Y’all – I am so close to $200,000 that all I need is one good day in the market and I’m there. I’m officially at $198,676, which is 39.7% of my $500,000 goal. So close to 40% that I’m gonna go ahead and call it.

Hi from Nashville! I’m at a Hyatt Place about 25 minutes northeast of downtown. I’ve been here for nearly two weeks, and it’s been great so far! I’m eagerly awaiting my Hyatt Globalist status to kick in and in the meantime, I’ve been living and working.

There’s free breakfast with coffee and snacks to last most of the morning, and a fitness room where I can work out in the evenings. The local places have great lunch deals and happy hours, and I’ve been able to see a couple of things in Nashville and walk some quiet nature trails with my dog.

I look like a happy demon with black eyes

I’m beginning to find my rhythm with this digital nomad stuff, though sometimes it’s weird to realize I don’t have a permanent address any more. But like, good weird. I also have to always be planning ahead, which energizes and simultaneously stresses me. But like, a good stressor. Can you tell this is new for me?

May 2021 Freedom update

Now where was I? Oh yes – let’s talk money.

Overall, I’m up $8K again this month. I have $25,000 in savings. In another couple of months, I should be at my $30,000 savings goal, and then I’ll switch the focus to loading up my taxable brokerage account. Reason being my 401k is set to fill up during the rest of the year, and I’ve already maxed out my $6,000 Roth IRA contributions this year. I started saving a little in a HSA through my employer, too (but won’t max that out).

I also realized something along the way.

😳

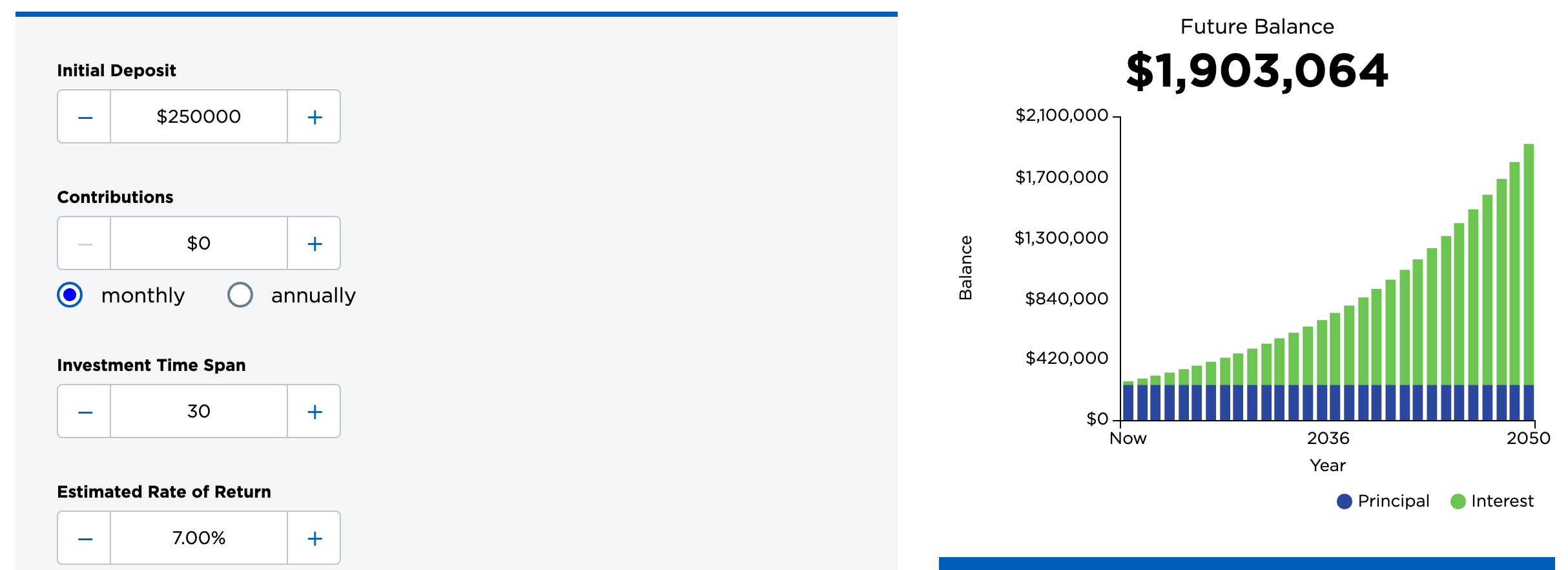

Once I get to $250,000 invested in my retirement accounts, I really don’t need to do anything else – I can coast. In 30 years, I’ll be 66, and assuming a modest 7% return, I’ll have nearly $2 million dollars. At 8%, that jumps to $2.5 million. That’s great for Future Me, but I’d like to live off my savings and dividends long before then.

So, I’ll focus on filling up my taxable accounts and leave my retirement accounts to work their compound interest magic. Life becomes a matter of making enough to get by.

I think I’m at the point where the magic is starting to happen. I’m taking care of Future Me – and can soon think about living off savings and dividends.

I can’t believe I’m about to enter into the phase of accumulating my third $100K. Especially as someone who’s clawed their way out of poverty, broke a scarcity mentality, and started believing he could do something like this.

Hotel life

It’s been surprisingly chill and easy to live in a hotel full-time. The more I’m here, the more it feels like any other apartment building. Except there’s breakfast every day and I don’t have to clean. It’s actually really nice.

In my haste to book this Hyatt Place, I assumed there would be a full kitchen. And you know what they say about assumptions.

Anyway, there’s only a mini fridge and a little sink in here. No stovetop or microwave. Not a biggie, but it did teach me to review – like, really review – the room features before committing. Had I known there wouldn’t be a way to heat up food, I wouldn’t gotten more packaged snacks before I arrived.

This here is the place where I am stayin / there isn’t a number you can call the pay phone / and let it ring a long long long long time

I get the feeling though that no matter how much I review a place, there’s always going to be something where I think to myself – oh yeah, I should’ve thought of this. But whatever, I’m rolling with it. And will continue to roll with it.

The room is clean and big enough, the wifi is fast (and free), and it’s quiet here. Also, I can crank the AC as much as I want. I kinda love thinking of it as an apartment building. There are a lot of similarities when you think about it.

Crypto

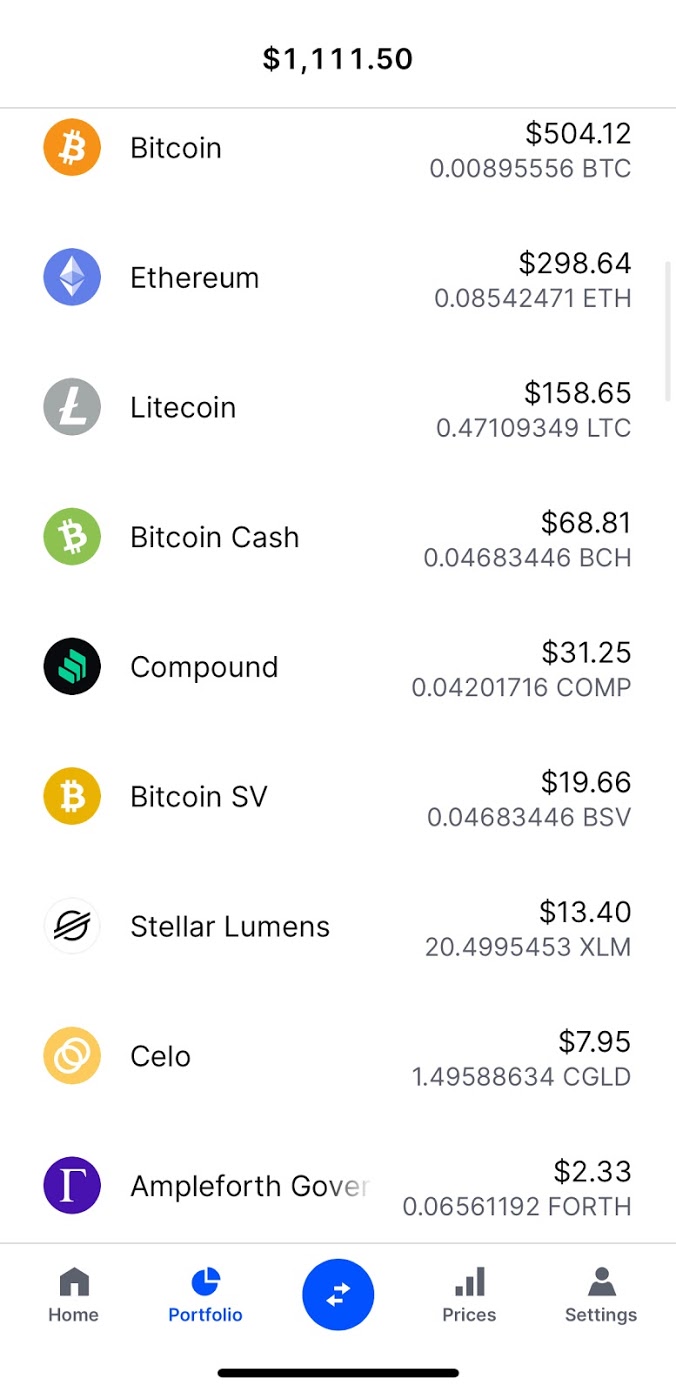

So a few years ago, I put $100 into each of three buckets: Bitcoin, Ethereum, and Litecoin. My total investment was $300. I haven’t followed it much, but it’s in the news nearly every day. So I logged in to my old Coinbase account (click here to join) and it’s turned into $1,100+.

My Coinbase portfolio

I know crypto is highly volatile and fluctuates all the time, but I decided to include Bitcoin in my overall net worth. So this month, ~$500 of my overall total is from Bitcoin.

I’m still learning about crypto and am glad I put in a little a few years ago. I hear Ethereum is starting to make moves, so I may put some more money into that.

I see crypto as a supplement to my other goals – not my main strategy (right now, anyway). But it’s fun to start thinking about how crypto might evolve in the future.

I recommend putting a couple of hundred bucks into an account and seeing how it goes. Get your feet wet and learn more about it. I’m still into traditional stock investments, but want to be a part of this when and if it really takes off.

Bank of America Preferred Rewards

I’m already at the Platinum tier with Bank of America’s Preferred Rewards program. Soon I’ll be at the Platinum Honors level.

I just got the Premium Rewards card with a $500 sign-up bonus. And I’ll get a $375 bonus for the new investment account, and $100 for the new checking account (free to keep with the status).

Gee thanks for the bonuses

Between the three, that’s nearly $1,000 in bonuses, so I’ll stick it all into ITOT or VTI and call it done. I say “all” but really mean “as much as I can” – Merrill Edge doesn’t allow fractional shares, which is the most annoying thing about them. Other than that, I’m pretty satisfied. Mostly because I’m letting my funds sit there and not actively trading.

So for my purposes, it’s great – and the $1,000 in bonuses for the new accounts is pretty nice, too.

By the numbers

This is getting long and I still need to show y’all the numbers. Here they are:

| Current | Last month | Change | 2021 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| 401k (contributions only) | $5,833 | $4,167 | +$1,666 | $19,500 | |

| Overall investments | $165,306 | $158,873 | +$6,433 | As much as possible | |

| Savings | $25,125 | $23,110 | +$2,015 | $30,000 | |

| Net worth in Personal Capital | $198,676 | $190,520 | +$8,156 | $500,000 | Track your net worth with Personal Capital |

I want to keep building up my retirement balances as much as I can while also padding my taxable accounts. But for now, I’ll keep adding to my savings accounts until I hit that $30K mark. And take it from there.

$200K, here we come

I’ll definitely be crossing the $200K mark this month (!!!). Somehow that feels more significant that $250K, even though that’s 50% of my goal. I think it’s because the first $100K was such a bear that adding the second $100K just feels insanely awesome. And now I can move on to the third $100K.

May 2021 Freedom update bottom line

- Link: Track your net worth with Personal Capital and get a $20 Amazon gift card

- Link: Join Coinbase and buy crypto

I’ll be in Nashville until May 24, then head to Knoxville for a couple of weeks. Then Asheville. And then? Maybe to West Virginia for a couple of weeks. I’m really into not planning too far out these days. And living on the road full-time – so far – is as fun as I thought it would be. I’m sure it’ll wear on me after a while, but for now it’s all new and novel. Being in the present moment is nice.

I’m so glad I left my old apartment and job and life. I know I can always rent a place and settle down, but for now the journey is just beginning. And now that I’m on the verge of $200K net worth, I wanna keep it going.

My fantasy is for the world to open up again so I can do this in Europe or Chile or somewhere in Canada. Hopefully soon. Maybe this summer or fall?

And crypto, yeah! It seems like it’s getting… more stable? For now, it’s mostly interesting. But as more banks invest and a possible crypto ETF gets off the ground, I want to be sure to stay informed. So I’ll include my Bitcoin balance in my net worth and see how that goes. So far, it’s just $500. I’m thinking I might get into Ethereum a bit more.

How’s everyone doing? What are your thoughts on crypto/Bitcoin/Ethereum/Dogecoin? Are you getting excited to travel again?

Stay safe and scrappy out there! ✨

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Fck all your other shit crypto is the future. My 18k is 180k in 3 moths and there’s still room to 3x or more.

Crypto is real. It’s usueful and you can retire in 5 years if you understand how the bitcoin cycle works and plan accordingly.

Put a bigger portion of money into ethereum.

The easiest way to understand those two cryptos.

Bitcoin is the new age gold and ethereum is the new age internet which decentralized apps are built on.

Don’t fuck up, a bitcoin halving happens every 4 years (2012,2016,2020) and the 12-18 months that proceed it there is always an increase in demand because supply has been reduced.

Ethereum will go to 5k this year.

Bitcoin to 150-200k mayb more.

I’m gonna do the biggest favor ever for no reason

Look of Decentrialzied Finance

It’s where all the money is going. We will be moving away from banks in the future. I lent my bitcoin out worth 20k at the time and got a 10k loan in my bank account no credit check to use how ever I want I just owe interest monthly abd the 10k nex feb. this is part of what the future looks like .

Look up yield farming. I’m earning 360 a day on 85k. Not a joke.

There’s a channel on YouTube Called Finematics

Look it up learn grow and fuck the traditional money system

Awesome progress and your dog is so cute! You have way more in crypto than I do but I’m gradually getting there. I also have to really shift my thinking away from how I was taught for the last 20 years on the proper way to invest. The financial professionals we’ve been trained by were Boomers and Gen X. Most everything we’re seeing fortunes made from was created within the last 10 years. Not to say there isn’t merit to the tried and true ways of investing, but hard to argue with the power of all the exponential growth we’ve seen.

I’m living vicariously through your travels. Still afraid to go anywhere alone, maybe one day I’ll grow a pair.. Or just need to make new friends in other cities. 😀

Hey Elliot! I’m actually really enjoying the extended solo travels. I can do whatever I want and follow my whims on where to visit. Although it would be great to have someone to split costs. I’ve also been fortunate enough to have people to hang out with (so far). I factor that in to where I go – although I’m going completely alone and unknown into a few places just because I’m curious about them.

And re: crypto – I’m still doing the “traditional” investing stuff. Maybe in a few more months once I’m satisfied with my cash levels, I can put a little more cash into experimental investments. But prolly only 3% to 5% of my total portfolio. I’m torn between missing out and sticking to the tried and true method.

I love following your journey too! I’m trying to post more on Insta and here of course. Always finding my rhythm with that stuff. Hope you’re doing well! Thank you for reading and commenting! 🙂

As a nomad, where do you pay state taxes if you’re all over the US?

For work purposes, I still have everything set to Texas (no income tax). For mail, I’m having everything sent to my mom’s house and she can read/forward the important stuff wherever I am.