Hey all! Meet Spencer!

He loves the Plastiq and Citi AT&T Access More combo as much as I do. I thought it would be fun to add his ideas about the recent RadPad promotion debacle that lead to the new Plastiq offer – to shake it up a little here at ol’ Out and Out. 🙂

A big thanks to Spencer for lending his thoughts!

Anyone who’s read Out and Out knows Harlan LOVES earning miles and points when he pays rent. When there’s a fun promo, you better believe he’s ready for it.

The Rent Promo Of The Year (Or Not)

Two weeks ago, RadPad rocked the points world with a promo that allowed fee-free credit card rent payments via Android Pay.

Gone too soon

This earth-shattering offer was set to run through the end of 2016. That’s four months of fee-free, points-earning rent fun!

Fast forward to last night.

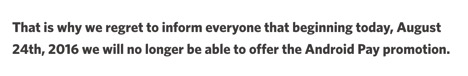

RadPad posts an update on their blog. They have pulled the promo.

RadPad’s crushing announcement

Only people who registered prior to August 24th, 2016, would be eligible and they will only be eligible for one rent payment that has to be paid by August 31st, 2016.

According to RadPad, Android Pay use increased from less than 5% of rent payments to 70% in the span of two weeks. That’s insane!

Well, so much for that points windfall.

If you were set on fee-free RadPad, where does that leave you?

The Consolation Prize (It’s A Good One)

Fear not, there are several points-earning options that could work including:

- Pay by credit card with RadPad (2.99% fee)

- Pay by debit card with RadPad ($4.95 flat fee)

- Pay by credit card with Plastiq (2.5% for Visa and American Express)

- Pay by credit card with Plastiq (1.75% promo fee for MasterCard)

Using a credit card with RadPad is clearly the most expensive option of the bunch. If you’re creative, you can make the debit card payment with RadPad work for you.

But let’s keep it simple and take a look at Plastiq. Not only can you pay rent, but you can pay other bills as well. The 2.5% fee for Visa and American Express payments is a decent option to meet a minimum spend on a credit card.

The Plastiq Promotion

Link: Plastiq

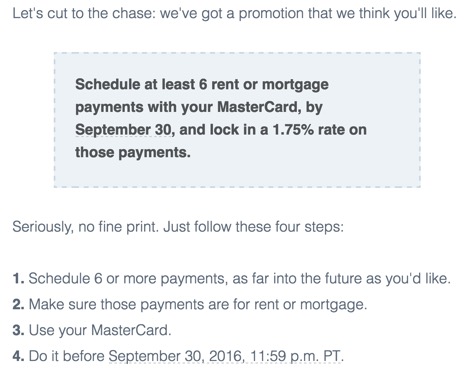

The promotional MasterCard rate of 1.75% is where you can really get some value. Perhaps, even beyond minimum spending.

To get the promotion rate, you need to schedule 6 rent or mortgage payments by September 30th, 2016. Having already paid my rent (via Plastiq) for the month of September, I jumped on the opportunity and scheduled payments from October through March.

Plastiq saves the day

Remember, this promotion only works for rent and mortgage payments. I’m betting that will work just fine for many of you.

When To Use A Rent Payment Service

With all these fees, it’s important to consider the cost vs. the benefit of using a credit card. However, there are two situations in which it can make a lot of sense:

- Hitting a minimum spend

- You have a card with a bonus category

Many folks have recently been approved for the most talked about credit card in the history of credit cards. Seriously, though. It was crazy.

You probably don’t need me to tell you what that card is, but just in case you are totally new to this or have been hibernating (in summer?), it’s the Chase Sapphire Reserve.

If you are looking for a quick and easy way to complete the minimum spending on this card, Plastiq provides an easy way to do so. The fee will be 2.5% (because it’s not a MasterCard), but if you’re like me, paying rent will be a nice boost to get those 100,000 Chase Ultimate Rewards points.

My Favorite Way To Pay Rent

If you aren’t trying to hit a minimum spend on a new card, you could use the Citi AT&T Access More card (not currently available for new sign-ups) and earn 3 Citi Thank You points per $1 on your rent.

As a MasterCard, you’ll earn Citi ThankYou Points at a reasonable cost for a payment you were going to have to make anyway. And, depending on how you redeem them, you can far more value than the cost of Plastiq’s fee.

Bottom Line

The implosion of the RadPad free-free promotion was a disappointment. But Plastiq swooped in to offer the grieving a solid opportunity to earn some miles and points to feed our travel addiction hobby.

What is your preferred method of paying rent? Do you plan on using the Plastiq promo?

Let me know in the comments!

About Spencer

I’m told that I’m obsessed with miles and points. Just because I spend three to four hours a day reading, talking, or thinking about points and the many ways to use them to travel doesn’t mean… fine, I’m obsessed.

Find me at Straight to the Points!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I wonder if it’s possible to PC to the AT&T card…

I think you still can. Might take a couple of tries, but I believe it’s possible.

I’ll keep that in mind once things settle down here.

Spencer! Great post!!

Thanks, Kendra!

Great post, now I just have to get the Chase Sapphire Reserve! Thanks 🙂

You and me both! Thank you for reading! 🙂

Thanks for reading, Gen!

The CSR is going to be a fun card for folks. If only they’d give me one…

Let me know if you have any questions!

Very helpful article, thank you! I’m a newbie to the points world and I guess I have been hibernating! Never heard of the Chase Sapphire Reserve. Care to share its benefits? 😀

Hi Tree! The CSR packs quite the punch for a frequent traveler. Some of the highlights: 3 points per dollar on dining and travel purchases, a $300 travel credit per calendar year, $100 credit for Global Entry. It also has a great sign-up bonus right now. Does have a hefty annual fee, but if you have expected paid travel it can be offset with the travel credit. Whether it’s a good choice for you all depends on what kind of travel you want to do.

Great post Spencer. Want to meet my min spend for my shiny new CSR and considering switching from Radpad to Plastiq because I want to avoid buying giftcards (paypal) using the debit trick on Radpad. This post is great timing with the new CSR.

Hey Dan, thanks for the kind words. Glad you enjoyed the post. Let me know if you have any questions!

Wow- another hibernator here. I had no idea you could pay rent with a credit card. And I’ve been meaning to switch credit cards — does already being a Chase cardholder give me an advantage for the Sapphire Reserve? We’ve got some heavy travel plans coming up, I definitely need to learn to optimize this stuff. I know I’ve been leaving loads of miles on the table. I’ll be keeping an eye on this site and Spencer to learn more!

Thanks for reading!

Having a current card doesn’t really help or hurt your chances. So long as you haven’t had 5+ new cards from ANY bank in the past 2 years, you should be good to go with the Sapphire Reserve. It’s an incredible card – one that I haven’t written much about yet. But I plan to do a review very soon.

Thanks again for reading – keep in touch! 🙂

Looks like Harlan beat me to the punch. Thanks for reading!

Spencer – that’s an awesome tip! Thank you so much for sharing! Time to up my points game!

Thanks, Pete! Let me know if you have any questions.