So here’s an idea I’ve been tossing around.

It absolutely burns me up that I’m still dealing with student loan debt. And it should. Mr. Money Mustache said it best:

YOUR DEBT IS NOT SOMETHING YOU “WORK ON”. IT IS A HUGE, FLAMING EMERGENCY!!!

I’ve put off paying down this debt because there have been other opportunities to earn more: I bought a house, maxed out my IRA, started Airbnbs, and now I’m looking at buying a duplex in the DFW area.

All of these things either appreciate or earn more than the interest I pay on my student loans.

But I’ll be damned if carrying that balance doesn’t give me a red rump.

The idea

- Link: Apply for Card Offers

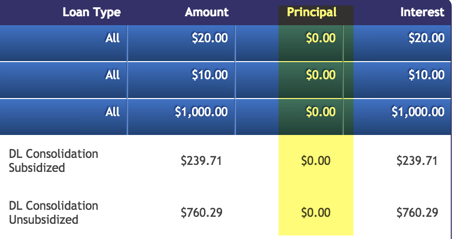

The thing I hate most is 100% of my payments go directly to interest right now.

I’d have to make ~$7,000 in payments before I can touch the principal

I currently owe ~$54K in student loans. The amount is what it is. I was a 17-year-old kid signing a promissory note to go to college. I could bitch about it, but it’s pointless now.

I think of all I could do with that money – travel, put a down payment on an investment property, throw it into my 401(k), or pay down my mortgage. It’s exactly that thought that’s kept me from beginning the repayment journey.

Ughhhh

I recently made a $1,000 payment. Not a cent of it touched the principal.

Fact is, I’d have to make ~$7,000 in payments before I can even begin to touch it.

It feels like saving a grain of sand from the beach. Spitting on a fire. You get the idea.

But, what if I could use a card with a long 0% APR period on purchases to

- Pay all the interest

- Work on paying down the principal in full

- Then pay off the interest that’s been sitting fee-free on a credit card?

Could it give me a boost toward slaying this dragon of dragons?

0% APR cards

- Link: Apply for Card Offers

Other cards on the list may surprise you:

Which card to pick? (How to turn a payment into a purchase)

- Link: Plastiq

I’ve written about how to make rent, mortgage, and student loan payments with Plastiq. Payments generally show up as a purchase. But be sure to set your cash advance limit to $0 to prevent paying nasty cash advance fees.

You can use Plastiq to pay nearly any bill. You’ll pay a 2% fee with a MasterCard. Or a 2.5% fee with an Amex or Visa card.

Fees with Amex and Visa are 2.5%, and 2% with MasterCard

In my case, I’m thinking of going for a Citi card to get a long 21-month 0% APR period. It’s a MasterCard, so I’d pay $140 to make a $7,000 payment (at 2% fee).

Or, it would cost $175 with an Amex or Visa (at 2.5%).

This is the part where you’ll need to run your own numbers to make sure this makes sense.

For example, the Capital One Venture card has a 12-month 0% APR period and a $200 sign-up bonus – totally wiping out the fee and giving me a solid year to pay the cost back.

But, I’d rather have 21 months than 12 months with the Citi card. And I’m willing to pay a little more to get it.

You might also have better relationships with certain banks. Have a lot of Chase cards (or opened lots of cards in the past couple of years)? Avoid Chase. Never had a US Bank card but have great credit? Try them.

Like the Amex Blue Cash EveryDay bonus categories and think you’ll keep the card long-term? Go for it.

As always, do what’s best for your situation.

The numbers

- Link: Loan Calculator

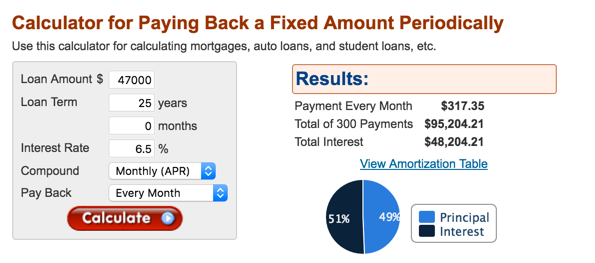

Quite simply, this is the power of compound interest. It’s amazing when it works for you. And can be devastating when it works against you.

~$48K in interest alone over the next 25 years

Now, if I make a payment every month for the next 25 years for the loan as it is now, I’ll end up paying double – the original $47K and $48K more in pure interest. Typing that gave me a full-body shake.

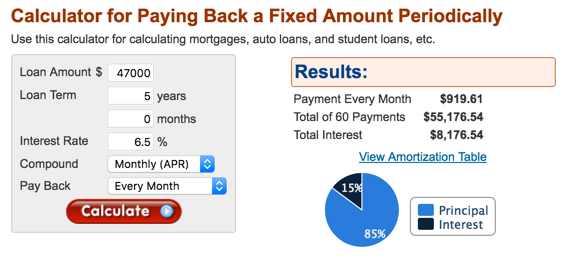

Or, I can pay it back in 5 years with ~$900 a month. And pay much less interest

If I commit to throwing ~$900 a month into the loan – with the current interest erased – it’ll be gone in ~5 years.

Again, that’s $900 a month I can’t use to pay down my mortgage, or to save, or invest. But it does mean I’ll avoid paying ~$40,000 in pure interest. That’s a more palatable way to think of it.

If I committed to putting all of my Airbnb income into it, it could disappear in a year. Somewhere in the middle, which is more realistic, is 2 to 3 years to fully pay this off.

Using a 0% APR card to pay the beginning ~$7K of pure interest would allow me to get right to work knocking this out.

Risk Vs. Reward

You can find cards with pretty long APR periods.

But at the end of the intro APR, you’ll be in a situation where you’ll have to pay off the card to avoid paying even more interest. That could temporarily stagnate the progress you’ve made.

On the other hand, you get a huge leg up into cutting right in to your principal, which will save you serious money down the road.

You are also at the mercy of your credit limit (and even getting approved). If you want to pay a $10,000 payment and your limit is only $2,000, well… you’re out of luck.

You may decide to pay Plastiq’s fee to pay a bill… just make sure your savings and/or sign-up bonus far outweigh that cost. What’s “far outweigh?” That’s hard to answer.

In my case, I’ll save $40,000 long-term by digging into my principal right away (see calculations above). I’d say that far outweighs Plastiq’s $140 fee. Again, run the numbers and make sure it’s worth it for you.

Your debtor might also accept credit cards directly without fees – that would be even better.

Caution, please

Don’t swap one debt for another.

Make no mistake: credit cards are financial tools. So you’ll need the mindset and temperament to handle your credit responsibly and re-pay your debts. Once you’re past the 0% APR period, well, you’re right back where you started – and perhaps even worse off.

Credit card companies are not in business to give you long-term fee-free loans. They’re hoping you’ll slip up and pay them interest. So don’t. Take the free loan. Just be careful.

A hammer is a tool, too. You can use it to build a house. Or you can slip and hit your thumb. With hammers and credit cards, be careful.

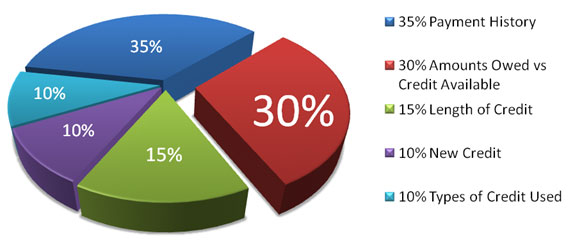

You’ll take a hit… but get a bump. The effect could be net-net

Also, if you get a new card with say, a $10,000 limit and you turn around and make a $10,000 payment, guess what? You’ve just maxed out your card.

Creditors do NOT like to see you using too much available credit on any one card – that sends a warning signal to them and could prevent you from getting more cards.

On the other hand, paying off a big debt (like a student loan) could dramatically improve your credit score. So the effects could cancel one another out.

If you have multiple cards with one bank, see if they’ll let you shift some credit around so you aren’t maxing out a single card.

And consider the risk vs. the reward long-term. Would you max out a card for a year to save a lot of interest on an outstanding debt? (I know I would.)

Again, I must stress how careful you must be here. Play your “cards” right and you could come out way ahead. But mess up, and you could reverse all your progress. Sorry to sound like a nag, but it’s worth repeating.

Bottom line

- Link: Apply for Card Offers

I think I’m gonna do it. Get a 0% APR card to take off my current student loan interest. Then pay off the loan like a maniac, and circle back around to pay off the card shortly before the APR intro period expires. And save a ton of money in interest payments. It’s all part of my journey toward FIRE.

In my estimation, this will put me right at the core of paying down my principal and shave years off the life of my loan.

I won’t earn a sign-up bonus on a Citi card, but saving thousands in interest long-term is worth more to me than any sign-up bonus ever could be.

I’ll use Plastiq to set up the payments and give myself a solid 18 months of consistent payments.

I haven’t considered this route before but it looks to be a quick way to cut right to the heart of the matter by giving myself a fee-free loan and a huge head start. It could work not only for student loans, but for nearly any big debt.

My biggest word of advice is to carefully watch the clock on that APR period. I have no intention of ever paying a dime of interest to any bank. And it’s that mentality that’ll let me use a credit card to avoid paying more of it on my student loan, too. Use it like a tool.

Here’s where to find all of the cards I’ve mentioned in this post:

Run the numbers, pick the right one, and start slicing away debt.

Have you used a credit card to pay down a large debt? Any words of advice you want to add?

Also see:

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

You should get a line of credit with a credit union and not use it, except for occasionally just to keep it active. Their interest rates are around 10%. This comes in handy for when time is up on your credit card and you haven’t paid the full balance yet. You pay the balance with the line of credit and then there are always balance transfers for credit cards for 0% interest rates and 1-5% fees to pay the line of credit. I did this for years with about 10 credit cards when we had a big debt from a failed business until we finally paid off the debt.

That’s a great tip, Karen! And I am lucky there are so many great credit unions here in Dallas. I’ll look into this more – sounds like it could be worth having in the ol’ back pocket.

Get an exact date for end of 0% promo. In my experience, that can be one tricky pitfall.

Absolutely, this. I watch the end date like a hawk. In fact, if I have, say, 12 months, I want to be done with the whole thing by month 11. Don’t even want to risk it.

Go Dave Ramsey style and hit it hard and get it done in 1 year. The amount you don’t have to make in payments AND your other income will give you a significant boost in your other investments once it is paid off. If you can do it faster by cutting back on lifestyle for a year I would do it. I used the citi freedom and citi diamond 0% interest to pay off a $15k debt I am well ahead of schedule paying back the $10k already on the freedom and will be done with the $5k in a few months. Its going to feel awesome once you paid it off! After you do that knock off your other debts one at a time just imagine the same income with no debt, including hitting your mortgage hard for a few years. Great feeling.

Exactly! I’ll try my best to get it done in a year. I’ve already cut out a LOT of lifestyle stuff. In my case, the feeling of not having to pay all that interest down the down is enough of dangling carrot to line ’em up and knock ’em out.

Thanks for sharing your experience and success with paying off a big debt. Congrats, and thanks for the inspiration!

1. Paying off “big” student loan debt will not improve score very much. I carry significant student loan debt (federal) and maintain an 800+ credit score. Has very little impact. Student installment loans are not scored the same way as a “maxed out credit card” and for good reason.

2. Payment by off federal loans with a credit card is extremely risky. Federal loans provide a to. Of coverage in case some thing goes wrong. For example, if you die or are severely disabled they are forgiven. If you lose your job, etc you can go into forbearance. Credit cards do not offer this option (unless you insurance your balance).

3. Your interest on federal loans is tax deductible.

4. It may make sense is in very limited situations to switch to another loan product, such as a credit card. But, federal loans are extremely flexible for all financial situations, including income based repayment and job loss. In my opinion this outweighs transferring the balances to a credit card and having my credit score drop by 50-100 points because of my credit card debt utilization.

Good point about the forbearance thing. In that case, I would rely on my emergency fund (that’s what it’s there for, after all). But it’s worth keeping in mind.

At this point, the tax deduction for the student loan interest is not enough to incentivize me to accrue more of it.

I also wouldn’t pay off the entire thing on a credit card – just the interest to allow me to start making payments on the principal. So hopefully that wouldn’t max out the entire credit line. Even if it did, the idea of saving thousands in interest long-term is worth more to me than a temporary dip in credit score.

I’d also rather deal with a short-term problem when and if it happens as opposed to giving the government more money over the next 25 years. Because forbearance or not, the government is still going to get their money one way or the other. I’d rather nip it in the bud and save myself years of interest payments than worry about what could or might happen.

But I agree with many of your points all the same. Caution should be exercised and a healthy safety net goes a long way toward avoiding worst-case scenarios.

Thanks for weighing in!

It’s been a while since I had a student loan, but are they still tax deductible? You need to include that in the computation if they are. Also, what interest are you paying on these loans? You might have said it above but I might have missed it.

I think if you want to buy a duplex, I’d focus on that first. Mortgage rates are still obscenely low and I think you want to get that situated first. That is assuming you think property values will stay flat or rise in the next few years. (I have ZERO knowledge of DFW real estate fyi).

My cousin paid off his $40,000 in student loans off in 1 shot with some inheritance money my uncle left him. He didn;’t have a mortgage or car payment at the time so these were his big installment loans. His credit score went from 810 to 760 in 4 months.

The interest is tax-deductible. For me, it’s about $1,000 a year. But with the way I file, it honestly doesn’t help me much – so I leave it out. But it’s a good point to consider.

My rate is 6.5% – very high – which is the main reason I want this loan gone so badly. If if were even 4% (or lower), I wouldn’t care as much.

I’m definitely focusing on the duplex right now. The student loan thing will come directly after the closing.

The real estate here is going up every day. I believe it’s a worthwhile investment. #priorities 🙂

Be very careful here with using a credit card to pay off student loan in full. Most loan applications now ask if you are using loan money to pay off student loans. Student loans are not forgivable, even with death. So taking out a loan to pay off that student debt is also alarming to and frowned on by the US government. Because if you default on the new loan, who’s gonna end up paying for the default? The government wants it’s money every which way.