I opened a new USAA card to take advantage of a 0% APR rate until February 2020 (but gosh how I wish the Limitless card with 2.5% cashback everywhere would come back). I previously got a new card to make a student loan payment.

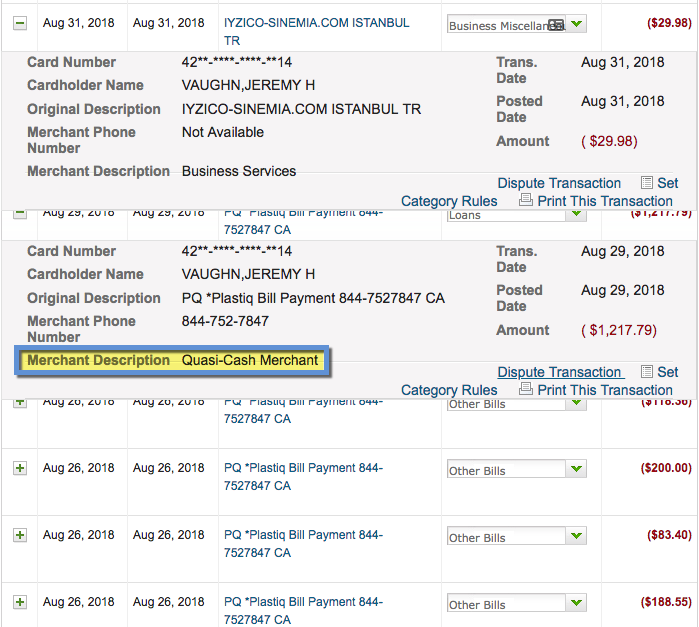

So the USAA Preferred Cash Rewards card earns 1.5% cashback on purchases. I was hoping Plastiq payments would code as “miscellaneous services” (or similar), but nope, they post as a “quasi-cash merchant” and do not earn any reward points.

So don’t use your USAA card with Plastiq!

More importantly, I hope this doesn’t signal a trend of Plastiq coding as cash-like purchases.

Even still, I was not charged a cash advance fee per Plastiq’s advising.

Tread carefully with USAA Plastiq payments

- Link: Blue Business Plus Amex – learn more here

- Link: Blue Business Plus Amex: New Card for Plastiq Payments?

Currently, the best cards to use for Plastiq payments are:

- MasterCards for mortgage payments

- Discover cards for mortgage payments

- Amex cards for rent, utilities, student loans, and most others

- Visa small business cards

Within this framework, there aren’t many worthwhile cards left. That’s why I recommend the Blue Business Plus Amex (learn more here) for most payments, though the jury’s still out regarding mortgage payments.

If you go the Visa personal card route, you’ll get a cash advance fee on cards except those issued by:

- Capital One

- Navy Federal Credit Union

- Alliant Credit Union

- USAA

- Wells Fargo

So when I saw USAA on the list, I thought, yay I can make payments without fees and get caught up on some bills.

I still did that but…

USAA cards don’t earn rewards for cash-like transactions

And Plastiq codes as a “quasi-cash merchant.” I hoped it would code differently.

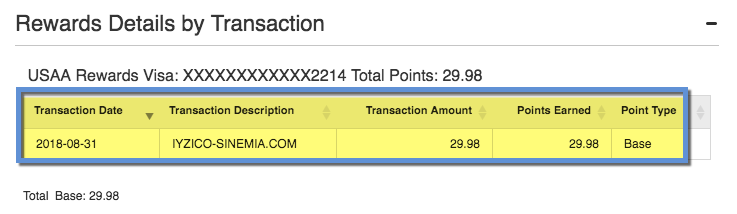

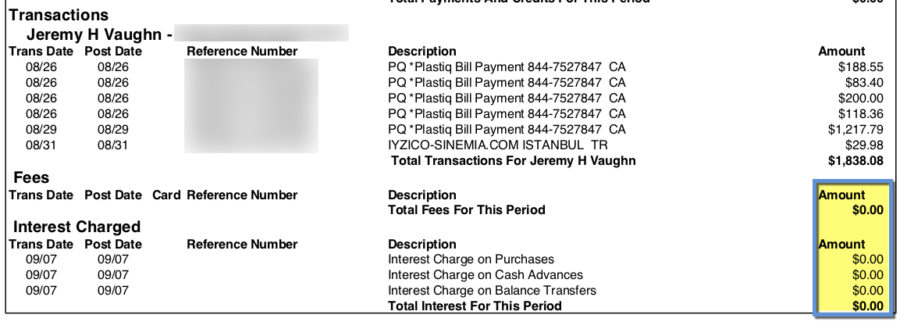

The only rewards I earned for this billing cycle were for my Sinemia membership (I’m using it the first time this week – review coming!). I earned nothing for $1,000+ of Plastiq payments.

That said, I did NOT incur cash advance fees (whew!) – so that is still a net positive.

But it stung a little to lose/not earn all that cashback. Which would’ve been awesome, but alas.

Bottom line

The bit about USAA cards not earning rewards for Plastiq payments is niche because not everyone can get a USAA card. But the bigger issue is how Plastiq codes – and how it continues to shift.

In a general sense, I hope this doesn’t mean a shift toward no rewards with any cards because these payments will eventually code as cash-like instruments. If that ever happens, Plastiq will be useless.

For now, I’m still earning points and cashback with other cards. And, touch wood, I hope USAA is alone in how they’re processing payments for a long time.

Just wanted to put it out there in case you’re in the same boat.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Harlan, do you know if the New world of hyatt credit card will code the plastic payments as a cash advance? It’s a consumer card, but I read somewhere that as long as the amount is less than 20% of credit limit, that it should not? Trying to meet minimum spend on another card! Btw, sorry wasn’t able to make it to the meet up last week. Hope you guys had a good time!

Yes, that’s right! Just call Chase to set your CA limit to as low as they’ll go (I set mine to $100). You should earn full rewards for Plastiq payments.

And no worries, there will be more – and you were missed! 🙂

Visa is definitely presenting some challenges for Plastiq right now. I have VGCs issued by US Bank and Metabank that won’t process through Plastiq because they’re coding as MCC 6051, “Non Financial Institutions — foreign currency, money orders (not wire transer), & Travelers Cheques”, which those banks are blocking. It’s been really frustrating and limits the utility of a service like Plastiq. Can’t use Amex either for my student loans since they’re financed with a private bank (as opposed to a SL servicer like Mohelo, Nelnet, etc).