Getting a new credit card is a big step for lots of peeps. It’s a new account, new financial history, and something else to track.

Some of you might be like “Ugh,” but I’m like “Yay!” Even though I have 33 credit cards right now (yep!).

Here are the steps I take with each new card. And you should, too. It’ll help maximize your benefits, earn more rewards, and keep track of what’s what!

So ya got a new card, eh?

Cool! Activate that sucker. And then to these things.

1. Keep track of your minimum spending

Chances are you have to spend $X,XXX amount in X timeframe to earn some awesome sign-up bonus. #kewlz

But, did ya know the clock is already ticking? It began the second you were approved for the card, NOT when you received or activated it. So you’re probably already a week or so behind by the time you first hold it in your hot little hand.

Make a note of your approval date. Or set a reminder on your calendar or phone. This date is so important. Because if you miss your timeframe, the banks will likely not have sympathy for you. So that’s the ultra first step.

Remember, you can always use Plastiq to meet your minimum spending in just a few minutes. Note that any annual fees do NOT count toward minimum spending.

2. Record that sucker

- Link: Evernote

- Link: 7 Awesome Uses of Evernote for Travelers

Snap a picture of that bad boy into your Evernote account. I find it’s helpful because:

- You always have the card number available even if you’re not at home

- It’s time-stamped, so you can see when you got it

- You can look it up on your computer when you’re too lazy to get up (#me 😴)

But for real, it’s good to have a record of your card in case you lose it, misplace it, or it’s stolen. I always take a picture of my cards as soon as I get it in the mail. Especially if they’re going right into the sock drawer not going in my wallet.

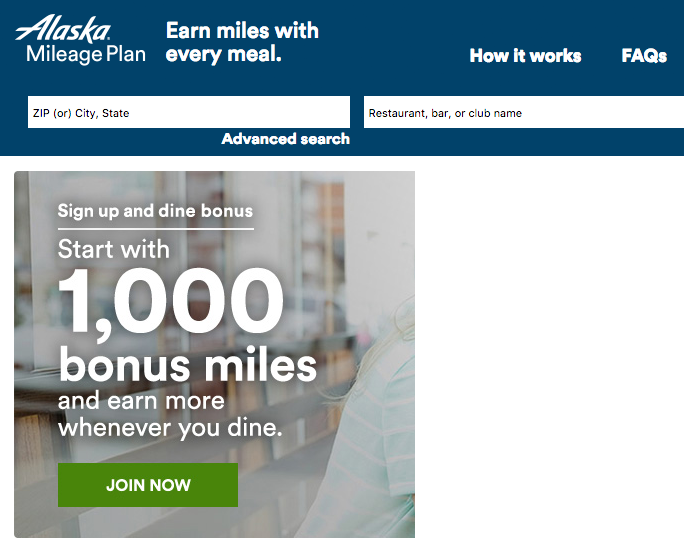

3. Enroll in dining rewards

- Link: Delta SkyMiles

- Link: American AAdvantage

- Link: United MileagePlus

- Link: Southwest Rapid Rewards

- Link: Alaska Air Mileage Plan

For the love of gods, add that card to dining rewards account. That way, you’ll earn bonus miles – FOR FREE – when you dine at a participating restaurant. This accomplishes 2 things.

First, you reset the expiration on your miles when your activity posts. And second, you sometimes earn miles unexpectedly, which is awesome.

You won’t earn enough for a free flight this way, but it adds up over time. And are you really gonna say no completely free miles???

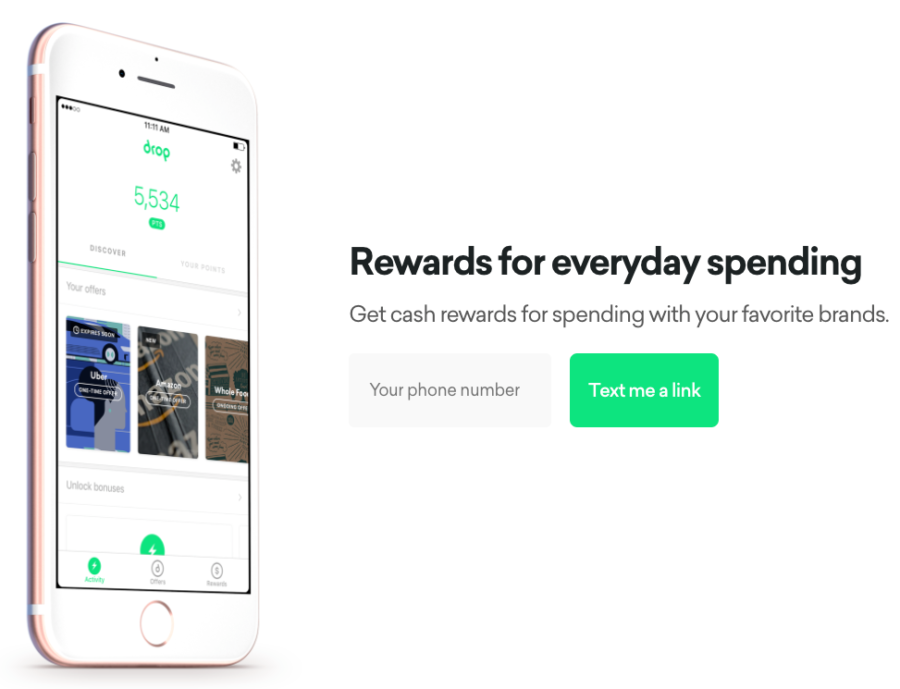

4. Add your card to Drop

- Link: Sign-up for Drop

More free points!

If you’ve already added your bank to Drop, cool – just make sure your new card is indeed linked.

And if you don’t have Drop already, might as well score some free points for gift cards on your everyday spending.

5. Add it to Uber to get Visa Local Offers

I described how to get free Uber credits with Visa cards in this post. Only works for Visa cards, but don’t turn down free rides for something as easy as linking a card!

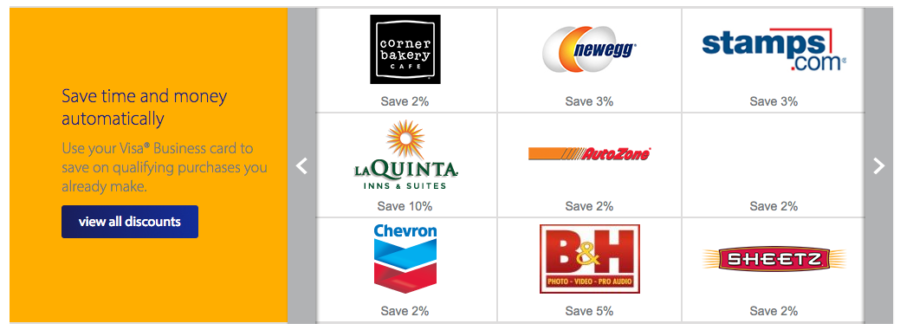

6. For Visa and MasterCard small business cards

- Link: Visa SavingsEdge

- Link: MasterCard Easy Savings

Earn statement credits when you shop at certain merchants.

You may or may not ever trigger said statement credit, but if it’s as easy as copy/pasting your card number into an info field, why not? I’ve actually earned a couple bucks here and there and not too proud to be above it. Again, free money for entering a card number!

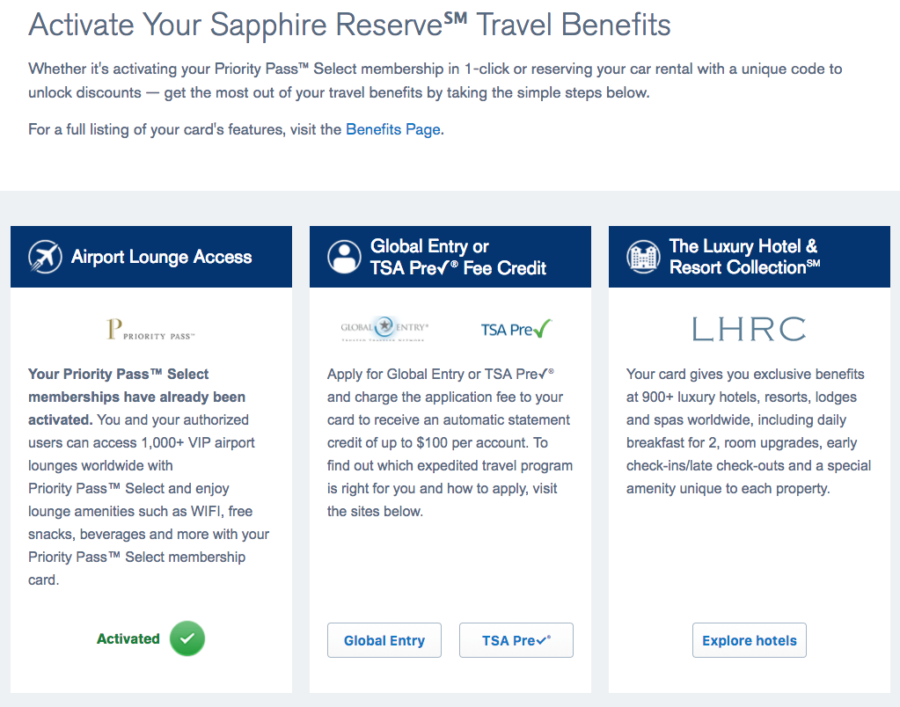

7. Activate special bennies or start the clock

Not every benefit is automatic.

Some cards, like the Chase Sapphire Reserve, require you to login and manually activate certain benefits. Other cards do this as well, for things like:

- Lounge access

- Airline travel credits

- Car rental elite status

- Free wifi passes

- Hotel elite status

For example, Stefan has an excellent checklist of what to do if you just got an Amex Platinum Card.

Chances are if you have these bennies on a card, you’re aware of them. In any case, be sure to activate/enroll/click the button.

Furthermore, if you have travel credits, be aware if they’re by calendar year or cardmember year. It makes a huge difference – and you could miss out on credits if you don’t make the distinction right when you get the card – set an alarm or reminder if necessary. Your benefits are a sunk cost if you don’t use them!

8. Make sure it’s plugged into Mint.com

- Link: Mint.com

This is super helpful for tracking where you are with your minimum spending. It’s so easy to track your transactions in Mint using the “Trends” feature.

9. Make sure it’s accurate on your credit report

- Link: Credit Karma

- Link: Credit Sesame

I’ve noticed recently some new cards – from Amex and Discover – did NOT cause a hard pull on my credit report. But after the first statement closed, sure enough, I saw the new account on my credit report.

Whatever the case, you should be in tune with your credit report and the information on it. Sometimes, it can take a couple of months for your new card to show up.

It’s always a best practice to make sure your accounts are accurate and up-to-date. Cuz god knows if you have to file a dispute, it can be, uh, hellish to put it mildly. This also goes for when you close a card – it ain’t over till it’s over, baby.

Bottom line

Congrats on your new card!

Make sure you:

- Meet your minimum spending (check out Plastiq)

- Record that little baby (hi, Evernote)

- Enroll in dining rewards

- Add it to Drop

- Get free Uber credits with Visa cards

- Sign up for Visa SavingsEdge or MasterCard Easy Savings if you got a business card

- Activate your card bennies

- Track your minimum spending in Mint

- Use Credit Karma and/or Credit Sesame to make sure your credit report is accurate

What did I miss? Is there anything else you do as soon as you get a new credit card?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

You need CreditKarma & Experian to see all 3 credit bureaus and both are free. CreditSesame adds nothing since it only shows info from TransUnion, while CreditKarma has both TransUnion & Equifax and Experian has (obviosuly) info from Experian.

Also, PersonalCapital’s UI is much better than Mint’s.