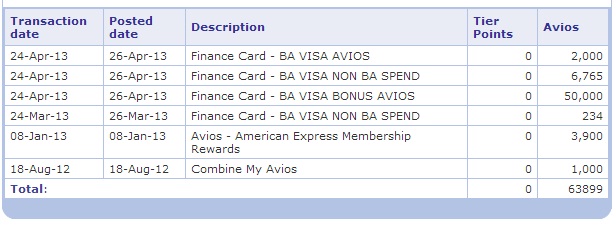

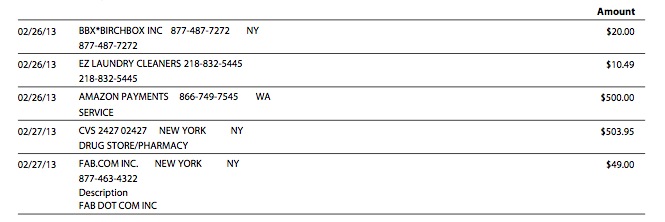

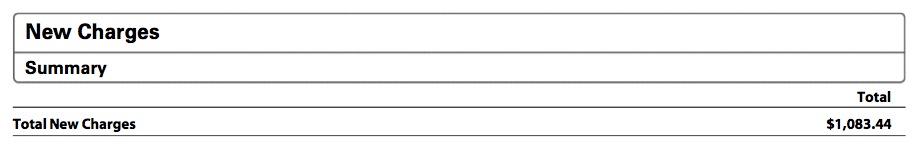

Since meeting the first spending requirement on my new British Airways Visa Signature, I have become Avios-rich to the point where I don’t know what to do with them all. It’s introducing all sorts of new issues, including problems I love to have (see: Dilemma of the Day: Which Caribbean Island?).

What could I do with 64,000 Avios?

- Take 7 trips to Montreal, Toronto, Boston, DC, Charlotte, or any other number of cool cities

- Take 3 trips to islands in the Caribbean

- Visit Vancouver for a long weekend

- Go back to Hawaii

After I meet the next set of spending requirements, I’ll have well over 100,000 Avios and can do even more. I’ve also just discovered the BA eStore, which includes a few merchants I shop regularly at great payouts. I’m really getting into Avios for their practical purpose of short-haul flights (and for getting to Ireland on the cheaps!).