Update: The version of the Chase IHG card described below is NO LONGER AVAILABLE. Check here for the latest card deals.

Yes, I fell in a moment of weakness.

Chase has been targeting me relentlessly for months about opening up a dang IHG credit card with them.

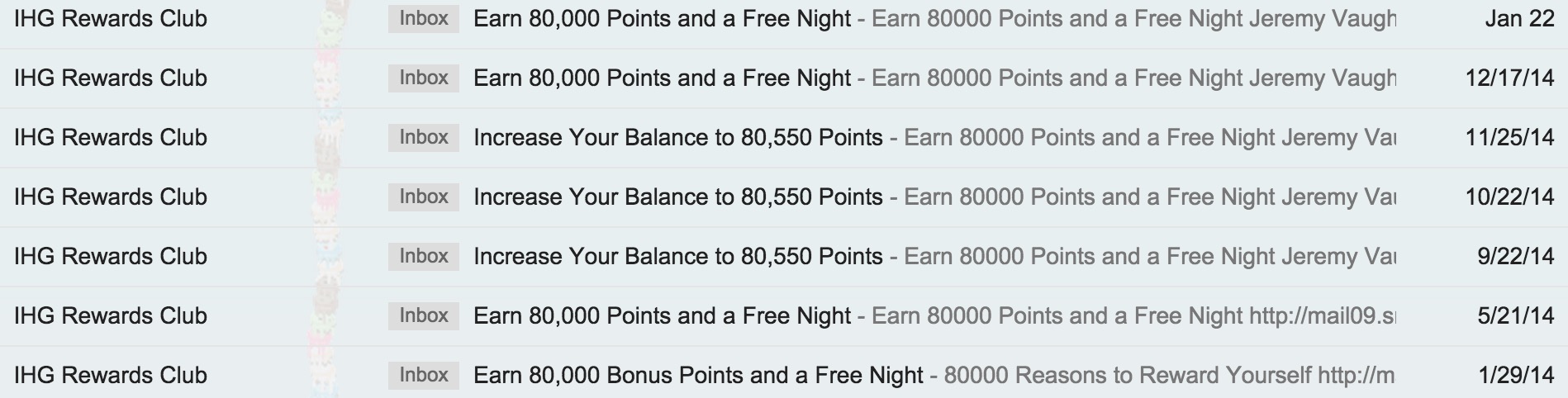

With regularity, I get these emails:

They interested me for a number of reasons:

- I have no status with IHG

- I don’t have any paid stays within the past 2 years

- My only stays have been reward stays

- I only had 550 “orphan points” that have been sitting there forever

- I already have 5 open credit cards with Chase – why are they trying to push a 6th one so hard?

I got this email in September, October, November, December, and January. I probably would’ve gotten one in February too – six months in a row – had I not pulled the trigger.