Always a good feeling to wake up to an extra $50 when you don’t expect it. Last week, I talked about my experience getting the Amex Serve card after ditching Bluebird. I’m currently testing out different banks to see if they charge cash advance fees + give me points for using credit cards. So far, I’ve confirmed US Bank does not charge any fees and they already posted my Club Carlson points.

Serve’s $50 Bonus Promo

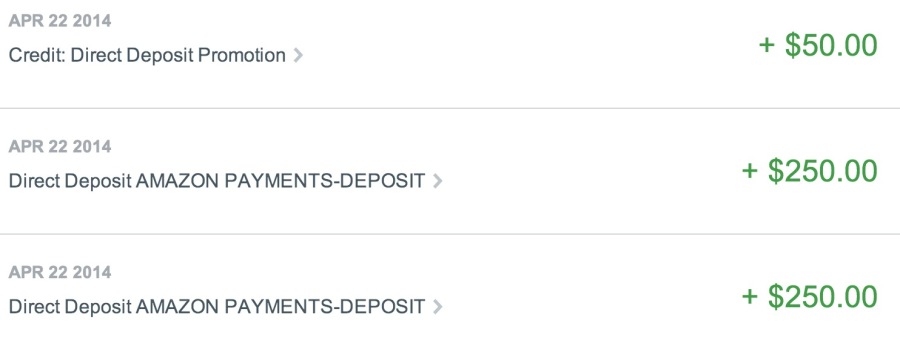

Right now and until the end of June, Serve is running a promo that gives $50 for two direct deposits of $250 or more. The questions in mind when I saw this were:

- Does Amazon Payments count as direct deposit?

- When will the bonus post?

Bluebird generates a monthly statement like any other bank account. I thought maybe Serve would do the same thing and post the bonus at the end of a statement cycle, that is, if Amazon Payments counted at all.

I can confirm that Amazon Payments does indeed work as direct deposit AND that the bonus posts as soon as the second direct deposit clears.

I loaded $1,000 to Amazon Payments after getting in on the recent (and current!) 6.6% cashback at the Arrival portal. It’s a great way to generate some points and liquidate Amex gift cards. In fact, I just ordered a second round.

From there, I sent over two direct deposits of $250 to my Serve account simultaneously.

This morning, all the cash was in the account with the bonus $50. Can’t beat that!

Bottom line

If you’re at all interested in getting a Serve account, I highly recommend signing up using this promo link and scoring an extra $50 for doing so.

Serve is a great complement to the points and miles world if you’re far from a Walmart and can’t load up Bluebird at CVS any more. Or if Walmart stops accepting gift cards for Bluebird reloads. (There have been reports that this might be starting to happen.) $1,000 a month is the credit card load limit (on the non-Isis version) for Serve accounts. It isn’t much, but it’s enough to pay a few bills and still get some points rolling in. Every little bit helps. It really does! – I did some quick math on this post.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Helpful post! Can you do Amazon Payments direct deposits with a credit card?

Chuck, this answer is yes, but it’s a bit roundabout. You can’t send money directly to yourself with a credit card, then transfer it to your bank account. You need a partner. You send them $1,000, and they send you back $1,000. Once you have money in your Amazon Payments account, you can then withdraw it to your bank. Just make sure you have it verified – it should go through with no problem.

Also, I send a couple of payments (2 or 3) totaling $1,000 and my partner does the same. (So maybe $700, $200, $100 – or something like that.) Just so it doesn’t look *too* suspicious. Once in my Serve account, I then pay my rent.

How, exactly, do I *send* money via AP to Serve. I only have the option in AP to send money to folks via email address. I don’t have Serve yet so I don’t quite understand how this works.

Hi Heddie!

So, your Serve account is like an ordinary bank account. Within AP, you have the option to withdraw your funds to a bank account. In there, you’d plug in the account and routing info provided to you by Serve. You can only withdraw funds that have been sent to you by someone else, which creates the need for a buddy to make this system work.