Dang, I just checked my credit file, and it looks like I closed my last Citi ThankYou Premier card in June 2017. I still have my Citi Prestige card open (and can’t wait to see how they refresh it this month).

According to Citi’s rules, I’m not eligible to earn another bonus on a ThankYou card because I’ve opened OR closed a ThankYou card within the last 24 months. But man, if you’re eligible to apply for this offer, there is absolutely no reason you shouldn’t hop all over it – especially if you’re over 5/24.

I have some FOMO about this offer. Because this offer is an easy $900 toward travel.

I use Citi ThankYou points all the time – including for flights to Belgium to stroll the gorgeous river that runs through Bruges

Here’s my expert analysis. 🧐

Dat Citi ThankYou Premier 60,000 point offer tho

This card earns:

- 3X Citi ThankYou points on travel, including gas stations

- 2X Citi ThankYou points on dining and entertainment

- 1X Citi ThankYou point on all other purchases

There is a $95 annual fee, but it’s waived the first year.

Each Citi ThankYou point is worth 1.25 cents each when you book travel through Citi. The sign-up bonus alone is worth $750 in airfare – on any airline, with no blackout dates.

But it’s that 3X category I really like. If you spend a lot on travel, or if you commute and spend a lot on gas, you can do well with this card. And if you complete all your minimum spending on travel and gas, you would:

- Earn the bonus of 60,000 Citi ThankYou points

- And earn an additional 12,000 Citi ThankYou points ($4,000 X 3)

- For a total of 72,000 Citi ThankYou points

Those points would be worth an astounding $900 (72,000 X 1.25) in airfare booked through Citi. That’s an excellent deal for a card with the annual fee waived the first year.

Even if all your minimum spending is in the 1X category, you’d earn 64,000 Citi ThankYou points – which are still worth $800 toward travel (64,000 X 1.25).

The Plastiq angle

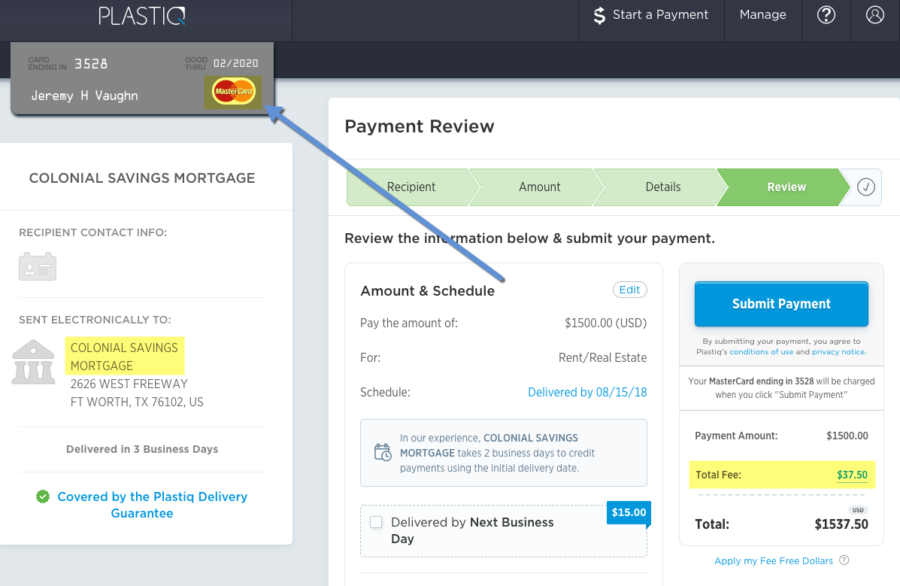

This card is a MasterCard – so you can use it to pay rent, mortgages, car notes, tuition, student loans, utility bills, and more with Plastiq.

If you used the ThankYou Premier card to make $4,000 worth of payments on Plastiq, their 2.5% fee would be $100 ($4,000 x 2.5%). Not bad. The cost of fees would eat into the value of your sign-up bonus, but it’s something to think about. Especially if you have trouble spending that much organically in a few months.

Now for the advanced level

You can also transfer Citi ThankYou points to 15 airline loyalty programs to book award flights:

- Avianca

- Asia Miles (Cathay Pacific)

- EVA Air

- Etihad Guest

- Flying Blue (Air France / KLM)

- Garuda Indonesia

- Jet Airways

- JetBlue

- Malaysia Airlines

- Qantas

- Qatar Airways

- Singapore Airlines

- Thai Airways

- Turkish Airlines

- Virgin Atlantic

They’re all at a 1:1 ratio, except JetBlue – which has a 5:4 ratio. And you have to transfer points in 1,000-point increments.

Look at those airlines. There’s nothing domestic with a 1:1 transfer. But there are some useful gems in there. To max them out, you have to get (or be) super geeky with your points.

Etihad miles are useful with Brussels Airlines and American, too – and Citi ThankYou points transfer 1:1 to Etihad. So you can see all the peeing statues in Brussels 💛

That’s not to say there aren’t easy wins. You could transfer to:

- Singapore Airlines and fly to Hawaii on United for 35,000 miles round-trip in coach (you can book this on Singapore’s site)

- Flying Blue for cheap domestic travel on Delta (price varies, but they have a calculator – you can book on the Air France site)

- Etihad for cheap hops to/from Brussels for 5,000 or 7,000 miles each way (must call to book and takes about a week for the transfer)

- Virgin Atlantic to fly from East Coast to London for 20,000 miles round-trip in coach (there are fuel surcharges, but could be helpful for expensive flights)

- Qantas for hops around Australia, or save your points and fly Emirates First Class

- Avianca for cheap flights with Star Alliance partners

Of all Citi’s partner airlines, I’ve personally used Singapore Airlines and Flying Blue the most. Oh, and Etihad.

Citi ThankYou points definitely have particular uses. They aren’t as user-friendly as, say, Chase Ultimate Rewards points. That said, this offer is a nice way to boost your points balance. And you can never have enough flexible points!

Plus, you can easily get more than $1,000 in value when you transfer points, depending on your redemption.

Bottom line

The $95 annual fee is waived the first year. But it’s also one of the few cards with a solid 3X category for gas station spending. If you spend a lot on gas, that might make it a long-term keeper.

Depending on how you spend and redeem, this offer is easily worth $800, $900, or even over $1,000 in value toward airfare. And keep in mind, you can still use MasterCards to pay mortgages (and most other bills) via Plastiq.

This is also an easy win if you’re over 5/24 and looking for a nice bonus to earn. The only reason to NOT get in this offer would be if you wanna see what the new Citi Prestige refresh will be – because getting this offer will preclude you from earning another ThankYou card bonus for 2 years. If you have no interest in the Prestige card (or have already had one for over 2 years), now’s the time to rack up some more ThankYou points.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

When did you open your Prestige card?! I opened my prestige in July 2016 and I just got approved for the Thankyou Preimer this week August 2018 so I’m eligible for the 60,000 points correct

I got mine November 2015. But closed my other Citi TY Premier card in June 2017. Because of Citi’s rules, I have to wait until June 2019 to get another bonus – or reset the clock when/if I close my Citi Prestige card.

It sounds like you’re over 24 months so you should be eligible to earn the bonus!

Hey, Harlan!

I currently have a Premier card… Am I eligible for a second one (and the bonus, of course!)

We were on a cruise the last meetup. Any chance we could do it on a Friday?

Nah, they won’t let you have 2 of the same card type. That hasn’t worked for quite a while.

And yes, I can try for a Friday meetup – that might be super fun!

Thank you, thank you, thank you! 🙂

Hey Harlan – great write up of the card. Can I add that you can schedule fee free MasterCard payments through masterpass on plastiq up to $250. I’m paying my landlord $250 weekly through this card

That’s awesome – and an excellent point! I used it to pay my car note, which is under $250. Great promo for those small bills you need to pay as they don’t count against your fee-free dollars and don’t have any fees. Thanks for the reminder!

Harlan, help me out here pls..

1. CLosed TY Premier in July 2016 – so I am good here

2. Downgraded Prestige to Citi Preferred in 2017….- this one is confusing for me..

do i qualify or not in your opinion?

I don’t think so. I believe product conversions reset the 24-month clock because Citi considers it “opening” an account. Let me verify.

OK so if you kept the same card number, you should be good to earn the bonus. Data points are all over the place. It would be rolling the dice, but might be worth it – especially if you kept the same card number. Hope that helps.

thanks Harlan