Everyone knows I’m Mr. Earn and Burn: I typically like to keep my miles balances as close to zero as possible.

I don’t trust any mileage or point program, really. Not for a second. Every major airline has had a drastic, no-notice-given change to their mileage program this year.

That being said, I like to have a little stash.

Where to keep the stash and how many to tuck away

I think the best place to have a stash of points is with Ultimate Rewards. Avios flights are cheap and easy to book for flights, and Hyatt is the same for hotels. If not Avios, then MileagePlus. If not Hyatt, then IHG. And if not flying, then Amtrak. I can get to anywhere within the Northeast at a moment’s notice – and I like that.

Hotels I’m not so worried about. They tend to stay pretty steady and there are plenty of sites to bid on hotel rooms for a set price. It’s the flights that are the killers. Because of that, I like to have 30,000 Ultimate Rewards points ideally – and always at least 15,000.

With 15,000 Ultimate rewards, I know I can always get home in an emergency. With same-day flights usually over $1,000, I like knowing I can get home for free if I need to.

With Ultimate Rewards, you can book United flights with United MileagePlus, American or US Airways flights with British Airways Avios, Delta flights with Korean Airlines Skypass, or Southwest flights with Southwest Rapid Rewards (in addition to other combinations and possibilities, like Aeroplan, Krisflyer, etc.).

The next best place for the stash would be with Membership Rewards. I tend to think their partners are a bit dicier, but in a pinch, it could really help you.

A few examples

Say I needed to get to Chicago in the morning tomorrow (today is 10/12).

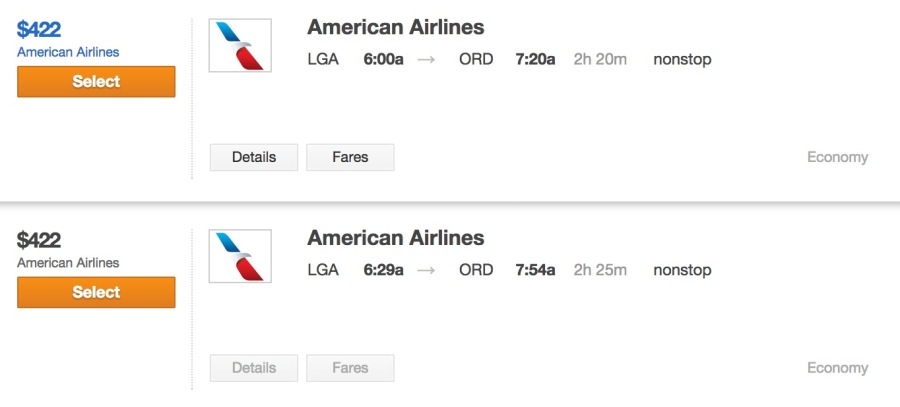

Kayak tells me this flight is $422.

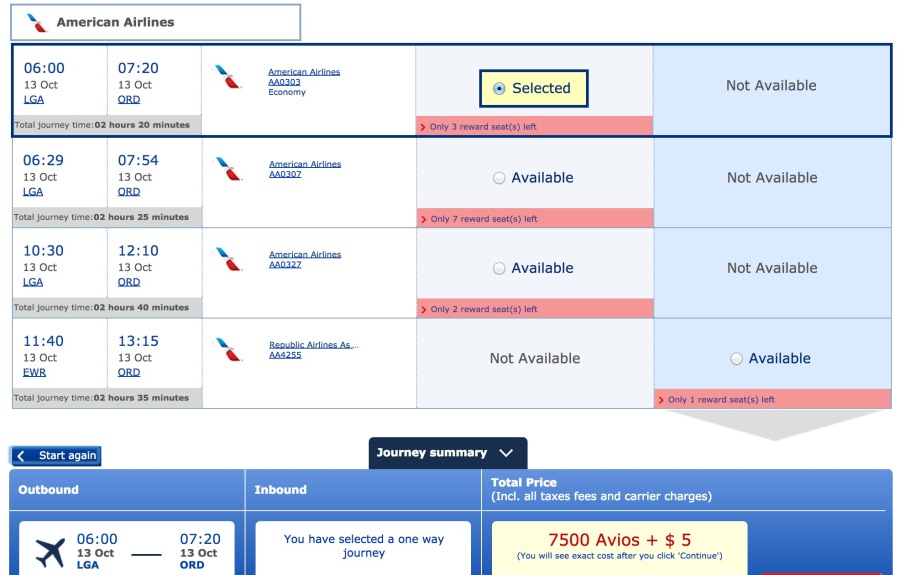

BA.com tells me these same flights are 7,500 miles and $5.

At nearly 6 cents per mile in value, I’d say this would be a no-brainer for an emergency award redemption. I could be in Chicago by tomorrow at 7am if I really needed to be. But that’s why having points for emergencies is a good thing. Then, once there, I could focus on getting back. Round-trip, this would wipe out a stash of 15,000 Ultimate Rewards points. But that’s exactly why they’re being saved.

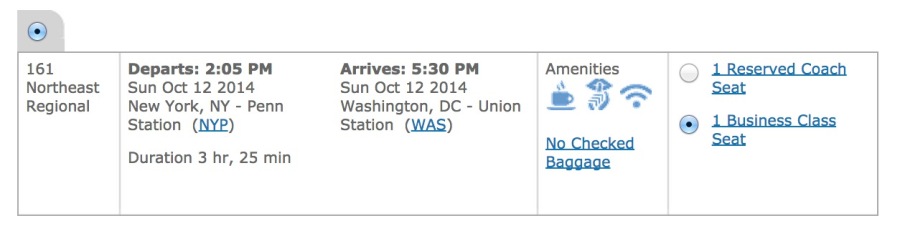

Say I need to get to Washington D.C. TODAY.

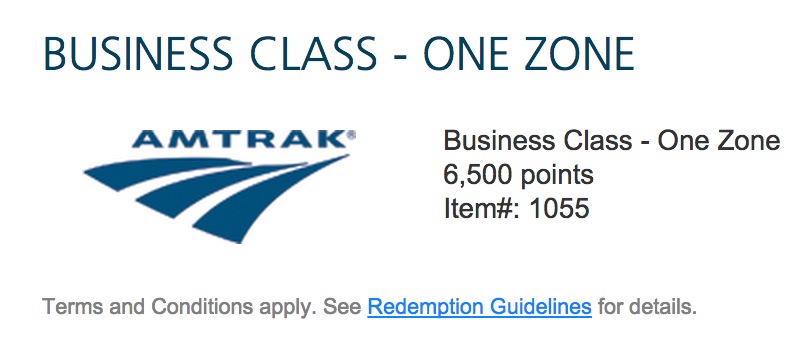

I could get a biz class ticket on the Acela express for $213 and head to Penn Station.

Or I could redeem 6,500 Ultimate Rewards points for the same ticket and be there at the same time. $213 isn’t much money, but then again neither is 6,500 points. In either scenario, I’d be able to go take care of business that same day.

One final example.

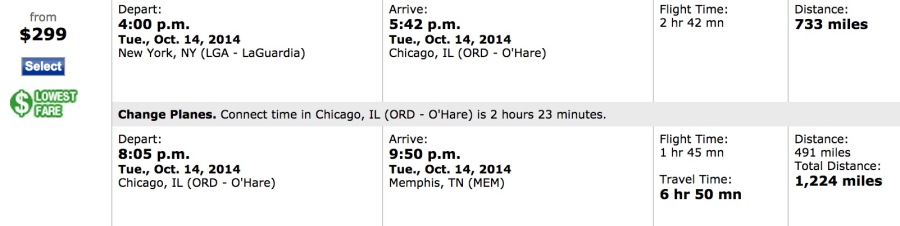

Getting to Memphis on Tuesday (that’s where my family is). With 12,500 United miles transferred in from Ultimate Rewards, I could make the trip in just under 7 hours -or- pay $299. At 2 cents per mile, it’s just enough to satisfy the criteria for using points and miles. The flights have connections, though, or I could also pay $652 to take the nonstop. In a true emergency, I’d probably eat the cost and pay for the nonstop. Otherwise, redeeming points is an option if I want it. And having the option is precisely why points make a good insurance.

This one’s a toss up. It would depend on the urgency of the situation.

This…

…or this?

In my eyes, they’re neck and neck. I may or may not want to redeem my points.

Personalize it

These examples are some things that could potentially come up for me. Do you live in a Delta hub? Membership Rewards might be better for you. Further than Avios are useful, or in a place where American or US Airways doesn’t fly? Forget Ultimate Rewards – get on the miles program that can get you home, and save enough of that currency for a round-trip.

Would you need to get farther, like someplace international? You’d need to stash away more points, then. At least 60,000 points or miles, and perhaps in another program.

The strength (AKA skill) you’ll need is being familiar enough with a program to use it on the fly. An emergency situation is no time to be dealing with something unfamiliar.

If you need to get home for a family emergency or event, get used to a program and save up enough for a round-trip, or at the very least a one-way, to get home at a moment’s notice.

Other uses

Not everything is an emergency. Sometimes you want to get somewhere fast and might want points. Get invited to a game that you couldn’t get tickets to? Is your favorite band throwing a surprise show and you really want to go? Best friend decide to have a weekend away? The scenarios are endless – and points are a great insurance.

Or maybe you just want to get out of town at a moment’s notice? If you think you ever will, having a stash is also a great idea.

Caveat

This is worth mentioning. You are going to be at the mercy of the availability gods. If space isn’t available, you might end up having to pony up the cash anyway. But always try to check availability. And sometimes a phone call to an airline is in order – they can force space to open up. But if not, be prepared to pay. Having points isn’t a guarantee that space will be there.

Bottom line

My friend got sick on a trip recently and didn’t want to pass on the illness to those around her. No problem, we pooled our points and got her a room of her own. She recovered, and we avoided being taken down by sickness.

There are so many things that can happen in life. If it comes down to being there for family or not due to cash flow, having points can at least get you home so you can sort things out.

I recommend Ultimate Rewards – they’re the most flexible and their partners the most valuable. You are also protected from any one program devaluing without notice.

Have enough for a round-trip in your preferred program, or at the very least a one-way. When it comes time to use them, you’ll be glad you saved up!

And yes, I have had to do this once or twice. Having a stash gives me so much peace of mind. That’s really what having insurance is all about.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

[…] get some cashback while I drain my current balances. Points accounts are NOT savings accounts (but they can be insurance). Earn and burn, […]