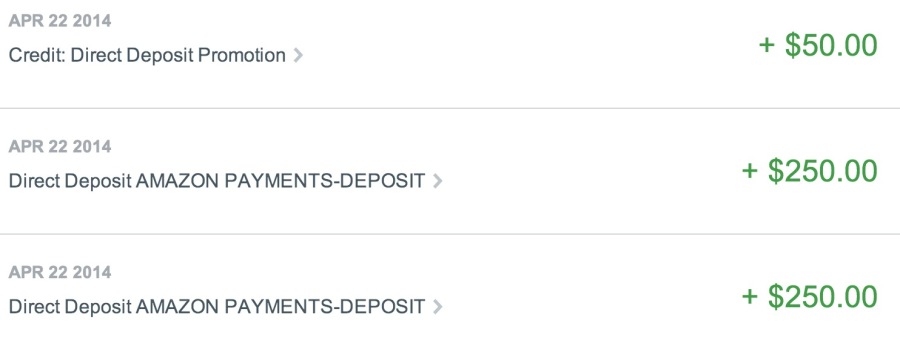

Ah, my adventures in Serve.

They are doing their best to make sure the product is secure, I’ll give ’em that.

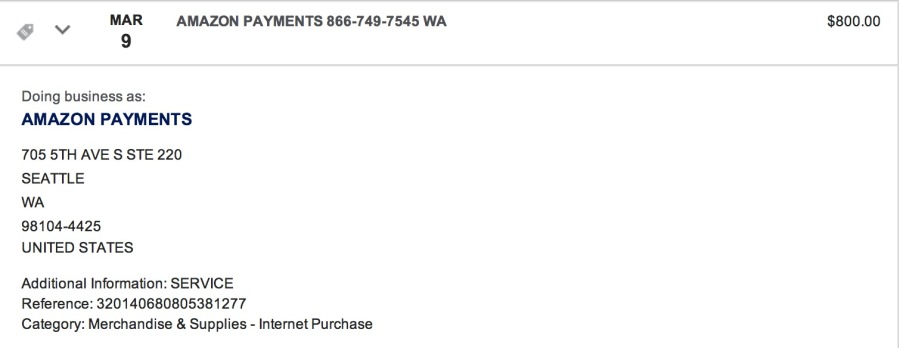

When I originally got the Serve card, I wanted to find out which banks charge cash advance fees for reloading with a credit card. My idea was to load $5 from each bank’s credit card and report the results. Not so fast.