FDIC-insured and then literally 1,000s of 5-star reviews on the App Store, I decided to throw in $100 bucks (which gets me 4 free daily tickets) just for fun.

I don’t have to pay for these tickets, and on average, Yotta claims to return 2.70% APY with winnings included.

But let’s be real. Yotta is about the thrill. The dream. The “what if?” The “somebody’s gonna win, and it could be me!”

Hey, in this world, we need to have fun whenever we can. And if Yotta gives you a daily boost of feel-good chemicals well… that’s worth it.

My Yotta review

I joined Yotta, read through the site, and downloaded the app. “Fine,” I thought, “Count me in for $100.”

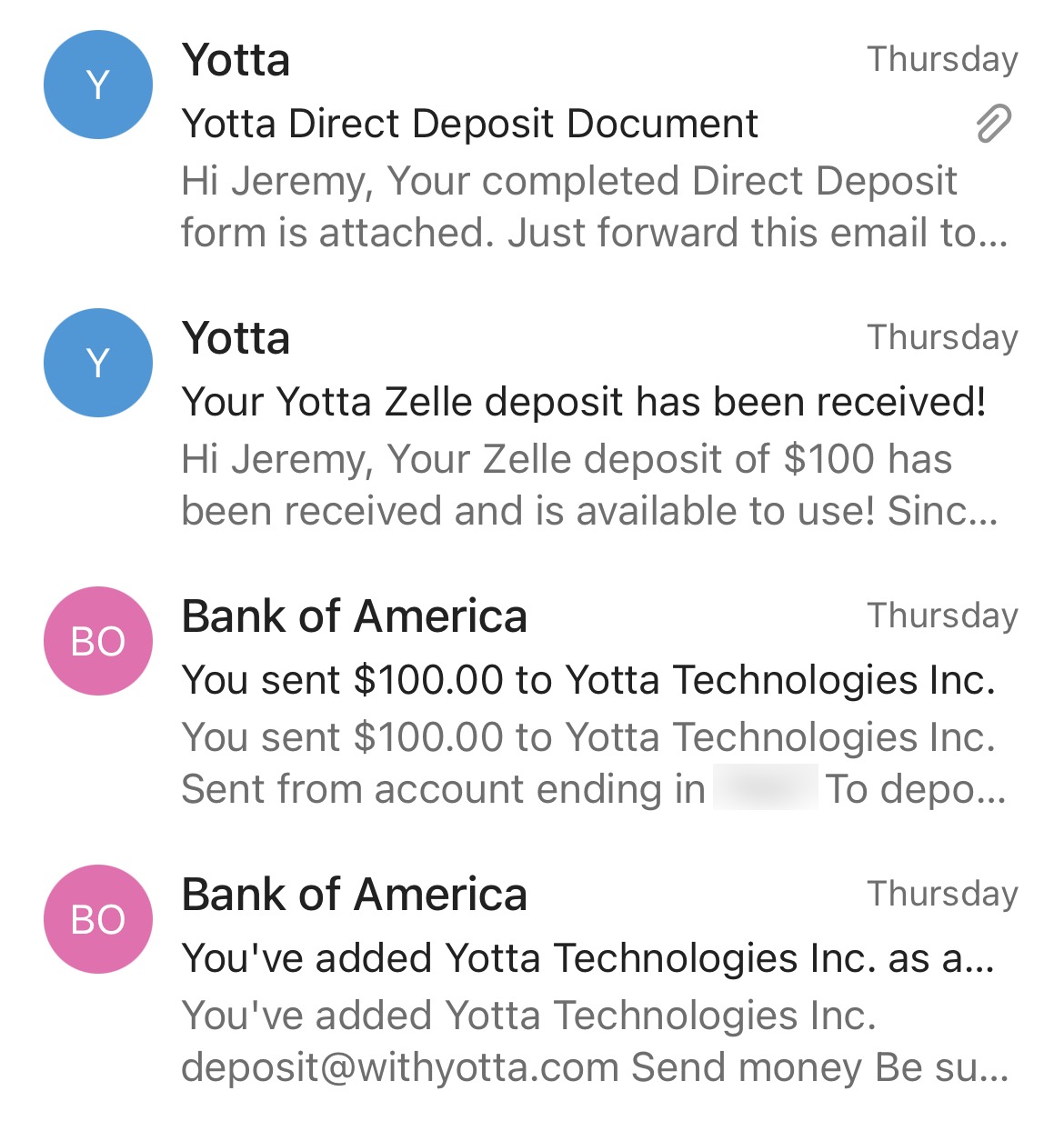

I connected my bank, but there’s no way for Yotta to “pull” money in. Instead, you have to “push” it in from your external account. I found that weird and a little red flag went up.

I actually put my phone down and thought, “I’ll come back to this.” And it was like a little seed was planted.

I want in!

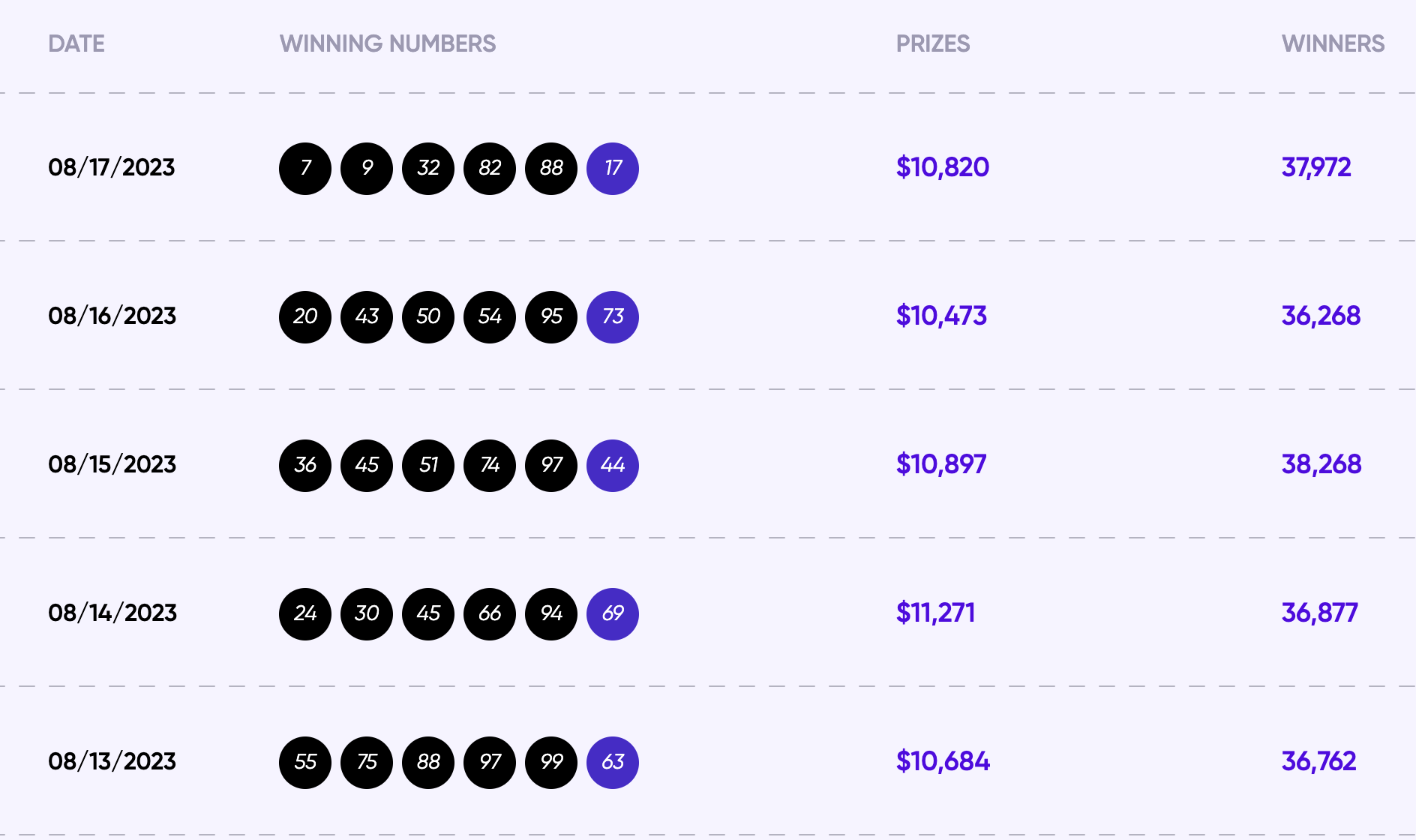

I noticed Yotta reliably pays out over $10,000 daily to 35,000+ winners.

People are getting money in there somehow, I reasoned. And I didn’t want to miss out on the fun. In a moment of delirium, I found I could Zelle money into the account.

Bing bang boom

Within literal seconds, the money was in my Yotta account—and I even got some bonus tickets for making the transfer.

Then I was off to the races. Here’s how it works:

- You get 1 daily ticket for every $25 in your account (so my $100 gets me 4 free daily tickets),

- Drawings are every night at 9pm Eastern. You can either pick numbers or go random (like any other lottery).

- If you win, your money is in your account immediately.

- There are opportunities to score extra tickets.

- There is no out-of-pocket expense, and the more you save, the more free daily tickets you get.

What a truly fun incentive to save money! As noted, the normal APY is only .02%, but with winnings it’s closer to 2.70% APY.

Can you do better than this? Absolutely. But for my $100, the difference in interest is literal pennies—and I love the anticipation this gives me each day.

Comparison with other savings accounts

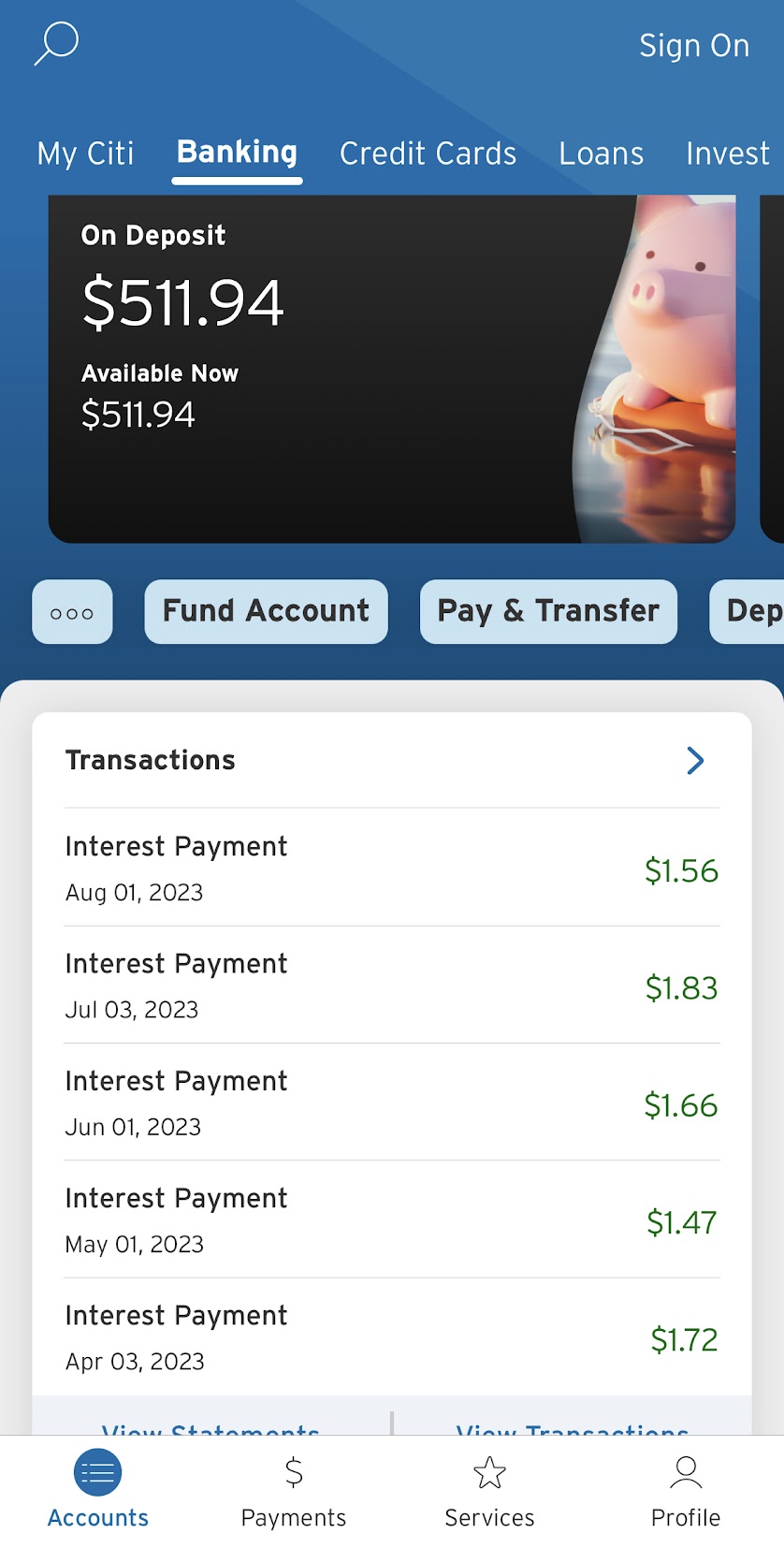

My Citi Accelerate account has a 4.25% APY. I keep $500 in there to keep it free. Here’s my interest payouts from the last few months:

Not even a full $2

Nothing life-changing. For the 4 free daily lottery tickets, those are worth much more to me—even in entertainment value—than the under-$2 monthly payouts I’m getting on my $500 balance.

So unless you’re savings $1,000s of dollars, the APY thing isn’t going to amount to a hill of beans.

More about Yotta

Yotta offers a debit card with more bonus incentives, loans, and even a credit card. I don’t plan to bank, or store very much money, with Yotta, so these don’t interest me.

The way I see it, this is low-risk thrills with a fun concept and slick execution, and their partner banks, Evolve Bank & Trust and Thread Bank are FDIC members insured up to $250,000.

And then I started thinking: Lottery? What lottery? Like, Mega Millions? Powerball?

Nope. Yotta has their own internal lottery and the top prize can vary daily. Usually, it’s $1 million but in the past has been lower, or something else, like a new car. But for the most part, they stick to their script.

Fun!

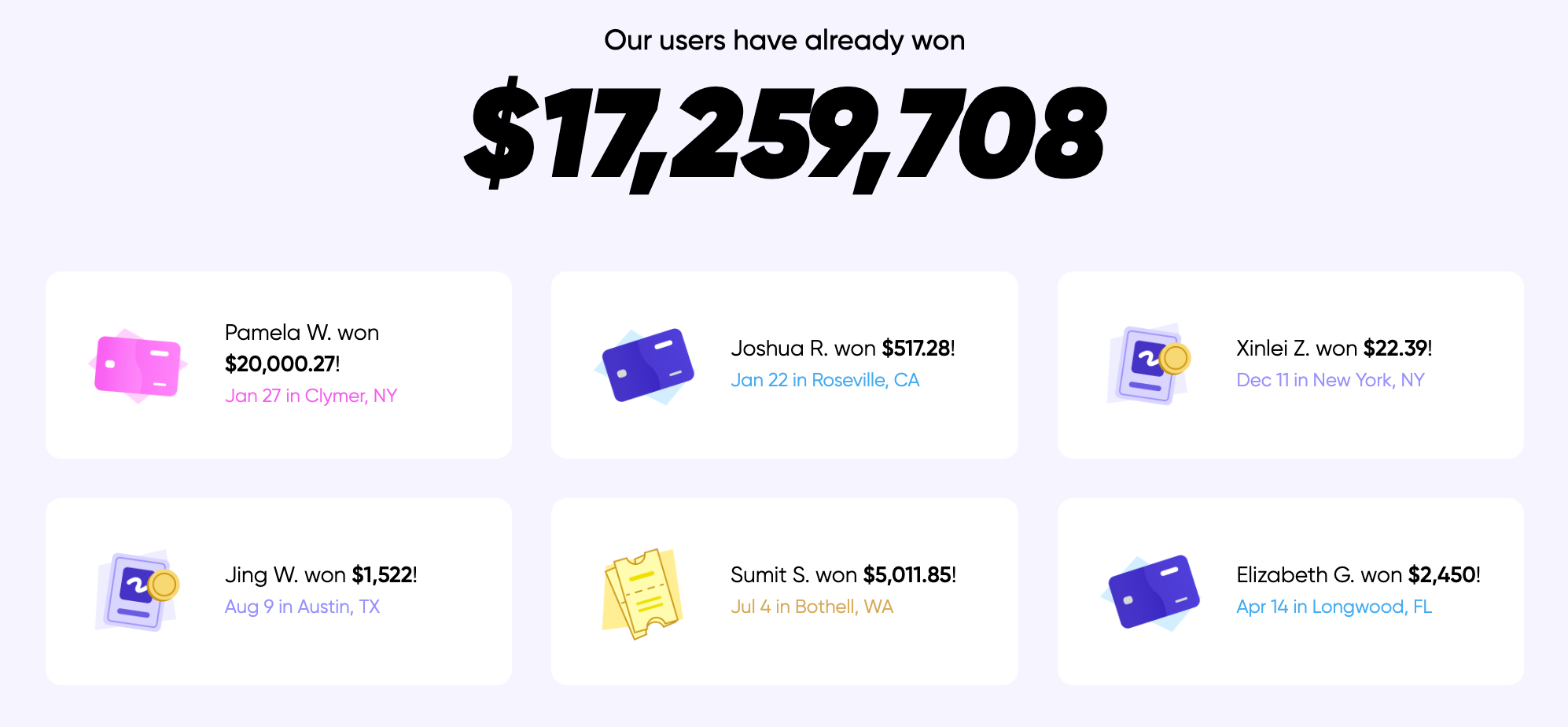

They claim to’ve paid out over $17 million so far, which is pretty cool.

Another thing to know: if you win less than $600, it’s yours to keep. If it’s over $600, you’ll get a 1099 and will need to claim the winnings on your annual taxes.

So while all of this is really cool, the thing that really drew me in was the app’s security. They send me a text every single time I log in, and the “having to push money” thing is to reduce fraud. They also collect your real, legal details upon enrollment.

In the end, the security, app reviews, and fun concept are what drew me in. There are no fees whatsoever, and they’re been around for a few years—so they’ve had time to work out the kinks.

Yotta review bottom line

And that’s the story of how I play a lottery for free every night.

If you’re interested, Yotta also offers a full suite of banking services. The debit card looks interesting, but I prefer to use rewards-earning credit cards and I bank with Fidelity’s Cash Management account, with no interest or capacity to switch right now. Plus, it takes me a long time to build up loyalty.

But I’m having a blast otherwise. The app is easy to set up, everything runs well, and I’ve had zero issues. I haven’t won so far, but my hope shines eternal. 🌞

Wanna join? Use my Yotta link and we’ll both get extra tickets and you’ll get a “Loot Box” with a few welcome goodies in there.

Have you used Yotta? If so, how’s your experience been? And if not—will you join?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

It’s a total scam I have video proof of them not allowing me to cash out it auto cash out

Support told me fuck of

I HAVE VIDEO PROOF

Yes, I got all my money out before the recent issues. The second they changed it, I bailed. It’s absolutely horrible what happened to people. I’m so sorry that happened to you. 🙁

“Influencers” will hawk any piece of trash for a buck