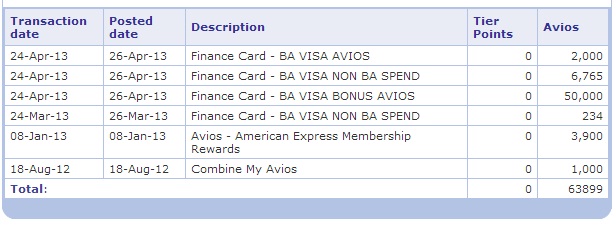

With the addition of two new cards earlier this month, I started to realize I was getting a little in over my head in my quest to play the “points game.” I now have ten credit cards, which seems a little overwhelming to me. A few of them are in “the drawer,” and I rotate them in and out of my wallet depending on spend requirements and bonus categories. If I’m traveling, I’ll only take cards that feature no foreign transaction fees.

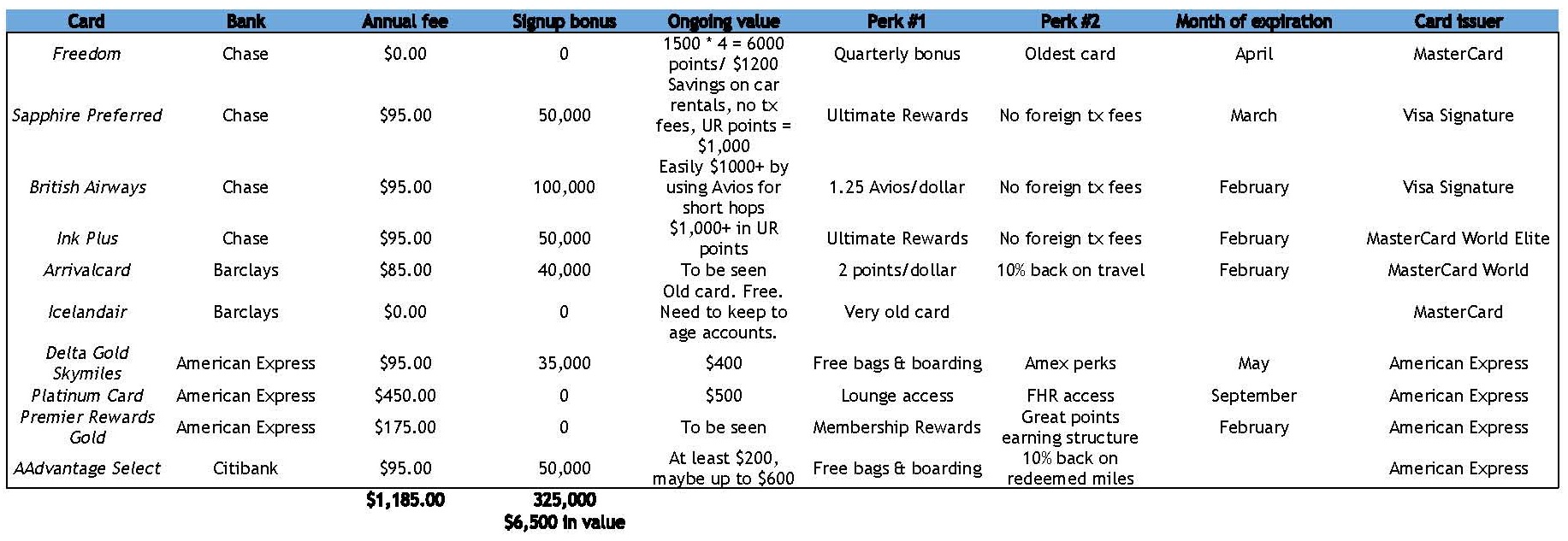

Going another step further, I don’t think it’s feasible for me to keep 10 cards active all the time. Once annual fee time comes around, I might have to cancel one or two of these babies (at least). With that thought, I cataloged all of my current cards with a cost-benefit analysis. Here are the results:

A few observations:

- This chart assumes I get at least .02 cents of value from each point

- Amex cards are less than 1/3 of my total cards, but make up over 2/3 of the annual fee costs. I do think the Platinum Card is worth it. The others… not as sure.

- Of the 325,000 points I’ve earned from these 10 cards, Amex cards only make up 35,000 of those (!!!). Amex LOVES to screw me out of signup bonuses. I’m sensing a trend here…

- I was able to find obvious ongoing benefits in keeping ALL of my Chase cards. The only one I’m sure about keeping with Amex is the Platinum Card. The Citi AAdvantage card is in “the drawer” now that I’ve received the signup bonus in full. However, the 10% rebate on redeemed miles is more than enough incentive to keep the card in perpetuity. It also gives me a relationship with Citi just in case I ever want another.

- The biggest wild card right now is Barclays. I am impressed with the direction they’re going in. I do think I will continue to keep the Arrivalcard, especially if it keeps giving TripIt Pro as a subscriber benefit. I really like the fare tracker feature. And hey, if it ever saves me money, it’s a no-brainer to keep the Arrivalcard.

- I’ve had the Chase Freedom (in several other incarnations) since 2002. That’s a nice boost to the length of my credit history.

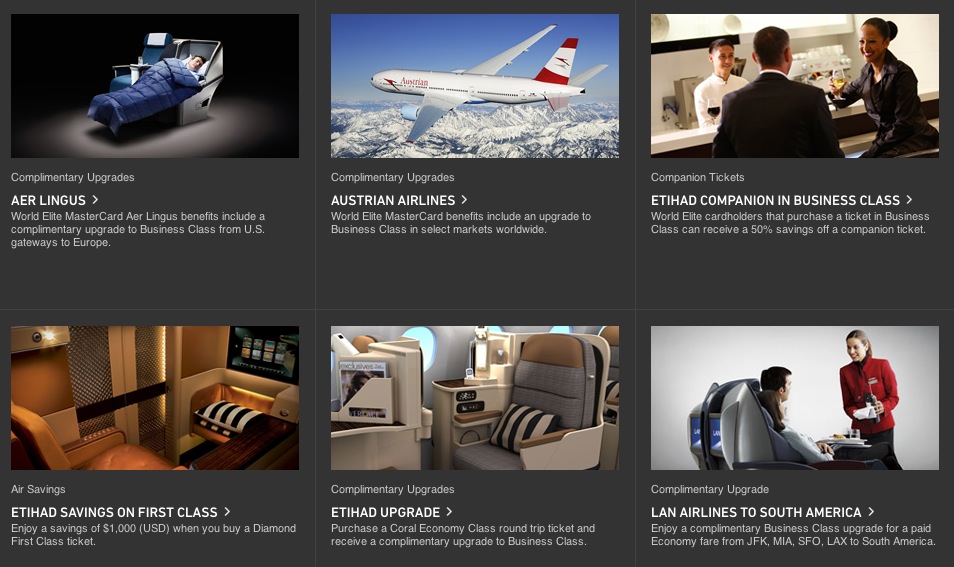

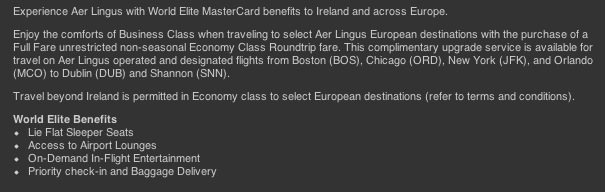

- I’d like to keep one Visa Signature on hand and the one World Elite for now. You never know…

- I haven’t assessed other perks like car rental coverage, trip cancellation, lost baggage, etc. I’d only ever rent a car with the Sapphire Preferred or Platinum Card anyway.

I do consider this analysis as a document that is very open to change. Airlines and credit cards slash and introduce benefits all the time. (So do hotels but I don’t have any co-branded hotel cards.) If I had to pick one or two to place on the chopping block, it would definitely be the Delta Amex and potentially the Premier Rewards Gold. Delta and Amex haven’t impressed me very much lately, especially with the customer un-friendly moves they’ve both been making. And American has been very generous, though I haven’t flown with them at all this year. Too bad Citibank doesn’t have better transferable points cards. If only United were better, I’d have the perfect bank-airline relationship (because god I love Chase!). More thoughts after the upcoming Chile/Easter Island trip. We’ll see how American & Co. fare with operations. This Saturday! Two days!