Also see:

Thinking about renting a car in Ireland?

Woof:

verb: to declare something bad, ugly, terrible, or nasty.

interjection: use as an expletive to express disgust or surprise.

Can be a replacement for damn that sucks!

Upon landing at DUB, I knew the next step was to go pick up the rental car.

So here’s how I did it (made the booking not picked up the car).

The booking

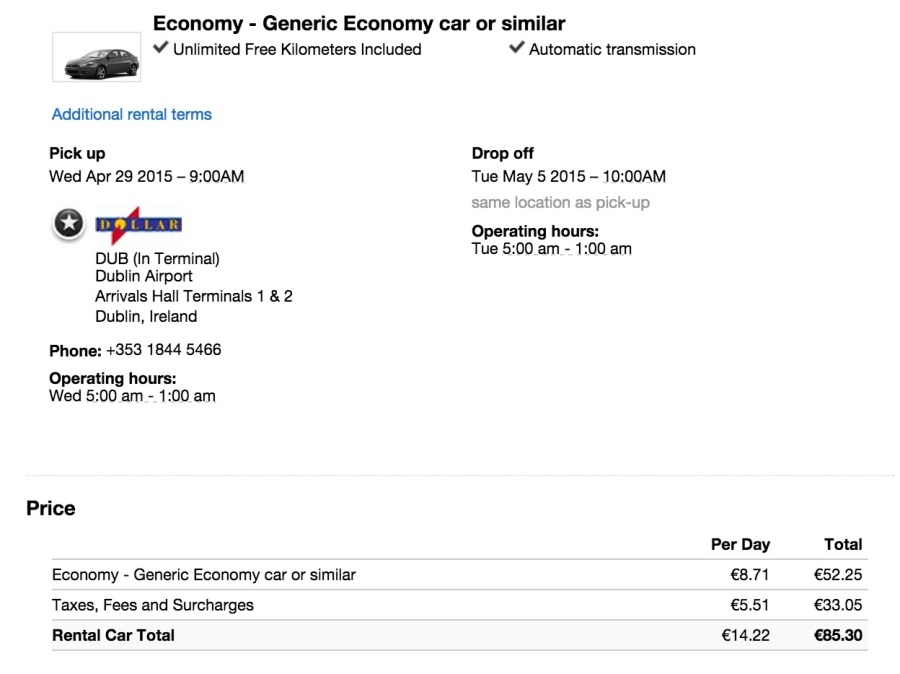

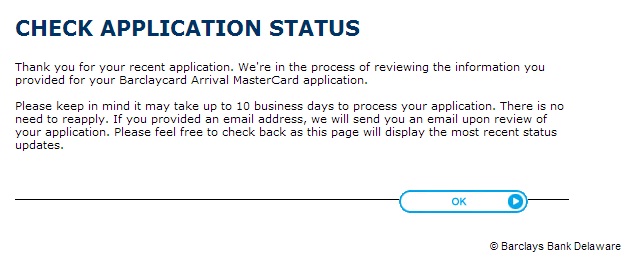

I ran a quick search on the Chase Ultimate Rewards website – they generally have fantastic rates on rental cars. That’s how I got such a good deal in Hawaii. Keep in mind that they ONLY service airport locations and you MUST pick up and return to the same location.

They quoted me at ~$325 for a 6-day rental. Not bad.

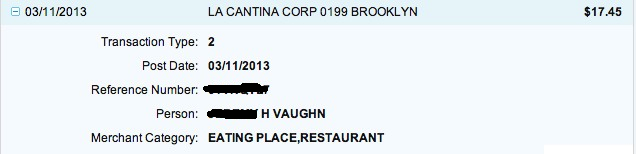

But when I hopped on kayak.com to compare and they had rentals pricing out at 9 Euros per day. And 85 Euros for the 6-day rental (~$97). Now that was a screaming deal. I booked a car at Dollar via priceline.com.

My only criteria were:

- 4-door (for ease of getting luggage in and out)

- Automatic transmission

- Unlimited kilometers (I wanted to drive a lot)

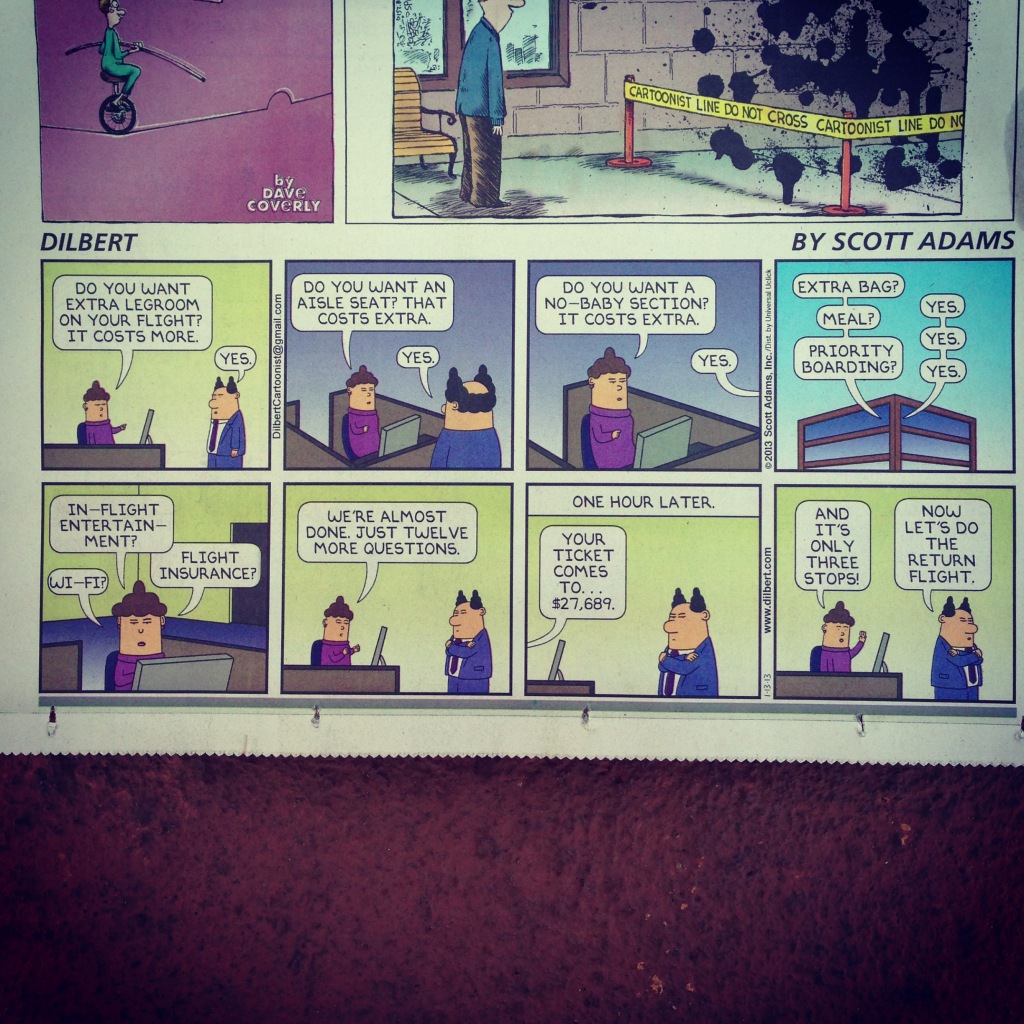

So, I did it. I thought I’d gotten a better deal than what the Chase Ultimate Rewards site was displaying.

Now that I’m back safe and sound, I’m not so sure any more.