The Oklahoma house is closing on Friday after being on the market only 6 days. I’m thrilled, sad, nervous, etc.

Thrilled to no longer make two housing payments, sad because a ton of bad stuff happened to us in that house, nervous because I don’t want any last-minute surprises, and etc. because.

THIS BABY. Three months old

I’ve been using my credit cards to get us through this patch and very much looking forward to paying them off with the money I get from the sale.

But I also discovered a tax lien sale and have a few properties on a watch list. The auctions are in late April. So, I’m going to hold the money for a few weeks and see what I can do there. If nothing, then I’ll eradicate all my credit card balances.

And if so… well, I still have until October with my 0% APR rates. Either way, not too worried and seeing a lot of upside and potential.

One thing is certain: My net worth will see BIG gyrations this month. I am more at peace with it now, yet I remain hopeful.

For one thing, I didn’t factor in the $20,000 it would cost to sell the house…

April 2024 Freedom update

The baby is doing so good. She’s sleeping more and has already doubled her birth weight. She’s three months old and so precious. We’re all settling after many recent transitions.

Mood AF

I’m traveling tomorrow to get the house sold. I think I’ll get around $36,000 after everyone gets their cut. I was hoping for $40,000, so that’s pretty close; I’m pleased.

I’ll be removing the house as an asset and the mortgage as a liability from my net worth calculations after it’s paid. I’ve been using Zillow’s “Zestimate” (which was actually super accurate in this case), but didn’t factor in transactions costs… so that will drop my net worth.

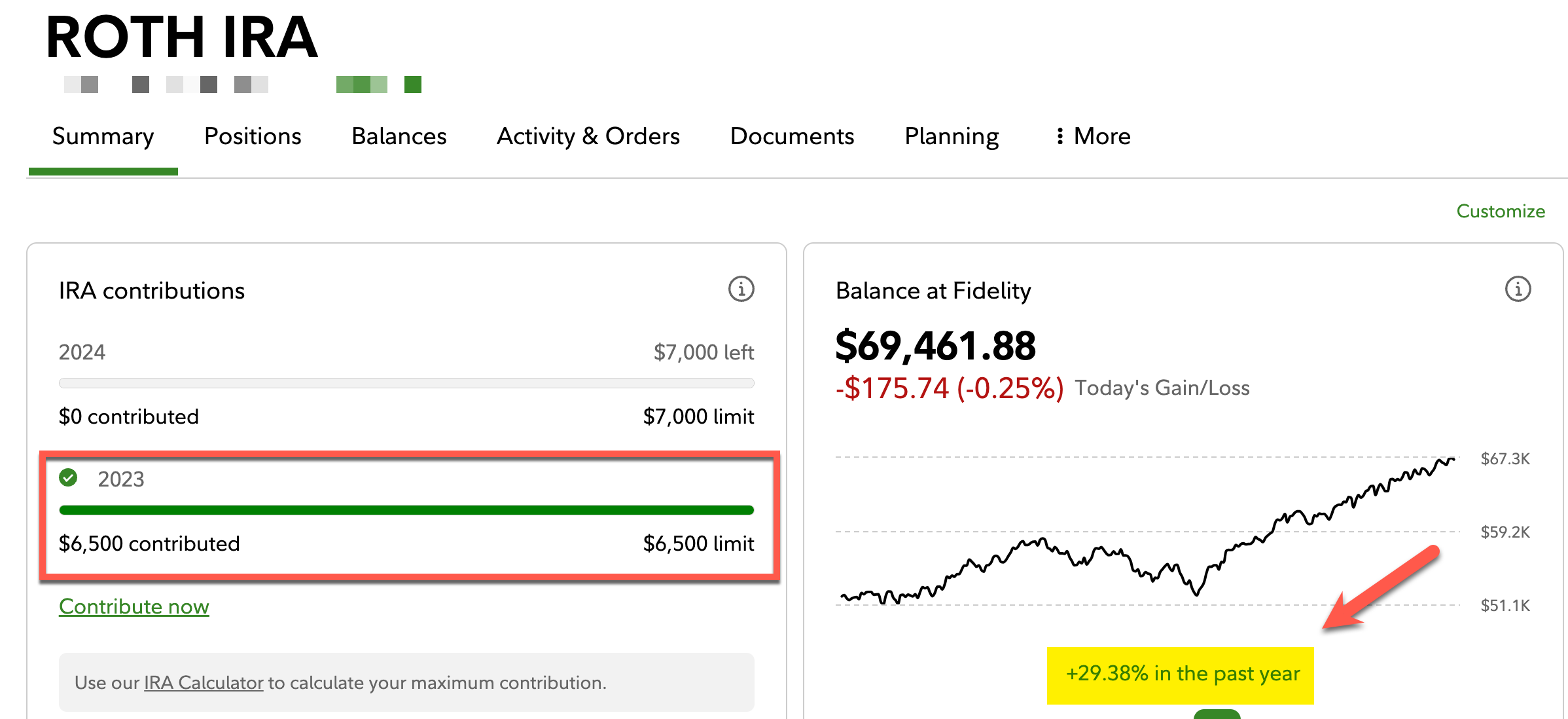

I’ve diligently kept contributing to my 401k and maxed out my 2023 Roth IRA, and last month saw 10% gains in the stock market.

So, those things could cancel each other out. At that point, most of my net worth will be my investments (which are sooo close to $300,000), and the market will dictate a bigger slice of it.

I am eager to see what happens in April 2024. I just have this feeling like… something big is going to happen.

I’d love if one of the tax sale properties worked out. Even if it did, that’s a chick that could take a year to hatch because of the redemption period (where the owner can come forward and pay the taxes to get the property back). And even if, the interest rate is 12%, so it’s all a win-win: I either get high interest or a new property. Or nothing—this is literally my first rodeo.

This month’s progress

It’s been hard to stay afloat. Everything helps, but having two housing payments and keeping five mouths fed and five booties wiped and/or diapered is soul-crushingly expensive. Though I realized nearly $7,000 in stock gains, I had to float expenses on credit cards and that resulted in a small overall gain of “only” $1,442.

Also, selling a house is expensive. The buyer’s insurance company required that I trim one tree and take down another. Well that was $1,000. Then the inspector came, and I had to make some small repairs. Those were another $1,000. Plus I’ve been paying two power bills, two water bills, two trash bills… Not to mention all the other little crap. It’s all been so much.

But I got paid a week ago and thought, you know what? I’m gonna max out my 2023 Roth IRA while I still can. So I did.

BOOM. This felt so good

I’d been meaning to complete that goal for a while and decided everything else could wait for a moment. Now I can start on my 2024 Roth IRA and my other financial goals. Selling this house is going to free up a lot of money that was getting eaten by maintaining it and getting it ready to sell.

I’m breathing a big sigh of relief, and feeling this is a huge weight lifted. It feels like my 2024 can really start now.

Check out this cute n cozy situation

To recap this month, I:

- Maxed out my Roth IRA with the last $2,500 stretch

- Continued investing in my 401k, HSA, and Roth IRA

- Put $1,000 toward SCHD (Schwab US Dividend Equity ETF), a high-dividend stock in my Roth IRA—curious to see how that performs

- Paid rent with my Bilt Mastercard and am getting into Bilt points all over again

- Still got more gains from a strong stock market to reach another new net worth high, even if it wasn’t “much”

- Spent thousands to get the house ready to sell (what a racket)

By the numbers

$363,000. Wow. Getting closer to that $400K mark. Then that last $100K toward my $500K goal should go a LOT faster than my first $100K.

Here it all is, in cold blue daylight:

| Current | Last Month | Change | 2024 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| Overall investments | $282,623 | $275,652 | +$6,971 | As much as possible | |

| Roth IRA 2023 | $69,455 | $65,731 | +$3,724 | $6,500 (in new contributions) | COMPLETE! |

| Roth IRA 2024 | $0 | $0 | xx | $7,000 (in new contributions) | Starting May 2024 |

| Taxable brokerage + UTMAs | $3,731 | $3,634 | +$97 | $25,000 (total invested) | |

| Savings | $495 | $418 | +$77 | $30,000 | |

| Primary home equity + appreciation | $56,224 | $61,524 | -$5,300 | $70,000 | |

| Raw land | $40,400 | $40,400 | xx | No goal, just including for completeness 🙂 | |

| LIABILITY | |||||

| TDB | ? | ? | ? | ||

| Net worth in Empower Personal Dashboard | $363,002 | $361,560 | +$1,442 | $500,000 (overall goal) | Track your net worth with Personal Capital |

Warren wrote “Dad” in sidewalk chalk

I’m moving a lot of money around this month. I also went ahead and decreased the value of my van and hatchback (the van has a payment, the hatchback is paid off). That shaved off $3,000. I used the Kelley Blue Book values and rounded down to the lowest number, to keep myself nice and honest.

Once I pay down the credit cards and build savings, I’d like to pad out the kids’ UTMA account and contribute more to my 401k. Maybe later this year (?!).

Short- and long-term goals include:

- Build my savings account again in 2024

- Work up to 15% in 401k contributions

- Put more money into Beck’s UTMA

- Contribute to new baby’s UTMA

- Max out my Roth IRA for 2024

- Buy more property

April 2024 Freedom update bottom line

- Link: Track your net worth with Empower Personal Dashboard and get a $20 Amazon gift card (this is where I pull all my numbers from each month)

Warren starts t-ball at the end of the month, and we’re hoping he can burn off some energy and meet kids around the neighborhood. He’s ready to start kindergarten in a few months. I look forward to traveling more, as always. We’re going to Arkansas next month for a family vacation.

This month finds me optimistic: Things are happening, working out, moving quickly. I genuinely have no sense how these changes will reflect in the next update, so I have the wonder of an onlooker in a way.

We are all healthy and getting outside nearly every day and that has felt so good in my body and spirit. No matter how much you have or save, you’ll never have anything without your health. What’s the point of being a millionaire if you’re too sick to enjoy it?

I am putting my health first and may get an Apple Watch soon to help me track my fitness goals. I’ll be 40 later this year and want to begin my next decade on a high note. I’m always amazed at how connected everything is. The kids are growing, I love and am loved, enjoy my work, and get to see my family often. Life is good.

As always, thank you for reading and following my journey. Hope everyone is doing well!

Stay safe and scrappy out there! ✨

-H.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

paywall unlocked gift link

https://www.wsj.com/personal-finance/retirement/retirement-savings-needed-increased-2024-9f7c01e0?mod=e2tw

Keep it up! Good work Harlan – you keep it realistic and honest and that’s importaint. Do what works for you.

With new laws on real estate sales commission to agents you might settle for less expense and save some money. 20K for house sale is a LOT and should not be that much.

Because of recent changes to the legislation governing real estate agents’ commissions, you may be able to negotiate a lower price and save money. A residence shouldn’t cost twenty thousand dollars.

Lots of changes! Are you still able to work remote these days?

It’s natural to feel excitement and relief when you’re no longer burdened with the financial obligation of two housing payments. This can be a significant milestone and a positive step forward in your financial situation.

It’s natural to feel excitement and relief when you’re no longer burdened with the financial obligation of two housing payments. This can be a significant milestone and a positive step forward in your financial situation.