Per the Flight Deal, fares to Dublin (and several other destinations), Delta is aggressively attacking fares to United hubs.

How aggressive?

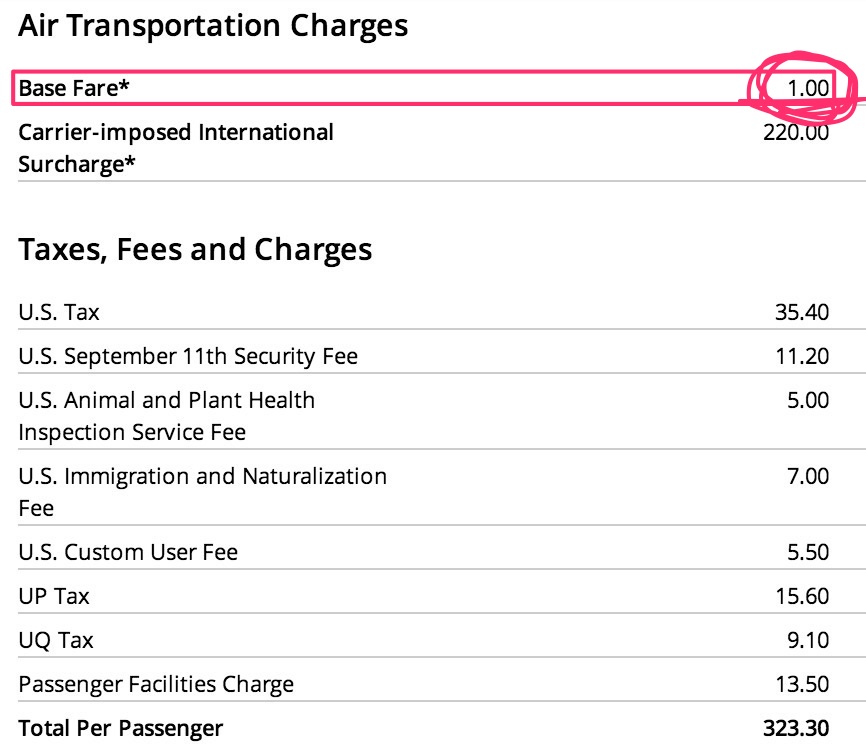

Base fares are pricing at $1 OR LESS. You are only paying the taxes and fuel surcharges!

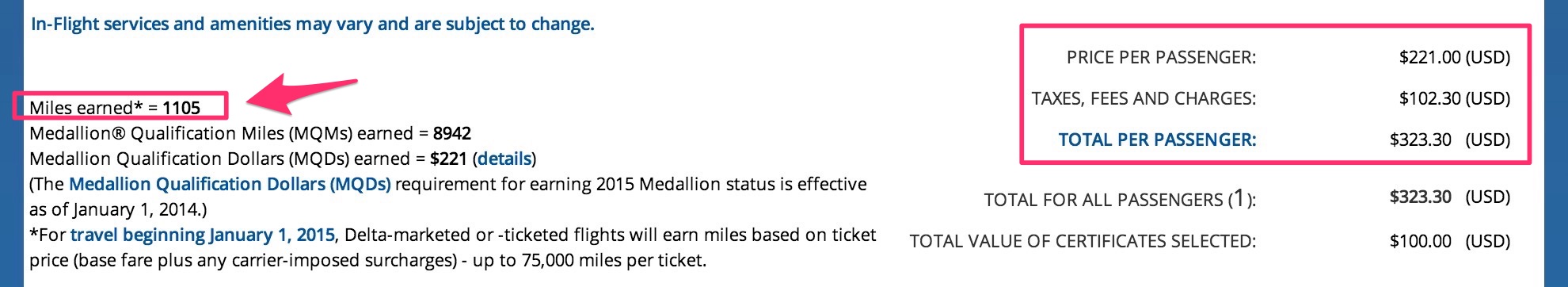

IAD-ATL-DUB is pricing out at $323 for several days in early May and it’s still available. I got in on this and can’t wait to go (although not thrilled that it’s on Delta – I credited to Alaska for the first time).

I will earn ~4,500 Alaska miles by crediting to Mileage Plan even with the V fare bucket. You’d earn just 1,105 with SkyMiles

In addition to all of this, I had a $100 egift certificate I bought with my American Express Platinum back in the day and never used, which brought my total down to $223 round-trip and all-in. I’ve always wanted to go to Ireland, and at just over $200, I couldn’t say no!

If you want to get in on this, I’d recommend booking ASAP. I’m usually not one for breaking news, but I’m super excited about going to Ireland and wanted to share in case anyone else would like to go. Lots of other cities/countries/continents/airlines are included in this sale so play around get yourself a great deal – especially to a place you’ve always wanted to go!

Be sure to look at the Flight Deal links above and play with dates into and out of the hubs. A list of airline hubs is here and the best place to check out flights is the ITA Matrix.

Good luck and godspeed!

Also see:

Also see: