I’ve been taking stock of my complete financial life: mortgage, credit cards, savings, and other debt.

At one point, I became obsessed with getting rid of my student loans. They’re an ugly stain, a black cloud always marring my ideal financial vision. Last year, I made a $7,000 payment just to start chipping away at the principal. I see now it was an emotional, not logical, decision.

Since then, I don’t feel like made much progress. And deep down, I want to save more in my IRA account. I was paying so aggressively that I wasn’t saving as much.

After running the numbers, I’ve decided to say screw the student loans. I’m gonna pay the bare minimum and invest everything else.

Past Harlan went to school. Future Harlan is gonna save his pennies. (Third person tense activatedddd!)

I just wanna be carefree. For me, that means giving up the ghost of paying off my student loans – I’m gonna invest the rest

I’m tired of missing out on opportunities.

Why I’m forgetting about paying off my student loans

First things first: my loans are all federal. That means I make payments to a government loan servicer, have protections against hardship, and most importantly… with my IBR plan, they’ll be forgiven after 25 years.

My loans originated in 2011, so they’ll be gone in 2036 – which is in…

*gulp*

17 years. I’ll be in my 50s by then – and I signed those promissory notes when I was 17. Isn’t that crazy?

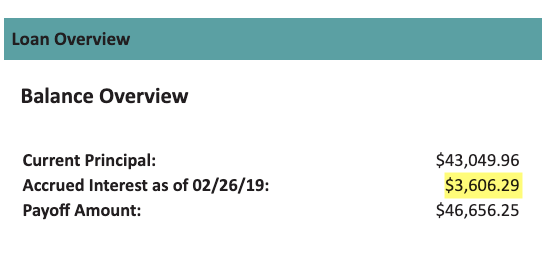

I don’t have a fixed payment. Instead, I re-certify every year. And somewhere along the line, I decided I wanted them gone and even got a 0% APR credit card to pay them down. I currently owe ~$46,000 (the average is $30,100).

I hate everything about Mohela – the apples, the logo, everything

That pains me to write, but my retirement savings far exceed that.

It wasn’t a financial decision rooted in reality. I decided removing the mental burden of having them would be worth more than saving. After all, with a 6.75% interest rate, that’s a guaranteed savings as opposed to hypothetical returns.

And then, once they were gone, I’d put all my resources into padding out my nest egg. Until I slapped myself in the face and looked closer at the numbers.

Despite how I feel about having the student loans, I was forgetting one huge truism: the sooner I invest, the more I’ll earn with compound interest + time on my side. The 8th wonder of the world – duh. And all my returns were actually over 7%.

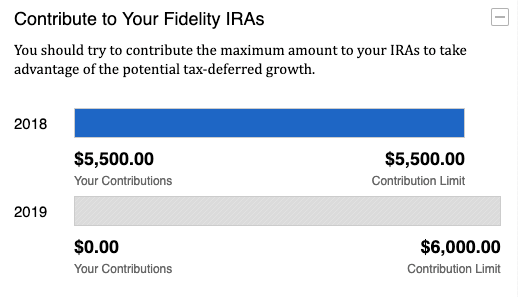

Plus, going back to feelings, it bummed me out to max out my 2018 IRA contributions before filing taxes in 2019. In other years, I maxed it out at the earliest moment – not the last.

I maxed out 2018, but 2019 has a ways to go. It will happen

I spent time thinking about it and looking at the numbers. Investing is the clear winner. Those student loans will just have to deal.

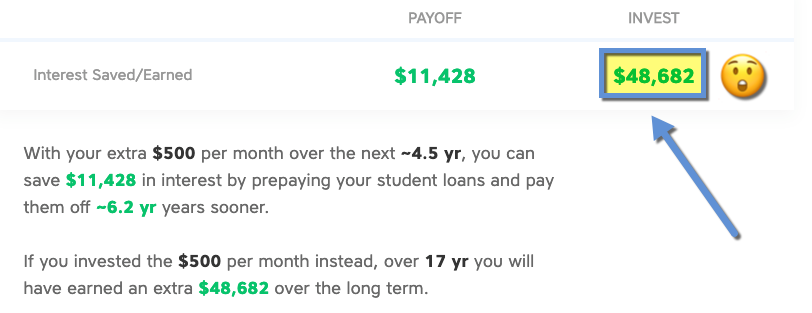

By the numbers, I can earn 10s of $1,000s more

I played around with online calculators and liked Student Loan Hero’s Student Loan Payoff vs. Invest Calculator the best.

That’s a huge difference

For this equation, I set:

- Investment returns at 7%

- Loan interest at 6.75% (cuz it is)

- Extra payment at $500 per month (how much I’d need to max out an IRA at $6,000 / 12)

- Contribution timeframe at 17 years (at which point, my loans will be forgiven)

This is crazy to me. And now I feel salty for having “wasted” that $7,000 payment – should’ve thrown into into an index fund and called it a day.

Or saved it to put down toward more real estate. Or just kept it. That’s money I literally threw into the wind. And the sad thing is most of it went to interest and didn’t even touch the loan principal… 😫

I prolly won’t repay my loans in full, but it’s not a cure

With my IBR plan, the student loans will be forgiven in 2036. If I make the minimum payments, I’ll likely never pay the entire principal. Which, cool. Because why would I go through extra effort to repay them when they’ll get thrown out eventually?

It’s a waiting game. And while it sucks to wait 17 whole years, if I steel my mind for the long term like I have with my investments, I’ll end up ahead, right? Kinda.

Interest works both ways – for you or against you

The problem is the IRS treats any amount forgiven as taxable income that year. Assuming my payments cover the interest, and maybe a little principal, they’ll still be around $46,000 in 2036.

I don’t know what my tax bracket will be by then, but I could be on the hook for a big tax payment – which might also potentially require a payment plan, as well as eff up my taxes that year.

So forgiveness isn’t a magic bullet – I’ll have to plan for a year of wonky taxes. One big payment doesn’t beat the potential gains I’ll realize with a 17-year investment horizon. And it’s a hell of a lot cheaper than paying off the loan in full.

The IRS always wants their money. Death and taxes. C’est la vie.

I can deduct student loan interest AND IRA contributions on taxes

Talk about a one-two punch. Not only can I save for the future, but save every year on my taxes. (Other than in 2036, which just is what it is.)

Paying the minimum on the student loan (most of which goes to interest), and maxing out a traditional IRA can save me cash over the next 17 years. Pretty sweet.

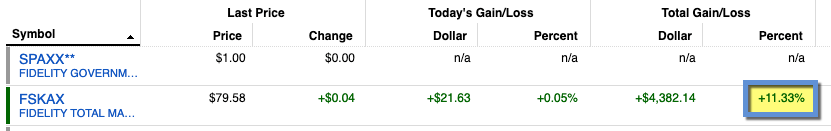

My investments have returned 11% (or more!) the past couple years

I know, I know:

Past performance is no guarantee of future results.

But still, it’s pretty cool. Actually, none of my stock index funds has returned below 7%, pretty much ever.

Here’s hoping this upward trend continues

This is where the “hypothetical” stuff comes into play. Barring a huge downturn, investing and earning compound interest is a better choice.

Or I could save and buy another property

I closed on my place in Dallas in December 2015 – and got an excellent deal. Homes were dirt cheap back then.

Right when I put in my offer

Right now, my mortgage is paid down to ~$148,000 and my place is worth ~$230,00. That’s a profit of over $80,000 (not accounting for repairs, transfers, and realtor fees, of course).

It’s increased in value by 26%, and Dallas is still exploding – I don’t see the value falling any time soon. This might be lightning in a bottle, but if I could find another place with that rate of return, it’d be germane to save cash for a down payment instead of plow it into student loans.

Or I could sell the place and pay the loans off in one fell swoop and profit anyway. Hey – there’s an idea.

Bottom line

It pisses me off that I got so on the war path with my student loans that I lost sight of other things I could’ve done with that valuable tool: money. It’s just a tool.

Instead of a guaranteed savings of 6.75% interest, I could’ve invested it, saved it, or bought another property. But I didn’t do that when time was on my side. I lost a year. Grrr. 🤬

Lesson learned. I only say this because I have a federal loan with an expiration/forgiveness date of 2036. So it’ll be taxed as income in, oh, 17 years.

Still, a one-time tax payment is much cheaper than paying back the entire principal.

Moving forward, I’m all about maxing out my IRA, and saving for another piece of property. I’m thinking Memphis – although I don’t know if I can recreate the appreciation of my Dallas place. That one took off like a rocket. 💥

I’m glad I took time to examine my overall financial picture. Without making it a priority, I might’ve never given it the care it deserves. I caught it and have a new, healthier plan.

Student loans plague a good portion of my generation, with the average balance at $30,100. Ah man, art school. Was it worth it?

No use thinking of the past. Now I have a plan for the future and that feels much better.

Have you sat down to have a ponder over your finances, including your credit cards, loans, and savings? Are you correcting course in any way?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Did you take into account that you will be paying regular income taxes on the money you are pulling out of that IRA at retirement? Why not contribute to a Roth? I felt the same as you previously, but my loans were at 8% and after a few years my income quickly rose above the limits for claiming traditional IRA dedeductions and the student loan interest dededution. For the last bit of loans I did take advantage of a 0% interest $0 fee balance transfer from Navy Federal Credit to pay the last $12k over 1 year. (They seem to run this annually).

The other problem I had was that originally my payments were on a 25 year repayment plan. I looked into IBR, but because my income had risen from being a new grad to a more reasonable level, they wanted over $600 a month. If your income keeps rising, but you let the interest keep growing, won’t you get to a point that your minimum payments become quite a bit more than if you paid it down sooner?

I can definitely say I’m very glad they are gone.

Yessss. I think/hope I’ll be a lower tax bracket in my 60s/70s, so paying lower taxes later is better than higher taxes now. That might change if my income goes up and I no longer qualify to deduct my contributions, which would be great, actually! I can always recharacterize the contributions the following year if I can’t deduct them (which I’ve done before).

With IBR, you pay the lower of their calculations OR the standard repayment, so it sounds like the higher number happened when you hit the standard repayment level – and that’s calculated to cover the interest every month. So I’m not super worried about it, really.

I’d like them gone, but they’re real and still definitely there. I’m sure it will continue to evolve yearly – and I’ll always adjust accordingly. Thanks for sharing your thoughts! Glad you’re done with your student loans – wish I was there with you. Will change over to Roth once I hit the income thresholds.

Harlan, while it’s certainly possible you are in a lower bracket then, I wouldn’t count on it. Tax collection rates are near historic lows with government debts increasing and the Fed using QE to support the stock market. I don’t think putting most of your contributions in a Roth is bad plan.

Also, to Michael’s comment, you do realize you can still do Backdoor Roth Contributions, right? If you’re not familiar with it, Google it.

I don’t have a 401k at the moment – but these are excellent points. As with everything, I try to balance and diversify, and it changes each year. Thanks for the tips, J!

Dude, don’t buy into the investing bullshit until you pay off your debts. Pay off all debt first.

If you don’t think 6.75% guaranteed is an amazing investment, you need to rethink. Everything do6esnt go up 20% per year forever. There will be a crash and pretty soon.

Oy. When a crash happens, I will have to start my plan over again. I’m just hoping I can earn enough to cover losses while things are trending up (which I already have, thankfully!).

Thank you for reading and commenting, Gene! I appreciate hearing from you.

What I notice is that you want to shirk your responsibility. You took out a loan you should repay it. Not wait 17 yrs and hope it goes away. Its hard to build wealth with debt hanging around.

If you have to sell your house to pay it off I think you should do it. Or like Ramsey would say eat beans and rice for a yr or two and knock the debt out.

I like your blog and thanks for sharing Harlan.

Thank you so much for reading! I’m sure I will ponder it more – and perhaps see it all differently. I write here to work through my thoughts, and I appreciate hearing from you. I like your blog, too. 🙂

I promise you I will keep thinking it over.

Dave Ramsey is great for folks who can’t manage their debts. If you are receiving a rate of return (after tax credits) greater than the interest on your debt, math would say to continue doing what you are doing. Dave is taking into account most people being emotional; banks/bankers know better than this. Discipline is the key!

As a fellow millennial that just paid off all his student loans, this is my message to you. The system is designed in a way to keep you in this bubble until you are old, dying and have no capabilities to function in society. It wants you to constantly make payments with the promise that you will be taken care of during retirement. But when is that actual retirement day? Even if you have all your financials in check and can seem like a better deal to diversify your investment instead of clearing your debt, don’t, because there are much smarter ways to increase your tax cuts. Retirement savings is important and you can always save when you are in a better income position, but postponing your debts doesn’t mean it will stop, even for a month.

Hey Bernard! I know they won’t stop – even for a month. I intend to keep paying them.

But waiting till I’m in a better income position could translate to $1,000s of lost accrued interest – and the loans will always be there, until they’re not. If I continue to do well with my writing, then sure – I could pay off my loans AND max out my retirement, which is ideal. For now, I’m thinking I should put the money where it will have the greatest impact. And that’s directly to combat when I’m old, dying, and have to capability to function in society.

When is the retirement day? I can’t say. I can’t withdraw penalty-free until I’m 70, so I expect then. With that type of horizon, I want all those years to work for me. Losing even one could be a game-changer, especially with a strong market.

I’m glad you paid off your student loans. It’s always a big decision. Now I’m curious – are you putting that cash toward your savings? I’d love to hear more about your goals! Thank you so much for reading and commenting!

Harlan,

Small correction. You can withdraw from most retirement accounts IRA, 401k, Roth without penalties starting at 59.5 (using the rules today). IRAs, but not other accounts REQUIRE you start taking Required Minimum Distributions by tax deadline after you turn 70.5 years old.

Ah yes, of course. You know, I’ll try to wait until they force me to start taking those distributions. Anything could happen of course, but more time to grow is usually better. Thanks for the eye to detail – pleases my lil Virgo heart lol

If that $7k didn’t 100% go to the principal, you truly made a poor decision. I definitely don’t think your idea is the slam dunk that you think it is, and you are forgetting (or assuming) many factors. Considering you took out your loans in 2011 does not surprise me. You have had the luxury of a somewhat robust economy. Lets just say if someone had your same idea and executed it in 2006, they would still be licking their wounds today (s&p500 gained 3% in 2007 and an eye watering 38% loss in 2008). Since you are talking about IRAs though the fact that you plan to hold this money long term somewhat negates this.

A few things to consider:

1. My back of the napkin calculation tells me that if you have $46k of debt at 6.75% interest, you will pay this off in 17 years at $380 a month. Are you paying less than that now? I am not that familiar with IBR but aren’t repayments income based? $46,000 sounds like a lot of money, and it is, but its not astronomical and I have a hard time believing that won’t be paid off by the 25 year mark.

2. That interest calculator is comparing apples to oranges. If you pay extra on your loan and its done in 5 years, then that’s 12 more years of payments you can invest or do whatever you want with. Its hard to compare that to the profits you might get over 17 years. The calculator also neglects to account for the taxes you would pay on that IRA.

3. Opportunity Cost – That’s cool if you think your loan will be forgiven in 17 years, but it will always go against you when applying for a loan until its gone. Lets say you find a super hot property that you think you can make a profit on. If your student loan is paid off your borrowing power is exponentially higher. If you went the IRA route you would have a non-liquid asset that takes years to turn any sort of respectable profit.

In short, I don’t think you have a bad idea, but don’t look at this like its black and white. I’m guessing right now maybe a 35% of your payment is going to the principal and 65% going to the interest. You don’t need to do something insane like pay off the loan in 5 years. You could easily add $150 to your monthly student loan payment and it would likely knock a decade off of the loan.

That’s how these payments always go: interest first, then principal. When I made that payment, that was the built-up interest. So I would’ve had to’ve paid even MORE to eat the principal. Whether it was a poor decision or not is moot – that’s just how it goes.

I do have to operate within my timing, and acknowledge there may be another 2006 to 2008 down the road. But with my timeline, it’s impossible to know – so I’ll just have to accept it if and when it happens.

My current payment is $543, and I just submitted my recertification. So I might end up paying off the whole thing in the next 17 years if I keep making more – even with the minimums. In that case, I would get the best of both – paid off loans AND a focus on investments.

I can’t possibly know my tax bracket beyond 2040, so factoring in the tax rate for that year is also theoretical at best – although I’d like to think in retirement it would be much lower than my working years.

And having those 5 years of compound interest could translate to $1,000s more at that time. As opposed to “losing” them by paying off the student loans first.

I haven’t found my borrowing power has been affected by my student loans at all. If it was, I’d surely already have it paid. It’s just part of my debt-to-income ratio and that’s the extent of the effect (at least for now).

I agree with you – it’s not black or white. It might – probably WILL – change. I might increase the payment now and just pay the minimum if my income rises and the payment starts touching the principal. I just want to invest while I still have precious time on my side. The loans will be there either way – but I feel like I need to get that money in the right place sooner rather than later.

Thank you so much for sharing these thoughts. All are valid and I truly appreciate the time and brainpower that went into them. <3

This is terrible advice and super irresponsible to recommend as an idea. The most fundamental rule of investing is to only start once your debts are paid and when It can be see as extra unneeded income.

As someone of color I hope you realize the privilege you have in even mentioning this and thinking you could be taken seriously.

Regardless I want the best for your financial situation and this isn’t it. Your still young. Pay your debts and get over it like the rest of us.

In September 2017 I had over $20k in credit card debt and between then and a few months ago I drove my ass off doing gig jobs like uber and amazon flex on time of a regular job and made it out. And I’m sure my regular job makes no where what you make and i certainly don’t have what you have in assets. So MAN UP and pay your debts. You got an education, your using it, pay it forward so the next person can get there’s.

Ironic how a certain group of people always talk about how another group are lazy and don’t want to pay bills butttttttttt ……. :p

Thank you for the reply! So I think it’s important to recognize the delineation between high-interest “bad” credit card debt and lower-interest “good” debt. I’ve already been approved for mortgages even with my student loan debt – it’s just recognized as a “normal” expense for most peeps of my generation and my payment is always included in my ratios.

Over the next 17 years, I may end up paying it off inadvertently as my income rises. I do agree with you though – if I had credit card debt, I would prioritize that above all else. But with only a mortgage and these loans, I feel like I can produce better results with investing. Either way, the government will get paid with both higher taxes and higher payments so it’s not like I’m skirting the bill. Rather, just choosing to pay the minimum based on their calculations and prioritize my own future – because I’m not expecting to rely on Social Security and other programs long-term.

Curious to hear your thoughts – thank you for opening the dialogue!