I recently emptied my Citi ThankYou points account. Yup, I burned every single last point to stay at the Hyatt Ziva Puerto Vallarta. For my 4-night stay, I could’ve spent:

- 80,000 Chase Ultimate Rewards points (because it’s 20,000 Hyatt points per night)

- ~131,000 Citi ThankYou points (with the 4th night free thanks to Citi Prestige)

I asked a friend which would be the better option. “Whichever is easier for you to replenish,” was her advice.

Within my Chase Ultimate Rewards portfolio, I spend most on my Sapphire Reserve for 3X, and sometimes my Freedom for 5X. Within my Citi ThankYou portfolio, I spend most on my Prestige for 5X, and sometimes my AT&T Access More for 3X. And the Prestige 5X category gets the bulk of my attention.

If I spend $10,000 on flights and dining:

- On Sapphire Reserve at 3X, I get 30,000 points

- On Prestige at 5X, I get 50,000 points

For my same spending, I get way more rewards. For the hotel stay above, the earn rate was actually equal (80/3 = 131/5). But for transfers to airline miles, that’s the difference between getting 1 award ticket instead of 2 for the same spend.

Match your spending to a 5X category and see what happens.

For views like this, just burn Citi ThankYou points if your 5X categories are similar to mine

If you buy a lot of airfare, and eat out often, you’d do well to earn 1.67 more points per $1 – they add up fast!

Citi Prestige Vs Chase Sapphire Reserve (again)

You can scale the 3X vs 5X example above as much as you want:

- 30,000 UR = 50,000 TY

- 60,000 UR = 100,000 TY

- 90,000 UR = 150,000 TY

Now I respect the Ultimate Rewards program because transfers to Hyatt are valuable. That’s why I said use the Sapphire Reserve for hotel awards, and the Citi Prestige for flights.

This photo is here just for fun. Hello!

The more I thought about it, the more I realized how much better it is to collect ThankYou points for many popular flight awards. Especially considering both programs transfer 1:1 to:

- Flying Blue (for flights on Delta and SkyTeam partners)

- Singapore Airlines (for flights on United and Star Alliance partners)

- Virgin Atlantic (excellent for flights on Delta, especially to Europe)

By the numbers

For same $30,000 of spending on airfare and dining, the difference is stark. If the flights you want cost 25,000 miles round-trip in coach (a typical price), you could get:

- 3 flights with Sapphire Reserve (75,000 miles)

- 6 flights in Prestige (150,000 miles)

For $20,000 in spending in the same categories, you could get 2 flights with Sapphire Reserve (50,000 miles) or 4 with Prestige (100,000 miles).

In each case, because of rounding, you’re always just out of reach with the Sapphire Reserve and right on the nose with Prestige. Obviously this is just example that just happens to work and awards cost all kinds of prices – but the point is if you can make the most of Citi’s air transfer partners, you can get more award flights faster.

That’s certainly helpful for everyone, especially peeps with big families or a large travel group.

And yes, that’s a lot of spending – but the way it adds up is huge.

At those earning rates, you don’t need to think about using your ThankYou points. Earn ’em and burn ’em!

I’m not paying big bucks to make important dates any more – earn and burn, baby

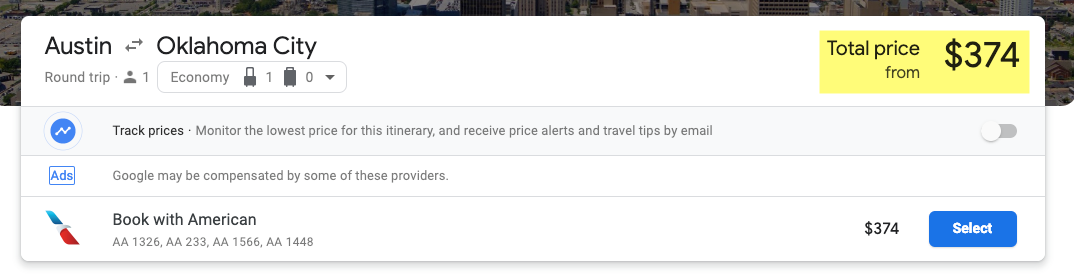

I already earned 20,000 more ThankYou points and just sent 16,000 of them to Qantas for a $374 round-trip award flight on American Airlines (which exceeds my 2 cent per point rule – score!).

It’s all in the pairing

For flight awards, the 3X or 5X earning rates are the make or break between being so close and having more than enough.

And within the UR and TY ecosystems, there are cards with plenty of 3X and 5X categories, like:

- 3X on travel and dining with Sapphire Preferred – UR

- 3X on travel, shipping, internet, phone, advertising with Ink Business Preferred – UR

- 5X on internet, phone, cable, and at office supply stores with Ink Business Cash – UR

- 5X in rotating categories with Freedom – UR

- 3X for shopping online with AT&T Access More (no longer available to new applicants) – TY

- 3X on travel and gas with Citi Premier – TY

- 5X on airfare, travel agencies, and dining with Prestige – TY

- 3X on hotels and cruises with Prestige – TY

I like being Prestigious!

I’m obviously zooming in on the Citi Prestige 5X categories. It’s the bulk of my spending and the main source of my rewards.

My 5X manna

The idea here is to identify where you spend the most and match it to a reward category. Then find the card most rewarding, and with benefits you like, for that spending.

Knowing your sweet spot, as shown above, can be the different between 3 award flights – or 6. That’s pretty huge.

Bottom line

I’m proclaiming Citi ThankYou points as my earn and burn points currency this year. Yup, I got places to go and I wanna get there on the double – quite literally.

Once I realized the huge difference between spending in 5X vs 3X categories, it was a no-brainer to keep my Prestige card another year.

In the example above, I got a $374 AA flight for 16,000 Qantas points (from Citi ThankYou). To earn 16,000 TY points @ 5X, I’d have to spend $3,200 on my Citi Prestige card.

With a 2% cashback card, I’d have to spend $18,700 to get $374 in rewards. Say what you will about steep annual fees – and this is just one example – but the difference is startling. And for me, these types of award flights are my norm based on my travel patterns.

So yeah, I feel good about earning and burning Citi ThankYou points – and jamming on my Prestige card. If you’re a frequent traveler who also spends a lot on airfare and eating out, this might be your jam too. I encourage you to find where you spend a lot of your discretionary income and see if you can get 5X (or as close as you can) for it.

What’s your go-to earn and burn currency for 2019?

Also see:

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Did you book the AA flight on Qantas website? Was it economy or business class? Thank you!

Yup, so easy! And it’s in coach, which is fine since the flights are both around an hour.

Thank you again, Harlan!

Just booked Aeromexico Business class 787 from Buenos Aires to Mexico City using Flying Blue (KLM/AF) for 70K miles pp. The transfer from Thankyou Points to Flying Blue was truly instant.

Amex charges for transfers to Delta, which would have made the out of pocket cost over $160 pp, and Delta was charging 77.5 Skymiles pp for the same flight.

People think I am being flip, though, when I am asked which points and/or miles are most valuable and I answer “whichever ones I need today.”

Thankyou is in the upcycle at the moment, and I agree we should “get while the getting is good.”

Good analysis, good post.

That’s so boss – happy to celebrate your success with you! Love hearing about your travels – cheers!

Thank you for reading and commenting. BA to CDMX sounds like a wonderful trip. Have so much fun!

I’d argue that if you’re spending $10000 on airfare, you’re doing miles & points wrong.

Yes and no. If a flight is super cheap, I’d rather pay cash and save my points up for something bigger. And of course the spend doesn’t have to be all at once, but spread out over time. You might also be getting reimbursed for work travel, booking for others, booking several cheap flights, etc.

Where is the Amex Gold in all of this? Since that offers 4X on groceries and dining, that’s basically as lucrative as the Citi Prestige, and doesn’t require as hefty as a fee.

Only works at US restaurants. Not interested if I can’t take it traveling with me.